Top 10 World's Oil And Gas Companies And Corporations

Petroleum is the world's top export product, accounting for 1.3% of the world's gross domestic product (GDP) as of 2019. Since the dawn of modernization, ... read more...Petroleum has played a key role in world operation, intertwining into human daily life. Here are some of the World's Biggest Petroleum Corporations.

-

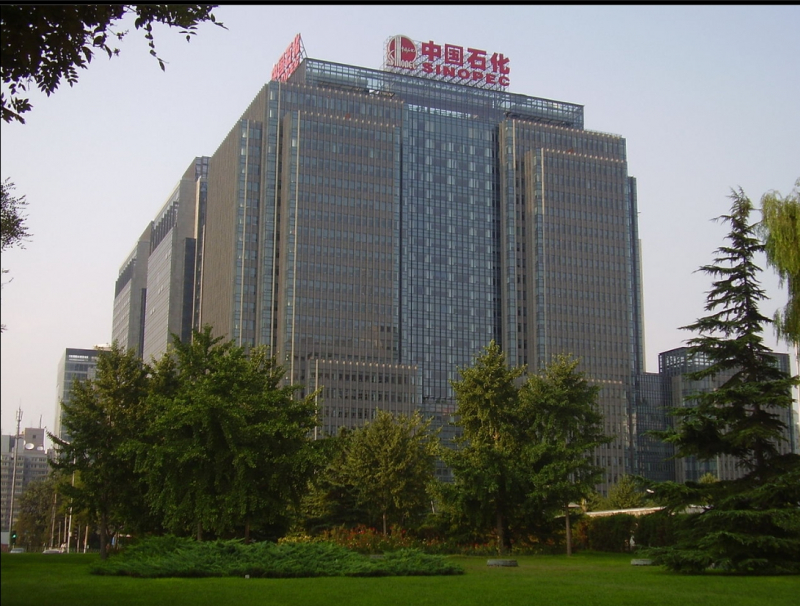

China's state-owned Sinopec was one of the first to feel the effects of the pandemic when China imposed lockdowns in early 2020. Since then, the company has recovered quickly. Although Chinese companies disclose far less information than companies in many other countries, Sinopec earned $323 billion in 2020, according to the white paper. According to GlobalData, the company's 2020 sales fell 28.8%. At the same time, net income fell 43%, raising Sinopec's value to around $70 billion. The company's total loss in 2020 for the company's oil refining and exploration/production was approximately $22 billion. However, gains of $21 billion in marketing and sales offset these losses.

In May, the first vessel docked at the Sinopec Zhongke Refinery Port, China's largest oil terminal. The pier includes a wharf with a capacity of 300,000 tonnes and eight terminals, providing an annual throughput of 5.61 million tonnes. The pier was built by more than 18,000 architects and the first construction cost more than $6 billion. In accordance with China's five-year plan, Sinopec proceeded to develop hydrogen production. The company has installed hydrogen refueling stations in at least four locations and has begun developing the infrastructure and technology for all hydrogen colors.

Founded: 25 February 2000

Headquarters: Chaoyang District, Beijing, ChinaMarket cap: $74.85 Billion As of December 2021

Revenue: $323bn in 2020

Website: sinopec.com/listco/en

Sinopec, http://www.sinopec.com/listco/en/

Sinopec, headquarters - 22 Chaoyangmen North Street, Chaoyang District,Beijing, China, https://en.wikipedia.org -

PetroChina is the public sector of the state-owned China National Petroleum Corp. The company has surpassed expectations after the pandemic, according to its 2020 annual report. Chairman Zhou Jiping explained that during the spread of Covid19, the focus was on profitable development. In one year, the company increased oil production by 4.8% and gas by 9.9% compared to 2019. At the same time, it reduced the cost of gas production by 8.3% to $11.1 per barrel.

