Top 8 Biggest Fintech Companies In America

Fintech companies are financial organizations that use technology to supplement, simplify, or digitize their financial services and products. In today's ... read more...financial technology ecosystem, a number of high-growth fintech startups with new business models are challenging traditional banks in various sectors such as lending and credit, payments, cryptocurrencies, blockchain, open banking, BNPL, insuretech, etc. Let's find out the Top 10 Biggest Fintech Companies In America below to have more options!

-

Stripe, Inc. is a San Francisco-based financial services and software as a service (SaaS) firm with offices in Dublin, Ireland. Payment processing software and application programming interfaces (APIs) for e-commerce websites and mobile applications are the company's primary offerings.

Stripe, which was founded in 2011, assists small companies as well as industry heavyweights like Microsoft and Zoom in processing online payments. Stripe and Ford Motor Company announced a five-year agreement in January 2022, in which Stripe would process transactions for consumer car orders and reservations. Stripe teamed up with Spotify the same month to let creators monetize subscriptions, take payments, and start recurring revenue streams. With a $95 billion value, it is still the most valuable fintech in the United States, up from $35 billion last year. Stripe is also the world's second-most valued company, behind only ByteDance, the owner of TikTok.

Detailed Information:

Founded: 2009

Founders: Patrick and John Collison

Headquarters: San Francisco, California, US and Dublin, IrelandRevenue: $7.4 billion (2020)

Number of employees: 4,000+ (May 2021)

Stripe

Stripe -

Klarna Bank AB, or simply Klarna, is a fintech firm based in Sweden that offers online financial services such as payments for online stores, direct payments, and post-purchase payments. The firm handled around $35 billion in online sales in 2019. In 2011, Klarna accounted for almost 40% of all e-commerce sales in Sweden. The corporation was estimated to be worth $45.6 billion in 2021.

Klarna's main offering is payment processing for e-commerce businesses, including managing shop claims and customer payments. It's become recognized as a "Buy now, pay later" (BNPL) service provider since it gives clients credit for their purchases throughout the checkout process. As the "buy now, pay later" pioneer, has risen to riches as customers increasingly choose debit over credit. Customers shopping at IKEA, H&M, and Etsy may use the 16-year-old fintech to get funding. In March 2021, its value increased as a result of the pandemic's eCommerce boom.

Detailed Information:

Founded: 2005

Founder: Sebastian Siemiatkowski, Niklas Adalberth, Victor Jacobsson

Headquarters: Stockholm, SwedenRevenue: 1,087 million USD (2020)

Number of employees: 4,000 (2021)

Klarna

Klarna -

Kraken is a cryptocurrency exchange and bank based in the United States that was created in 2011. The exchange facilitates cryptocurrency and fiat currency trading, as well as provides pricing data to Bloomberg Terminal. Kraken is available to citizens of 48 US states and 176 countries as of December 2021, and it currently includes 95 cryptocurrencies for exchange. All nations are supported by Kraken, with the exception of the ones listed below: Cuba, Iran, Japan, and North Korea.

Kraken stated in January 2016 that it was purchasing Coinsetter and Cavirtex, two well-known bitcoin exchanges, in order to grow into the American and Canadian markets. Kraken purchased Crypto Facilities, a registered futures marketplace, in 2019. Money Partners Group, Hummingbird Ventures, Blockchain Capital, and Digital Currency Group, among others, have invested in Kraken.

Detailed Information:

Founded: July 28, 2011; 10 years ago

Founder: Jesse Powell

Headquarters: San Francisco, California, United States

Owner: Payward, Inc.

Kraken

Kraken -

Chime Financial, Inc. is a financial technology company based in the United States that offers fee-free mobile banking services through The Bancorp Bank or Stride Bank, N.A. Account-holders are given Visa debit or credit cards and have access to an online banking system via the company's website or mobile apps. The majority of Chime's revenue comes from the collection of interchange fees.

Chime is a virtual bank with no physical locations and no monthly or overdraft fees. Chime is regarded as the country's largest digital quasi-bank, offers no-fee checking accounts, a debit card, and overdraft protection. When it released a starting credit card and gave early access to government stimulus money in 2020, annualized sales reached $600 million. Chime had 8 million registered users as of February 2020. Chime's partners' bank accounts are covered up to the normal maximum deposit insurance value of $250,000.

