Top 7 Biggest Cross-Border E-Commerce Platforms in China

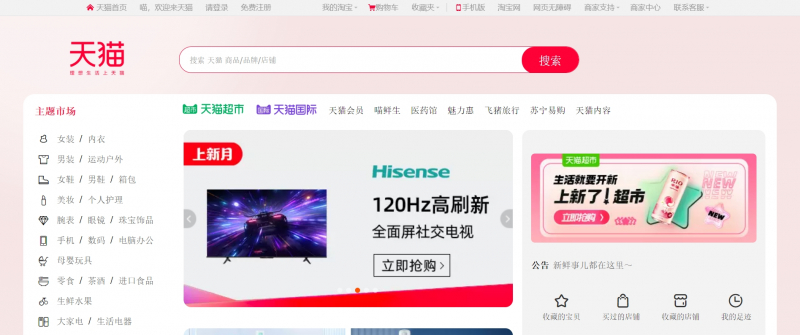

For US exporters looking to access Chinese consumers, the expansion of e-commerce channels in China, particularly since the COVID-19 outbreak, presents new ... read more...prospects. Access to markets across China is now possible thanks to cross-border e-commerce channels. This is as a result of advancements in transportation techniques, regulations that permit cross-border direct-to-consumer purchases, and the exclusion of some products from registration, Chinese labeling, and testing requirements. Here are some Largest Cross-Border E-Commerce Platforms in China.

-

On April 23, 2006, Daniel Ek and Martin Lorentzon established Spotify, a privately held Swedish supplier of media services including audio streaming. As of December 2022, it had over 489 million active monthly users, including 205 million paid members, making it one of the biggest music streaming service providers. Through a holding company with a Luxembourg City address, Spotify Technologies S.A., Spotify is traded as American depositary receipts on the New York Stock Exchange.

The market capitalization of Spotify was $24.99 billion as of March 2023. By market cap, this places Spotify as the 685th most valuable firm in the world. The most recent financial reports from Spotify show that the company's current revenue (TTM) is $12.33 Billion. The company generated $11.23 billion in revenue in 2021, a rise from $9.14 billion in revenue in 2020.

Founded: 23 April 2006

Headquarter: Stockholm, Sweden

Market cap: $24.99 Billion

Revenue in 2022 (TTM): $12.33 B

Website: https://www.spotify.com/jp/premium/

Screenshot via https://www.spotify.com/jp

Screenshot via https://www.spotify.com/jp -

The second-largest player in China's cross-border e-commerce sector after Tmall Global is Kaola, a cross-border e-commerce platform that operates under the NetEase brand. The foundation of Kaola's business strategy is acquiring premium European products to sell to affluent Chinese households. In a market plagued by phony goods and counterfeits, NetEase's resources and reputation as a media and gaming company over the last two decades have aided Kaola in winning over customers.

Kaola was introduced in 2015 by NetEase, one of China's top online gaming and internet service providers. Tmall Global is the largest cross-border retail e-commerce site selling Western brands in China.

NetEase chose the moniker Kaola, which translates to "koala," because it wants its users to continue being "lazy and comfy" like the marsupial. With a quick delivery service, Kaola provides a large selection of products for baby and mother care, health care, beauty, and cosmetics. The $ 2 billion purchase of Kaola by Alibaba Group, which also owns Tmall, was announced in September 2019. This explains why Tmall and Kaola are connected frequently during significant business events.

Even though Kaola is still a relatively new competitor in the e-commerce space compared to Tmall or JD, it managed to overtake Tmall Global in early 2020 to become China's top cross-border e-commerce platform in 2019, with a market share of over 27.1%. Kaola generates less revenue than JD.com; now, we are at 69.979 million dollars versus 3.131 million dollars (2019 data).It should be taken into account that its earnings have dramatically increased after the Covid-19 pandemic. Similar to other international e-commerce platforms, Kaola enables vendors to display their goods on a variety of forums, websites, and online advertising platforms.

Founded: 2015

Headquarter: 26F SP Twr D Tsinghua Science Park Bld 8 No 1 Zhongguancun E Rd Haidian, Beijing, 100084, China

Revenue: US$159.1m in 2021

Website: kaola.com

Screenshot via kaola.com

Screenshot via kaola.com -

With partners like Tencent, Google, and Walmart, JD.com has close to 500 million active consumer accounts per year. While Tmall is the preferred fashion marketplace, JD.com is more well-known for its 3C products (computer, communication and consumer electronics).

Sellers on JD Worldwide benefit from industry-leading internal integrated logistics services thanks to a vast logistics network of warehouses and shipping facilities throughout China. Depending on the product, JD Worldwide's security deposits range from 10,000 to 30,000 USD and its commissions from 2% to 8%. The yearly platform usage cost is one thousand dollars.

Businesses must be registered outside of China and have a USD bank account in order to sell on JD International. Businesses must have capital of at least 500,000 RMB and submit any necessary stock certificates, ownership/authorization documents, and retail and trade qualification information.

