Top 5 Interesting Facts about Ben Bernanke

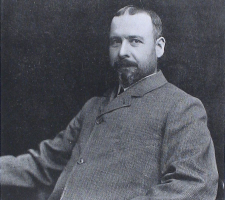

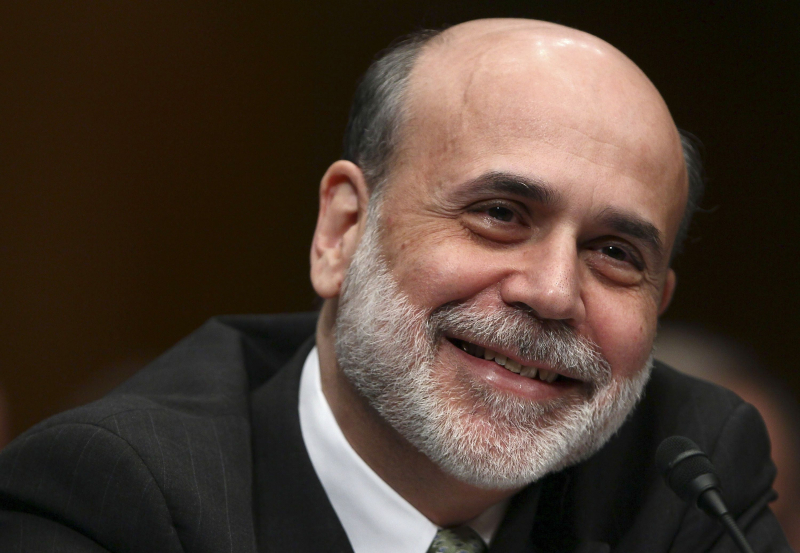

Ben Bernanke (born December 13, 1953) is an American economist and former Chairman of the United States Federal Reserve. Ben Bernanke was appointed by ... read more...President George W. Bush in October 2005 and served as Chairman of the Council of Economic Advisers to President George W. Bush. He succeeded Alan Greenspan on February 1, 2006, and was reappointed by President Barack Obama to a second term starting February 1, 2010. In 2009, he was named Person of the Year by Time magazine. Here are some interesting facts about Ben Bernanke.

-

He was raised in Dillon, South Carolina. Ben was a man of great talent, and at the age of 11, he showed his talent when he achieved a state spelling bee. He had the highest SAT score in South Carolina and got a graduation degree in economics from Harvard University in 1975, an interesting fact about Ben Bernanke. Afterward, in 1979, Bernanke got a Ph.D. degree in economics from the Massachusetts Institute of Technology. Dr. Ben Bernanke currently works as a Distinguished Fellow-in-residence with the Economic Studies Program at the Brookings Institution. However, he is best known for his role as Chairman of the Board of the Federal Reserve System (also known as the Fed) from 2006-2010, a period marked by the 2008 Financial Crisis. Many experts and influential leaders, including Barack Obama, credit Bernanke for “preventing another Great Depression”. Bernanke is an expert in macroeconomics, specifically monetary policy. His ideas, which influenced many of the decisions taken by the Fed following the collapse in 2008, can be summarised by the ‘Bernanke Doctrine’ a speech he gave upon his initial appointment as a Governor of the Fed in 2004. He is a scholar of the Great Depression, specifically its underlying causes and the lessons that could be learned from it.

A former Princeton Professor, Dr. Bernanke has published several scholarly articles tackling a wide range of economic issues. He is the author of several books, including ‘The Courage to Act: A Memoir of a Crisis and its Aftermath, which documents his experience as Chairman of the Federal Reserve during and after the 2008 financial crisis. Ben Bernanke’s life is full of success and achievements, and every institution desired the services of this economic expert. As an economics professor, he served the Princeton University and Stanford University. Furthermore, he also served the MIT and New York University as a visiting professor. He was associated with the Federal Reserve Board of Governors in 2002. He was appointed as Chairman in 2006. Besides, he has also appointed the Chair of the Presidential Council of Economic Advisers in 2005. Ben also won the title “Time Magazine person of the year “in 2009, a fun fact about Ben Bernanke.

