Top 21 Best Stocks Under a Dollar Permanent

Penny stocks on platforms like Robinhood are still doing well in the stock market. This article will teach you about the best penny stocks on Robinhood. It is ... read more...also my hope that the information will encourage you to consider investing in stocks. Toplist have compiled a list of 21 stocks in which you can invest this year. However, be cautious about the amount of money you invest in them because they are frequently unstable, have low liquidity, and are highly volatile.

-

Acasti Pharma is another biotech penny stock under $1. The company focuses on the development of biotech treatments.

At the beginning of November, the stock hit a 52-week low of $0.171. ACST stock has since risen to highs of $0.4177 this week.

CaPre, a therapeutic currently in Phase 3 trials to treat hypertriglyceridemia, is among the products in its pipeline.

Oppenheimer & Co. was hired by the company earlier this year. The primary reason was to conduct a strategic review of the company in order to explore strategic alternatives to drive shareholder value.

This includes any potential mergers, acquisitions, or other initiatives involving Acasti and/or CaPre, the company's omega 3 product.

Website: www.acastipharma.com

Market Cap: $0.05 Billion

Photo: Acasti Pharma Inc.

Photo: LinkedIn -

Marathon Oil Corporation, abbreviated as Marathon Oil, is an American petroleum and natural gas exploration and production company headquartered in Houston, Texas, in the Marathon Oil Tower.

There were numerous oil and gas stocks that saw short-term price increases. Marathon Oil Corporation (NYSE: MRO) was not one of these companies.

Regardless, certain names, such as Marathon, are being mentioned in the broader context of oil and gas recovery. While shares fell late last week, MRO stock tested and held above $3.70-$3.80.

Marathon, in particular, is not entirely unfavorable to the sector. The company reinstated its base dividend in early October. It was also successful in reducing the company's debt by approximately $100 million.

Again, we'll have to wait until November to see if these efforts pay off or if the pressure on oil prices is the more powerful force to contend with.

As a result, this is one of the cheapest stocks on Robinhood, with a price of less than $1.

Website: www.marathonoil.com

Market Cap: 15.991B

Photo: marathonoil

Photo: marathonoil -

Nokia Corporation is a multinational telecommunications, information technology, and consumer electronics company headquartered in Finland. This is also one of the cheapest stocks on Robinhood.

Nokia Corporation (NYSE: NOK) was one of the more impressive rebound stories following the March sell-off. However, things quickly unraveled at the end of August. Last week, the penny stock fell from more than $5 to below $3.50.

Nokia, on the other hand, has remained one of the most popular penny stocks on Robinhood. Is it because there are few stocks under $1-$5 involved in 5G, or is it another case of investing in a "popular name"? Investors must deal with the when regardless of the why.

Website: www.nokia.com

Market cap: $32.26 B

Photo: www.nokia.com

Photo: vov -

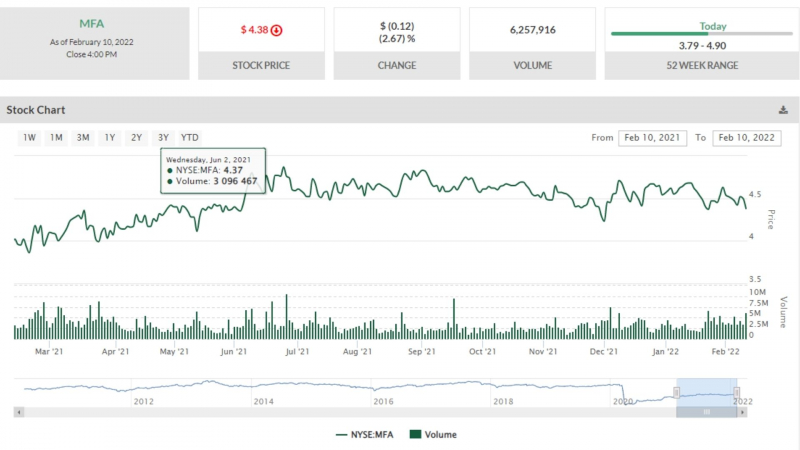

This is a real estate investment trust that primarily invests in residential mortgage assets, including residential mortgage-backed securities and residential whole loans, on a leveraged basis.

