Top 10 Best Credit Unions in The World

You might picture rigid membership criteria that keep you on the outside looking in when you think of credit unions. While that might be the case for some, the ... read more...greatest credit unions have open admissions policies and flexible prerequisites. Free checking accounts, competitive rates on deposit products, and more individualized customer service are just a few of the perks credit unions are renowned for providing. Following are the best credit unions based on revenue.

-

Alliant Credit Union ranks first on the list of the best credit unions based on revenue in the world. Alliant Credit Union is a member-owned financial cooperative headquartered in Chicago, Illinois.

All Foster Care to Success participants, people who live or work in a qualifying community, and their families are served by Alliant. With $14 billion in assets and a history dating back to 1935, Alliant serves more than 600,000 members across the country and is the ninth-largest credit union by asset size.

Alliant Credit Union offers savings accounts, checking accounts, certificates, IRAs, consumer loans, and Visa credit cards. The initial savings deposit for an Alliant savings account is $5, and it starts membership with Alliant Credit Union. Regular Savings, Supplemental Savings, Custodial Savings, and Kidz Klub are the savings account options available to people under the age of twelve.

The first set of checks from Alliant is free; you can choose not to receive paper statements; and the high-rate checking option requires at least one monthly electronic deposit. Mortgages, auto loans, and personal loans are all examples of consumer debt. In addition, Alliant provides insurance and investment services. Until 2017, when it sold the accounts to Health Equity, Alliant offered health savings accounts.

Founded: 1933

Headquarters: Vienna, Virginia, United States

Website: https://www.navyfederal.org/

Image via alliantcreditunion.org

Image via bizjournals.com -

Alaska USA Federal Credit Union is a credit union based in Anchorage, Alaska, that is chartered and governed by the National Credit Union Administration (NCUA). Alaska USA is one of the largest credit unions in the United States by assets and one of the top 20 credit unions by membership.

Alaska USA is a federally chartered, member-owned, non-profit financial cooperative with over 100 branch offices and service sites throughout Alaska, Maricopa County, Arizona, San Bernardino County, California, and Washington State. Alaska USA had $6.9 billion in assets and over 600,000 members as of 2017.

The credit union is Alaska's top provider of consumer financial services, with membership rising in all 50 states. Alaska USA offers deposit accounts, consumer loans, credit cards, online and mobile account management, and 24/7 service.

Alaska USA offers business goods, personal insurance, real estate loans, financial planning, and investment services in an increasing number of locations. Alaska USA Insurance Brokers in Alaska and Washington, as well as Alaska USA Mortgage Company in Alaska, California, and Washington, are both owned and operated by the credit union.

Founded: 1948

Headquarters: Anchorage, Alaska, United States

Website: https://www.alaskausa.org/

Image via senseiprojectsolutions.com

Image via juneauempire.com -

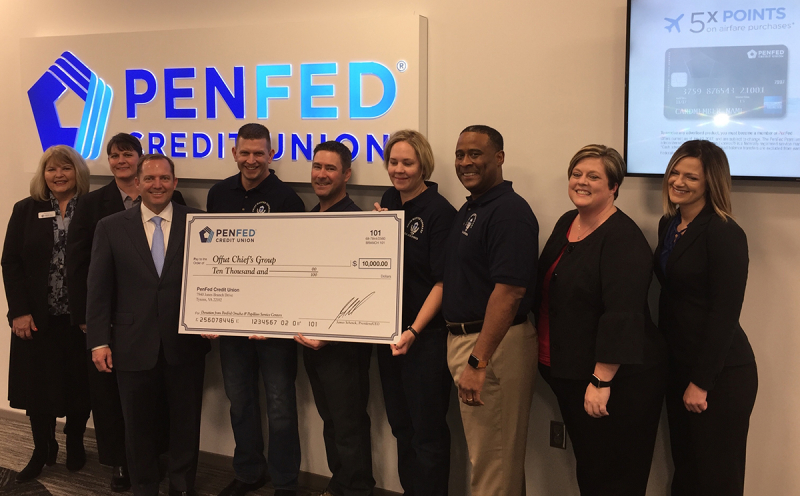

Pentagon Federal Credit Union, commonly referred to as PenFed, is a United States federal credit union with its headquarters in McLean, Virginia. It was established and is governed by the National Credit Union Administration (NCUA).

With $25 billion in assets and more than 1.8 million members as of July 2018, PenFed is the third-largest federal credit union in the US. PenFed offers a range of loans, savings accounts, and bank accounts, in addition to credit cards and other financial services.

In the past, membership in the Pentagon Federal Credit Union was restricted to those who shared the national defense-related affiliations specified in the credit union's charter. In 2018, PenFed purchased the Progressive Credit Union, a New York-chartered institution that had failed as a result of loans for taxi medallions in New York City but had an open membership charter that allowed anybody nationwide to join.

