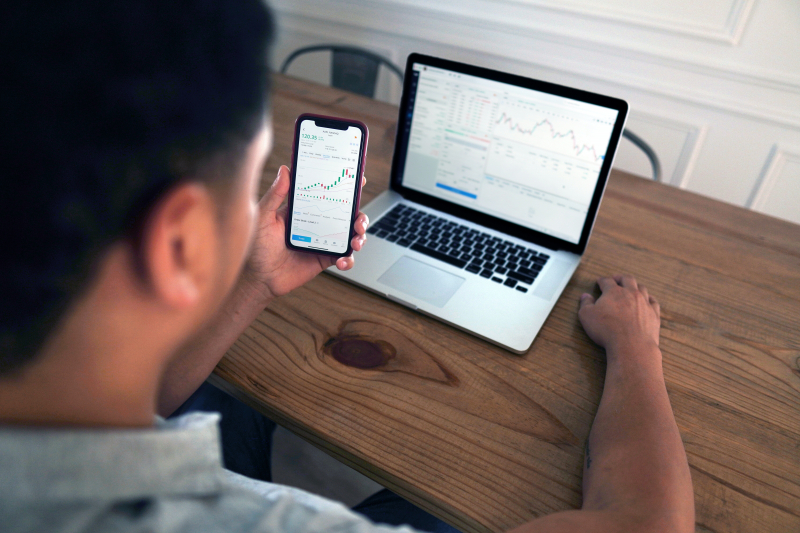

Top 12 Best Websites for Investing

In this 4.0 technology era, investment still brings a big profit, but at the same time, it also requires a lot of knowledge to be able to bring a lot of value. ... read more...Toplist has listed some websites to invest in for beginners that you can refer to.

-

Seeking Alpha is a popular online platform that hosts articles and analysis from a diverse community of investors and industry experts. It covers a wide range of investment topics, offering insights on specific stocks, ETFs, and industries. It aims to provide individual investors with valuable information and perspectives to aid their investment decisions.

- Pros:

Diverse community: It has a large community of investors and experts sharing insights.

Detailed analysis: Users can find in-depth research on stocks and industries.

Timely updates: Real-time news and market updates keep investors informed.

Educational resources: The platform provides educational articles to enhance knowledge.- Cons:

Quality variation: As contributions come from a diverse community, the quality of analysis may vary.

Overwhelming content: The extensive range of articles and opinions can be overwhelming for some users.

Potential biases: Contributors may have their own biases or conflicts of interest.

Not suitable for beginners: The platform's depth of information may be more suitable for experienced investors rather than beginners.DETAILED INFORMATION:

- Founded: 2004

- Founder: David Jackson and Eli Hoffmann

- Headquarters: New York City, United States.

- Website: https://seekingalpha.com/

- Facebook: https://seekingalpha.com/

- LinkedIn: https://www.linkedin.com/company/56547/

- Instagram: https://www.instagram.com/seekingalpha/

- YouTube: https://www.youtube.com/channel/UC9ZGkLwawKeG5C0Dt9FS-lQ

- Twitter: https://twitter.com/SeekingAlpha

Image by Karolina Grabowska via pexels.com

Image by MayoFi via pexels.com -

The Motley Fool is a popular financial website that provides educational content, investment analysis, and stock recommendations. It aims to help individuals make informed investment decisions by offering a combination of informative articles, research tools, and resources designed to simplify complex financial concepts.

- Pros:

Educational content: The Motley Fool offers a wealth of educational resources, making it a valuable platform for beginners looking to learn about investing.

Investment analysis: The website provides in-depth analysis on stocks, mutual funds, and other investment options, helping users make informed decisions.

Stock recommendations: The Motley Fool offers stock recommendations based on their research and analysis, providing potential investment opportunities.

Community engagement: Users can engage with a community of investors, exchange ideas, and learn from others' experiences.- Cons:

Subscription fees: Some of The Motley Fool's premium services require a paid subscription, limiting access to certain features and content.

Risk of biased information: As with any investment platform, it's important to exercise caution and consider potential biases in stock recommendations and analysis provided by The Motley Fool.

