The Revenue Act of 1862

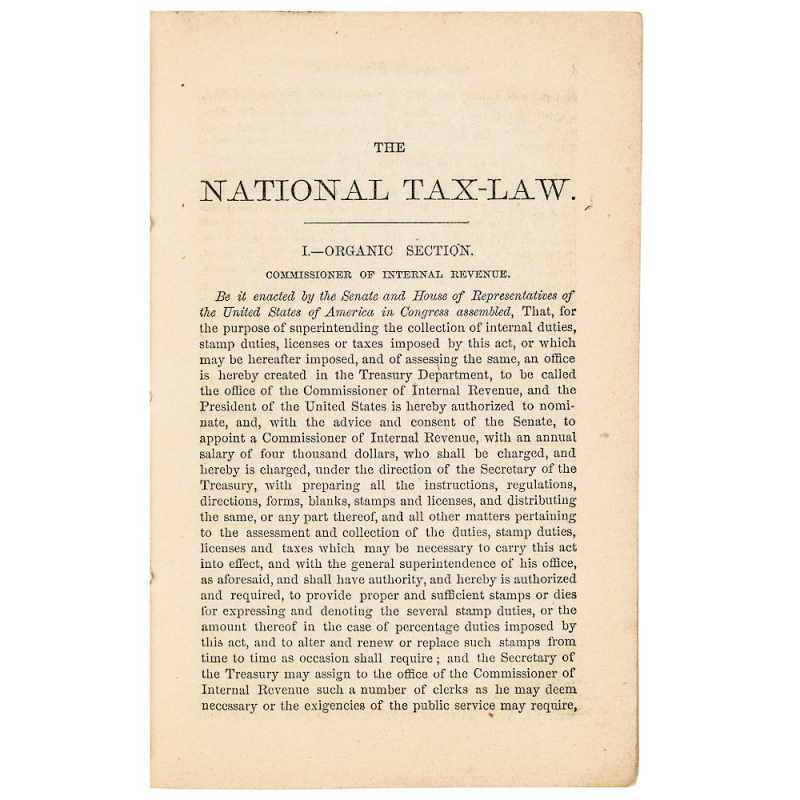

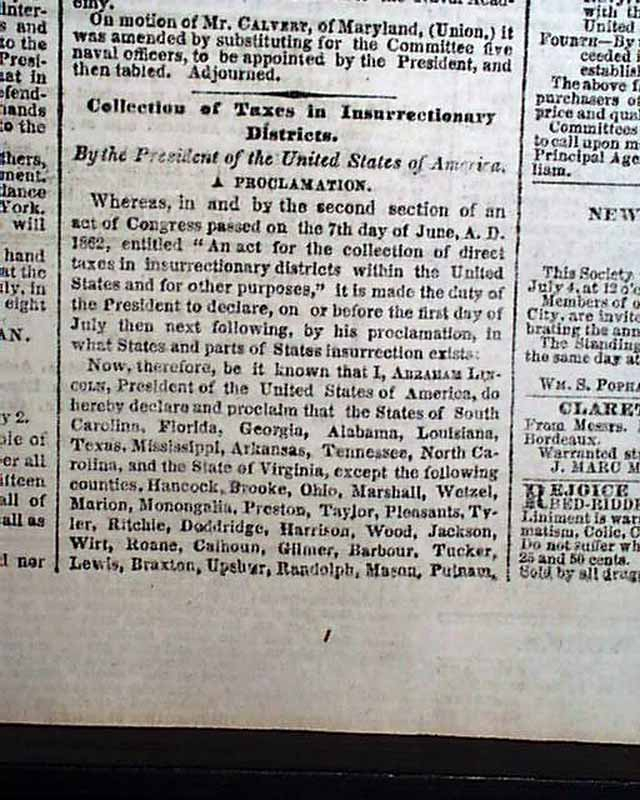

Congress passed the Revenue Act of 1862 in 1862 after realizing that the Revenue Act of 1861 was useless and unable to collect taxes. On July 1, 1862, President Lincoln officially signed the bill into law. The act's institution of the Commissioner of Internal Revenue was a crucial element. The job of collecting taxes within the US was given to the new commission. A large portion of the levies came from excise taxes on consumer products and services, company earnings, interest on savings and investments, and business licenses.

The Act also replaced the 3% income tax on earnings over $800 with a progressive tax structure. The tax threshold was lowered to $600, and a 3% tax was applied to incomes between that amount and $10,000. 5% of the amount over $10,000 was charged. The tax rate was quite modest compared to those assessed today, with $10,000 in 1862 being equivalent to about $260,000 today. In order to find those who were evading taxes, notably those levied on alcohol and tobacco, the Commissioner recruited three investigators in 1863.

In American history, the idea of a progressive tax was first introduced by the Revenue Act of 1862. After being abandoned in 1872, it was reinstated in 1913 after the 16th Amendment to the Constitution was ratified. The Internal Revenue Service, everyone's favorite branch of the federal government, sprang from the Commissioner of Internal Revenue. The Internal Revenue Service, the nation's favorite department, was originally the Commissioner of Internal Revenue. Today, it employs nearly 75,000 people and has an operating budget of more than $11 billion.