PetroChina`s revenue fell by 23.2% in 2020, with PetroChina`s annual report stating that its financial position “remained stable”. Still, the company increased its full-year dividend by more than 20%. In 2021, PetroChina has achieved new record levels of gross profit, lifted by economic recovery and rising oil prices.

The company discovered hydrocarbon reserves in the Sichuan, Ordos, and Tarim basins, which it will now develop. Abroad, the company made discoveries in Chad and Kazakhstan. PetroChina aims to start reducing emissions in 2025, reaching “near-zero” emissions by 2050.Founded: 5 November 1999

Headquarters: Dongcheng District, Beijing, ChinaMarket cap: $134.23 Billion As of December 2021

Revenue: $296bn in 2020

Website: petrochina.com.cn/ptr/

PetroChina,http://www.petrochina.com.cn/ptr/

PetroChina headquarters ,https://en.wikipedia.org/wiki/PetroChina -

In April 2020, Saudi Aramco reached a record high of 12.1 million barrels per day in one day. In August, the company pumped 10.7 billion cubic feet of gas per day. At the same time, global regulations have forced Saudi Aramco to pump 6% fewer hydrocarbons than in 2019. In the same year, Saudi Aramco was listed on the Saudi Arabian Stock Exchange, but the company is still primarily owned by the Saudi Arabian government. This link has played a key role in helping Saudi Arabia curb oil production in 2020 when demand declines in partnership with other OPEC members and the Russian government. This has forced Saudi Aramco to limit its own production in mid-2020 with the goal of raising oil prices.

In 2020, Saudi Aramco's capital expenditures decreased by $6 billion. However, Aramco spent some money in June to acquire a controlling stake in chemical company Sabic. The company also invested in a joint materials company with oilfield services company Baker Hughes and agreed to build a chemical plant in eastern Saudi Arabia with TotalEnergies. Saudi Aramco achieved a pre-tax profit of $101 billion and a net income of $49 billion in 2020, which is about 60% of the previous year. The company made significant progress in 2021 and profits nearly tripled as oil prices recovered. Saudi Aramco also joined the Hydrogen Council, which aims to accelerate hydrogen development. In August, the company shipped a blue ammonia trial batch to Japan to test its hydrogen export infrastructure. However, in 2020, the company’s flaring intensity slightly rose.

Founded: 29 May 1933

Headquarters: Dhahran, Saudi ArabiaMarket cap: $1.864 Trillion As of December 2021

Revenue: $230bn in 2020

Website: aramco.com

Saudi Aramco,https://www.aramco.com/#

Saudi Aramco,https://en.wikipedia.org/wiki/Saudi_Aramco#/ -

Shell, a large non-state oil company, has responded to the virus's spread by cutting costs and operating costs. It abandoned the Lake Charles LNG project and sold its Appalachian assets to secure sufficient funds to respond to the Covid19 threat. The company still suffered a loss of $21 billion in fiscal 2020. Most of this was due to $180 billion in revenue, which nearly halved.

However, Shell continued to invest in several projects, such as LNG processing in Nigeria. When oil prices recovered, the company repaid its debts with available income and increased its dividend. In 2021, the company sold most of its Canadian assets to Crescent Point Energy for approximately $707 million. the company also signed contracts with Cairn Energy and Cheiron Petroleum Corp for inland Egyptian production.

Shell also continued to develop its renewable energy business by investing in wind energy in the Netherlands and the United States. The company has also been experimenting with floating and air wind projects with seven other major companies, agreeing to several energy transitions with seven other leading companies.

Founded: April 1907

Headquarters: Haagse Hout, The Hague, NetherlandsMarket cap: $169.18 Billion As of December 2021

Revenue: $181bn in 2020

Website: shell.com

Royal Dutch Shell, https://www.shell.com/

Royal Dutch Shell , https://en.wikipedia.org/wiki/Royal_Dutch_Shell#/ -

British giant BP also agreed to the transition principle after announcing a zero target just before the outbreak of COVID-19. The company's finances are on par with Shell, and sales have fallen to $180 billion.