MFA Financial Inc. (NYSE: MFA) is also one of Robinhood's top cheapest penny stocks under $1.

Despite the sell-off, this stock has made a clear and consistent recovery with little volatility.

MFA stock has returned more than 780 percent since March, despite not having a large daily swing.Website: www.mfafinancial.com

Market Cap: 1.944B

Photo: mfafinancial

Photo: mfafinancial -

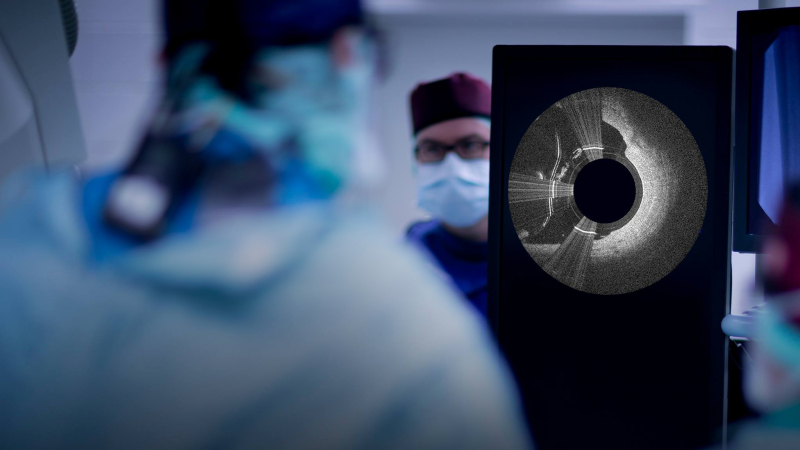

Endologix, Incorporated ELGX is yet another penny stock on our list of the best penny stocks to buy right now. It is traded on the NASDAQ stock exchange.

Endologix was founded in 1992 as one of the new companies to buy penny stocks. Its primary focus is on the development, manufacture, and sale of medical devices. The devices are used to treat abdominal aortic aneurysms all over the world.

The company provides endovascular aneurysm repair (EVAR) with minimally invasive techniques, as well as the VELA Proximal Endograft and the Ovation abdominal stent graft system.

It also sells an EVAS (endovascular aneurysm sealing system).

ELGX's stock price was $0.22 on December 3rd. It has a market cap of 371.83K and a market volume of 7,798,100. Please keep in mind that the next Earnings Date is February 24, 2021.

Website: endologix.com

Market Cap: $4,217,763

Photo: Business Wire

Photo: elgx.org -

Avinger Inc. is one of the Robinhood penny stocks available for purchase for less than $1. The stock has a Buy rating from the firm, with a price target of approximately 212 percent higher than current trading levels around $0.32.

Aegis' AVGR stock forecast of $1 was issued in September. Furthermore, Avinger received an extension from the exchange at the beginning of December, giving them until May of next year to reach $1.

Avinger is looking into a possible reverse stock split of 1:5 and up to 1:20. This will be voted on at the company's annual shareholder meeting on December 10th.

Website: avinger.com

Market Cap: 25.086M

Photo: Warrior Trading News

Photo: LinkedIn -

Oragenics Inc. does not currently have a price target or an analyst rating. However, the company has been working on a number of different projects.

These have contributed to a buildup of momentum in the fourth quarter. In fact, since November 20th, OGEN stock has risen from around $0.38 to highs of $0.6499 this week.

That's a gain of more than 70% in just a few weeks, resulting from a move of less than 30 cents. The company recently completed a $6 million public offering, which provides the capital required to expand on its preclinical developments.

Oragenics is specifically working on a SARS-CoV-2 vaccine, Terra CoV-2, as well as its lantibiotics program.

Oragenics is specifically working on a SARS-CoV-2 vaccine, Terra CoV-2, as well as its lantibiotics program.

