Top 10 Best Books On Bond Investing

Bonds are one of the most popular, dependable, and liquid investment options. As a result, bonds can be found in practically every financial portfolio. The ... read more...following are shortlists of the best bond investment books.

-

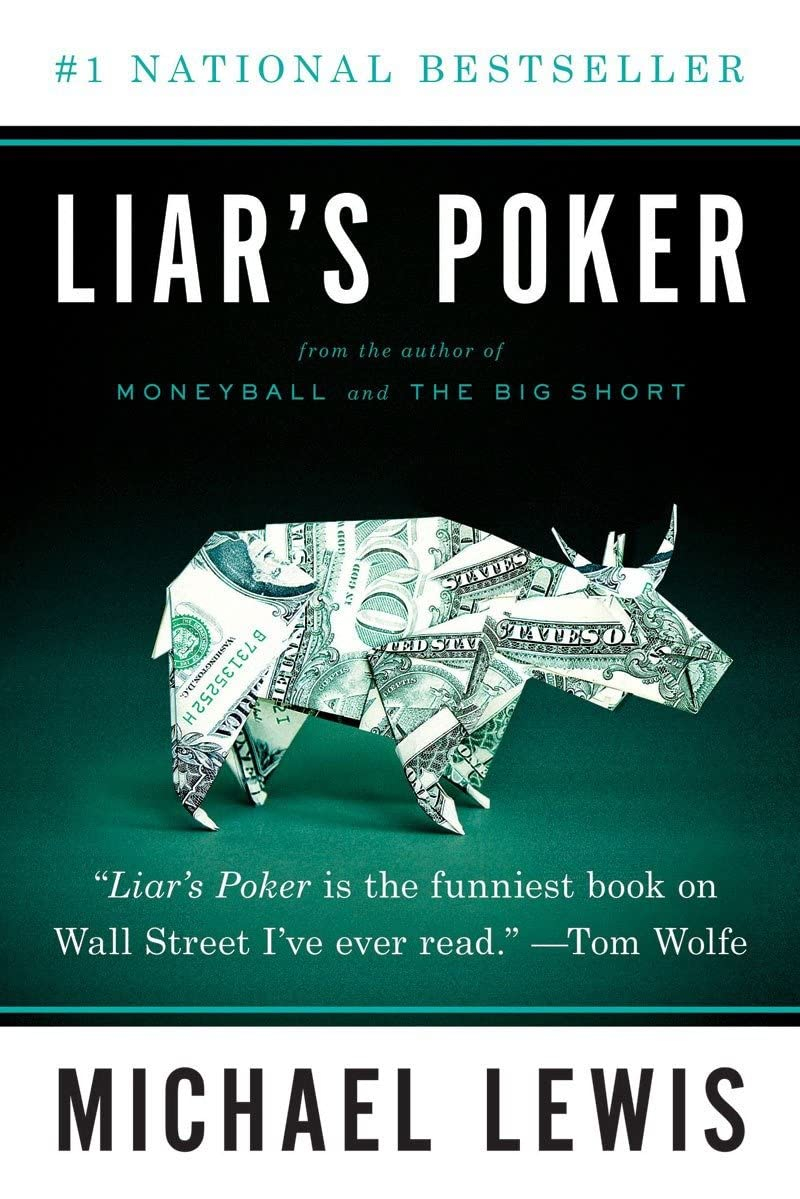

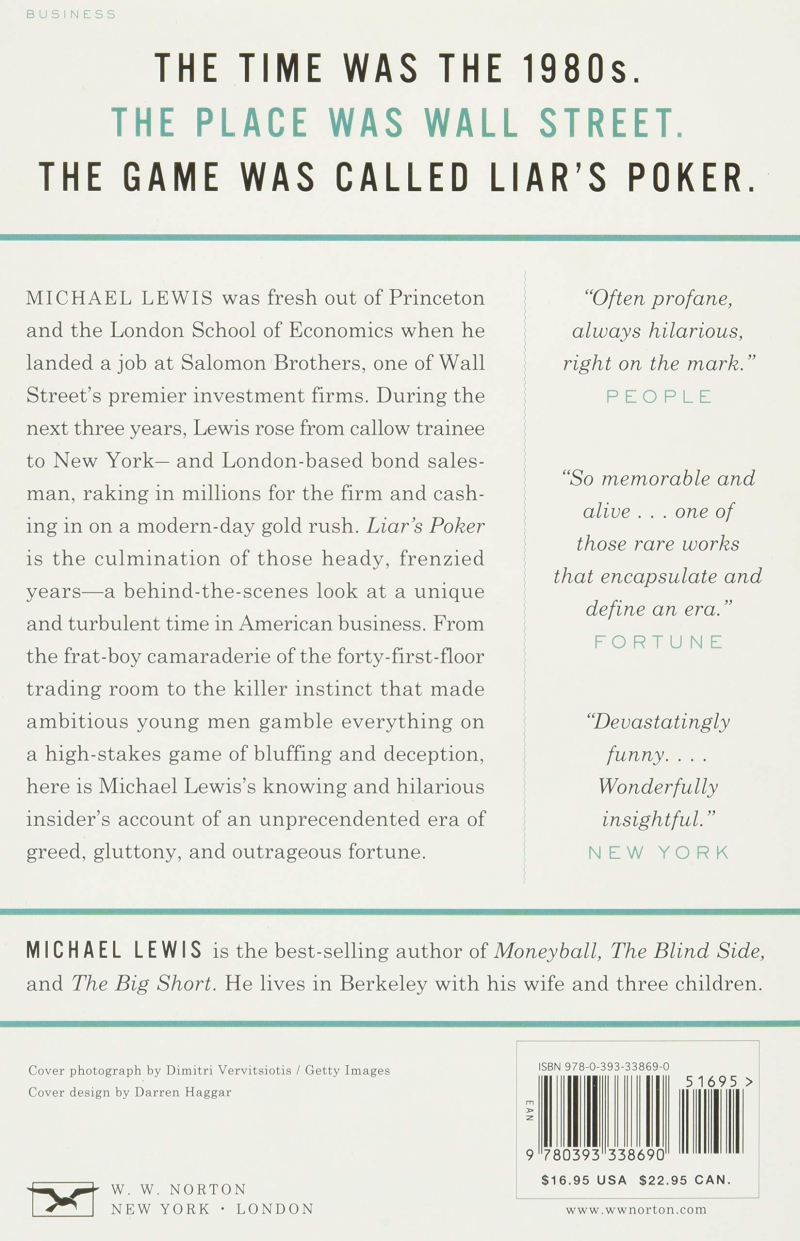

Liar's Poker, Moneyball, The Blind Side, The Big Short, The Undoing Project, and The Fifth Risk are all best-sellers by Michael Lewis.

The 1980s were here. Wall Street was the location. Liar's Poker was the name of the game.

Michael Lewis had just graduated from Princeton and the London School of Economics when he secured a job at Salomon Brothers, one of the most prestigious investing firms on Wall Street. Over the next three years, Lewis progressed from inexperienced trainee to bond salesperson, raking in millions for the firm and profiting from a modern-day gold rush.

Liar's Poker is the culmination of those heady, frantic years, providing a behind-the-scenes glimpse at a unique and chaotic period in American industry. From the frat-boy camaraderie of the forty-first-floor trading room to the killer instinct that drove ambitious young men to risk everything on a high-stakes game of bluffing and deception, Michael Lewis's knowing and hilarious insider's account of an unprecedented era of greed, gluttony, and outrageous fortune is presented.

Author: Michael Lewis

Link to buy: https://www.amazon.com/Liars-Poker-Norton-Paperback-Michael/dp/039333869X/

Ratings: 4.5 out of 5 stars (from 3512 reviews)

Best Sellers Rank: #5,914 in Books

#1 in Bonds Investing (Books)

#3 in Business & Professional Humor

#10 in Stock Market Investing (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Mary Childs is a Planet Money program co-host and journalist for NPR. She formerly worked as a correspondent for Barron's, the Financial Times, and Bloomberg News. She earned a degree in business journalism from Washington & Lee University in Lexington, Virginia.

Bill Gross was a gambler before being renowned as the Bond King among investors. In 1966, as a recent college graduate, he traveled to Las Vegas equipped with his net worth ($200) and a talent for card counting. He was hooked after $10,000 and several casino bans, so he enrolled in business school.

