Top 9 Largest Banks in Hungary

Several banks in Hungary provide a wide range of services to both individuals and companies. These banks are noted for their strong financial stability, ... read more...excellent customer service, and diverse product and service offerings. The banking industry has a lengthy history in this country and is undergoing considerable changes. The Hungarian financial sector, on the other hand, is well developed, with numerous banks functioning in the country. And here are the largest banks in Hungary.

-

OTP Bank Group is Hungary's largest commercial bank and one of the leading independent financial service providers in Central and Eastern Europe, offering banking services to both individuals and businesses. The OTP Group has businesses in insurance, real estate, factoring, leasing, asset management, and investment and pension funds. Albania, Bulgaria, Croatia, Hungary, Moldova, Montenegro, Romania, Russia, Serbia, Slovenia, and Ukraine are among the 11 countries where the bank operates.

In Hungary and worldwide, OTP Bank provides institutional, commercial, corporate, private, and retail banking. Auto financing, real estate, and business loans are among the services provided by the corporation and its subsidiaries, as are investment, asset, and fund management, as well as lending and deposit banking facilities.

With over 18.5 million consumers, OTP Group is a regional leader in financial services. It maintained its position as the market leader in the retail credit institution area in Hungary, Montenegro, and Bulgaria. As its flagship unit, OTP Bank Hungary offers a wide range of cutting-edge financial services in Hungary, while also providing solutions to a variety of other special financial needs, such as the distribution of investment funds, home and other specific savings, and auto financing, through a network of local Group subsidiaries. In addition to retail, OTP Bank prioritizes serving corporate customers to a high degree, with the parent bank and most affiliate banks offering agricultural enterprises unique products.

Founded: 1949

Headquarters: Budapest, Hungary

Website: https://www.otpbank.hu/

Screenshot of https://www.otpbank.hu/ OTP Bank Magyarország -

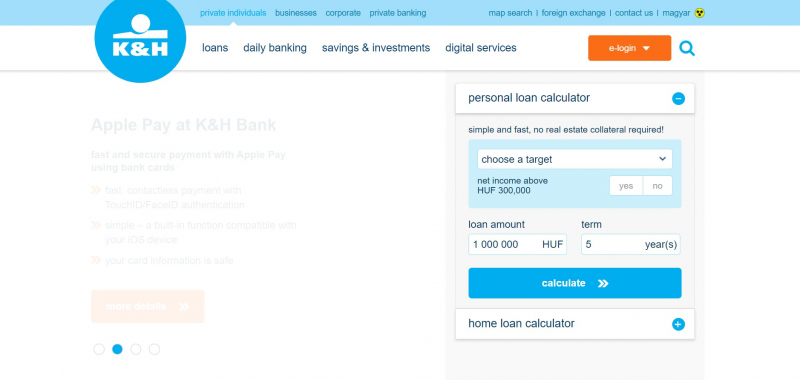

K&H Bank, also known as Kereskedelmi és Hitelbank, is one of Hungary's largest commercial banks owned by KBC Bank of Belgium. It is also one of the largest banks in Hungary. Regarding retail and corporate services, K&H is one of Hungary's largest financial institutions. K&H Bank has over 200 branches around the country. It provides a comprehensive range of financial products, including traditional products such as account management, investments, savings, loans, bank guarantees, bank card services, custody management, treasury, project financing, Private Banking services, and so on, as well as investment fund management, leasing, securities trading, factoring, life and pension insurance, and so on. These later services are provided via subsidiaries.

The goal of the above goes beyond increasing operational efficiency through cross-selling opportunities: the major goal for both K&H Bank and K&H Insurance is to give clients a full choice of conveniently accessible products through marketing each other's products and services. As the second largest retail bank, K&H provides a number of innovative services in addition to traditional financial products to assist you in managing your personal finances on a daily basis, such as account management, transfers, utilities' direct debits, fixed deposits, house loans, and cash loans. K&H Bank was the first in the Hungarian bank card market to introduce chip cards that met more strict international security criteria than magnetic strip cards.

Founded: 1987

Headquarters: Budapest, Hungary

Website: https://www.kh.hu/

Screenshot of https://www.kh.hu/

Photo by Vardan Papikyan on Unsplash https://unsplash.com/photos/zQghIOp61xg -

UniCredit Bank Hungary Zrt. is the Hungarian subsidiary of UniCredit, which operates Central and Eastern Europe's largest and most diverse international banking network. UniCredit Bank provides extensive and flexible financial products and services to private customers, as well as small and medium-sized businesses and major corporations, in Hungary. UniCredit is a simple and successful Pan European Commercial Bank with a fully integrated CIB, providing a unique Western, Central, and Eastern European network to our large customer franchise of 25 million clients.

