Lincoln is behind the progressive nature of income tax in the US

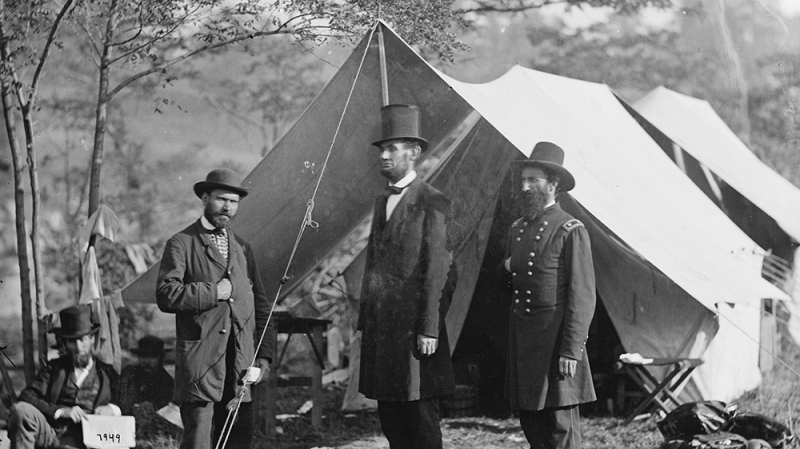

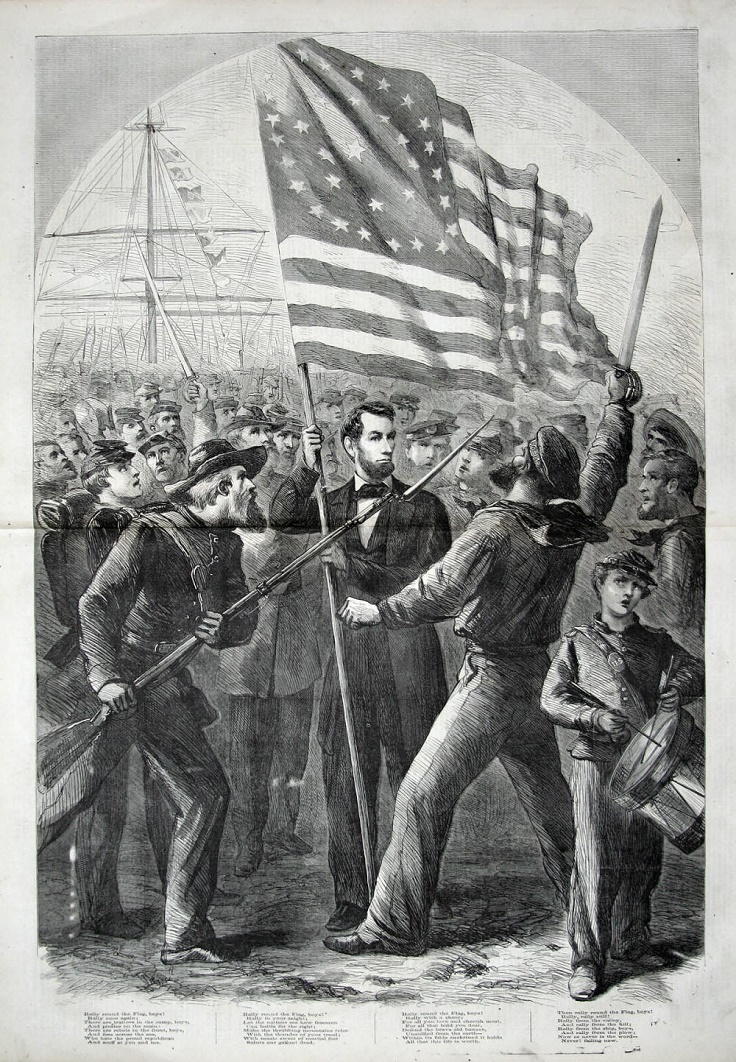

Lincoln signed the Revenue Act of 1862 on July 1, 1862, behind the progressive nature of income tax in the US. It established the Commissioner of Internal Revenue's Office, which later became the IRS. It also instituted a system in which taxpayers were divided into numerous income groups and taxed accordingly. The progressive aspect of income tax is still present today. Wealth taxes were the primary means of preventing the return of aristocracy in President Abraham Lincoln's age. In other words, wealth taxes were not an afterthought; they were a direct result of the American Revolution.

The issue of taxation was at the heart of the popular uprising that sparked the American Revolution. During the Stamp Act crisis, for example, artisan and working-class rebels focused on wealth trappings, such as chariots and fancy houses. These working people resented the British-imposed aristocracy that used regressive taxation to lord their wealth and status over the working people of America.