McGraw-Hill Federal Credit Union announced plans to combine with PenFed in February 2019. On May 1, 2019, the conversion of customers to PenFed customers will be complete. As of September 2019, the old McGraw-Hill branch in East Windsor, New Jersey, is now a PenFed bank.

Founded: 1935

Headquarters: 7940 Jones Branch Drive, McLean, Virginia, United States

Website: https://www.penfed.org/

bizjournals.com

zippia.com -

Suncoast Credit Union ranks 4th on the list of the best credit unions based on revenue. Suncoast Credit Union is a financial cooperative based in Tampa, Florida. The credit union was founded in 1934 to serve teachers in Hillsborough County, but it gradually expanded to serve school employees throughout the state's Suncoast region.

Since December 2013, the credit union has been open to anybody who lives, works, attends school, or worships in one of the 39 counties it covers. Suncoast has $14.96 billion in assets and over 1 million members as of June 2022.

Hillsborough County Teachers Credit Union was founded on January 31, 1934, with the goal of assisting teachers in Hillsborough County. In 1953, the credit union changed its charter to allow teachers from Citrus, DeSoto, Hardee, Hernando, and Pasco counties to join. By 1960, membership was open to residents of Charlotte, Levy, Manatee, and Sumter counties, as well as all employees of schools in the counties to which its charter had been extended.

In 1975, the credit union changed its name to Suncoast Schools Credit Union to reflect its expanded membership. The credit union received a state charter in December 2013 and changed its name to Suncoast Credit Union.

Founded: 1934

Headquarters: Tampa, Florida, United States

Website: https://www.suncoastcreditunion.com/

Image via compassconstruction.com

Image via bizjournals.com -

America First Credit Union (AFCU) is a federally chartered credit union headquartered in Riverdale, Utah, in the United States. America First was the sixth-largest credit union in the United States in terms of total membership and the eighth-largest credit union in terms of assets in the United States as of January 2020.

America First has 131 branch locations, over 1 million members, and assets worth over USD 11.713 billion as of January 2020. America First is also a member of the CO-OP Network of ATMs, which gives its members free ATM access to nearly 30,000 ATMs around the country.

Membership in America First is open to anybody who lives, works, worships, attends school, conducts business, or volunteers in any county or city within their field of membership in Utah, Idaho, Oregon, New Mexico, Arizona, or Nevada.

Owners, employees, suppliers and their employees, or associated companies and their employees involved in the food industry, an affiliated association, or a select employee group in the state of Utah are also eligible.

Founded: 1939

Headquarters: Riverdale, Utah, United States

Website: https://www.americafirst.com/

Image via gobankingrates.com

Image via money.com -

Navy Federal Credit Union (or Navy Federal) is a multinational credit union with its main office in Vienna, Virginia. It ranks 6th on the list of the best credit unions based on revenue. It was established and is governed by the National Credit Union Administration (NCUA). Navy Federal is the biggest natural member (or retail) credit union in the country in terms of membership and asset size. Navy Federal has 12.1 million members and assets of $156.7 billion as of October 2022.

As with most financial institutions, Navy Federal provides a full range of account services, including savings accounts, checking accounts, debit cards, IRA accounts, home equity lines of credit, and certificates. Because a member's initial savings deposit ($5.00) actually symbolizes their part of ownership in the credit union, the savings product is called "Share Savings" to reflect this.

In addition, Navy Federal provides its customers with credit cards, mortgages, home equity lines of credit, personal, auto, and student loans, as well as internet banking and some small business services such as PPP loans. Navy Federal Financial Group, the CUSO for Navy Federal, provides more comprehensive insurance, financial planning, and investment services.

Founded: October 26, 1935

Headquarters: Chicago, Illinois, United States

Website: https://www.alliantcreditunion.org/

Image via dallasnews.com

Image via businesswire.com -

Federally incorporated, Bethpage Federal Credit Union has its main office in Bethpage, Long Island, New York. With around $9.2 billion in assets, 405,700 members, and 38 publicly accessible branches spread across Nassau and Suffolk counties as of January 2017, Bethpage FCU is the largest credit union organization in New York State and the 16th largest in the country.

Anyone who resides in the United States of America is qualified for membership. Bethpage FCU's member deposits of up to $250,000 are protected by the National Credit Union Share Insurance Fund.

The communities Bethpage FCU serves are deeply ingrained in their cultures. Bethpage FCU has supported the Bethpage Air Show at Jones Beach for many years. The Suffolk County Sports Park in Central Islip, currently known as Bethpage Ballpark and the home of the Long Island Ducks, received a 10-year sponsorship agreement from Bethpage FCU in 2010.

In 2014, Bethpage FCU decided to sponsor the football stadium at Long Island University's C.W. Post Campus, where they have also set up a high-tech branch for the teachers and students.