The mining sector of the company posted a net loss of $21 billion in the 2020/21 fiscal year. Nevertheless, the cost per barrel of oil equivalent was about $6.30. The adjusted value of BP's non-operating assets resulted in a loss of $16 billion in value, but this figure will change as oil prices rise.In June, BP sold its petrochemical business to Ineos for $4 billion. In early 2020, it started operations in the Alligin oil field in the UK and the Gazer oil field in Oman. Engineers produced the first gas in Egypt's Katameya oil field in October 2020, and India's R-Cluster ultra-deep-sea project produced its first gas in December 2020.

In the meantime, the company continued its diversification efforts.BP announced investments in US wind farms and UK carbon capture projects, as well as investments in clean hydrogen projects in Germany. Lightsource has developed several solar power plants in the US, and Chargemaster has installed electric vehicle charging stations throughout the UK.

Founded: 14 April 1909

Headquarters: London, England, United KingdomMarket cap: $91.53 Billion As of December 2021

Revenue: $180bn in 2020

Website: bp.com

BP, https://www.bp.com/

BP, https://en.wikipedia.org/wiki/BP#/ -

In 2020, ExxonMobil recorded its first quarterly loss since the 1999 merger of Exxon and Mobil. In the fourth quarter of 2020, it posted a loss of $22.4 billion from a profit of $14.3 billion a year earlier. Much of this is due to the devaluation of previously discovered reserves. Since then, rising oil prices have increased the company's assets.

ExxonMobil has removed $10 billion from its investment budget and cut operating costs by $7 billion during 2020 to adapt to the financial challenges of Covid19. As a result, 450 fewer wells were drilled in 2020 than a year ago. However, liquid oil production fell by only 80,000 barrels per day per year, although gas production declined significantly.

ExxonMobil's mining division posted a loss of $20 billion in 2020 from revenue of $14 billion in 2019. While most analysts expect this trend to reverse again in 2021, revenues declined by around $77 billion. The

company has built three major oil fields in Guyana. We continue to develop rentals in the country's seas. New processing and export facilities opened in the United States and construction of new chemical facilities continued.Founded: November 30, 1999

Headquarters: Irving, Texas, U.S.Market cap: $262.37 Billion As of December 2021

Revenue: $179bn in 2020

Website: corporate.exxonmobil.com

ExxonMobil,https://corporate.exxonmobil.com/

ExxonMobil, https://www.hydrocarbons-technology.com -

Last year, Total became TotalEnergies to highlight the company's commitment to broader energy investments. Like BP, the small renewable energy sector has performed well, but oil losses have made 2020 a difficult year.

revenue was $60 billion less than a year ago.Total's net income increased from $11.4 billion in 2019 to a loss of $7.3 billion in 2020. CEO Patrick Pouyanné praised the company's move to lower the break-even point to $26 a barrel, helping it overcome a "double crisis" of Covid-19 and low oil prices. price. We were able to preserve company assets by opening 4,444 reservoirs off the coast of England, Egypt and South Africa. In the UAE, Total and ADNOC have agreed to work together to develop applications for carbon capture, use and storage. Shortly thereafter, the company announced that it would invest in a Norwegian CCS initiative with Shell and Equinor.

In May 2020, TotalEnergies officially adopted a net-zero target for 2050. As part of that, Total acquired 50% of its 2GW solar portfolio from Adani Green Energy, acquiring 20% of the company itself in 2021. Through its subsidiary Total, it will develop a portfolio of 2GW solar panels in Spain. In the UK, France and Korea, companies have teamed up to launch pilot floating wind turbines. Total also announced its intention to enter the vehicle charger market. After signing a contract to install 20,000 chargers in Amsterdam, the charging network was acquired a charging network in London.