Among the best books on bond investing, The Bond King tells the story of how that brilliant young man convinced Americans to fund his casino. Bill Gross transformed the sleepy bond market into a destabilized game of high risk, high reward over the course of decades; founded Pimco, one of today's most powerful, secretive, and cutthroat investment firms; helped to reshape our financial system in the aftermath of the Great Recession to his own advantage; and amassed legions of admirers and enemies along the way. His ambition, like that of every American antihero, would be his undoing.

Understanding the victors and losers in today's money game, according to journalist Mary Childs, is understanding the bond market, and understanding the bond market is understanding the Bond King.

Author: Mary Childs

Link to buy: https://www.amazon.com/Bond-King-Market-Built-Empire/dp/1250120845/

Ratings: 4.3 out of 5 stars (from 261 reviews)

Best Sellers Rank: #8,844 in Books

#2 in Bonds Investing (Books)

#5 in Economic Policy

#5 in Economic Policy & Development (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Rachel Richards, a former financial advisor, retired at the age of 27. She now survives on passive income of more than $20,000 a month. Rachel Richards is the New York Times bestselling author of "Money Honey: A Simple 7-Step Guide to Getting Your Financial Sh*t Together." She is a business owner, public speaker, and investor.

What if one book could completely transform the way you thought about money? What if you could finally do the things you've been meaning to do but haven't gotten around to, like making a budget, paying off debt, and investing in the stock market? What if you could finally learn about finance without getting dizzy?

Money Honey: A Simple 7-Step Guide to Improving Your Financial Situation Rachel Richards, popular author and former financial advisor, accomplishes the unthinkable by injecting fun and sass into the dreaded subject of personal finance. Rachel, an active investor and business owner, speaks candidly on how to achieve financial freedom.

This tough-love guide is chock-full of gold nuggets that will show you how to:

- Increase your revenue while cutting your expenses in half.

- Consolidate your student debts to save money on interest.

- Get a credit score that is bulletproof.

- Open a brokerage account and place your first trade to begin investing in the stock market.

- Divide your money between debt repayment, short-term savings, and retirement...

- and much more!

You will also discover:

- Rachel's 7-Step Plan for Getting Your Financial House in Order

- The 4-Bucket Savings Method

- Answers to 12 of the most frequently asked financial questions

- The Four Golden Investing Rules

PLUS, you'll gain instant access to Rachel's budgeting and net worth worksheets to help you with your money management.

Money Honey is ideal for beginners and is applicable in 2020 and beyond. Get this book as a birthday, Christmas, or graduation present for a struggling millennial or young adult in your life... or treat yourself! This book is for you if you want to get your money in order while also having fun.

Author: Rachel Richards

Link to buy: https://www.amazon.com/Money-Honey-Getting-Financial-Together/dp/197594996X/

Ratings: 4.7 out of 5 stars (from 1310 reviews)

Best Sellers Rank: #10,487 in Books

#1 in Financial Services Industry

#2 in College & Education Costs

#5 in Bonds Investing (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Justin Donald is the New York Times bestselling author of The Lifestyle Investor. According to Entrepreneur Magazine, Justin Donald is the "Warren Buffett of Lifestyle Investing." He specializes in simplifying difficult financial techniques, arranging agreements, and developing disciplined investment systems that regularly yield profitable returns. "Create riches without creating a job," he says.

Let's be honest. You desire more—more money and freedom, less work, and a greater standard of living.

What if there was a simple, tried-and-true strategy that could get you off the hamster wheel, generate cash flow, and build real wealth with little risk or complexity?

The Lifestyle Investor, one of the best books on bond investing, gives you access to:

- Stop exchanging time for money so you can have more of both.

- Increase your cash flow while lowering your investment risk.

- Replace your employment with passive cash flow sources that compound your wealth and allow you to live life on your terms.

- Join the super-achievers who are enjoying money and freedom right now!

