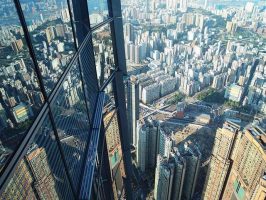

Top 10 Largest Banks in Hong Kong

Hong Kong, a hub for financial services, is regarded by overseas investors and expats as a reliable location to open a business account. It will be challenging ... read more...to choose because this nation has a lengthy list of reliable banks. Toplist has compiled a rundown of the Largest Banks in Hong Kong by Market Cap.

-

HSBC is now the Asia-Pacific division of the international HSBC banking corporation, which was its parent company until 1991. The largest bank in Hong Kong, HSBC has offices and branches all across the Indo-Pacific area as well as in other nations. Also, it holds one of the three commercial banks' licenses from the Hong Kong Monetary Authority to print Hong Kong dollar banknotes.

The Hongkong & Shanghai Bank was founded in British Hong Kong in 1865, became the Hongkong and Shanghai Banking Corporation in 1866, and has maintained its Hong Kong headquarters ever since (although it is now a subsidiary). In 1989, it underwent a name change to "The Hongkong and Shanghai Banking Company Limited."Since 1990, it has served as the namesake and one of the top subsidiaries of HSBC Holdings PLC, a bank holding company with headquarters in London. It is a founding member of the HSBC group of banks and businesses. The company's operations include investment banking, private banking, and international banking, in addition to the typical High Street functions of retail banking, commercial banking, and corporate banking.

HSBC's market capitalization as of March 2023 was $136.40 billion. By market valuation, this places HSBC as the 86th most valuable firm in the entire world. The most recent financial reports from HSBC indicate that the company's current revenue (TTM) is $61.49 billion. The corporation generated $63.66 billion in revenue in 2021, an increase from $62.88 billion in revenue in 2020.

Founded: 3 March 1865

Headquarters: HSBC Main Building, 1 Queen's Road Central, Central, Victoria City, Hong Kong

Website: www.hsbc.com.hk

Screenshot via www.hsbc.com.hk

Screenshot via -

State-owned Chinese banks first entered the banking system of the then-colony with the establishment of a branch of the Bank of China in Hong Kong in 1917. Starting with Yien Yieh Commercial Bank in 1918, other banks quickly imitated it.

In addition to nine mainland-incorporated banks that were public-private joint ventures, there were 15 state-owned Chinese banks with branches in Hong Kong at the time the People's Republic of China was founded in 1949. The Chinese government also founded Nanyang Commercial Bank in 1950 and Po Sang Bank in 1949. These two were both founded in Hong Kong.

The market capitalization of the Bank of China (Hong Kong) as of March 2023 was $34.18 billion. By market capitalization, Bank of China (Hong Kong) is now the 506th most valuable corporation in the world. The most recent financial reports from the Bank of China (Hong Kong) show that the company's current revenue (TTM) is $8.37 billion. The company's revenue in 2021 was $8.37 billion, down from $9.67 billion in 2020.

Founded: 16 October 1964

Headquarters: Bank of China Tower, Central, Hong Kong

Website: bochk.com

Screenshot via bochk.com

Screenshot via bochk.com -

A subsidiary of Standard Chartered, Standard Chartered Hong Kong (formally known as Standard Chartered Bank) is a registered bank established in Hong Kong. Also, it holds one of the three commercial banks' licenses from the Hong Kong Monetary Authority to print Hong Kong dollar banknotes.

The Chartered Bank of India, Australia, and China opened a branch in Hong Kong in 1859, beginning the history of Standard Chartered in that city. The Bank began issuing Hong Kong dollar banknotes in 1862, and it continues to do so today.

The retail banking operations of Chase Manhattan Bank in Hong Kong, including the Chase Manhattan Card Company Limited, were purchased by Standard Chartered in 2000. In 2010, Standard Chartered purchased GE Capital's consumer business in Hong Kong. The Standard Chartered Bank Building, an office building at Des Voeux Road, Central, Hong Kong, bears the name of the bank. Hang Lung Group is the current owner of the structure.

The market capitalization of Standard Chartered was $20.91 billion as of March 2023. By market cap, Standard Chartered is now the 812nd most valuable corporation in the world. The most recent financial reports from Standard Chartered indicate that the company's current revenue (TTM) is $16.17 billion. The company's sales in 2021, which were $14.63 billion, were down from its revenue in 2020, which was $14.91 billion.