Individual research required: While The Motley Fool provides analysis and recommendations, users should conduct their own due diligence and research before making investment decisions.

Market Volatility: Investing in stocks and other financial instruments involves inherent risks, and users should be aware of the potential for market volatility and losses.

DETAILED INFORMATION:- Founded: 1993

- Founder: Tom and David Gardner

- Headquarters: Alexandria, Virginia

- Website: https://www.fool.com/

- TikTok: https://www.tiktok.com/@themotleyfoolofficial

- Instagram: https://www.instagram.com/themotleyfoolofficial/

- YouTube: https://www.youtube.com/user/TheMotleyFool

- Pinterest: https://www.pinterest.com/themotleyfool/

- LinkedIn: https://www.linkedin.com/company/the-motley-fool/

- Twitter: https://twitter.com/TheMotleyFool

- Facebook: https://www.facebook.com/themotleyfool

Image by Burak The Weekender via pexels.com

Image by Chris Liverani via unsplash.com -

Morningstar is a renowned platform offering independent investment research and analysis. It provides comprehensive information on mutual funds, stocks, ETFs, and other investment options. With its in-depth analysis and tools, Morningstar aims to assist investors in making well-informed investment decisions.

- Pros:

Independent research: Morningstar is known for its unbiased and independent investment research, providing valuable insights to investors.

Comprehensive information: The platform offers a wide range of data and analysis on mutual funds, stocks, ETFs, and more, enabling investors to make informed decisions.

Ratings and analysis tools: Morningstar provides ratings, performance metrics, and powerful analysis tools to help investors evaluate investment options.

Educational resources: Morningstar offers educational materials and articles to enhance investors' knowledge and understanding.- Cons:

Premium features: Some advanced features and in-depth research reports may require a paid subscription or membership.

Complexity for beginners: The platform's extensive information and analysis may be overwhelming or challenging for novice investors.

Limited coverage: Morningstar may not cover every investment option comprehensively, particularly smaller or less well-known assets.

Possible limitations in accuracy: While Morningstar strives for accuracy, there is always a possibility of errors or omissions in their data and analysis.DETAILED INFORMATION:

- Founded: 1984

- Founder: Joe Mansueto

- Headquarters: Chicago, Illinois, United States.

- Website: https://www.morningstar.com/

- Facebook: https://www.facebook.com/MorningstarInc

- Instagram: https://www.instagram.com/morningstarinc/

- YouTube: https://www.youtube.com/user/morningstar

- LinkedIn: https://www.linkedin.com/company/morningstar/

- Twitter: https://twitter.com/MorningstarInc

Image by Anna Nekrashevich via pexels.com

Image by PiggyBank via unsplash.com -

Bloomberg is a prominent global financial news and information provider. Bloomberg specifically caters to the Asian market, offering real-time market data, news, analysis, and a wide range of resources for investors and professionals in the Asian financial industry.

- Pros:

Extensive financial coverage: Bloomberg provides comprehensive coverage of global financial markets, including Asia, offering real-time data and news updates.

In-depth analysis: The platform offers sophisticated tools and analysis that cater to the needs of professional investors and financial industry experts.

Market insights: Bloomberg provides insights from expert analysts, helping users stay informed about market trends and developments.

Broad range of resources: It offers a wide range of resources, including charts, graphs, and economic indicators, to assist with investment decisions.- Cons:

Cost: Bloomberg's services can be expensive, making it more accessible to institutional investors or professionals rather than individual investors.

Complexity: The platform has a steep learning curve and can be overwhelming for beginners or those unfamiliar with financial markets.

Overemphasis on short-term news: Bloomberg focuses heavily on breaking news and short-term market movements, which may not align with long-term investment strategies.

Limited access: Bloomberg's services are primarily available to subscribers, limiting access to those who are willing to pay for the service.DETAILED INFORMATION:

- Founded: 1981

- Founder: Michael Bloomberg

- Headquarters: New York City, United States.