Source: wikipedia

Source: csmonitor -

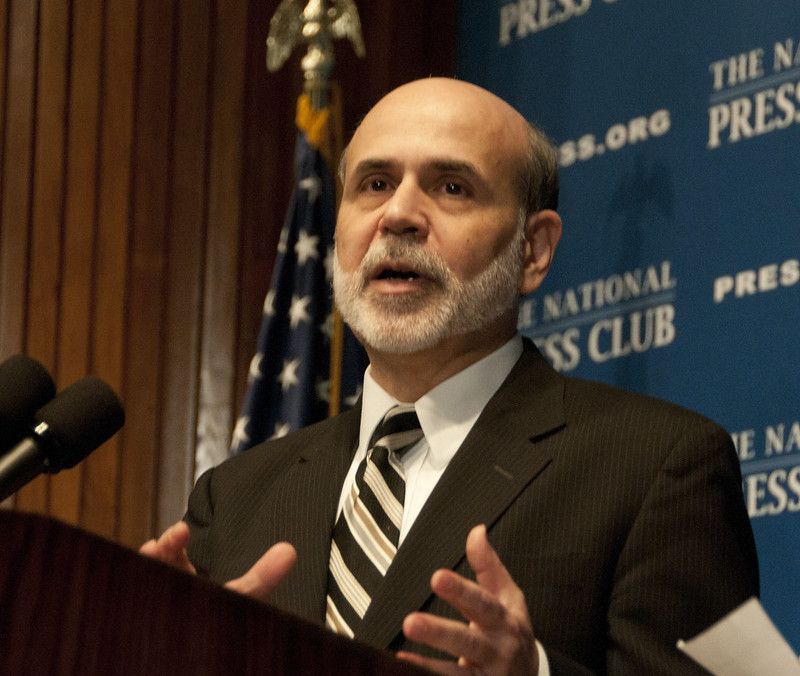

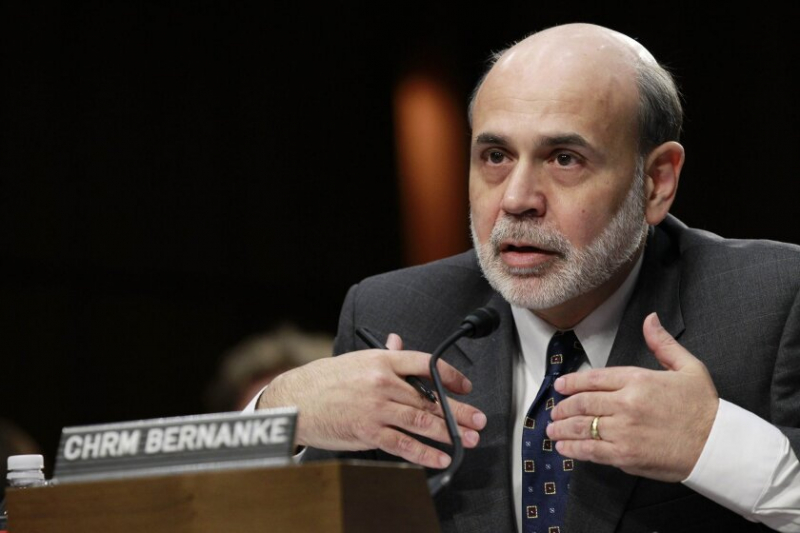

Ben Bernanke is considered a vital figure in the US economy. No one could earn that place as Bernanke. As a fed chair, he was responsible for designing and implementing the monetary policy of the U.S economy. When it became worst and fiscal policy was going hamstrung by the national debt, then all eyes were seeing towards Ben Bernanke. According to a spokesperson, Bernanke’s words swayed the stock market and the value of the dollar. He was not only a country's premier economic expert but an essential person in the global economy.