Founded:

- First branch on 19 July 1859; 163 years ago

- Local incorporation on 1 July 2004; 18 years ago

Headquarters: Standard Chartered Bank Building, Central, Hong Kong

Website: www.sc.com/hk

Screenshot via www.sc.com/hk

Screenshot via www.sc.com/hk - First branch on 19 July 1859; 163 years ago

-

Hong Kong-based Hang Seng Bank is a provider of banking and financial services with headquarters in Hong Kong. It belongs to the HSBC Group, which owns a majority equity interest in the bank and is one of the top publicly traded corporations in Hong Kong in terms of market capitalization.

Retail banking, wealth management, commercial banking, treasury services, and private banking are among the main business operations of Hang Seng Bank, a commercial bank. In Hong Kong, Hang Seng Bank runs a network of about 260 service locations. Also, it has a 46-branch network of sub-branch Hang Seng Bank (China) Limited, a completely owned subsidiary in mainland China. In 1969, it created the Hang Seng Index as a public service, and it is today widely recognized as the key indicator of the Hong Kong stock market.The market capitalization of Hang Seng Bank was $27.59 billion as of March 2023. By market capitalization, Hang Seng Bank is now the 629th most valuable corporation in the world. The company's current revenue (TTM) is $6.35 billion, according to the most recent financial filings from Hang Seng Bank. The company's sales in 2021, which were $6.35 billion, were lower than its revenue in 2020, which was $7 billion.

Founded: 3 March 1933

Headquarters: Hang Seng Bank Headquarters Building, Central, Hong Kong

Website: hangseng.com

Screenshot via hangseng.com

Screenshot via hangseng.com -

ICBC is a state-owned commercial bank that was established on January 1st, 1984, as a limited company. The bank's Tier 1 capital in 2013 was the largest of 1,000 global banks thanks to funding from the Chinese Ministry of Finance, making it the first bank with its headquarters in China to hold this distinction in modern times.

ICBC was subsequently ranked first in The Banker's Top 1000 World Banks ranking every year since 2012 and first (2019) on the Forbes Global 2000 list of the largest public companies in the world. ICBC was ranked as the largest bank in the world in 2017 and 2018, by total assets (31 December 2020, US$4.324 trillion).

ICBC is also regarded as one of the most profitable businesses in the world, ranking fourth, according to Forbes. The Financial Stability Board views this bank as one of systemic importance. A number of former ICBC personnel now hold important government posts in China. Vice Governor of the PBoC, Gongsheng Pan, and Chairman of the CSRC, Huiman Yi, are notable ICBC alumni.

Founded: 1984

Headquarters: Beijing, China

Website: www.icbc-ltd.com/

Screenshot via www.icbc-ltd.com

Screenshot via www.icbc-ltd.com/ -

Bank of East Asia, frequently referred to as BEA, is a banking and financial services provider with its main office in Central, Hong Kong. The other family-run Hong Kong bank is Dah Sing Bank, and it is today the largest independent local bank in Hong Kong. The third and fourth generations of the Li family are still in charge.

A group of local Hong Kong Chinese businesspeople who "not only understood modern banking but the necessities of modern Chinese industry" founded it on November 14, 1918, and it was formally opened for operation on January 4, 1919. In essence, it sought to help the locals of Hong Kong who were currently underserved by the big British banks and the small, unorganized, and frequently unincorporated local moneylenders in Hong Kong. BEA was regarded as the city's most important local Hong Kong bank by the 1930s.Bank of East Asia's market capitalization as of March 2023 is $3.37 billion. By market capitalization, Bank of East Asia is now the 2945th most valuable company in the world. The most recent financial reports for Bank of East Asia show that the company's current revenue (TTM) is $2.04 billion. The company's revenue in 2021 was $2.04 billion, down from $2.21 billion in 2020.

Founded:

- Incorporated on 14 November 1918; 104 years ago

- Officially opened on 4 January 1919; 104 years ago

Headquarters: 10 Des Voeux Road Central, Central, Hong Kong

Website: hkbea.com

Screenshot via hkbea.com

Screenshot via hkbea.com - Incorporated on 14 November 1918; 104 years ago

-

With 42 locations, Hong Kong-based Nanyang Commercial Bank is a fully owned subsidiary of China Cinda Asset Management (Cinda). It was started on December 14th, 1949, in Hong Kong. NCB primarily targets corporate clients, particularly trading firms.

