Top 9 Best Books for Young Investors

It’s a great idea to begin investing as soon as you earn a paycheck. When you’re just starting, it’s essential to understand the basics of investing and the ... read more...different options available to you so that you can choose the most brilliant path for your financial future. As your income grows, your investment portfolio can also expand. These picks of the best books for young investors will help you succeed.

-

The Little Book of Common Sense Investing is the classic guide to getting savvy about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at a meager cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

While the stock market has tumbled and then soared since the first edition of Little Book of Common Sense was published in April 2007, Bogle's investment principles have endured and served investors well. This tenth-anniversary edition includes updated data and new information but maintains the same long-term perspective as its predecessor. Bogle has also added two new chapters designed to provide further guidance to investors: asset allocation and retirement investing.

A portfolio focused on index funds is the only investment that effectively guarantees your fair share of stock market returns. This strategy is favored by Warren Buffett, who said this about Bogle: "If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle. For decades, Jack has urged investors to invest in ultra-low-cost index funds. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and me."

While index investing allows you to sit back and let the market do the work for you, too many investors trade frantically, turning a winner's game into a loser's game. The Little Book of Common Sense Investing is a solid guidebook to your financial future.

Detail information:

Link Amazon: https://www.amazon.com/Little-Book-Common-Sense-Investing-ebook/dp/B075Z6HSCJ

The Little Book of Common Sense Investing

The Little Book of Common Sense Investing -

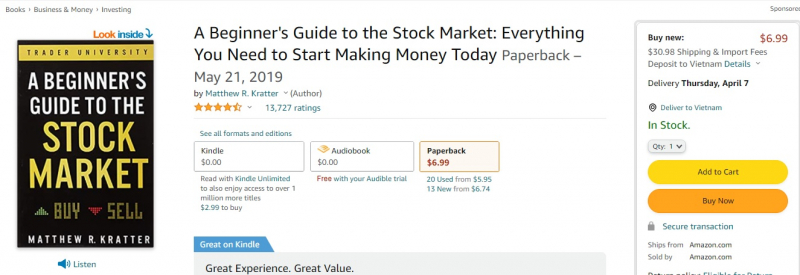

Young investors who do not have experience with the stock market will learn the ins and outs of the market with this guide. Matthew R. Kratter breaks down the types of stocks and how they work while explaining how to analyze stocks to find ones that should perform well in the short-term and long term.

One key area this book addresses is the mistakes beginning investors often make and how to avoid them. "A Beginner's Guide to the Stock Market" also dives into investing strategies and the methodologies that are ideal for new, aspiring investors, making this a great first read among investing books.

Even if you know nothing about the stock market, A Beginner's Guide to the Stock Market will get you started investing and trading the right way. Join the thousands of intelligent traders and investors who have profited from this ultimate guide to the stock market. Amazon best-selling author and retired hedge fund manager Matthew Kratter will teach you the secrets he has used to trade and invest profitably for the last 20 years. Even if you are a complete beginner, A Beginner's Guide to the Stock Market will have you trading stocks in no time.

Detail information:

Link Amazon: https://www.amazon.com/Beginners-Guide-Stock-Market-Everything/dp/1099617200

A Beginner's Guide to the Stock Market

A Beginner's Guide to the Stock Market -

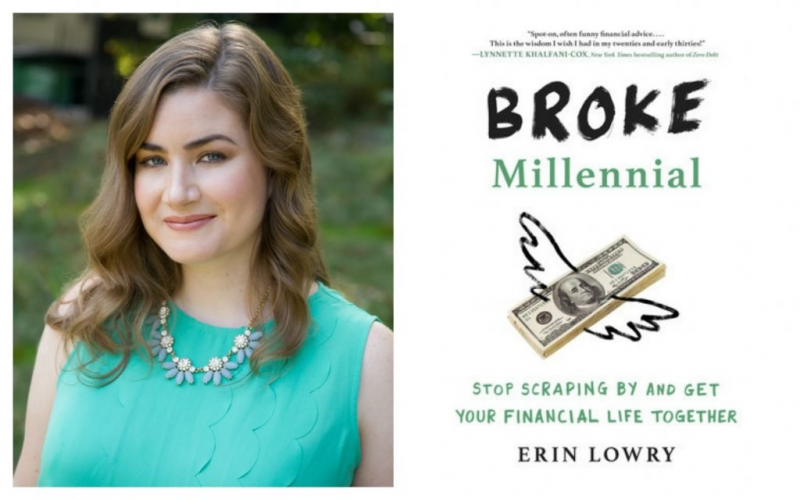

“Broke Millennial,” as recommended by members of the Investopedia Financial Review Board as one of the top picks for young investors. Addresses what many other investing guides fail to acknowledge: understanding personal finance and addressing your spending habits are crucial if you want to become an influential investor.