It provides both local expertise and worldwide reach. UniCredit Bank Hungary follows and supports our 25 million global clients, giving them unrivaled access to our premier banks in 14 core regions and another 18 nations. Italy, Germany, Austria, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Romania, Russia, Slovakia, Slovenia, Serbia, and Turkey are among its European banking partners. Because of its strategic location across Western, Central, and Eastern Europe, we have one of the largest market shares in the region.

As one of the leading players in the Hungarian banking sector, UniCredit Bank Hungary offers a comprehensive range of cutting-edge banking products and services ranging from loans for private and corporate customers and factoring services to large development projects funded by the European Union, from bank accounts and deposits to asset management and investment banking services. This offer is completed by the services of UniCredit's leasing company, UniCredit Leasing Hungary Zrt., as well as Pioneer Fund Management Ltd., and is backed financially by UniCredit Jelzálogbank Zrt.

Founded: 1990

Headquarters: Budapest, Hungary

Website: https://www.unicreditbank.hu/

Screenshot of https://www.unicreditbank.hu/ UniCredit Bank Hungary -

Erste Bank (Hungary) is a significant bank as well as one of the largest banks in Hungary and has been a member of the Erste Group (Austria) since 1997. Erste Bank (Hungary) is a universal bank that serves people, small, medium, and large businesses, municipalities, the public sector, and non-profit organizations. Erste Bank (Hungary) provides a broad range of financial goods and services to retail consumers, including mortgage loans, personal loans, and business loans, current accounts, payment cards, electronic banking services, investment and deposit products, and premium and private banking services.

Its total assets in 2021 were 4 178,20 billion HUF. The bank's net income in 2021 was 55 842,60 million HUF. Fitch and Moody's have assigned ratings to Erste Bank. Fitch has granted the bank a long-term credit rating of BBB+ (good credit quality). Moody's granted the bank a Baa1 (lower medium grade) long-term credit rating. Erste Bank participates in Hungary's deposit guarantee scheme. This scheme applies to deposits of up to 100,000 EUR per bank and depositor.

For over 20 years, Erste Bank has worked to generate wealth for all people, regardless of social status, nationality, gender, or religion, because they believe that tomorrow is in the hands of its customers. The bank believes that with effective financial cooperation, they can not only give a product and service, but also contribute to people's financial self-confidence. This self-assurance might offer you an extra boost to perform better in every area of your life!

Founded: 1997

Headquarters: Budapest, Hungary

Website: https://www.erstebank.hu/

Screenshot of https://www.erstebank.hu/ Erste Magyarország -

Raiffeisen Bank, founded in 1986 as Unicbank, provides a broad range of services to business and retail banking customers, as well as municipalities. It serves over 500,000 customers through 71 company locations. Under the Friedrich Wilhelm Raiffeisen name, the primary business divisions are Retail Banking, Corporate Banking, and the many award-winning Private Banking.

The corporate business line (market share of roughly 10%, leader in certain areas) provides a comprehensive variety of customized services on both the asset and liability side to mid sized and big corporate clients. International clients are supported by a dedicated unit. In terms of data security, flexibility, and usability, the electronic corporate banking service is at the forefront of the market. Raiffeisen's treasury division is an active participant in the FOREX, stock exchange, and OTC markets, using the bank's exceptional international ties.

Raiffeisen Bank's strategic goal as a universal bank is to become a leading player in the financial services market by delivering complete financial services in collaboration with its subsidiaries. The bank's strategy includes regular innovation, expertise and professionalism, high-quality client service, accessibility, and a solid owner's background. The bank intends to enhance its market share while also strengthening and expanding its current market positions.

Founded: 1986

Headquarters: Budapest, Hungary

Website: https://www.raiffeisen.hu/

Screenshot of https://www.raiffeisen.hu/ Raiffeisen Bank Hungary -

Next one in the list of largest banks in Hungary is MKB Bank. MKB Bank, formerly Magyar Külkereskedelmi Bank, is Hungary's second-largest commercial bank. Its privatization began in 1994, when BayernLB bought a minority interest. In 2014, the Hungarian government repurchased it. They joined the Magyar Bankholding Zrt (together with Budapest Bank and MTB Bank) in 2020. Budapest Bank merged with MKB in 2022, becoming Hungary's second largest bank, and MTB Bank will also combine with the bank, but under the name MBH Bank.

MKB Bank is one of the country's oldest banks, having been founded in 1950. It was established with the intention of participating in the international monetary system and managing financial transactions relating to foreign commerce. BayernLB agreed with the European Commission to divest itself of certain interests in exchange for state financial aid. As a result, on September 30, 2014, the Hungarian state acquired ownership of MKB Bank Zrt after 20 years. The European Union-supervised bank reform process began at the end of this year, putting the financial institution on a sustainable path via reorganization and rationalization measures.

