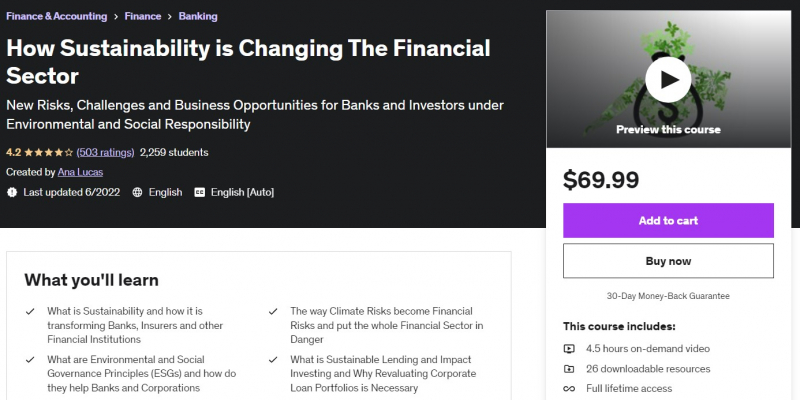

How Sustainability is Changing The Financial Sector

Given the escalation of climate challenges and the perceived detrimental impact that some financial operations have on the environment or human well-being, the notion of sustainability is gaining traction. Previously, investment and credit choices were made to balance risks and projected returns; however, a new dimension is now taking precedence, based on the concept of 'investing with a purpose.' This includes investing in and financing activities and enterprises that benefit the environment or society. Simultaneously, divesting from enterprises that contribute to degradation is being considered. This will have far-reaching implications for banks and other financial institutions, resulting in unprecedented changes as loan portfolios and assets under management are created, re-evaluated, and/or wound down.

Climate change concerns are severe and critical to the financial sector. They are critical to involving banks' decision-making at all levels, from customer acquisition and relationship management to top management, including, of course, risk management and compliance. Sustainability is now a required component of a bank's strategic strategy and operations. New regulatory components are being implemented, as are new governance, information disclosure, and rating organizations.

In this course, you will discuss all of the above, as well as the contentious issue of why you need financial institutions to cease funding flows to fossil fuels. You explain why sustainability is also providing new commercial prospects and goods, as well as encouraging new professional functions inside institutions. You discuss how banks might transition to more environmentally friendly portfolios, the relevance of being reviewed by rating agencies for sustainability standards, and what this all means for the financial sector's image and future.

Who is this course for?

- Relationship Managers/Sales representatives at Banks, Investment Funds, or Insurance Companies

- Credit Officers and Credit Analysts at Financial Institutions

- Risk Analysts or Junior Compliance Officers dealing with climate risks, portfolio risks, control processes, and regulatory procedures

- College students interested in studying the impact of sustainability and green finance on financial institutions should contact

- Financial Advisors

- Anyone interested in how financial institutions may contribute to a better world by embracing Sustainability

- Anyone who deals with new sustainability-related risks and/or with claims from catastrophic weather-induced disasters should contact

- Junior ESG Analysts in any sector, including in ESG rating agencies

Requirements:

- Fair understanding of how Corporate Banks and Financial Institutions contribute to the economy and the society

- Basic knowledge of Credit Risk analysis and Risk Management in Corporate Banking

- Interest in the principles of Climate Emergency, Inequality, de-carbonization of the Economy, Social Responsibility and Well Being

Udemy rating: 4.2/5

Enroll here: https://www.udemy.com/course/how-sustainability-is-changing-the-financial-sector/