- Website: https://www.bloomberg.com/asia

- Facebook: https://www.facebook.com/bloomberg

- Instagram: https://www.instagram.com/bloomberg

- Twitter: https://twitter.com/bloomberg

Image by Antoni Shkraba via pexels.com

Image by Karolina Grabowska via pexels.com -

Zacks Investment Research is a platform focused on providing stock research, analysis, and recommendations. It offers a variety of tools and services to help investors make informed decisions, including stock rankings, earnings estimates, and expert insights. Its goal is to assist individuals in achieving better investment outcomes.

- Pros:

Extensive stock research: Zacks provides comprehensive research and analysis on a wide range of stocks, helping investors make informed decisions.

Stock rankings and ratings: The platform offers stock rankings based on various factors, providing a quick assessment of investment opportunities.

Earnings estimates: Zacks provides earnings estimates, allowing investors to gauge the potential performance of companies.

Expert insights: Zacks offers insights and recommendations from experienced analysts, providing valuable perspectives for investors.- Cons:

Subscription fees: Access to some of Zacks' premium features and reports may require a paid subscription.

Potential bias: Like any research provider, Zacks' recommendations and analysis may carry inherent biases or conflicts of interest.

Market volatility: Investors should be aware that investing in stocks carries risks, and market conditions can be unpredictable.

Individual research required: While Zacks provides analysis, investors should conduct their own research and consider multiple sources before making investment decisions.

DETAILED INFORMATION:- Founded: 1978

- Founder: Leonard Zacks

- Headquarters: Chicago, Illinois, United States.

- Website: https://www.zacks.com/

- Facebook: https://www.facebook.com/ZacksInvestmentResearch

- Twitter: https://twitter.com/ZacksResearch

- YouTube: https://www.youtube.com/user/ZacksInvestmentNews

Image by Alesia Kozik via pexels.com

Image by Kanchanara via pexels.com -

Yahoo Finance is a comprehensive financial website providing real-time stock quotes, news, portfolio management tools, and in-depth analysis. It covers a wide range of financial information, including stock market data, company profiles, financial charts, and personalized portfolio tracking, making it a valuable resource for investors and finance enthusiasts.

- Pros:

Real-time financial information: Yahoo Finance provides real-time stock quotes, market data, and news updates, keeping users informed about the latest market trends.

Portfolio management tools: The platform offers portfolio tracking features, allowing users to monitor and manage their investments in one place.

Wide coverage: Yahoo Finance covers a vast range of financial instruments, including stocks, bonds, mutual funds, ETFs, and more, providing comprehensive information for different investment options.

User-friendly interface: The website is known for its user-friendly interface, making it easy to navigate and access financial data and tools.- Cons:

Limited in-depth analysis: While Yahoo Finance provides basic analysis, it may not offer as extensive and detailed research reports as specialized platforms.

Advertisements: The platform includes advertisements, which can be distracting or disrupt the user experience.

Potential data delays: In certain cases, real-time data updates may have slight delays, which can affect the accuracy of information.

Limited customization: Customization options for portfolio tracking and alerts may be limited compared to dedicated portfolio management platforms.DETAILED INFORMATION:

- Founded: 1994

- Founder: Jerry Yang and David Filo.

- Headquarters: Sunnyvale, California, United States.

- Website: https://finance.yahoo.com/

- Facebook: https://www.facebook.com/yahoofinance

- LinkedIn: https://www.linkedin.com/company/yahoo-finance

- Twitter: https://twitter.com/YahooFinance

Image by Leeloo Thefirst via pexels.com

Image by Tima Miroshnichenko via pexels.com -

ValueInvesting.io is a platform dedicated to value investing, a strategy focused on buying undervalued stocks. It provides tools, resources, and educational content to help investors identify and analyze investment opportunities based on fundamental analysis and value principles.

- Pros:

Focus on value investing: The platform is dedicated to value investing, offering specialized tools and resources for investors interested in this strategy.

Investment analysis: ValueInvesting.io provides tools and resources to help investors analyze and evaluate stocks based on fundamental analysis and value principles.

Educational content: The platform offers educational resources and content to enhance investors' understanding of value investing concepts and strategies.

Community engagement: Users can engage with a community of like-minded investors, share ideas, and learn from each other's experiences.- Cons:

Narrow focus: ValueInvesting.io primarily caters to investors interested in value investing, which may limit its appeal to investors with different investment strategies.