Erin Lowry explains how to take control of your finances, even if you don’t make much money, and how to begin investing. Young investors will learn tips for stretching their paychecks and getting started on building a retirement fund at an early age. Unlike many traditional financial guides, Broke Millennial is written for millennials in simple terms that novice investors quickly grasp.

Broke Millennial shows step-by-step how to go from flat-broke to financial badass. Unlike most personal finance books out there, it doesn’t just cover boring stuff like credit card debt, investing, and dealing with the dreaded “B” word (budgeting). Financial expert Erin Lowry goes beyond the basics to tackle tricky money matters and situations most of us face.

Packed with refreshingly simple advice and hilarious true stories, Broke Millennial is the essential roadmap every financially clueless millennial needs to become a money master. So what are you waiting for? Let’s start to read the book!

Detail information:

Link Amazon: https://www.amazon.com/Broke-Millennial-Scraping-Financial-Together/dp/0143130404

Broke Millennial

Broke Millennial -

More than half a million copies are sold worldwide. Everything you need to fast-track your way to financial freedom with rental properties!

Real estate investing can provide a safe and fast path to financial freedom, and this business bestseller will show you exactly how to get there. With nearly 400 pages of in-depth advice, The Book on Rental Property Investing imparts practical and exciting strategies that real estate investors worldwide use to build significant cash flow with rental properties.

Brandon Turner is an active real estate investor, best-selling author, and co-host of the BiggerPockets Podcast breaks down the time-tested strategies he used to build his wealth in real estate. Whether you are just getting started or already own hundreds of units, you will learn how to create an achievable plan, find incredible deals, analyze properties, and do everything you need to become a millionaire rental property investor.

Young investors might immediately think of the stock market when building an investment portfolio, but it is not the only place you can invest your money. Rental property investing can help diversify and grow cash if you know what you're doing. The Book on Rental Property Investing covers the entire process of buying and renting properties while offering advice on choosing the right property, deciding between selling and leasing, and flipping houses.Detail information:

Link Amazon: https://www.amazon.com/Book-Rental-Property-Investing-Passive-ebook/dp/B018UTI2DO

The Book on Rental Property Investing

The Book on Rental Property Investing -

For nearly forty years, The Only Investment Guide You'll Ever Need has been a favorite finance guide, earning the allegiance of more than a million readers across America. This completely updated edition will show you how to use your money to your best advantage in today's financial marketplace, no matter what your means.

Using concise, witty, and truly understandable tips and explanations, Andrew Tobias delivers sensible advice and useful information on savings, investments, preparing for retirement, and much more.

Learn how to get started building an investment portfolio with $0 using this guide. Finance writer and co-host of the PBS series "Beyond Wall Street: The Art of Investing," Andrew Tobias walks young investors through the importance of building a financial foundation for investing and focuses mainly on establishing a healthy savings account.

Readers will find sound investing advice that can apply to all aspects of their financial lives in this guide. "The Only Investment Guide You'll Ever Need" was initially published in the 1970s and was completely updated in 2016 with more commentary on modern-day investing, including the author's thoughts on the 2008 financial crisis.Detail information:

Link Amazon: https://www.amazon.com/Only-Investment-Guide-Youll-Ever/dp/0544781937

The Only Investment Guide You'll Ever Need

The Only Investment Guide You'll Ever Need -

More than one million copies have been sold of One Up on Wall Street on investing in which legendary mutual-fund manager Peter Lynch explains the advantages that average investors have over professionals and how they can use these advantages to achieve financial success.

America’s most successful money manager tells how average investors can beat the pros by using what they know. According to Lynch, investment opportunities are everywhere. From the supermarket to the workplace, we encounter products and services all day long. We can find companies to invest in before professional analysts discover them by paying attention to the best ones. When investors get in early, they can find the “ten baggers,” the stocks that appreciate tenfold from the initial investment. A few ten baggers will turn an average stock portfolio into a star performer.

Lynch offers easy-to-follow advice for sorting out the long shots from the no shots by reviewing a company’s financial statements and knowing which numbers count. He offers guidelines for investing in cyclical, turnaround, and fast-growing companies.