Founded: 28 March 1924

Headquarters: Tour Total, Courbevoie, FranceMarket cap: $129.05 Billion As of December 2021

Revenue:$120bn in 2020

Website: totalenergies.com

TotalEnergies,https://totalenergies.com/

TotalEnergies, https://facimexpo.com/ -

A key moment for Chevron in 2020 was the October acquisition of US shale oil and gas producer Noble Energy. Due to high production costs, the US shale sector felt the impact of lower oil prices more severely than other sectors. As Noble's margins shrink and debt rises, Chevron seizes the opportunity to purchase its reserves in a $4.2 billion deal.

Meanwhile, Chevron needed to think about finances. The loss peaked in the second quarter of 2020 when the company reported a net loss of $8.3 billion. During the year, the company suffered no significant changes in net production but suffered a net loss of $5.5 billion.

Chevron increased its dividend by 8% when several large companies stopped or cut payments to shareholders in 2020. Although the company's profits have recovered in 2021, they have not yet returned to pre-pandemic levels. The company also converted existing refineries to increase biofuel production. The company also joined the Hydrogen Council, which later acquired a joint venture for hydrogen production and announced plans to expand its own hydrogen production. A collaboration with Algonquin Renewable Energy has also begun the construction of 500 MW renewable generation by Chevron.

Founded: September 10, 1879

Headquarters: San Ramon, California, U.S.Market cap: $222.26 Billion As of December 2021

Revenue: $94bn in 2020

Website: chevron.com

Chevron, https://www.chevron.com/

Chevron, https://en.wikipedia.org/wiki/Chevron_Corporation#/ -

In 2020, Gazprom continued construction of the politically controversial Nord Stream 2 gas pipeline. Completed in September 2021, the pipeline will transport huge amounts of gas from Russia to Germany. This will allow Gazprom to improve access to the Central European market, which is causing concern among Eastern European countries that rely on Gazprom's pipelines as a source of income.

In June, construction of an ice-resistant platform began at the Astrakhan field and drilling began at the Kharavskoye field. Gazprom is continuing negotiations with OMV on the sale of its stake in the Urengoyskoye field. Last August, Gazprom discussed the possibility of building a gas pipeline between Russia and China via Mongolia.

Gazprom also announced that it would develop helium production after the construction of the Amur gas processing plant was completed. The first block of the plant will be put into operation in September 2021, producing 20 million cubic meters of gas per year. Its revenue fell from $29 billion in 2019 to $22 billion in 2020, in part due to production restrictions imposed by Russia's OPEC deal. As a result, net income fell from $10 billion to a loss of $9.7bn.

Founded: August 8, 1989

Headquarters: Saint Petersburg, Russia

Market cap: $107.21 Billion As of December 2021

Revenue: $85bn in 2020

Website: www.gazprom.com

Gazprom,https://www.gazprom.com/

Gazprom, https://cdni.rt.com/ -

Marathon cuts capital expenditures by nearly half to combat the pandemic in 2021. The company was still having a tough year, halted by a massive sale in August 2020. Marathon sells Speedway, a gas station network, with a 15-year contract with buyer 7Eleven.

Marathon CEO Michael Hennigan said the $21 billion deal helped the company meet its asset disclosure obligations. Marathon's unadjusted profit, including speedway revenue, fell from $11.1 billion a year ago to $4.4 billion in 2020. Most of the decline occurred in the company's downstream segments, with net income for the year rising from $2.8 billion to $5.1 billion in losses.

In April 2020 Marathon set a target of reducing emissions per barrel of oil by 30% by 2030. Since then, more refineries have switched from plant-based products to “renewable diesel” and started using energy-efficient equipment.

Founded: November 9, 2009

Headquarters: Findlay, Ohio, United States

Market cap: $38.51 Billion As of December 2021

Revenue: $70bn in 2020

Website: https://www.marathonpetroleum.com/

Marathon, https://www.marathonpetroleum.com/

Marathon, https://www.toledoblade.com