Top 10 Best Apps to Borrow Money

If you need money quickly to address personal financial concerns, you can look for reliable lending applications that offer quick and reasonable loans while ... read more...also assisting you in building credit and avoiding overdraft fees. Here are the top picks for the best apps to borrow money that you should try once.

-

CashApp is much more than a money transfer app. You can also borrow up to $200 quickly with no credit check, no interest, and no fees. You can return the loan in four monthly installments or pay it off early at any time. CashApp will also provide you rebates and discounts when you use your Cash Card at certain retailers.

CashApp is simple to use and safe. Sign up using your phone number or email address, link your debit card or bank account, and borrow money in minutes. CashApp also allows you to send and receive money from friends and family, buy and sell Bitcoin, and trade in equities. All of your transactions are encrypted and fraud-protected.

CashApp is not only the finest app for borrowing money, but it is also the best app for money management. It enables you to save, spend, and invest more wisely. CashApp has you covered if you need a quick cash advance, a convenient way to pay bills, or a simple way to expand your money.

Download: https://play.google.com/store/apps/details?id=com.squareup.cash&hl=en_US

Website: https://cash.app/

Image via https://cash.app/

Image via https://cash.app/ -

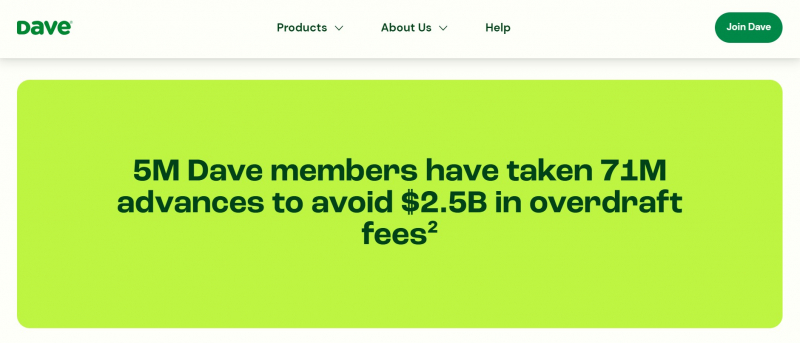

Unlike other applications that have hidden costs or excessive interest rates, Dave simply has a $1 monthly fee. You can also tip Dave if you wish, but it is not required. Dave does not conduct credit checks or report to credit bureaus, so your credit score will not be affected. Dave also offers a feature called SpotMe that allows you to overdraft up to $200 without incurring fees if you make regular direct deposits.

Dave is one of the best apps to borrow money because it is easy to use and helpful. You can quickly sign up for Dave using your bank account and phone number, and you'll be accepted in minutes. You can then request a $100 advance, which will be transferred into your account within a day or less. You may also use Dave's budgeting tool to track your costs and income and receive reminders when you run out of money or have a bill due. Dave also provides access to side gigs via its partner app, Steady, which can help you make extra money and pay off your debts more quickly.Download: https://play.google.com/store/apps/details?id=com.dave&hl=en_US

Website: https://dave.com/

Image via https://dave.com/

Image via https://dave.com/ -

The Branch provides no-credit-check, no-interest, and no-fee fast loans of up to $. The Branch is simple to use: simply connect your bank account and your employer's payroll system to request a loan in minutes. The Branch also offers budgeting tools, overdraft protection, and cash-back benefits to help you manage your funds.

The Branch is not only a convenient and cost-effective option to borrow money, but it is also dependable and trustworthy. The Branch also has a pleasant and professional customer service crew that is ready 24 hours a day, seven days a week to address any questions or problems you may have. The Branch is dedicated to assisting you in achieving your financial objectives and improving your finances.

The Branch can help you receive the money you need quickly and conveniently, whether you need a small loan to meet an emergency expense or a larger loan to invest in your future.Download: https://play.google.com/store/apps/details?id=com.branch_international.branch.branch_demo_android&hl=en&gl=GB