Founded: 1941

Headquarters: Bethpage, New York, United States

Website: https://www.bethpagefcu.com/

Image via longislandpress.com

Image via cuinsight.com -

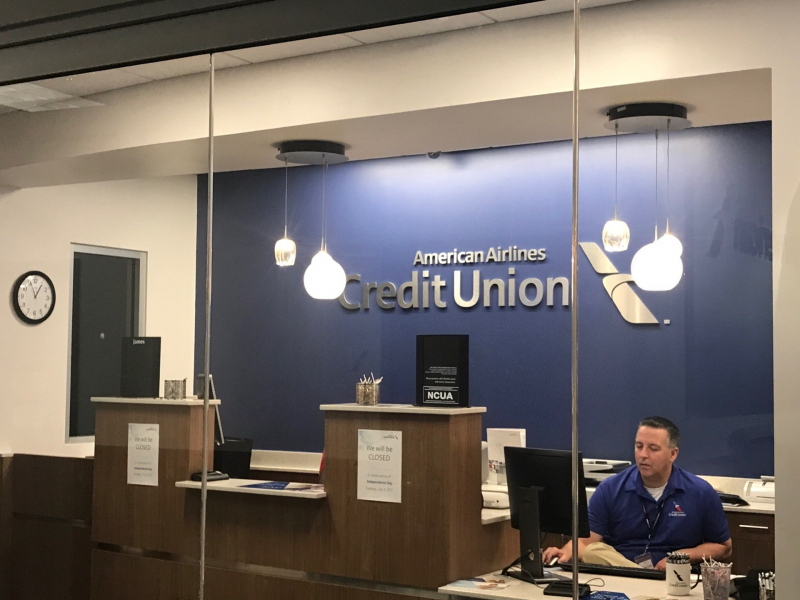

American Airlines Federal Credit Union, which was established in 1936, provides a variety of banking and lending products to members of the aviation industry. Members must be certain present or retired employees of the airline sector and their families.

The National Credit Union Share Insurance Fund provides up to $250,000 in insurance for deposits made to American Airlines Credit Union. The credit union is a member of the CO-OP network of ATMs and shared branches and has locations in the majority of the major airports in the United States.

The Primary Savings Account at American Airlines Federal Credit Union just needs a $5 initial deposit and a one-time $1 membership fee. It does not impose a monthly service fee and offers a competitive APY. Although some other institutions may provide slightly better yields, members who are solely seeking a savings account that pays the best rate would do well with an American Airlines Federal Credit Union savings account. Also available from the credit union is their emergency fund savings account. It has the same APY but no minimum balance requirement.

Founded: 1936

Headquarters: 4151 Amon Carter Blvd Fort Worth, TX 76155 United States

Website: https://www.aacreditunion.org/

Image via communityimpact.com

Image via mapquest.com -

Located in Apple Valley, Minnesota, Wings Financial Credit Union is a member-owned, non-profit financial institution. With $8 billion in assets, the credit union provides services to residents of the Seattle/Tacoma metro area, the Minneapolis/St. Paul metro area, and those employed in the aviation sector. The National Credit Union Administration is in charge of overseeing Wings, which was incorporated in 1938. (NCUA).

More than 50 different airlines, several aviation support businesses, and governmental organizations with ties to the aviation sector are all served by Wings' financial services. 33 branch offices are run by Wings across the nation, including ones in Atlanta, Orlando, Detroit, Minneapolis/St. Paul, and Seattle.

Additionally, Wings Financial has a network of over 80,000 surcharge-free ATMs that spans the whole country. Applications for membership, loan applications, account information, and remote deposit are all available online through the credit union. The largest credit union in Minnesota is Wings Financial, which ranks among the top 40 credit unions nationwide in terms of assets (at least $8 billion).

Founded: 1938

Headquarters: Apple Valley, Minnesota, United States

Website: https://www.wingsfinancial.com/

Image via popearch.com

Image via glassdoor.com -

Connexus Credit Union, a cooperative that serves members in all 50 states, is happy to return profits to member-owners through competitive rates for personal, home, and auto loans, as well as high yields for checking accounts and deposit products.

Members take advantage of a multi-channel service strategy that includes a strong digital banking platform that is accessible around the clock, a member contact center that is fully staffed and trained, shared branching, online chat assistance, and a number of branch locations.

Because Connexus Credit Union is a credit union, it is a not-for-profit company that is owned by its members, not by a collection of people or shareholders. As a result, extra money is given back to members in the form of higher dividends, lower loan interest, and upgraded or improved services.

Connexus has maintained a solid reputation as a safe financial institution over the years and has stayed dedicated to meeting the requirements of member-owners across the nation.

Founded: 1935

Headquarters: Regina, Saskatchewan, Canada

Website: https://www.conexus.ca/personal/

Image via ghidorzi.com

Image via merrillfotonews.com