Limited coverage: The platform's coverage may be focused on specific markets or regions, potentially limiting the availability of certain stocks or investment opportunities.

User experience: Depending on the platform's design and user interface, some users may find it less intuitive or user-friendly compared to other investment platforms.

Potential bias: As with any investment platform, users should be aware of potential biases in analysis or recommendations based on the platform's focus on value investing.

DETAILED INFORMATION:- Website: https://valueinvesting.io/

- Reddit: https://www.reddit.com/r/valueinvesting_io/

- Facebook: https://www.facebook.com/valueinvesting.io

- Twitter: https://twitter.com/_valueinvest_

- LinkedIn: https://www.linkedin.com/company/valueinvesting/

Image by m. via unsplash.com

Image by Alesia Kozik via pexels.com -

AlphaResearch is a platform that provides investment research and analysis. It offers users access to comprehensive financial data, advanced analytics, and tools for evaluating stocks and investment opportunities. The platform aims to assist investors in making informed decisions based on data-driven insights and research.

- Pros:

Comprehensive financial data: AlphaResearch.io provides users with access to a wide range of financial data, enabling thorough analysis of stocks and investment opportunities.

Advanced analytics: The platform offers advanced analytics tools to help investors evaluate the performance, trends, and potential risks of investments.

Data-driven insights: AlphaResearch.io focuses on data-driven research and analysis, providing users with objective and quantitative insights.

Decision support: The platform's tools and resources assist investors in making informed investment decisions.- Cons:

Potential learning curve: The advanced features and analytics tools may require some learning and familiarity to utilize effectively.

Limited user base: AlphaResearch.io may have a smaller community compared to more well-known investment platforms, resulting in less user-generated content and discussion.

Subscription fees: Access to some of the advanced features and premium content on AlphaResearch.io may require a paid subscription.

Potential biases: While the platform emphasizes data-driven insights, users should be aware of potential biases or limitations in the analysis provided.DETAILED INFORMATION:

- Website: https://alpharesearch.io/

- LinkedIn: https://www.linkedin.com/company/74479335

- Twitter: https://twitter.com/AlphaResearch9

Image by Dylan Calluy via unsplash.com

Image by Alesia Kozik via pexels.com -

Finsheet is a platform that provides financial data and analysis for investors. It offers a range of tools and resources to help users track and evaluate stocks, create portfolios, and make informed investment decisions. The platform aims to simplify financial analysis and empower investors with actionable insights.

- Pros:

Financial data and analysis: Finsheet.io provides users with access to comprehensive financial data and analysis tools to make informed investment decisions.

Portfolio management: The platform offers features for creating and managing investment portfolios, helping users track their holdings and performance.

Actionable insights: Finsheet.io aims to provide actionable insights and recommendations based on its analysis, assisting investors in identifying potential opportunities.

User-friendly interface: The platform is designed to be user-friendly, making it easy for investors to navigate and utilize its features.- Cons:

Limited coverage: Flysheet may have limitations in terms of coverage of markets, stocks, or other investment options compared to more comprehensive platforms.

Potential data delays: Depending on the data sources used, there may be occasional delays in updating information, affecting real-time accuracy.

Lack of personalized advice: While Finsheet.io provides analysis and insights, it does not offer personalized investment advice tailored to individual circumstances.

Subscription fees: Some advanced features or premium content on Finsheet.io may require a paid subscription.- Website: https://finsheet.io/

Image by André François McKenzie via unsplash.com

Image by Leeloo Thefirst via pexels.com -

Investopedia is an online educational platform that provides comprehensive resources on investing, finance, and related topics. It offers articles, tutorials, courses, and a financial dictionary to help individuals understand complex financial concepts, improve their investing knowledge, and make informed financial decisions.

- Pros:

Comprehensive educational resources: Investopedia offers a wide range of articles, tutorials, and courses covering various aspects of investing and finance.

Easy-to-understand explanations: The platform breaks down complex financial concepts into simple and accessible language, making it suitable for beginners.

Financial dictionary: Investopedia has a comprehensive financial dictionary that helps users understand industry-specific terms and jargon.