Website: https://www.branchapp.com/

Image via https://www.branchapp.com/

Image via https://www.branchapp.com/ -

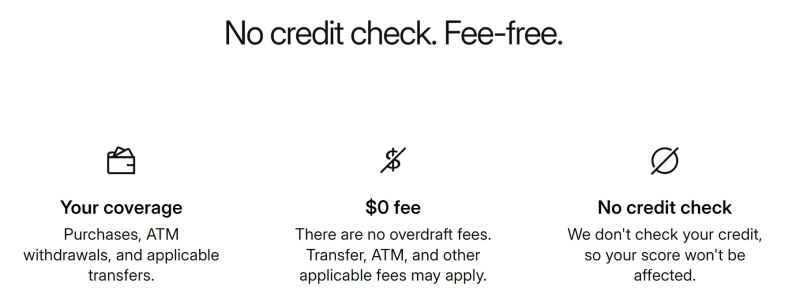

Chime is a financial app with a number of features, including quick transfers, no overdraft fees, and early access to your paycheck. However, what distinguishes Chime as one of the best apps for borrowing money is its SpotMe feature, which allows you to overdraft your account up to $200 without incurring any penalties or interest. When you need extra income to cover an unforeseen bill or a gap in your budget, this might be a lifesaver.

Chime allows you to open a checking account and receive a Visa debit card that you can use anywhere Visa is accepted. You can also withdraw cash from over 38,000 fee-free ATMs located around the United States. You can also open a Chime savings account and earn 0.50% APY on your balance, which is significantly higher than the national average. You can also set up automated savings options, such as rounding up your purchases to the nearest dollar and saving the change, or automatically depositing 10% of your income to your savings account each pay period.

The Chime app is accessible for both iOS and Android smartphones, and it boasts a slick and user-friendly design. With a few taps on your phone, you can check your balance, monitor your transactions, transfer money, pay bills, deposit checks, and more.Download: https://play.google.com/store/apps/details?id=com.onedebit.chime&hl=vi&gl=US

Website: https://www.chime.com/mobile-banking/

Image via https://www.chime.com/mobile-banking/

Image via https://www.chime.com/mobile-banking/ -

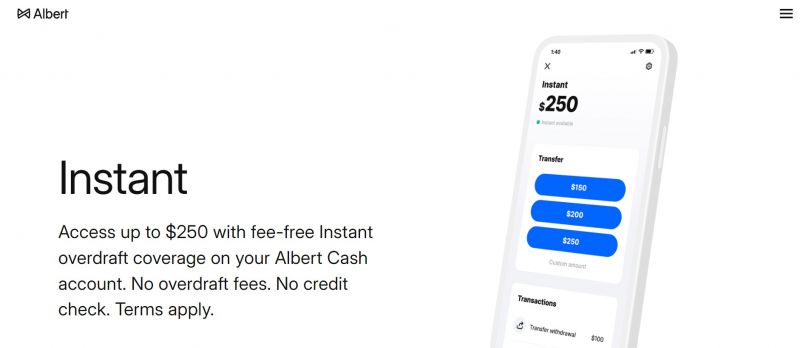

Albert is a smart and simple app that lets you to borrow money instantaneously, with no credit checks, fees, or hidden charges. You can borrow up to $250 from your next salary and repay it automatically on payday. Albert also assists you in saving money, budgeting better, and investing wisely by providing you with individualized recommendations and insights into your spending habits and financial health.

Albert is that it is quite simple to use. Simply link your bank account, verify your identity, and apply for a cash advance. You will have the money in your account within minutes and can use it for whatever you like. There are no late penalties, overdraft fines, or interest costs because Albert simply charges a tiny optional gratuity for its services.Download: https://play.google.com/store/apps/details?id=com.meetalbert&hl=en_US