Detailed Information:

Founded 2013; 9 years ago

Founders: Chris Britt and Ryan King

Headquarters: San Francisco, California, United StatesRevenue: the US $200 million (2019)

Chime

Chime -

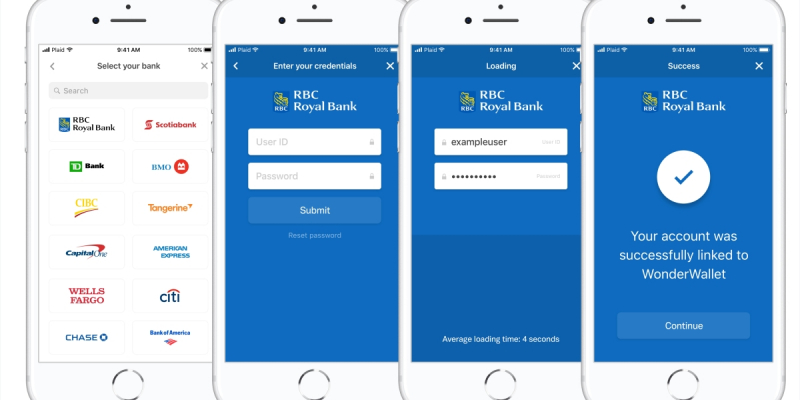

Plaid is a San Francisco, California-based financial services company. The firm creates a data transmission network for fintech and digital financial applications. Plaid's offering is a technological platform that allows apps to connect to customers' bank accounts. Through various financial technology apps, consumers and companies may communicate with their bank accounts, check balances, and make payments. The firm has offices in the United States, Canada, the United Kingdom, France, Spain, Ireland, and the Netherlands.

Visa announced its intention to buy Plaid for $5.3 billion on January 13, 2020. The purchase was ultimately abandoned because the US Department of Justice objected owing to data privacy issues, antitrust and monopolistic concerns. Plaid nearly quadrupled its client base to 4,500 in 2020.

Detailed Information:

Founded: May 2013; 8 years ago

Founders: Zach Perret, William Hockey

Headquarters: San Francisco, California

Revenue: US$200 million (2019)

Number of employees: 500

Plaid

Plaid -

Robinhood Markets, Inc. is an American financial services firm based in Menlo Park, California, that is most known for pioneering commission-free stock, ETF, and cryptocurrency trading with a mobile app launched in March 2015. Robinhood is a FINRA-regulated broker-dealer that is also a member of the Securities Investor Protection Corporation. It is also registered with the US Securities and Exchange Commission.

Interest gained on clients' cash balances, selling order information to high-frequency traders (a practice for which the SEC started an inquiry into the firm in September 2020), and margin lending is the three primary sources of revenue for the company. For the first three months of 2021, revenue more than quadrupled year over year to $331 million. Robinhood has 31 million users and 1.6 million individuals on its cryptocurrency wallet waitlist as of 2021.

Detailed Information:

Founded: April 18, 2013; 8 years ago

Founders: Vladimir Tenev, Baiju Bhatt

Headquarters: Menlo Park, California, U.SNumber of employees: 1,281 (2020)

Robinhood

Robinhood -

Brex Inc is a San Francisco, California-based financial services and technology firm. Technology firms may get business credit cards and cash management accounts from Brex. Brex cards are business charge cards that need at least $50,000 in a bank account if professionally invested, or $100,000 if not, to open, and cardholders who fail will not have their personal credit or assets negatively impacted. Brex cards are issued by Emigrant Bank.

Airbnb, Carta, and an estimated 20,000 additional users are among the companies that use the cost reporting service. A corporate credit card with travel benefits, corporate cash management accounts, and expense-tracking software are all popular options. The firm announced in February 2021 that it has submitted an application with the Federal Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions (UDFI) to form Brex Bank, a wholly-owned subsidiary of Brex.

Detailed Information:

Founded: January 3, 2017

Founders: Henrique DubugrasPedro Franceschi

Headquarters: San Francisco, CA

Brex

Brex -

In 2012, serial investor Manu Kumar and entrepreneur Henry Ward started Carta as eShares. Ward was named CEO, while Kumar was named Chairman. The founders noticed a need for venture-backed firms to be able to electronically manage stock, issue securities, and maintain their cap tables, so they founded the company.

Carta is a technology business located in San Francisco, California that focuses on capitalization table management and valuation software. Paper stock certificates, as well as stock options, warrants, and derivatives, are digitized by the firm to assist corporations, investors, and workers in managing their equity and producing a real-time image of corporate ownership. In addition, the firm runs the CartaX private stock exchange and publishes research on the gender equity gap in several industries. CartaX, a secondary marketplace, was just formed, allowing unicorn startup employees to sell their shares to investors.

Detailed Information:

Founded: 2012

Founders: Henry Ward, Manu Kumar

Headquarters: San Francisco, CaliforniaNumber of employees: 1451 (2021)

Carta

Carta