2015 saw Cinda pay HK$68 billion to the Bank of China (Hong Kong) to buy Nanyang Commercial Bank. In order to expand its operations into international finance, Cinda acquired NCB. In December 2018, it was revealed that Nanyang Commercial Bank was a shareholder in the startup fintech company Nova Credit, which had submitted a bid to develop a new Know Your Client utility platform for banks in the Hong Kong and broader Bay of China region.Founded: December 14, 1949

Headquarters: Hong Kong

Website: https://www.ncb.com.hk/

Screenshot via https://www.ncb.com.hk/

Screenshot via https://www.ncb.com.hk/ -

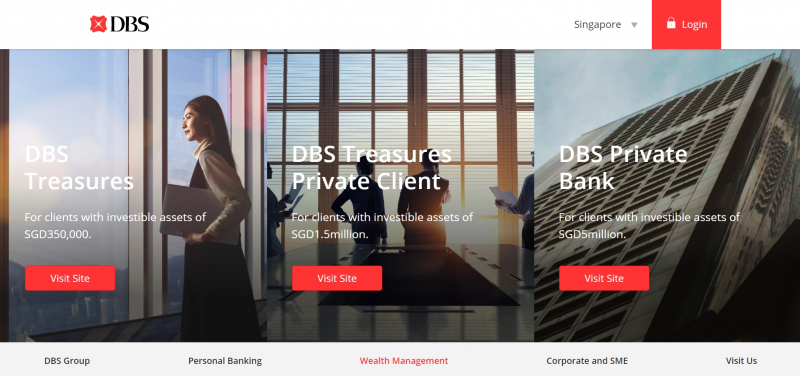

DBS Bank, commonly abbreviated as DBS, is a worldwide banking and financial services company with its headquarters in Singapore's Marina Bay region. The Development Bank of Singapore Ltd., from which "DBS" was formed, was the bank's prior name before its current abbreviated name was adopted on July 21, 2003, to better reflect its status as a worldwide bank. Together with OCBC Bank and United Overseas Bank, it is one of Singapore's "Big Three" banks (UOB).

The bank, which is listed on the Singapore Exchange, was established by the Singaporean government on July 16, 1968, to take over the Economic Development Board's industrial finance operations. There are currently more than 150 of its branches.DBS Group's market cap was $65.49 billion as of March 2023. DBS Group is now the 221st most valuable company in the world, according to market cap. The most recent financial reports from DBS Group indicate that the company's current revenue (TTM) is $10.54 billion. The company generated $10.58 billion in revenue in 2021, which is a decline from the $10.58 billion in revenue in 2020.

Founded: 16 July 1968

Headquarters: 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982

Website: dbs.com.sg

Screenshot via dbs.com.sg

Screenshot via dbs.com.sg -

Of China's "big four" banks, China Construction Bank Corporation (CCB) is one of them. By market capitalization, CCB was the second-largest bank and sixth-largest firm in the world in 2015. There are roughly 13,629 domestic branches for the bank.

Furthermore, it operates wholly owned subsidiaries in London, Barcelona, Frankfurt, Luxembourg, Hong Kong, Johannesburg, New York City, Seoul, Singapore, Tokyo, Melbourne, Kuala Lumpur, Santiago de Chile, Brisbane, Sydney, and Auckland, in addition to overseas branches in each of those cities. The Financial Stability Board classifies it as a systemically important bank due to its total assets of CN 8.7 trillion in 2009. Its main office is located in Beijing's Xicheng District.

China Construction Bank's market cap as of March 2023 is $161.20 billion. By market capitalization, China Construction Bank is now the 64th most valuable firm in the world. The most recent financial reports from China Construction Bank show that the company's current revenue (TTM) is $125.47 billion. The corporation generated $127.14 billion in revenue in 2021, a rise from $109.77 billion in revenue in 2020.

Founded: 1 October 1954

Headquarters: Beijing, ChinaWebsite: ccb.com

Screenshot via ccb.com

Screenshot via ccb.com -

In short, CNCBI, China CITIC Bank International Ltd., is a full-service commercial bank in Hong Kong. CNCBI's controlling shareholder with a 75% shareholding is China CITIC Bank Corporation Limited through its wholly-owned subsidiary CITIC International Financial Holdings Ltd. CNCBI's ultimate parent company is the Beijing-based CITIC Group Corporation.

InMotion, a mobile banking platform from CNCBI, was introduced in 2018. In addition to having a presence abroad, CNCBI maintains 27 branches and two business banking centers in Hong Kong. The CNCBI's total assets were valued at HK$449.50 billion as of June 30, 2022.

The market capitalization of CITIC Bank was $35.16 billion as of March 2023. By market cap, this places CITIC Bank as the 493rd most valuable firm in the entire world. The most recent financial reports from CITIC Bank indicate that the company's current revenue (TTM) is $31.59 billion. The company generated $31.58 billion in revenue in 2021, an increase from $28.30 billion in revenue in 2020.

Founded: 1922

Headquarters: Hong Kong

Website: http://www.cncbinternational.com

Screenshot via http://www.cncbinternational.com

Screenshot via http://www.cncbinternational.com