For the first time in nearly a decade, the Federal Reserve is considering raising its target interest rate, which would end a long period of near-zero rates. Like the cessation of large-scale asset purchases in October 2014, that action will be an important milestone in the unwinding of extraordinary monetary policies, adopted during my tenure as Fed chairman, to help the economy recover from a historic financial crisis. As such, it’s a good time to evaluate the results of those measures and to consider where policymakers should go from here.

What the Fed can do is two things. First, by mitigating recessions, monetary policy can try to ensure that the economy makes full use of its resources, especially the workforce. High unemployment is a tragedy for the jobless, but it is also costly for taxpayers, investors, and anyone interested in the health of the economy. Second, by keeping inflation low and stable, the Fed can help the market-based system function better and make it easier for people to plan for the future. Considering the economic risks posed by deflation, as well as the probability that interest rates will approach zero when inflation is very low, the Fed sets an inflation target of 2%, similar to that of most other central banks around the world. During his tenure as Fed Chairman, interest rates of the country did not increase in six years. After taking charge of the office, the interest rate was only raised a few times and topped out at 5.25% before holding at 0.25% for more than three years. It is shocking for everyone because zero interest rates are harmful to the economy of the country. Still, it went in the favor of the country and encouraged loans for small businesses.

Source: thebalance

Source: nytimes -

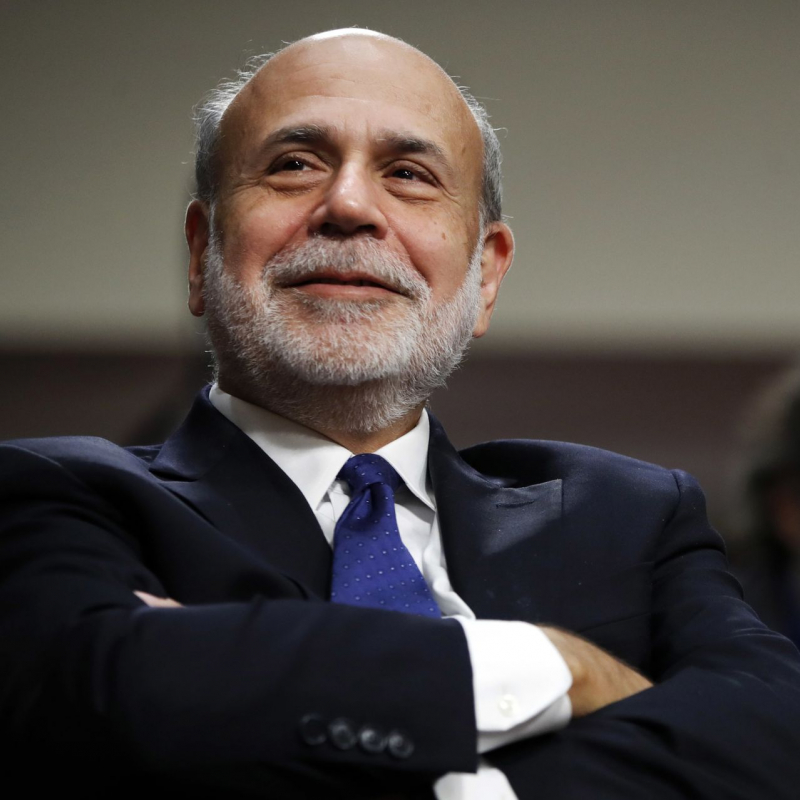

Ben S. Bernanke is a Senior Advisor to PIMCO and Citadel in addition to being a Distinguished Fellow in Residence with the Economic Studies Program at the Brookings Institution. Dr. Bernanke presided over the President's Council of Economic Advisers from June 2005 to January 2006 before being named chairman. He has previously performed many duties for the Federal Reserve System. He served on the Federal Reserve System's Board of Governors from 2002 to 2005, served as a visiting scholar at the Federal Reserve Banks of Philadelphia (1987–89), Boston (1989–90), and New York (1990–91, 1994–96), and was a member of the Federal Reserve Bank of New York's Academic Advisory Panel (1990-2002).

