Top 10 Best Websites to Invest in Stocks

There are several reputable websites where you can invest in stocks. Here is a list of top 10 Best Websites to Invest in Stocks.... read more...

-

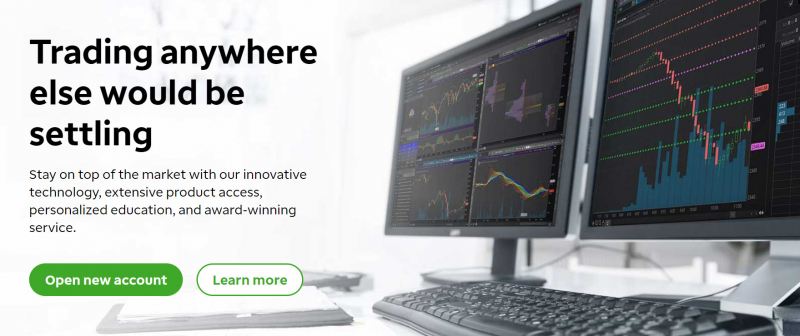

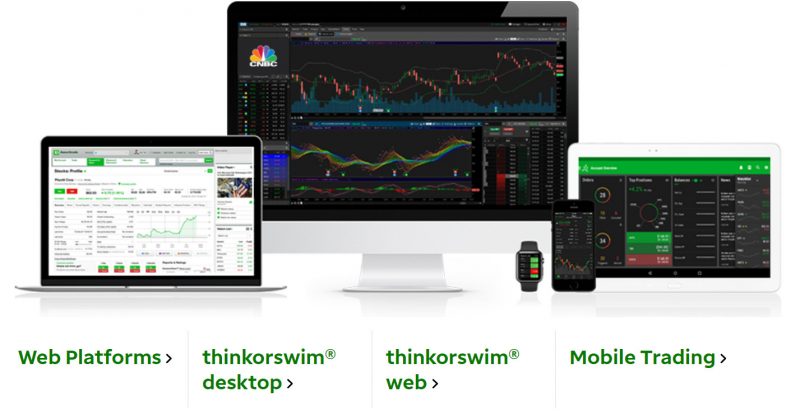

TD Ameritrade is a popular online broker that offers a variety of investment products and services to individual investors and traders. The company was founded in 1971 and is headquartered in Omaha, Nebraska.

TD Ameritrade provides access to a wide range of investment products, including stocks, options, mutual funds, exchange-traded funds (ETFs), futures, and foreign exchange (forex). The company also offers a number of trading platforms, including the thinkorswim platform, which is designed for active traders and offers advanced charting, analysis, and trading tools.

In addition to its trading platforms, TD Ameritrade also provides a variety of educational resources for investors and traders, including webinars, articles, and videos. The company's website and mobile apps are user-friendly and offer a wide range of features, including real-time quotes, news, and research.

In 2020, Charles Schwab announced plans to acquire TD Ameritrade, and the two companies merged in October of that year. Today, TD Ameritrade continues to operate under the Charles Schwab brand.

Pros

- Wide range of investment products

- Advanced trading platforms

- Educational resources

- User-friendly website and mobile apps

- Customer support

Cons

- High fees

- Minimum account balance requirements

- Limited availability of commission-free ETFs

- No fractional shares

- High margin rate

Google rating: 5.0/5.0

Fees: $0 stock trades

Website: https://www.tdameritrade.com/

Screenshot via tdameritrade.com

Screenshot via tdameritrade.com -

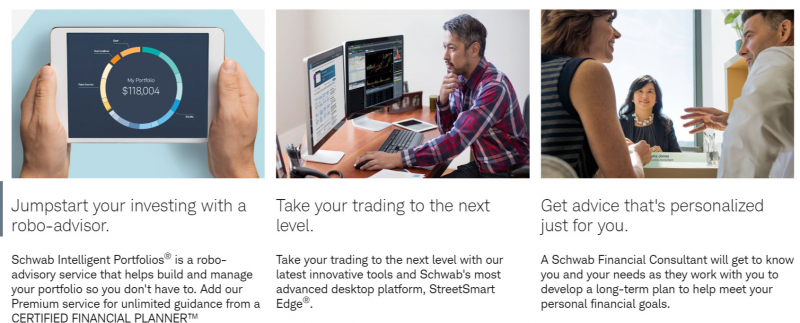

Charles Schwab is a financial services company that provides a range of investment services and products to its clients. The company was founded in 1971 and is headquartered in San Francisco, California.