Community engagement: Users can engage with a community of fellow investors, ask questions, and participate in discussions.- Cons:

Limited depth: While Investopedia provides a solid foundation, its resources may lack the depth required for advanced or specialized topics.

Subject to bias: Like any educational platform, Investopedia's content may be subject to inherent biases or commercial interests.

Not a substitute for professional advice: It's important to remember that the information provided on Investopedia is educational in nature and should not replace personalized advice from a qualified financial professional.

Some content may require a subscription: Certain premium content or courses on Investopedia may require a paid subscription.

DETAILED INFORMATION:- Founded: 1999

- Founder: Cory Wagner and Cory Janssen

- Headquarters: New York City, New York, United States.

- Website: https://www.investopedia.com/

- Facebook: https://www.facebook.com/Investopedia/

- LinkedIn: https://www.linkedin.com/company/investopedia-ulc

- Instagram: https://www.instagram.com/investopedia/

- Twitter: https://twitter.com/investopedia

Image by Anna Nekrashevich via pexels.com

Image by Artem Podrez via pexels.com -

Benzinga Pro is a real-time stock market news and research platform designed for traders and investors. It provides fast and reliable market data, breaking news alerts, in-depth research tools, and customizable watchlists to help users stay informed and make informed trading decisions.

- Pros:

Real-time market data: Benzinga Pro offers fast and reliable real-time market data, enabling users to make timely trading decisions.

Breaking news alerts: The platform provides instant news alerts, ensuring users stay updated on market-moving events.

In-depth research tools: Benzinga Pro offers a range of research tools and analysis features to help users conduct thorough market research.

Customizable watchlists: Users can create personalized watchlists to track specific stocks or sectors of interest.- Cons:

Subscription fees: Access to the full features of Benzinga Pro requires a paid subscription.

Learning curve: The platform may have a learning curve for new users due to its extensive features and tools.

Limited coverage: Benzinga Pro may focus more on US markets and may have limited coverage of international markets or specific asset classes.

Overwhelming for casual investors: The platform's features and data may be more suitable for active traders and professional investors, potentially overwhelming casual investors.

DETAILED INFORMATION:- Founder: Jason Raznick

- Headquarters: Detroit, Michigan, United States.

- Website: https://pro.benzinga.com/

- LinkedIn: https://www.linkedin.com/company/1058415

- Twitter: https://twitter.com/Benzinga

- Facebook: https://www.facebook.com/Benzinga/

- Stockwits : https://stocktwits.com/Benzinga

-

TradeStation is a brokerage and trading platform that offers advanced tools and technology for active traders and investors. It provides access to a wide range of markets, customizable trading strategies, advanced charting and analysis tools, and educational resources to support informed decision-making and trading strategies.

- Pros:

Advanced trading tools: TradeStation offers sophisticated trading tools and technology for active traders, including advanced charting, analysis, and strategy development.

Market access: The platform provides access to a wide range of markets, including stocks, options, futures, and cryptocurrencies.

Customization options: TradeStation allows users to customize their trading strategies, indicators, and alerts to suit their individual preferences and trading style.

Educational resources: TradeStation offers educational materials, webinars, and a community platform to help users enhance their trading knowledge and skills.- Cons:

Steep learning curve: Due to its advanced features, TradeStation may have a steeper learning curve for beginners or less experienced traders.

Higher fees: Compared to some other brokerage platforms, TradeStation may have higher commission and fee structures, particularly for active trading.

Platform complexity: The platform's advanced features and tools may be overwhelming for casual investors or those seeking a simpler trading experience.

Customer service: Some users have reported mixed experiences with TradeStation's customer service and support.DETAILED INFORMATION:

- Founded: 1982

- Founder: William and Rafael Cruz

- Headquarters: Plantation, Florida, United States.

- Website: https://www.tradestation.com/

- YouTube: https://www.youtube.com/tradestation

- Twitter: https://twitter.com/tradestation

- Instagram: https://www.instagram.com/tradestation/

Image by Maxim Hopman via unsplash.com

Image by Tima Miroshnichenko via pexels.com