Bernanke served as the Princeton University's Class of 1926 Professor of Economics and Public Affairs from 1994 to 1996. From 1996 to 2002, he served as the university's Howard Harrison and Gabrielle Snyder Beck Professor of Economics and Public Affairs and Chair of the Economics Department. Since 1985, Dr. Bernanke has served as a professor of economics and public policy at Princeton. Dr. Bernanke worked at Stanford University's Graduate School of Business as an Assistant Professor of Economics from 1979 to 1983 and an Associate Professor of Economics from 1983 to 1985 before moving to Princeton. In addition, he taught as a visiting professor of economics at the Massachusetts Institute of Technology and New York University in 1993. (1989-90).

Dr. Bernanke is the author of many academic works as well as two textbooks. He has written several papers on a variety of economic topics, such as macroeconomics and monetary policy. He has received Sloan and Guggenheim fellowships, and he is a fellow of the American Academy of Arts and Sciences and the Econometric Society. Dr. Bernanke held the positions of Director of the National Bureau of Economic Research's Monetary Economics Program and Member of the Business Cycle Dating Committee. He was named Editor of the American Economic Review in July 2001. Among Dr. Bernanke's involvement with community and business organizations is his two years on the Montgomery Township Board of Education.

Source: kidadl

Source: wsj.com -

Ben Bernanke, a soft-spoken, analytical man tasked with balancing America's shaky finances, has been named Time magazine's "person of the year," defeating opposition from the top US commander in Afghanistan, the first female speaker of Congress, and China's enormous number of low-level workers. Bernanke, the 56-year-old chairman of the US Federal Reserve, was named "the most powerful geek in the world" by Time, which is one of the interesting facts about Ben Bernanke that you may not know. According to the magazine, he should be given the most credit for changing US monetary policy and for spearheading an initiative to save the world economy from certain doom.

The honor arrives at a difficult moment for Bernanke, whose decision to serve a second term at the Federal Reserve has angered some senators in the US and who may lose some of the Fed's independence under a new supervision system that Congress is considering. Richard Stengel, the managing editor of Time, stated that Bernanke "truly stood for what transpired this year more than the others." Bernanke, an expert on the Great Depression of the 1930s, was determined to avoid austerity because he thought it would have compounded the effects of that historic slump. He has played a key role in developing the US government's $700 billion (£425 billion) financial rescue plan since the start of the credit crisis. Under his leadership, the Fed reduced interest rates to almost zero and pumped massive quantities of liquidity into the US economy by making cheap money available to the markets.

Source: wsj.com

Source: npr.org -

This is one of the interesting facts about Ben Bernanke that may surprise many people. It may occasionally be accepted for someone who works for the police or an intelligence agency to use a secret identity, but assuming a false identity while one is a central banker is not. According to a Wall Street Journal investigation, that's exactly what former Federal Reserve Chairman Ben Bernanke did during the worst of the financial crisis. According to documents provided as proof in an AIG shareholder lawsuit against the U.S. government, Bernanke used the alias Edward Quince in a series of emails with colleagues about the precarious financial situation insurance giant American International Group (AIG) found itself in during the fall of 2008.

Bernanke did use the fictitious name, a Fed spokesperson told the Journal, but she made no mention of why. As the credit markets froze up and the company's access to short-term finance was in peril, AIG held discussions with Fed officials about getting government financial aid. The pseudonym was only finally revealed on Wednesday, six years after the disaster, in a Washington courtroom during the trial surrounding the government's contentious rescue of AIG.

A Fed spokesperson told the Wall Street Journal that Bernanke employed a pseudonym, despite being the most influential person throughout the financial crisis in determining the Fed's policies, but she was unable to say why or whether the moniker had any special meaning for him. According to WSJ.com, Edward Quince participated in an email discussion regarding AIG in September 2008 that also involved Tim Geithner, the head of the New York Fed at the time. Quince was Bernanke's email pseudonym, a Justice Department attorney testified in court, and Geithner concurred. AIG ultimately received a total federal bailout of US$182.3 billion throughout the crisis. The corporation paid it all back by December 2012, leaving American taxpayers with a profit of around US$23 billion.

Source: cnbc

Source: latimes