Charles Schwab offers a variety of investment options, including stocks, bonds, mutual funds, ETFs, and options trading. The platform also offers a robo-advisory service called Schwab Intelligent Portfolios, which creates a diversified portfolio for clients based on their investment goals, risk tolerance, and time horizon.

In addition to investment services, Charles Schwab also offers a range of research and educational resources to help clients make informed investment decisions. These resources include market analysis, news updates, and educational articles and videos.

Charles Schwab offers a range of account types, including individual and joint brokerage accounts, traditional and Roth IRA accounts, education savings accounts, and small business retirement accounts. The platform also offers a cash management account called Schwab Bank High Yield Investor Checking, which provides clients with a high-yield checking account and a debit card with no account fees or ATM fees.Pros

- Three platforms with no minimum or fees.

- Above-average mobile app.

- Extensive research.

- Large fund selection.

- Commission-free stock, options and ETF trades.

Cons

- Low default cash sweep rate.

Google rating: 5.0/5.0

Fees :$0 stock and ETF trades

Website: https://www.schwab.com/

Screenshot via https://www.schwab.com/

Screenshot via https://www.schwab.com/ -

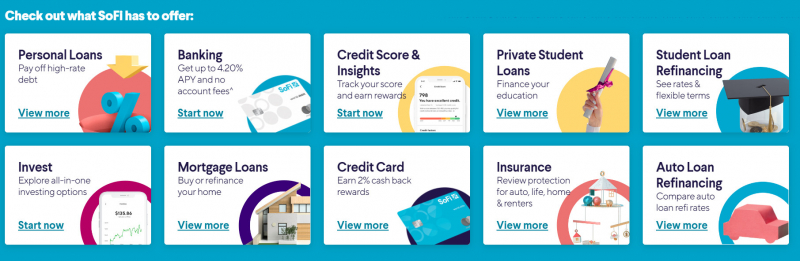

SoFi, short for Social Finance, is an online personal finance company that offers a range of financial services to its members. The company was founded in 2011 and is headquartered in San Francisco, California.

SoFi offers a variety of financial services, including student loan refinancing, personal loans, home loans, investing, and banking. In addition to traditional financial products, the company also offers a range of member benefits, including career coaching, financial planning, and exclusive events.

One of the unique features of SoFi is its focus on community and member benefits. The company aims to create a community of like-minded individuals who are interested in improving their financial well-being. Members can connect with each other through the platform and attend exclusive events and experiences.

SoFi's investment platform offers a range of investment options, including stocks, ETFs, and cryptocurrency. The platform also offers a robo-advisory service called SoFi Automated Investing, which creates a diversified portfolio for clients based on their investment goals, risk tolerance, and time horizon.

Pros

- Broad range of low-cost investments.

- Free management.

- Automatic rebalancing.

- Customer support.

- Access to certified financial planners.

Cons

- Limited account types.

- No tax-loss harvesting.

Google rating: 4.9/5.0

Fees: $0 for stocks, $0 for options contracts

Website: https://www.sofi.com/

Screenshot via https://www.sofi.com/

Screenshot via https://www.sofi.com/ -

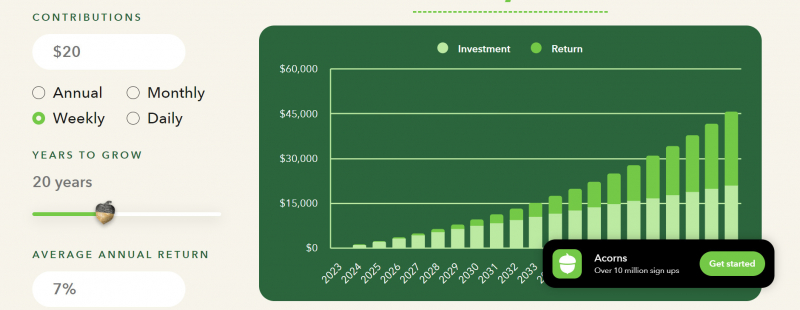

Acorns is an online investing platform that aims to make investing more accessible to everyday individuals. The company was founded in 2012 and is headquartered in Irvine, California.

Acorns is a unique platform in that it focuses on micro-investing, which allows clients to invest small amounts of money on a regular basis. The platform rounds up each of the client's debit or credit card transactions to the nearest dollar and invests the difference into a diversified portfolio of ETFs.

In addition to micro-investing, Acorns also offers a range of investment options, including individual stocks and ETFs. The platform also offers a robo-advisory service called Acorns Later, which creates a retirement account for clients and automatically invests their contributions based on their retirement goals and time horizon.