As long as you invest for the long term, Lynch says, your portfolio can reward you. This timeless advice has made One Up on Wall Street a #1 bestseller and a classic book of investment know-how.Detail information:

Link Amazon: https://www.amazon.com/One-Up-Wall-Street-Already/dp/0743200403

One Up on Wall Street

One Up on Wall Street -

In his mega-bestseller, Thinking, Fast and Slow, Daniel Kahneman, world-famous psychologist and winner of the Nobel Prize in Economics, takes us on a groundbreaking tour of the mind and explains the two systems that drive the way we think.

System 1 is fast, intuitive, and emotional; System 2 is slower, more deliberative, and more logical. The impact of overconfidence on corporate strategies, the difficulties of predicting what will make us happy in the future, the profound effect of cognitive biases on everything from playing the stock market to planning our next vacation? They can understand each other only by knowing how the two systems shape our judgments and decisions.

Engaging the reader in a lively conversation about how we think, Kahneman reveals where we can and cannot trust our intuitions and how we can tap into the benefits of slow thinking. Does he offer practical and enlightening insights into how choices are made in our business and personal lives? And how we can use different techniques to guard against the mental glitches that often get us into trouble. Topping bestseller lists for almost ten years, Thinking, Fast and Slow is a contemporary classic, an essential book that has changed the lives of millions of readers.Detail information:

Link Amazon: https://www.amazon.com/Thinking-Fast-Slow-Daniel-Kahneman/dp/0374533555

Thinking, Fast and Slow

Thinking, Fast and Slow -

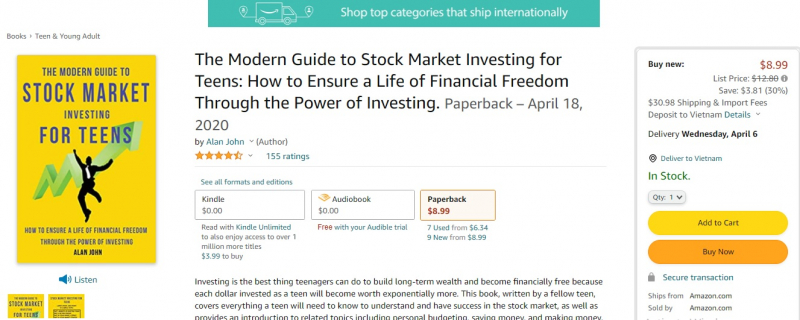

"The Modern Guide to Stock Market Investing for Teens" covers vital tips and strategies for those interested in investing in the stock market. Alan John published this book in 2020; a teenager wrote this quick read in California, Alan John, who wanted to help young people see the importance of beginning their investing journeys early.

Investing is the best thing teenagers can do to build long-term wealth and become financially free because each dollar invested as a teen will become worth exponentially more. The Modern Guide to Stock Market Investing for Teens, written by a fellow teen, covers everything a teen will need to know to understand and have success in the stock market and provides an introduction to related topics, including personal budgeting, saving money, and making money.

We'll also explore concrete, real-life examples and learn from the world's most successful investors. As the author, I wrote The Modern Guide to Stock Market Investing for Teens so investing can change others' lives as it changed and continues to change mine. No matter who you are, your age, and the amount of money you have, you can invest, and this book will help you do just that.Detail information:

Link Amazon: https://www.amazon.com/Modern-Guide-Stock-Market-Investing/dp/1087879337

The Modern Guide to Stock Market Investing for Teens

The Modern Guide to Stock Market Investing for Teens -

Real Estate Investment Trusts (REITs), which provide some of the best total returns in the investment world, along with above-average dividend yields and stable earnings, have become increasingly popular with individual and institutional investors. Investing in REITs, Fourth Edition has established itself as the definitive guide to understanding this attractive asset class. The book is invaluable for investors, financial planners, and investment advisers interested in understanding REITs and investment opportunities.

Passive real estate investing is often overlooked by young investors who might become a landlord or property managers. The fourth edition of “Investing in REITs” breaks down how young and new investors can begin diversifying their portfolios and earn some of the best returns on the market through REITs.

Written by the late Ralph L. Block, an expert advisor on REITs for 40 years, this book offers a comprehensive exploration of REITs, the history of this investment type, and how to begin incorporating them into your portfolio. Block received the 2004 Industry Achievement Award from the National Association of Real Estate Investment Trusts.Detail information:

Link Amazon: https://www.amazon.com/Investing-REITs-Estate-Investment-Trusts/dp/1118004450

Investing in REITs

Investing in REITs