Top 7 Interesting Facts about Milton Friedman

You will learn interesting facts about Milton Friedman, a contributor to the global economy, in the following paragraphs.... read more...

-

The Royal Swedish Academy of Sciences has decided to award Professor Milton Friedman of the University of Chicago, Illinois, USA, the 1976 Nobel Prize in Economic Sciences in Memory of Alfred Nobel for his contributions to consumption analysis, monetary history and theory, and his demonstration of the complexities of stabilization policy.

Milton Friedman's name is most closely associated with the renaissance of the role of money in inflation and the resulting renewed understanding of the monetary policy instrument. With the emergence of monetarism in a Chicago school, he gave us the terms "money matters" or even "only money matters." This strong emphasis on the role of money should be viewed in light of how economists - typically advocates of a narrow interpretation of Keynesian theory - have long ignored the importance of money and monetary policy when analyzing business cycles and inflation. Friedman was a pioneer in the well-founded reaction to earlier post-Keynesian one-sidedness as early as the early 1950s. And, owing to his independence and brilliance, he was able to spark a very lively and fruitful scientific debate that has lasted more than a decade. In terms of monetary factors, today's macro-econometric models differ greatly from those of a few decades ago, and this is largely due to Friedman. The widespread debate over Friedman's theories prompted a reconsideration of monetary policies pursued by central banks, particularly in the United States.

It is unusual for an economist to have such direct and indirect influence not only on the direction of scientific research but also on actual policies.

Photo: NobelNobel Prize in Economics

Photo: NobelNobel Prize in Economics -

Next, one of the interesting facts about Milton Friedman is Milton Friedman was an economist who advocated monetarism. According to this theory, the amount of money printed by a government each year has a significant impact on the country's economy. His stance on this was that it is preferable to print the same low rates of money every year rather than a different amount. He received numerous honors, including the Nobel Prize. Milton Friedman, one of the most influential economists of the second half of the twentieth century, popularized many economic ideas that are still relevant today, most notably free-market capitalism and monetarism. Friedman's economic theories evolved into monetarism, which refuted key elements of Keynesian economics, a dominant school of thought in the first half of the twentieth century. Friedman's proponents of monetarism were so effective that he shifted the tide of economic thought away from Keynesian fiscal policy and toward monetary policy focused on controlling the money supply to control inflation.

Throughout his academic career, Friedman published pioneering books on the modern economy and wrote influential articles on the modern economy.