Acorns also offers a cash management account called Acorns Spend, which provides clients with a checking account, a debit card, and a high-yield savings account. The account also offers features like instant funding, mobile check deposit, and fee-free ATM withdrawals.Pros

- Automatically invests spare change.

- Cash back at select retailers.

- Educational content available.

Cons

- High fee on small account balances.

Google rating: 4.5/5.0

Fees: $3 - $5 per month

Website: https://www.acorns.com/

Screenshot via https://www.acorns.com/

Screenshot via https://www.acorns.com/ -

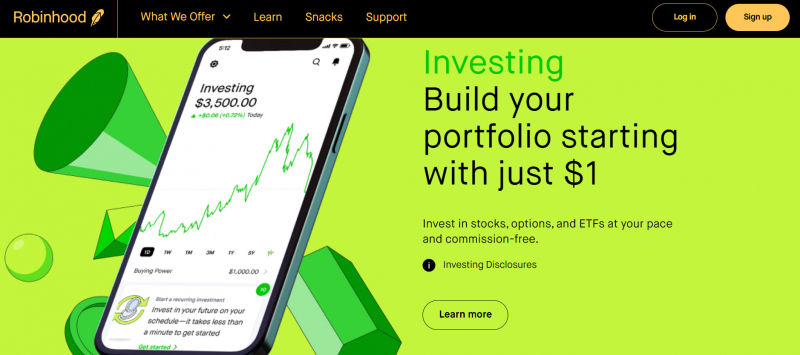

Robinhood is a commission-free online brokerage platform that allows individuals to invest in stocks, options, ETFs, and cryptocurrencies. The company was founded in 2013 and has gained popularity due to its user-friendly interface and commission-free trading.

One of the unique features of Robinhood is its mobile app, which allows clients to trade on-the-go and provides real-time market data and news updates. The platform also offers a variety of educational resources, including articles, videos, and podcasts, to help clients make informed investment decisions.

Robinhood is known for its commission-free trading model, which allows clients to buy and sell securities without paying any commission fees. However, the company generates revenue through other means, such as interest on cash balances and fees for premium services like Robinhood Gold.

In addition to its investment services, Robinhood also offers a cash management account that provides clients with a debit card, ATM access, and a high-yield savings account.

Pros

- No account minimum.

- Streamlined interface.

- Cryptocurrency trading.

Cons

- No mutual funds or bonds.

- Limited customer support.

Google rating: 4.5/5.0

Fees: $0 for stocks, ETFs, and options

Website: https://robinhood.com/us/en/

Screenshot via robinhood.com

Screenshot via robinhood.com -

E*TRADE is one of the best Websites to Invest in Stocks that offers a variety of investment services and products to its clients. The company was founded in 1982 and has since grown to become one of the largest online brokerage firms in the United States.

ETRADE provides clients with a wide range of investment options, including stocks, bonds, mutual funds, ETFs, and options trading. The platform also offers a robo-advisory service called ETRADE Core Portfolios, which uses an algorithm to create a diversified portfolio for clients based on their investment goals, risk tolerance, and time horizon.

In addition to investment services, E*TRADE also provides a variety of research and educational resources to help clients make informed investment decisions. These resources include market analysis, news updates, and educational articles and videos.

E*TRADE offers a range of account types, including individual and joint brokerage accounts, traditional and Roth IRA accounts, education savings accounts, and small business retirement accounts. The platform also offers a cash management account that provides clients with access to a high-yield savings account, a debit card, and online bill pay.

Pros

- Easy-to-use tools.

- Large investment selection.

- Excellent customer support.

- Advanced mobile app.

- Commission-free stock, options, mutual fund and ETF trades.

Cons

- Website can be difficult to navigate.

Google rating: 4.5/5.0

Fees: Commission Free

Website: https://us.etrade.com/home

Screenshot via https://us.etrade.com/home Arvabelle channel on youtube -

Merrill Edge is an online brokerage platform that allows individuals to invest in the stock market, mutual funds, ETFs, and other investment vehicles. It is a subsidiary of Bank of America and was launched in 2010. Merrill Edge offers a variety of investment tools, including a mobile app, research and insights, educational resources, and a wide range of investment options.

One of the unique features of Merrill Edge is its integration with Bank of America's banking services. This allows clients to link their Merrill Edge accounts with their Bank of America accounts, providing easy access to their investment accounts and a single sign-on process for both services.

