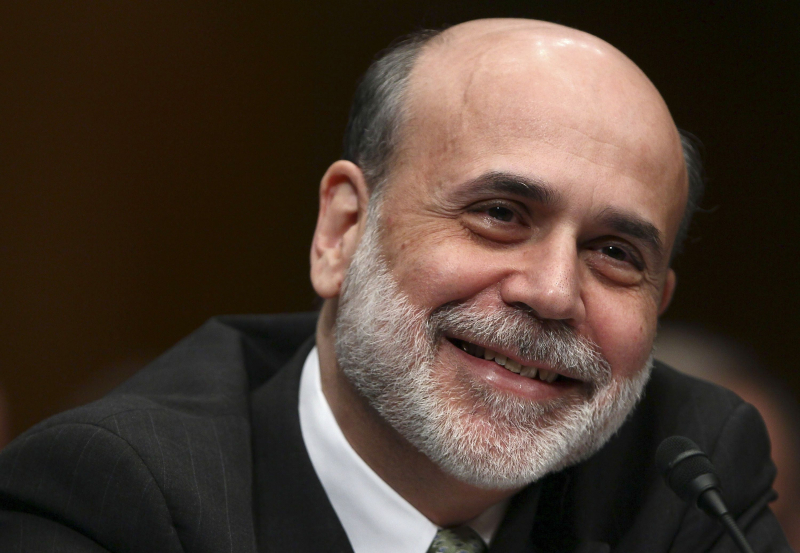

Ben Bernanke helped save the Global Economy

Ben Bernanke is considered a vital figure in the US economy. No one could earn that place as Bernanke. As a fed chair, he was responsible for designing and implementing the monetary policy of the U.S economy. When it became worst and fiscal policy was going hamstrung by the national debt, then all eyes were seeing towards Ben Bernanke. According to a spokesperson, Bernanke’s words swayed the stock market and the value of the dollar. He was not only a country's premier economic expert but an essential person in the global economy.

For the first time in nearly a decade, the Federal Reserve is considering raising its target interest rate, which would end a long period of near-zero rates. Like the cessation of large-scale asset purchases in October 2014, that action will be an important milestone in the unwinding of extraordinary monetary policies, adopted during my tenure as Fed chairman, to help the economy recover from a historic financial crisis. As such, it’s a good time to evaluate the results of those measures and to consider where policymakers should go from here.

What the Fed can do is two things. First, by mitigating recessions, monetary policy can try to ensure that the economy makes full use of its resources, especially the workforce. High unemployment is a tragedy for the jobless, but it is also costly for taxpayers, investors, and anyone interested in the health of the economy. Second, by keeping inflation low and stable, the Fed can help the market-based system function better and make it easier for people to plan for the future. Considering the economic risks posed by deflation, as well as the probability that interest rates will approach zero when inflation is very low, the Fed sets an inflation target of 2%, similar to that of most other central banks around the world. During his tenure as Fed Chairman, interest rates of the country did not increase in six years. After taking charge of the office, the interest rate was only raised a few times and topped out at 5.25% before holding at 0.25% for more than three years. It is shocking for everyone because zero interest rates are harmful to the economy of the country. Still, it went in the favor of the country and encouraged loans for small businesses.