As of March 2023 Jingdong Mall has a market cap of $70.37 Billion. Jingdong Mall is now ranked as the 194th most valuable corporation in the world by market cap. The most recent financial reports for Jingdong Mall indicate that the company's current revenue (TTM) is $155.18 B. The corporation generated $147.29 billion in revenue in 2021, a rise from $108.95 billion in revenue in 2020.Founded: 6 June 1998

Headquarter: Beijing, China

Market cap: $70.37 Billion

Revenue in 2022 (TTM): $155.18 B

Website: https://corporate.jd.com/

Screenshot via https://corporate.jd.com/

Screenshot via https://corporate.jd.com/ -

In contrast to rivals Tmall and JD.com, VIP Shop is a flash-sale e-commerce platform that pre-orders goods from overstock to sell at a deep discount. With about 40% of the Chinese flash-sale market under its control, VIP Shop has established a distinct position in the country's cutthroat e-commerce business.

This business strategy extends to VIP International, its international e-commerce division. VIP International has established procurement abroad to prevent counterfeits, and all products are sourced and purchased directly from abroad. With 12 abroad facilities and 11 in China, VIP International runs an internal logistics network much like JD Global.

VIP International doesn't charge sponsors platform usage fees, commissions, or security deposits thanks to its pre-purchasing business model. However, due to this business strategy, VIP International mainly welcomes bigger firms with a history of doing business in China.Vipshop's market cap was $8.97 billion as of March 2023. Vipshop is now the 1556th most valuable company in the world according to market valuation. The most recent financial reports from VIPshop indicate that the company's current revenue (TTM) is $15.27 Billion. The company generated $18.11 billion in revenue in 2021, a rise from $14.93 billion in revenue in 2020.

Founded: December 2008

Headquarter: Guangzhou, Guangdong, China

Market cap: $8.97 Billion

Revenue in 2022 (TTM): $15.27 B

Website: https://www.vip.com/

Screenshot via https://www.vip.com/

Screenshot via https://www.vip.com/ -

One of China's biggest non-government merchants, Suning.com Co., Ltd., formerly known as Suning Commerce Group Co., Ltd., has its headquarters in Nanjing, Jiangsu Province. With more than 10,000 locations nationally, Suning is one of the top three B2C enterprises in China.

Suning.com is its e-commerce platform. Physical goods such household appliances, 3C products, books, general merchandise, household essentials, cosmetics, and infant care items are among the operation categories. Content products and service goods are also included, with a total SKU count reaching 3 million. In 2004, it was admitted to the Shenzhen Stock Exchange. Suning.com was rated 328th on the Fortune Global 500 list in 2021.

According to a survey from the worldwide financial website "Insider Monkey," Suning.com is ranked 9th on the list of the 15 Fastest Growing Ecommerce Businesses in 2020 and ranked 2nd in "Total Online Retail Sales" in China.

Founded: 1990

Headquarter: Nanjing, China

Market Cap: 19.923B

Revenue: 18,328.04

Website: suning.cn

Screenshot via suning.cn

Screenshot via suning.cn -

The Chinese electronics company Xiaomi, famed for its smartphones and consumer IoT products, runs the youpin e-commerce site. The majority of its domestic product offers come from the Xiaomi ecosystem because it is a platform run by Xiaomi.

Korea Agro-Fisheries & Food Trade Corp is a cross-border seller on the freshly launched Xiaomi Youpin Global cross-border e-commerce platform. To make international goods available to Chinese consumers on its platform, Youpin Global primarily collaborates with foreign governments. Youpin Global and JD.com have a strategic alliance, and JD Logistics' extensive warehousing and delivery networks throughout China handle their logistics.Xiaomi's market cap as of March 2023 is $34.71 billion. This places Xiaomi as the 493rd most valuable business in the world according to market cap. The company's current revenue (TTM) is $45.35 Billion, according to Xiaomi's most recent financial filings. The corporation generated $50.77 billion in revenue in 2021, an increase above the $35.95 billion it generated in revenue in 2020.

Founded: 6 April 2010

Headquarter: Haidian District, Beijing, China

Market cap: $34.71 Billion

Revenue in 2022 (TTM): $45.35 B

Website: https://www.xiaomiyoupin.com/

Screenshot via https://www.xiaomiyoupin.com/

Screenshot via https://www.xiaomiyoupin.com/ -

A global e-commerce platform called YMatou focuses primarily on C2C and M2C, or manufacturer-to-customer, transactions. Chinese microblogging juggernaut Weibo made an investment in the business in 2020 as a move toward realizing Weibo's potential for social e-commerce. YMatou is regarded to be one of the pioneers of livestreamed e-commerce trend and was a successful early user of the group-buy sales model.

The site organizes flash sales for international businesses and is primarily focused on cross-border e-commerce. Similar to VIP International, YMatou has a small selection of goods that they pre-purchase from foreign companies with well-known names in China.

Bei Hai International is the name of the internal cross-border logistics network that YMatou runs. Bei Hai International enables YMatou to offer affordable and dependable shipping to Chinese customers through its connections with numerous international airlines and bonded warehouses located throughout North America, Europe, Asia, and Australia.Founded: 2009

Headquarter: Shanghai, China

Market Capitalization: N/A

Revenue:$87.7M

Website:www.ymatou.com

Screenshot via www.ymatou.com

Screenshot via www.ymatou.com