Website: www.oragenics.com

Market Cap: 47.769M

oragenics Video: SNN Network -

The COVID-19 vaccine frenzy has swept up a slew of small pharmaceutical and biotech names. That's good news for a lot of these smaller companies. Even if they are only minor players, they receive coverage. This helps them gain attention within the industry and from investors.

This is what happened to AMPE. Its anti-inflammatory drug Ampion, which is being tested for osteoarthritis, has been approved for use in COVID-19 patients with respiratory issues. The company is currently conducting an IV trial and has recently begun research on an inhalable version.

It also has another drug in development for diabetic macular edema, which affects approximately 600,000 patients in the United States each year.

Year to date, the stock is up 42 percent.

Website: ampiopharma.com

Market Cap: 117.608M

Photo: ampiopharma

Photo: ampiopharma -

For decades, mining companies have been a part of the penny stock world. Because the operations are typically small and the work is risky, they are typically inexpensive stocks. Mining operations are frequently conducted in foreign countries where conditions are difficult, governments are unstable, and logistics are a headache.

GPL, a Canadian mining company, has, on the other hand, been handling all of the above since 1965. That's quite a survival record in this difficult game. The majority of its operations are in Peru, specifically in the Andes. It is primarily concerned with gold, silver, copper, lead, and zinc.

In general, the business strategy of smaller miners looks something like this. You discover promising prospects for industrial metals, which usually indicate the presence of precious metals, and you begin digging. While you wait for gold and silver, industrial metals keep the money flowing.

The stock has a market capitalization of $303, so it is not insignificant. And gold is an excellent hedge in uncertain times.Year to date, the stock is up 67 percent.

Website: www.greatpanther.com

Market Cap: 96.546M

Photo: greatpanther Video: 121 Mining Investment TV -

Aside from mining, the other companies in this low-priced tier are oil and natural gas exploration and production (E&P) companies.

GPOR, with a market cap of only $57 million, is an Oklahoma-based E&P firm focused on natural gas. It owns land in Oklahoma, the Utica Shale, and Louisiana.

This stock typically follows the ebbs and flows of the energy markets. Its 52-week range has been 33 cents to $3 per share. That makes for an exciting ride.

The bet here is that energy prices are nearing a bottom rather than a peak, especially since the dollar's weakness is supporting energy prices and the winter season will likely increase demand for natural gas.

Year to date, the stock is down 89 percent.

Website: www.gulfportenergy.com

Market Cap: 1.33B

Photo: gulfportenergy

Photo: oilandgas360 -

Labrador Iron Mines Holdings Limited is a mineral resource company that explores, develops, and mines iron ore projects in Canada.

The Schefferville and Houston projects, which include the Houston and Malcolm properties, as well as the Elizabeth Taconite property, are the company's main projects. The company was founded in 2007 and is based in Toronto, Canada.

- OTCMKTS: LBRMF

- Stock Price: $0.19 (+$0.04)

- Consensus Rating: Buy (5 Buy Ratings, 0 Hold Ratings, 0 Sell Ratings)

- Consensus Price Target: $31.40 (16,873.0% Upside)

Market Cap: 16.723M

Photo: labradorironmines Video: Labrador Iron Mines Limited -

9 Meters Biopharma, Inc. is a clinical-stage biotechnology company that focuses on patients with rare disorders and unmet medical needs. Drug candidates for short bowel syndrome (SBS) and celiac disease are in the company's pipeline.

It is working on NM-002, a long-acting injectable GLP-1 agonist in Phase 2 clinical trials for SBS, as well as Larazotide, a celiac disease Phase 3 therapeutic in development.

NM-003, a proprietary long-acting GLP-2 agonist, and NM-004, a double-cleaved mesalamine with an immunomodulator, are also under development for rare and/or orphan indications. The headquarters of 9 Meters Biopharma, Inc. are in Raleigh, North Carolina.- NASDAQ: NMTR

- Stock Price: $0.84 (+$0.08)

- Market Cap: $113.50 million

- Consensus Rating: Buy (5 Buy Ratings, 0 Hold Ratings, 0 Sell Ratings)

- Consensus Price Target: $5.00 (498.8% Upside)

Website: 9meters.com

Market Cap: 177.689M

Photo: 9meters

Photo: 9meters -

Motus GI Holdings, Inc., a medical technology company, offers endoscopy solutions in the United States and Israel that improve clinical outcomes and cost-efficiency in the diagnosis and management of gastrointestinal conditions.