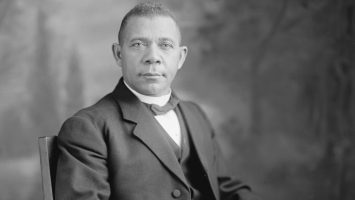

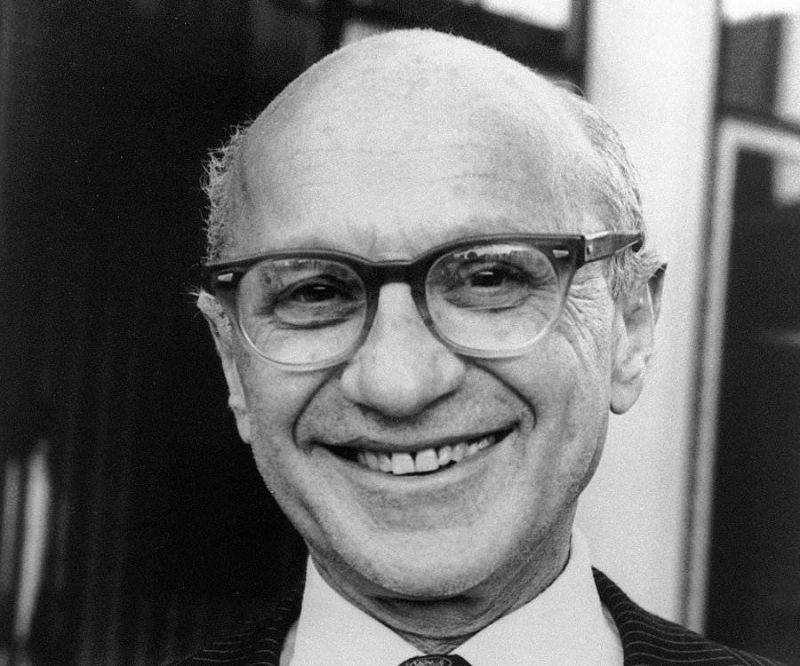

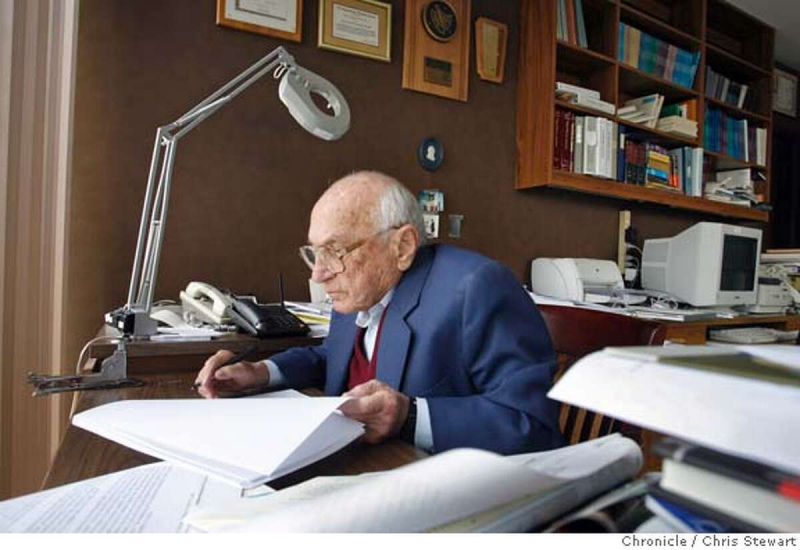

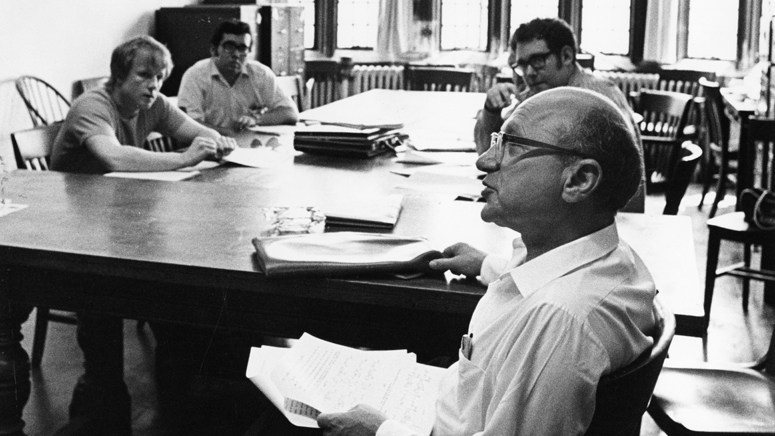

Photo: Milton Friedman

Photo: Milton Friedman -

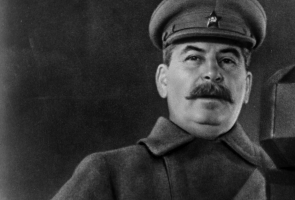

Friedman served as an advisor to Republican President Ronald Reagan and Conservative British Prime Minister Margaret Thatcher after retiring from the University of Chicago in 1977 and becoming an Emeritus professor in economics in 1983. His political philosophy praised the benefits of a free-market economic system with little government intervention in social matters. He once stated that his contribution to the abolition of conscription in the United States was his proudest achievement. Friedman advocated for policies such as a volunteer military, freely floating exchange rates, the abolition of medical licenses, a negative income tax, school vouchers, opposition to the war on drugs, and support for drug liberalization policies in his 1962 book Capitalism and Freedom. Because of his support for school choice, he founded the Friedman Foundation for Educational Choice, which was later renamed EdChoice.

He also believed that the government should not have undue influence over the economy and that there should be a cap. Friedman also thought it was a good idea to lower taxes, reduce government spending, and eliminate any regulations that hampered the economy.

In addition, while Senator Goldwater was running for President in 1964, he served as an informal economic adviser to him. In 1968, he played the same role for Richard Nixon, and in 1980, he played the same role for Ronald Reagan.

Photo: Ronald Reagan and Margaret Thatcher

Photo: Friedman served as an advisor to Republican President Ronald Reagan and Conservative British Prime Minister Margaret Thatcher -

The term agnosticism was coined in the second half of the nineteenth century by Thomas Huxley, but some of its variants—most notably, suspended judgment—have been debated since antiquity. The work of Jane Friedman has recently sparked renewed interest in research on suspended judgment. She has developed and defended a novel account of suspended judgement, which she identifies with agnosticism, in a series of papers (Friedman 2013a,b, 2017). According to Friedman, agnosticism is a unique attitude that cannot be defined in terms of belief or disbelief.