Website: https://albert.com/instant

Image via https://albert.com/instant

Image via https://albert.com/instant -

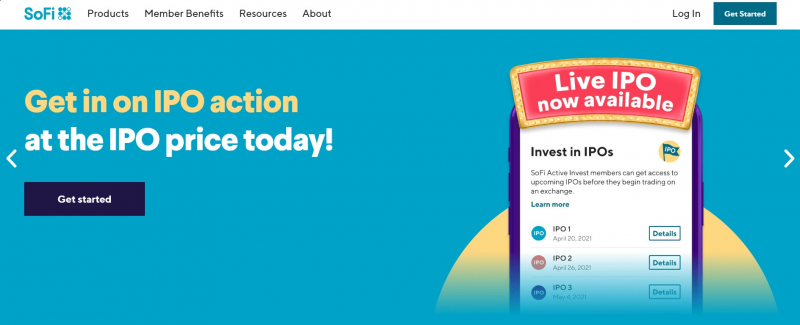

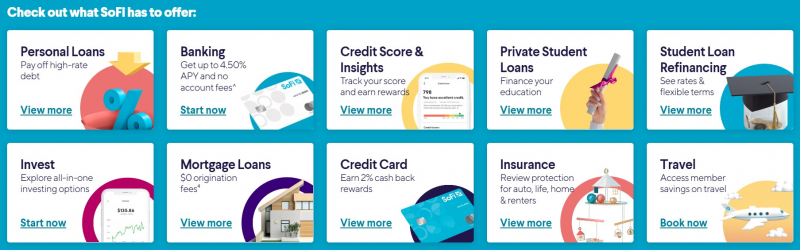

SoFi is a renowned online lender that provides personal loans, student loans, mortgages, investment services, and banking. SoFi is an acronym for Social Finance, and its objective is to assist people in achieving financial independence and achieving their goals. SoFi personal loans are intended for borrowers with good credit and consistent income who wish to consolidate debt, upgrade their home, support a wedding, or make any other large purchase.

The advantage of SoFi is that there are no expenses. That means there are no origination costs, prepayment fees, late fees, or insufficient funds fees. You just pay interest on the amount borrowed, and you can select between fixed and variable rates. SoFi also has payback arrangements that range from 2 to 7 years. Depending on your creditworthiness and state of residency, you can borrow between $5,000 and $100,000.

SoFi is one of the best apps to borrow money since it provides low-interest rates, no fees, adjustable periods, useful rewards, and a simple application procedure. If you are looking for a personal loan to help you reach your financial goals and enhance your life, SoFi is an excellent choice.Download: https://play.google.com/store/apps/details?id=com.sofi.mobile&hl=en_US

Website: https://www.sofi.com/app-download/

Image via https://www.sofi.com/app-download/

Image via https://www.sofi.com/app-download/ -

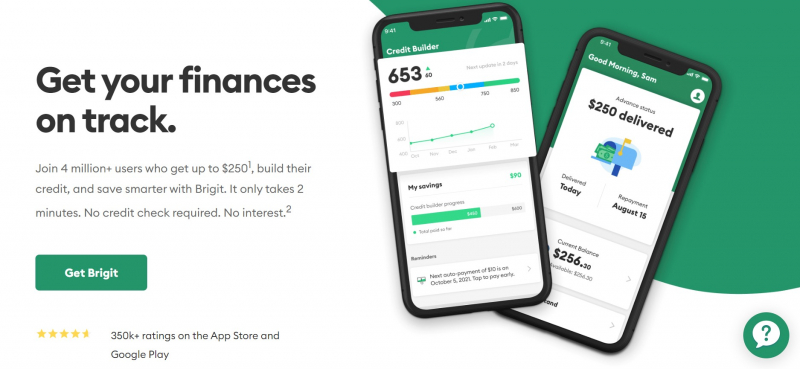

Brigit has various features that set it apart from the finest money-lending apps. It provides up to $250 in interest-free cash advances that you can use whenever and wherever you want. You can also schedule automatic advances to be made when your balance falls below a specific level.

Brigit's budgeting tools and expenditure insights assist you in better managing your funds. You can monitor how much you spend in each category, track your income and bills, and get personalized savings suggestions. Brigit's monthly price is $9.99, which includes unlimited advances and access to all features. You can also cancel at any moment without incurring any fines or expenses.

Brigit is also incredibly simple to use and dependable. With your phone number and bank account information, you can sign up in minutes. Brigit supports over 6,000 institutions and works with the majority of major banks and credit unions in the United States. You can also link numerous accounts to your Brigit profile and select which ones will get advances.Download: https://play.google.com/store/apps/details?id=com.hellobrigit.Brigit&hl=en_US