The Pure-Vu system, a medical device used to clean a poorly prepared colon during a colonoscopy procedure, is its flagship product. The headquarters of the company are in Fort Lauderdale, Florida.- NASDAQ: MOTS

- Stock Price: $0.97 (-$0.03)

- PE Ratio: -1.36

- Market Cap: $32.24 million

- Consensus Rating: Buy (5 Buy Ratings, 0 Hold Ratings, 0 Sell Ratings)

- Consensus Price Target: $2.40 (148.6% Upside)

Market Cap: 19.794M

Photo: motusgi

Photo: motusgi -

CES Energy Solutions Corp. and its subsidiaries provide consumable chemical solutions throughout the oilfield's life cycle.

It offers solutions at the drill-bit, the completion and stimulation point, the wellhead and pump-jack, and all the way to the pipeline and midstream market.

Corrosion inhibitors, demulsifiers, H2S scavengers, paraffin control products, surfactants, scale inhibitors, biocides, and other specialty products are among the solutions offered by the company.

It also develops and manufactures drilling fluid systems and complete solutions for oil and gas producers, as well as products and specialty chemicals for use in the oil and natural gas production markets, stimulation and fracturing markets, and pipeline and midstream markets.

Furthermore, the company offers environmental consulting, water management services, and drilling fluid waste disposal services primarily to oil and gas producers, as well as trucks and trailers to transport oil and gas products.

It provides services to the oil and gas industry, including multinational producers, intermediate oil and gas operators, independent juniors, and joint ventures, as well as pipeline and midstream markets in western Canada and the United States.

In June 2017, the company changed its name from Canadian Energy Services & Technology Corp. to CES Energy Solutions Corp. CES Energy Solutions Corp. was founded in 1986 and is based in Calgary, Canada.- OTCMKTS: CESDF

- Stock Price: $0.95 (-$0.03)

- Consensus Rating: Buy (5 Buy Ratings, 2 Hold Ratings, 0 Sell Ratings)

- Consensus Price Target: $1.85 (94.7% Upside)

Website: www.cesenergysolutions.com

Market Cap: 632.083M

Photo: CES Energy Solutions Corp. Video: CES Energy Solutions -

CaixaBank, S.A., through its subsidiaries, offers banking and financial products and services in Spain and around the world. The company operates in two segments: Banking and Insurance and Non-Core Real Estate Activity.

The Banking and Insurance segment is involved in the banking business, which includes retail banking, corporate and institutional banking, cash management, and market service activities, as well as insurance and asset management.

The Non-Core Real Estate segment finances non-core real estate assets such as non-core developer lending, foreclosed real estate assets for sale and rental, and other real estate assets and holdings.

As of December 31, 2018, the company served its customers through 5,110 branches, 4,608 in Spain and 502 abroad, as well as approximately 9,425 ATMs in Spain and 1,369 in Portugal. CaixaBank, S.A. was established in 1904 and is headquartered in Valencia, Spain.

- OTCMKTS:CAIXY

- Stock Price: $0.90 (-$0.01)

- Consensus Rating: Buy (6 Buy Ratings, 3 Hold Ratings, 0 Sell Ratings)

- Consensus Price Target: N/A

Website: www.caixabank.es

Market Cap: 26.375B

Photo: dailysabah

Photo: atalayar -

In Canada and Australia, MediPharm Labs Corp. and its subsidiaries manufacture and sell pharmaceutical-grade cannabis oil and concentrates for derivative products. It also offers licensed producers and growers cannabis contract processing services, as well as tolling services to licensed cultivators in Canada.

Furthermore, the company provides purified cannabis concentrate raw materials as well as product formulations for ready-to-sell advanced cannabis products. Furthermore, it is involved in the real estate industry. The company was founded in 2015 and is based in Barrie, Ontario, Canada.