Author: Justin Donald

Link to buy: https://www.amazon.com/Lifestyle-Investor-Commandments-Investing-Financial/dp/1636800122/

Ratings: 4.4 out of 5 stars (from 484 reviews)

Best Sellers Rank: #10,723 in Books

#2 in Financial Services Industry

#3 in Financial Engineering (Books)

#3 in Valuation (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Ted D. Snow, CFP®, MBA is a best-selling author, finance industry veteran of more than 30 years, and the founder of Snow Financial Group, LLC. He has appeared in various publications, including CNBC, Investopedia, Forbes, Kiplingers, and Yahoo! Finance.

Do you want to know how to make your money work for you? Do you want to understand how to make real money by leveraging the power of the stock market? Have you ever imagined using stock market trading to generate passive income and retiring early?

A solid investing strategy is the foundation of every wealth-building journey—if your money isn't working hard for you, it's being devalued by inflation. It has never been easier – or more crucial – for novice investors to begin trading in the stock market.

Ted D. Snow CFP®, MBA, best-selling author, counselor, and financial industry veteran, offers over 30 years of knowledge to the pages of Investing QuickStart Guide. Investing QuickStart Guide, developed with new investors in mind and presented in plain English, demonstrates that with the appropriate advice, anyone can find investing success and build the financial freedom we all deserve.

- Investing QuickStart Guide is updated and redesigned for an entirely new investing environment, with over 100 pages of fresh material, and includes:

- A deeper look at the asset classes that comprise a well-rounded portfolio, including a thorough and in-depth review of investable real estate.

- In light of current tax law developments, there is a greater emphasis on controlling – and decreasing – your tax responsibilities associated to investing activities.

- A tour of the benefits and drawbacks of new and emerging finance technology (aka fintech), as well as a greater emphasis on ESG investing (the practice of Environmental, Social, and Corporate Governance sustainable investing).

Learn the Secrets to Successful Investing in:

- Stocks (Including Dividend Paying Stocks!)

- Mutual Funds

- ETFS

- Bonds

- Index Funds

- REITS and Real Estate

- Commodities

The Investing QuickStart Guide, one of the best books on bond investing, includes:

- Everything You Should Know Before Making Your First Trade!

- How to Take Advantage of Market Opportunities Without Relying on Chance!

- How to Compare and Evaluate Stocks and Other Securities!

- How Disciplined Investing Approaches Can Lead to Early Retirement and Financial Freedom!

- How Economic and Geopolitical Factors at the National and Global Levels Affect Investment Prospects!

Author: Ted D. Snow CFP MBA

Link to buy: https://www.amazon.com/Investing-QuickStart-Guide-Simplified-Successfully/dp/1636100287/

Ratings: 4.5 out of 5 stars (from 2620 reviews)

Best Sellers Rank: #12,417 in Books

#2 in Options Trading (Books)

#6 in Online Trading E-commerce

#7 in Bonds Investing (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Rachel Richards, finance genius, former financial advisor, and Amazon bestselling author of Money Honey, has one aim in mind: to teach you everything you need to know to become financially free sooner than you ever imagined possible. Rachel retired at the age of 27, living off $10,000+ a month in passive income streams. Allow her to demonstrate how to do it at any age—never it's too late.

What exactly is passive income? Passive income is obtained by doing little or no work. It's not a get-rich-quick scheme, but once your passive income exceeds your expenses, you're good to go for the rest of your life.

If you suffer from the Sunday Scaries or dread getting out of bed in the morning, this book is for you. Passive Income, Aggressive Retirement is for the college student who is already dreading the 9-5 existence that awaits him after graduation; the couple who would rather spend their time doing what they want rather than working away for their job every day; and the single parent who is barely making ends meet.

Whatever your WHY is, passive income could be your HOW.

Rachel provides 28 tried and true passive income models in a refreshingly practical how-to guide, assisting you to:

- Without penny-pinching, you can achieve "Financial Independence, Retire Early."

- Create steady, long-term residual income (the non-MLM way) so you may live life on your terms.

- Have the freedom to work when, where, and how you want.

- Say "goodbye" to your 9-to-5 and start living a life you adore.

- Get rid of your money worries and concerns.

You'll learn straight from a plethora of topic matter specialists in this book, including:

- Hal Elrod, who survived many near-death experiences and went on to change the lives of millions of people with his worldwide successful book, The Miracle MorningTM!