One of the most heartbreaking things to witness is a truly brilliant individual with a sharp intellect who does not believe in God, Jesus Christ, or the Bible. As an example: Milton Friedman was a free-market economist. Dr. Friedman stated in a letter to the editor of the "Wall Street Journal" (10/30/92) that he is a "radical," get-to-the-root-of-the-problem type of guy. So, while we knew what his answer would be in general, but not exactly, the letter was sent to Dr. Friedman at the Hoover Institute at Stanford University and asked him:

"Do you believe in God? And what, if anything, does God have to do with economics?" He replied:

“I am an agnostic. I do not ‘believe in’ God, but I am not an atheist, because I believe the statement, ‘There is a god’ does not admit to being either confirmed or rejected. I do not believe God has anything to do with economics. But values do.”

Photo: Friedman was an agnostic

Photo: Friedman was an agnostic -

When learning about interesting facts about Milton Friedman, you should not ignore the information he received honorary degrees by several universities in the world.

Professor Friedman is a member of the American Philosophical Society and the National Academy of Sciences, as well as the American Economic Association, the Western Economic Association, and the Mont Pelerin Society. He had also received honorary degrees from universities in the United States, Japan, Israel, and Guatemala, as well as the Japanese government's Grand Cordon of the First Class Order of the Sacred Treasure in 1986.

Friedman earned a bachelor's degree in business administration from Rutgers University in 1932. He then earned an M.A. from the University of Chicago in 1933. Finally, in 1946, he received his Ph.D. from the University of Columbia.

However, in recognition of his numerous accomplishments, he was awarded honorary degrees by universities in other countries as well as the United States. Japan, Guatemala, and Israel were among those nations. In 1986, the Japanese government awarded him the Grand Cordon of the First Class Order of the Sacred Treasure.