Website: https://www.hellobrigit.com/

Image via https://www.hellobrigit.com/

Image via https://www.hellobrigit.com/ -

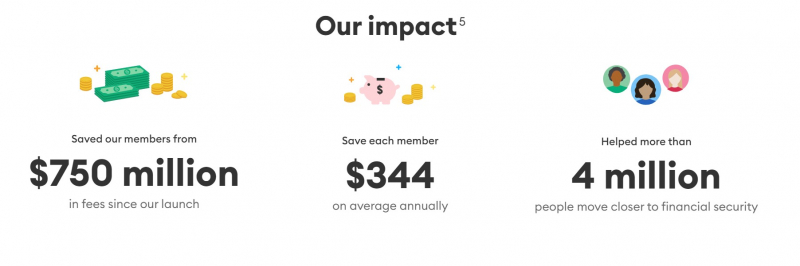

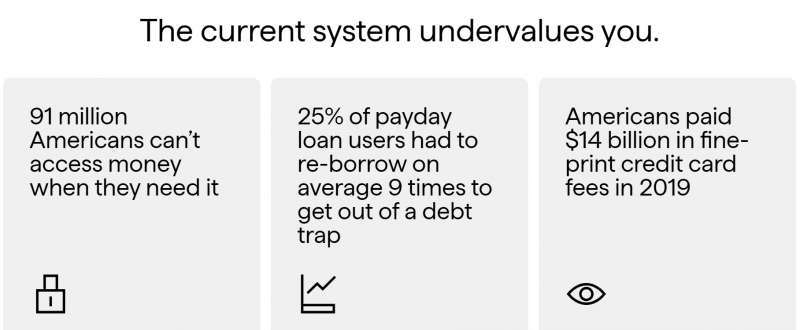

Possible Finance is an app that allows you to borrow up to $500 in minutes without a credit check. You can repay the loan in four payments over eight weeks, with numerous payment choices. The app also records your payments to credit bureaus, which might help you improve your credit score over time.

The app charges a hefty interest rate of 150% APR, which means you'll wind up paying more than twice what you borrowed. For example, if you borrow $500, you must repay $750 in total. That is a large sum of money for a small loan. Possible Finance may be an excellent alternative for you if you have terrible credit or no credit history and need a modest loan quickly. It can help you receive cash immediately while also improving your credit score over time.Download: https://play.google.com/store/apps/details?id=com.possible_mobile&hl=en_US

Website: https://www.possiblefinance.com/

Image via https://www.possiblefinance.com/

Image via https://www.possiblefinance.com/ -

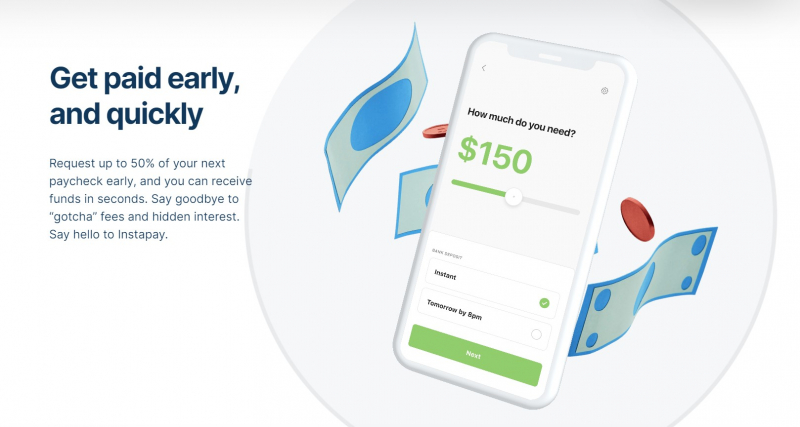

PayActiv is a financial platform. For a flat price of $5 per pay, you can borrow up to 50% of your net income, up to $500. PayActiv can be used to pay bills, transfer money, acquire cash, or buy groceries. PayActiv also provides financial counseling, budgeting tools, savings programs, and medication and other service discounts.

PayActiv is also quite simple to use. With a few taps on your phone, you may access your earned money at any time and from any location. The program also allows you to keep track of your earnings, expenses, and savings. PayActiv has a polite and professional customer care team available 24 hours a day, 7 days a week to answer your inquiries and handle any concerns.

PayActiv is both a smart strategy to improve your financial health and a quick way to borrow money. PayActiv can help you avoid overdraft penalties, late fees, payday loans, and credit card debt. You can also save for long-term goals, such as retirement.Download: https://play.google.com/store/apps/details?id=com.ProActMobile&hl=en

Website: https://www.payactiv.com/

Image via https://www.payactiv.com/

Image via https://www.payactiv.com/ -

Even is more than just a lending app. It is a financial platform that helps you budget, save, and access your earned wages before payday. Even lets you borrow up to 50% of your net pay, with no interest or fees, as long as you have a steady paycheck and a bank account. You can repay the loan automatically from your next paycheck, or earlier if you want.

Even is also intended to assist you with avoiding overdrafts and late fees by displaying how much money you have left after paying your payments. You may also set up automatic savings goals and Even will transfer money from your paycheck to your savings account each pay period. Even has a Plus subscription that provides access to additional functions such as credit monitoring, identity protection, and cashback benefits.

Even is one of the best apps to borrow money since it is simple to use, transparent, and dependable. You can apply for a loan in minutes and have the funds transferred to your bank account within hours. On the app, you can also view your loan status and repayment history.

Website: https://www.even.com/

Image via https://www.even.com/

Image via https://www.even.com/