- Bobby Hoyt is a former high school band director who launched the Millennial Money Man blog and now earns six figures each month!

- David Osborn is a multi-millionaire real estate magnate who started out broke and unemployed at the age of 26 and went on to become one of the world's most successful real estate franchise owners!

- Honorée Corder is a speaker, executive book coach, and author of over 50 books!

- Doug Skipworth, who owns hundreds of rental properties and co-founded Crestcore Realty!

Join the thousands of others who have experienced success with similar tactics. Passive Income, Aggressive Retirement is the gift that keeps on giving in 2020 and beyond. Purchase it for yourself, as a holiday gift, or to kickstart a New Year's resolution.

Whether you're a complete beginner or not, you'll know exactly what it takes and how to get started by the end of Passive Income, Aggressive Retirement. Passive income is genuine and accessible to everyone, including you. Are you ready to join the revolution?

Author: Rachel Richards

Link to buy: https://www.amazon.com/Passive-Income-Aggressive-Retirement-Independence/dp/1706203020/

Ratings: 4.5 out of 5 stars (from 892 reviews)

Best Sellers Rank: #16,899 in Books

#1 in E-Commerce (Books)

#2 in Unemployment

#4 in Book Publishing Industry

https://www.amazon.com/

https://www.amazon.com/ -

Eric Tyson, MBA, is a financial advisor, syndicated columnist, and best-selling author of For Dummies books on personal finance, taxes, property buying, and investment.

Nothing beats having your money create more money—and getting there isn't as difficult as you've been taught to believe. You, too, can see your money grow like a tree with some common sense, careful preparation, and the appropriate guidance.

Best-selling author and nationally acclaimed personal finance expert Eric Tyson shows you how to make your money work for you in the Ninth Edition of Investing for Dummies, with rock-solid advice that has survived the test of time. Tyson avoids flashy get-rich-quick schemes in favor of a slow-and-steady method that may benefit everyone from young professionals just starting out in their jobs to baby boomers looking to boost their nest eggs right before retirement.

You will find the following in the book:

- Begin investing by researching your options, calculating risk versus return, and getting your financial home in order.

- Learn about the roles stocks, bonds, real estate, and small businesses can play in your portfolio.

- Learn how to select the best magazines, radio, television, and digital media to keep you informed while avoiding the hype.

The Ninth Edition of Investing For Dummies is the newest must-have reference to investing your money like a boss, with updated coverage of recent developments such as the Tax Cuts and Jobs Act and their influence on investments, as well as the growing trend among brokers toward zero- and low-fee stock trades. The book is regarded as one of the best books on bond investing.

Author: Eric Tyson

Link to buy: https://www.amazon.com/Investing-Dummies-Eric-Tyson/dp/1119716497/

Ratings: 4.6 out of 5 stars (from 456 reviews)

Best Sellers Rank: #36,556 in Books

#12 in Bonds Investing (Books)

#185 in Introduction to Investing

https://www.amazon.com/

https://www.amazon.com/ -

Ann C. Logue, MBA, is a finance lecturer at the University of Illinois in Chicago. She is a Chartered Financial Analyst (CFA) and has written on business and finance for magazines such as Barron's, Entrepreneur, and InvestHedge, among others.

The dangers and opportunities for day traders are evolving as a result of the volatile economy, trade conflicts, and new tax legislation. Trading can be scary now more than ever due to the various approaches and strategies used by Wall Street dealers. Day Trading For Dummies gives anyone interested in this type of fast-paced trading the information they need to get started and keep their assets in good condition.

Day Trading For Dummies provides you with the knowledge and confidence you'll need to keep a cool head, manage risk, and make rapid judgments as you buy and sell your positions, covering everything from classic and renegade techniques to the nitty-gritty of everyday trading practices.

- Cryptocurrencies are examples of new trade items.

- SEC rules and regulations, as well as tax legislation, have been updated.

- Using options to manage risk and profit

- Additional programming information

If you need to learn a lot about day trading in a short period of time, here is the place to start.