Photo: Milton Friedman

Photo: Milton Friedman -

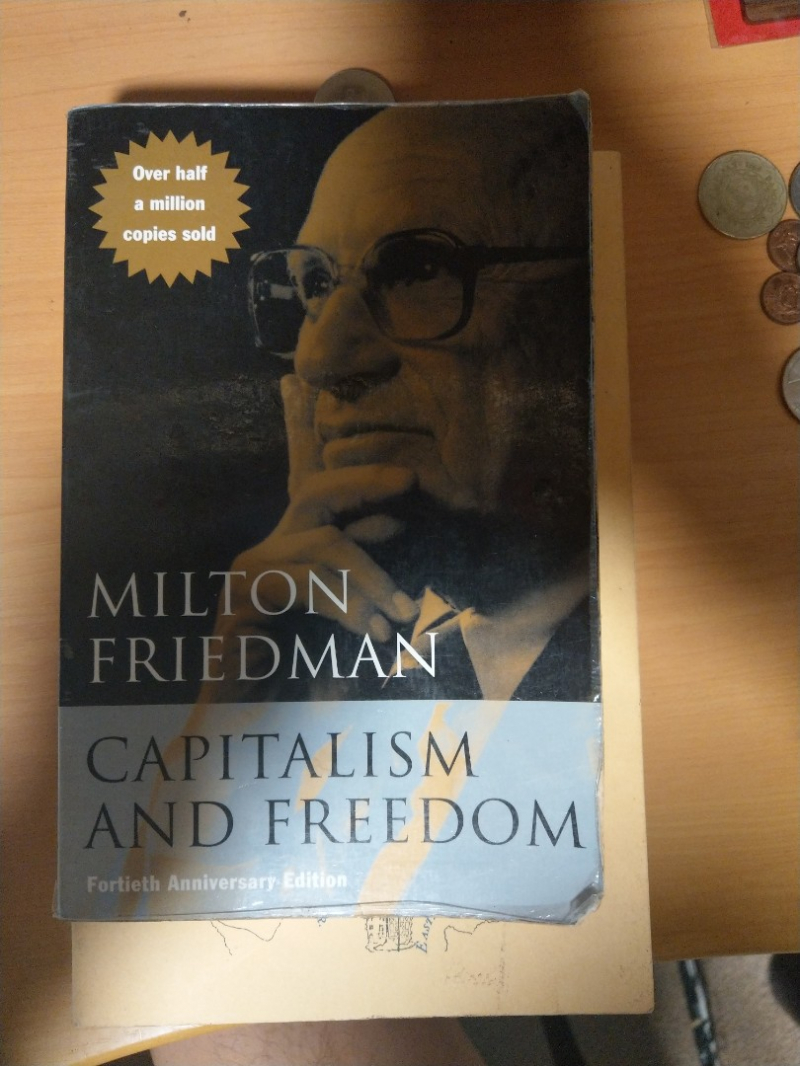

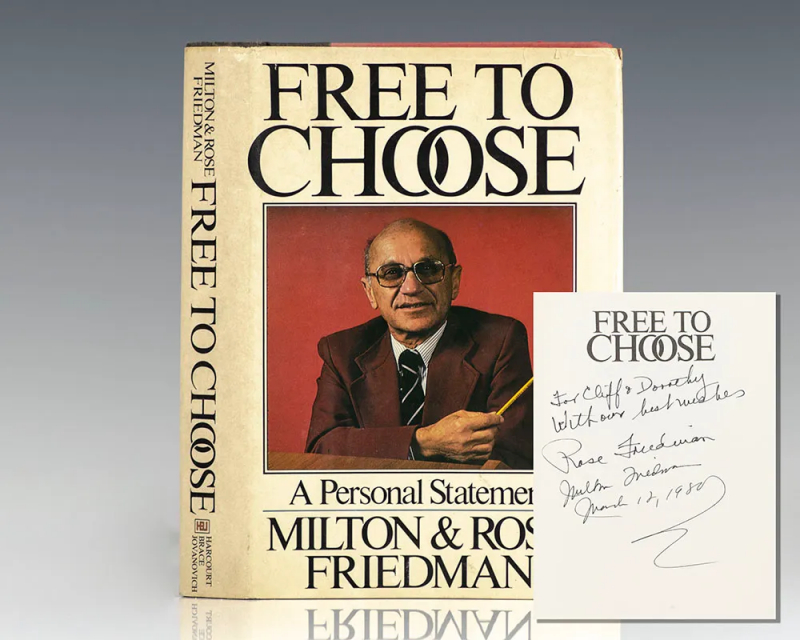

Professor Friedman authored a number of books on public policy. He was primarily concerned with the preservation and extension of individual liberty. Capitalism and Freedom, Bright Promises, Dismal Performance, Free to Choose, and Tyranny of the Status Quo are some of his most important books on the subject.

Rose wrote in her memoirs, “As we look back at the events chronicled in this chapter, it all seems like something of a fairy tale. Who would have dreamed that after retiring from teaching, Milton would be able to preach the doctrine of human freedom to many millions of people in countries around the globe through television, millions more through our book based on the television program, and countless others through videocassettes.”

His other works are also noteworthy. A Theory of the Consumption Function (University of Chicago Press, 1957), The Optimum Quantity of Money and Other Essays (Aldine, 1969), and (with A. J. Schwartz) A Monetary History of the United States (Princeton University Press, 1963), Monetary Statistics of the United States (Columbia University Press, 1970), and Monetary Trends in the United States and the United Kingdom (Columbia University Press, 1970). (University of Chicago Press, 1982).

Photo: Capitalism and Freedom by Milton Friedman

Photo: Free To Choose Milton Friedman First Edition Signed Rare -

Macroeconomists commonly employ a simplified version of the optimization framework known as the "permanent income hypothesis," which has its roots in economist Milton Friedman's treatise A Theory of the Consumption Function (1957). The permanent income hypothesis omits the life-cycle model's detailed treatment of demographics and retirement, instead focusing on the aspects that matter most for macroeconomic analysis, such as predictions about the nature of the consumption function, which relates consumer spending to factors such as income, wealth, interest rates, and so on.

An interesting fact about Milton Friedman is that he also questioned Keynesians' economic theories. They stated that fiscal policies must always take precedence over monetary policies. Friedman's theory of free-market monetarism provided a different perspective on the subject.

What the consumption function says about the marginal propensity to consume (MPC) when income changes is perhaps the most important feature for macroeconomics. In The General Theory of Employment, Interest, and Money (1936), economist John Maynard Keynes was the first to emphasize the importance of the MPC, believing that up to 90% of any increase in current income would translate into an immediate increase in consumption expenditure (an MPC of 90 percent). However, evidence suggests that Friedman's permanent income hypothesis is much more accurate: Friedman claimed that only about one-third of any windfall (a one-time unanticipated gain) would be spent within a year on average. He went on to say that a one-to-one correlation between increased income and increased spending would occur only if the income increase was perceived to be a permanent change in circumstances (e.g., a new, higher-paying job).

Photo: A Theory of the Consumption Function

Photo: Friedman became famous for his Theory of the Consumption Function