- OTCMKTS:MEDIF

- Stock Price: $0.45

- Consensus Rating: Buy (3 Buy Ratings, 2 Hold Ratings, 0 Sell Ratings)

- Consensus Price Target: $1.56 (247.2% Upside)

Website: www.medipharmlabs.com

Market Cap: 44.938M

Photo: potstocknews

Photo: businessquant -

While the majority of the low-cost stocks on this list are in fairly straightforward industries, GSM is an intriguing player in a niche market. It manufactures silicon and manganese metals and alloys for use in a variety of applications ranging from solar panels to stainless steel.

It is fairly vertically integrated, with mines in Spain, South Africa, and the United States, as well as factories that refine the mined materials for its customers.

GSM was formed in 2015 by the merger of a Spanish and an American company. It is currently registered in the United Kingdom.

As the global economy has slowed due to the pandemic, its business lines have suffered. However, a weaker dollar means lower production costs, and institutional investors' growing interest in ESG (environmental, social, and governance) investing will help.

It has a market capitalization of $106 million, and the stock is down 33% year to date.Website: www.ferroglobe.com

Market Cap: 1.508B

Photo: Tech Stock Observer

Photo: ferroglobe -

This biopharmaceutical is more about a new drug delivery platform than it is about drugs.

It is working on a drug for people who have dyslipidemia, or abnormally high triglycerides or cholesterol. It delivers omega-3 fatty acids to lower lipid counts more effectively than other methods using its proprietary platform.

Its platform is known as Lipid Nano-Crystal (LNC), and it allows drugs that would otherwise be highly toxic in the blood to be delivered to the cells that require treatment. This could have a significant impact on how drugs are delivered for a variety of diseases.

SunTrust has just started covering the stock, which has a market cap of $177 million. MTNB is down 61 percent year to date, indicating that it is inexpensive and has more upside than downside ahead of it.

Website: www.matinasbiopharma.com

Market Cap: 153.536M

Photo: Facebook

Photo: sternaegis -

Do you want to invest in a copper-gold-silver mining project in Outer Mongolia? TRQ, on the other hand, is a low-cost stock designed specifically for you.

TRQ has been mining in Mongolia for decades, while most miners focus on classic properties in North America, South America, Africa, and Southeast Asia. Because of its location, it has access to both the Chinese and Indian markets. That makes for an intriguing game.

Furthermore, with a market capitalization of $1.6 billion, it has the largest market cap of any of the seven stocks here. TRQ is up 9% year to date and still trades at a PE of 4, which is a steal given the rise in other gold mining stocks.

Website: www.turquoisehill.com

Market Cap: 4.252B

Photo: turquoisehill

Photo: turquoisehill -

Tanzania is 1.4 times the size of Texas. It is located on Africa's east coast, below Kenya and above Mozambique. While you may not have heard much about the country, you are likely to be familiar with two of its major attractions: Serengeti National Park and Mount Kilimanjaro.

Agriculture, mining, and energy are among the country's natural resources. TRX is a gold miner that has recently started production at its Buckreef Gold Mine Project open pit mine.

An independent assessment of the property updated its gold estimate by 2.5 times in late June. Furthermore, the projected operational costs are very low.

TRX has a market cap of $145 million, which is up 14% year to date. If gold continues to rise as economic uncertainty persists, it has plenty of room to rise from here, particularly as production expands.

Website: www.tangoldcorp.com

Market Cap: 95.848M

Photo: tangoldcorp

Photo: The Assay -

This is one of Robinhood's cheapest and most popular penny stocks. This may not be the best penny stock to purchase. It goes without saying that where there is attention, there is usually momentum. Aurora Cannabis Inc. (NYSE: ACB) is no stranger to market turbulence.

Aurora anticipates revenue to be at the higher end of its previously stated range of $60-$64 million.

Furthermore, the company expects adjusted gross margins to range between 46 and 50 percent for the quarter.

While this may appear to be a positive development on the surface, there are several factors to consider as headwinds for ACB stock. The cost is $1. So, for more information, please see the link below.

Website: www.auroramj.com

Market Cap: 994.399M

Photo: Newswire.CA

Photo: YouTube