Author: Ann C. Logue

Link to buy: https://www.amazon.com/Trading-Dummies-Business-Personal-Finance/dp/111955408X/

Ratings: 4.5 out of 5 stars (from 975 reviews)

Best Sellers Rank: #42,357 in Books

#13 in Bonds Investing (Books)

#16 in Education Funding (Books)

#25 in Digital Currencies

https://www.amazon.com/

https://www.amazon.com/ -

John C. Bogle is the founder and President of the Vanguard Mutual Fund Group's Bogle Financial Markets Research Center. He founded Vanguard in 1974 and served as chairman and CEO until 1996, then as senior chairman until 2000. Mr. Bogle was named one of the four "Investment Giants" of the twentieth century by Fortune magazine in 1999; in 2004, Time named him one of the world's 100 most powerful and influential individuals; and Institutional Investor honored him with its Lifetime Achievement Award.

Much has changed since the first edition of Common Sense on Mutual Funds was published in 1999, and no one is more aware of this than mutual fund pioneer John Bogle. Bogle returns in this newly updated Second Edition to take another critical look at the mutual fund sector and assist investors understand the bewildering number of investing possibilities accessible to them.

This dependable resource covers the principles of mutual fund investing in today's tumultuous market environment and offers timeless advice on constructing an investment portfolio in a plain and accessible approach. Along the way, Bogle demonstrates how simplicity and common sense always triumph over costly complexity, and how a low-cost, broadly diversified portfolio is almost certain to outperform the great majority of Wall Street professionals in the long run.

- John C. Bogle, a mutual fund industry legend, wrote this.

- Discusses the timeless financial fundamentals that apply in any market.

- Considers the structural and regulatory developments that have occurred in the mutual fund business.

- Bogle's other books include The Little Book of Common Sense. Enough and Investing

Securing your financial future has never been more difficult, but reading the Second Edition of Common Sense on Mutual Funds can make you a better investor.

Author: John C. Bogle

Link to buy: https://www.amazon.com/Common-Sense-Mutual-Funds-Anniversary/dp/0470138130/

Ratings: 4.5 out of 5 stars (from 390 reviews)

Best Sellers Rank: #50,649 in Books

#15 in Bonds Investing (Books)

#16 in Business Finance

#17 in Business Investments

https://www.amazon.com/

https://www.amazon.com/ -

Annette Thau is a visiting scholar at Columbia University's Graduate School of Business and a former municipal bond analyst for Chase Manhattan Bank. She has authored numerous pieces for the AAII Journal and spoken to organizations around the country. She was a featured speaker at the American Association of Individual Investors' national meeting in November 2009.

The 2008 financial crisis generated enormous changes in every area of the bond market, leaving even the most savvy investors perplexed about the safety of their assets. Former bond analyst Annette Thau builds on the features and authority that made the first two editions bestsellers in the totally rewritten, updated, and enlarged third edition of The Bond Book to assist these investors and anybody wishing to explore prospects in fixed-income investing.

This is a one-stop shop for seasoned bond investors looking for the most up-to-date information on the fixed-income market as well as equities investors looking to diversify their holdings. Thau delivers cutting-edge tactics for making the greatest bond-investing decisions in plain English, while also teaching how to identify risks and possibilities. She also provides up-to-date listings of web resources that contain bond pricing and other information. Look to this all-in-one resource for information on essential issues such as:

- Investing in individual bonds or bond ETFs

- The differences between open-end funds, closed-end funds, and exchange-traded funds (ETFs)

- The new municipal bond landscape: revised rating scales, bond insurance on the verge of extinction, and Build America Bonds (BABs)

- The most secure bond funds

- Bonds classified as junk (and emerging market bonds)

- Purchasing Treasuries without having to pay a commission

The Bond Book, third edition, is a must-read for individual investors and financial advisers who want to improve the fixed-income allocation of their portfolios. It covers everything from how bonds work to how to buy and sell them to what to expect from them.

Author: Annette Thau

Link to buy: https://www.amazon.com/Bond-Book-Third-Everything-Treasuries/dp/007166470X/

Ratings: 4.6 out of 5 stars (from 211 reviews)

Best Sellers Rank: #68,655 in Books

#20 in Bonds Investing (Books)

#28 in Mutual Funds Investing (Books)

#132 in Retirement Planning (Books)

https://www.amazon.com/

https://www.amazon.com/