MKB Bank's professional customer service remains the number one core value, with the most significant parts being client relationship and experience, value preservation and generation, and innovative banking solutions. MKB is a prominent player in the domestic corporate trade financing, money and liquidity management, and investment markets, thanks to the knowledge base built up over its half-century of operation, the skilled team, and the embedded contact system. The bank's strong professional reputation aids in the creation of value for its retail customers.

Founded: 1950

Headquarters: Budapest, Hungary

Website: https://www.mkb.hu/

Screenshot of https://www.mkb.hu/ MKB Bank -

MTB is a banking and financial services business in Hungary that serves as the umbrella organization for more than 60 co-operative banks and approximately 1,100 branch locations. MTB has operated as both a central bank and a business and investment bank since its founding in 1989. MTB represents the interests of Hungarian Cooperative Financial Institutions on both national and international levels, as well as coordinates and develops the network's unified strategy. The bank provides legal, tax, and business management advice and support to its members.

The business potential inherent in the savings cooperative system will be used through integration with Hungary's largest branch network. As a result, a nationally competitive banking group will be formed, delivering modern products tailored to the demands of the entire Hungarian population and entrepreneurs. MTB's goals include modernisation, commercial and organizational renewal, and the preservation of traditions and values.

The Savings Group's business and organizational restructuring best integrates the century-and-a-half traditions of savings cooperatives with modern, creative commercial banking methods. MTB designs modern products for families and people of all ages, and welcomes young people and city dwellers. They promote the structure and management of local communities, ecosystems, and value chains, and assist local growth. The Bank provides competitive items that are adapted to customers' actual wants and life situations in any section of the country.

Founded: 1989

Headquarters: Budapest, Hungary

Website: https://www.mtb.hu/

https://www.mtb.hu/

Photo by Stephen Phillips - Hostreviews.co.uk on Unsplash https://unsplash.com/photos/em37kS8WJJQ -

CIB would be the following largest banks in Hungary. CIB Bank Zrt. is an Intesa Sanpaolo Group subsidiary. With more than 40 years of expertise as a universal credit institution and backing from its significant international parent bank, CIB Bank Zrt. offers a full range of commercial banking and investment services, reinforced by the products and plans of its subsidiaries (CIB Leasing, CIB Broker). CIB Bank Zrt. serves almost 420,000 customers through a branch network spread across the country, while always pursuing creative solutions customized to their needs.

CIB Bank Zrt. provides services to enterprises, institutions, municipalities, individual proprietors, and retail customers. Customers can manage their finances quickly and conveniently through a wide range of electronic channels, including the CIB Internet Bank, CIB Bank Online, the CIB Bank Mobile application, and the eBroker information and securities trading system, in addition to the bank's branches. The financial institution is a fully licensed Hungarian bank that conducts a wide variety of local and foreign banking operations.

Recognizing the significance of our activities, CIB Bank promotes a growth model that focuses on long-term results and the development of a process based on the trust that comes from customer and shareholder satisfaction, a sense of belonging on the part of our employees, and close monitoring of community and local area needs. In accordance with our international banking group's ethical standards, the Bank's goal is to act with a feeling of responsibility in terms of justice, transparency, and sustainable development.

Founded: 1979

Headquarters: Budapest, Hungary

Website: https://www.cib.hu/

Screenshot of https://www.cib.hu/ CIB Bank -

Since 1985, Citi Bank has provided world-class products and services to local and multinational clients, as well as financial and public sector institutions in Hungary. As a part of Citi, it is one of the country's largest international banks, with unrivaled global and local knowledge, providing world-class services to customers throughout Hungary. Citibank is a market leader in the local market for diverse distribution channels, including branches, internet banking, telephone customer support, and sales agents.

Citi Bank has a strong presence in all main areas of finance, including working capital management, execution, securities services and advisory, and capital raising. To provide those services, the Bank must invest significant capital by lending to clients, financing their assets, and taking on their counterparty credit risk. They provide these services through a much broader integrated network of countries than any other financial organization.

Citi Bank is uniquely positioned to capitalize on growing global trends and deliver a broad range of integrated products and services to major, multinational enterprises, public sector institutions, ultra-high-net-worth people, and investment managers. Citi operates one of the largest global financial infrastructures, facilitating roughly $4 trillion in movements daily on average, with trading floors in approximately 80 markets, clearing and custody networks in 63 locations, and links with 400 clearing systems.

Founded: 1985

Headquarters: Budapest, Hungary

Website: https://www.citibank.com/icg/sa/emea/hungary/

Screenshot of https://www.citibank.com/icg/sa/emea/hungary/ Citi