Merrill Edge offers a variety of account types, including individual and joint brokerage accounts, traditional and Roth IRA accounts, education savings accounts, and small business retirement accounts. The platform also offers a robo-advisory service called Merrill Edge Guided Investing, which uses an algorithm to recommend investments based on a client's risk tolerance, investment goals, and time horizon.

Pros

- Low trading fees

- Limited to US clients and products

- Easy and seamless account opening

Cons

- No demo account

- Strong parent company

- Few options for deposit/withdrawal

Google rating: 4.5/5.0

Fees: $0 for online stock and ETF trades

Website: https://www.merrilledge.com/

Screenshot via merrilledge.com Merrill channel on youtube -

Fidelity Investments is a financial services company that provides investment management, retirement planning, wealth management, and other financial services to individuals, institutions, and financial advisors. Founded in 1946, Fidelity is one of the largest investment managers in the world, with over $10 trillion in assets under management as of 2021.

Fidelity offers a wide range of investment products and services, including mutual funds, exchange-traded funds (ETFs), individual retirement accounts (IRAs), 401(k) plans, and brokerage services. The company also offers financial planning and advisory services, as well as educational resources to help investors make informed decisions about their investments.

Fidelity is known for its technology platforms and tools, which are designed to help investors manage their investments and make informed decisions. Some of these tools include a mobile app, online trading platforms, and research and analysis tools.

Fidelity has a reputation for strong customer service and has received numerous awards for its products and services. The company is headquartered in Boston, Massachusetts, and has operations in North America, Europe, Asia, and Australia.

Pros

- Wide range of investment products and services

- Strong customer service reputation

Cons

- High fees

- High minimum investment requirements

- Risk of losing money due to market fluctuations.

Google rating: 4.4/5.0

Fees: $0 commission for online U.S. stock and ETF tradesWebsite: https://www.fidelity.com/

Screenshot via fidelityinternational.com TruFinancials channel on youtube -

Vanguard is a well-known investment management company that offers a range of investment products and services to individuals and institutions. The company was founded in 1975 and is headquartered in Malvern, Pennsylvania.

Vanguard is known for its low-cost index funds and ETFs, which are designed to provide broad market exposure and low fees. The company's index funds and ETFs cover a wide range of asset classes, including stocks, bonds, and real estate.

In addition to index funds and ETFs, Vanguard also offers actively managed funds, which are managed by professional investment managers who attempt to beat the market. Vanguard also offers a range of retirement accounts, including traditional and Roth IRAs, 401(k) plans, and SEP-IRAs.

Vanguard also offers a variety of research and educational resources to help clients make informed investment decisions. These resources include market analysis, news updates, and educational articles and videos.

One of the unique features of Vanguard is its client-owned structure, which means that the company is owned by its funds and, in turn, by its clients. This structure is designed to align the interests of the company with those of its clients and keep costs low.Pros

- Large mutual fund selection.

- Commission-free stock, options and ETF trades.

- Leader in low-cost funds.

Cons

- Basic trading platform only.

- Limited research and data.

Google rating: 4.2/5.0

Fees: $0 stock and ETF trades

Website: https://investor.vanguard.com/corporate-portal/

Screenshot via https://investor.vanguard.com/home

Screenshot via https://investor.vanguard.com/home -

Cash App is a mobile payment service that allows individuals to send and receive money, pay bills, and invest in stocks and bitcoin. The service was launched in 2013 by Square, a financial services company founded by Jack Dorsey, the co-founder and CEO of Twitter.

Cash App allows users to send and receive money from other Cash App users instantly, using a mobile app. The app is free to download and use, and users can link their debit card or bank account to the app to add or withdraw funds. Cash App also offers a Cash Card, which is a free debit card that can be used to make purchases anywhere that Mastercard is accepted.

In addition to its payment services, Cash App also allows users to invest in stocks and bitcoin through the app. Users can buy fractional shares of stocks and exchange-traded funds (ETFs) and can also buy and sell bitcoin. The app charges no commissions or fees on stock or bitcoin trades.

Cash App also offers a Boost program, which allows users to earn discounts and rewards on purchases made with their Cash Card. Users can choose from a selection of Boosts, which offer discounts at specific retailers and restaurants.Pros

- Free money transfer

- Availability of debit card for purchases

- Opportunity to invest in stocks or bitcoin

Cons

- Not FDIC-insured

- Can’t cancel a transaction once authorized

- Limited investing opportunities

Google rating: 4.0/5.0

Fees: $0 for stocks, fees vary for cryptocurrencies

Website: https://cash.app/

Screenshot via https://cash.app/

Screenshot via https://cash.app/