Top 10 Largest Banks in South Africa

South Africa is one of the most developed economies in Africa, with a well-established banking industry. The banking sector in South Africa is highly ... read more...competitive, with a large number of domestic and international banks operating in the country. In this article, we will take a look at the top 10 largest banks in South Africa.

-

Standard Bank is considered one of the largest financial institutions in South Africa with a rich history of over 155 years of banking experience. The bank was established in 1862 and headquartered in Johannesburg. Standard Bank, which is known for its extensive branch network, innovative products, and excellent customer service, has grown to become a leading provider of banking services throughout the African continent.

Standard Bank Group is the largest bank in South Africa and also one of the largest in Africa with assets valued at over R2.5 trillion. The bank has a network of over 600 branches throughout South Africa, Africa and operates in 20 different countries. Standard Bank Group provides a wide range of banking and financial services including Wealth and Investment, Corporate and Investment, and Personal and Business and Commercial Banking to corporate, institutional, and retail clients, individuals, and small businesses. Additionally, this bank, coupled with its modern mobile banking platforms, has made its financial services easily accessible to customers.

The bank has also been recognized as a major contributor to the South African economy, creating job opportunities and supporting various educational, charitable, and community development projects. Standard Bank's commitment to mitigating risks, has helped it build a reputation as a trusted financial partner for individuals, businesses, and organizations in South Africa and beyond.

Founded: 1862

Headquarters: Johannesburg

Website: https://www.standardbank.com/sbg/standard-bank-group

Standard Bank - Photo by Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Standard_Bank,_Praca_25_de_Junho,_Maputo.jpg) Standard Bank Group -

ABSA is the third-largest bank in South Africa ABSA with assets valued at R1.3 trillion. Dating back to its establishment in 1916, with a history more than 150 years, The group has a strong presence in Africa with its headquarters in Johannesburg, ABSA operates in 12 countries across the continent, serves over 10 million customers in South Africa and has a significant presence in the African financial services market.

ABSA Group Limited offers a broad range of financial products and services, including retail, corporate, personal, commercial and business banking, wealth management, insurance and investment products. The company's strategy focuses on creating a digitally-led bank by investing in technology and innovation to enhance customer experience. In 2021, ABSA was named as the most innovative bank in Africa at the Global Finance Innovators' Awards for its digital transformation initiatives.

The company's focus on innovation and digital transformation highlights its commitment to staying ahead of the curve in the evolving African financial services space. The group's mission is to be an African financial services company that is constantly growing, improving, and evolving to meet the needs of its customers. ABSA Group Limited employs over 40,000 people and is committed to making a positive impact in the communities it serves through various social and economic development initiatives.

Founded: 1916

Headquarter: Johannesburg

Website: https://www.absa.co.za/personal/

ABSA bank - Photo by Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Standard_Bank,_Praca_25_de_Junho,_Maputo.jpg) -

Nedbank is the fourth-largest bank established in 1888 in South Africa with assets valued at R1.2 trillion. Nedbank Group has over 900 branches in South Africa, making it one of the largest banks in the country. It also has a presence in Namibia, Swaziland, Lesotho, Malawi, and Zimbabwe. With its headquarters in Johannesburg, the bank is known for its customer-centric approach and innovative banking products.

Nedbank strives to create value for its customers by offering innovative products and services including retail, corporate and commercial, personal, business banking, asset management, investment banking, forex, loans, savings and wealth management that are tailored to meet their financial needs. One of the bank's unique offerings is its Green Savings Bonds. These bonds enable investors to finance environmental projects by providing clean and renewable energy to communities across South Africa. With a minimum investment of R1000, investors can earn an attractive interest rate while contributing to a cleaner and greener environment.

The bank's vision is to be Africa's most admired bank, trusted and loved by its clients, employees, shareholders, and communities it serves. Nedbank Group is committed to making a positive impact on the society it operates in. The bank supports several initiatives that focus on areas such as education, healthcare, and environmental sustainability. The Nedbank Foundation is the bank's corporate social investment arm that supports numerous education and community development projects.

Founded: 1988

Headquarter: Johannesburg

Website: https://personal.nedbank.co.za/home.html

Nedbank - Photo by Wikimedia commons (https://commons.wikimedia.org/wiki/File:Nedbank_regional_office_in_Cape_Town,_South_Africa.jpg) NedBank -

Investec is a specialist bank and asset management company, founded in South Africa in 1974 with total assets of over R1 trillion. The bank has a presence in South Africa, the United Kingdom, Europe, Australia, Asia, and the United States. The bank's philosophy is centred around offering value-adding products and services that cater to the unique needs of its clients and provide a range of solutions, such as wealth management and succession planning.

Investec Bank has a global footprint and operates in three main business areas: Investec Wealth & Investment, Investec Asset Management, and Investec Specialist Banking. One of the bank's unique offerings is its private banking service. Investec Private Bank provides a comprehensive service to high-net-worth individuals and their families. Investec Bank is renowned for its innovative approach to banking. In 2019, Investec became the first bank in South Africa to launch a purpose-driven investment program, aimed at investing in businesses that positively impact society and the environment. The program works by identifying businesses that have a clear environmental, social and governance strategy and investing in them to help them grow.

Investec Bank is committed to making a positive contribution to society. The bank supports several philanthropic initiatives, with a particular focus on education, entrepreneurship, and social development. The Investec Out of the Ordinary Foundation is the bank's corporate social responsibility arm and supports programs that create meaningful and sustainable impact.

Founded: 1974

Headquarters: London, UK, Sandton, South Africa

Website: https://www.investec.com/en_za.html

screenshot of https://www.investec.com/en_za.html (Link ảnh) Investec Bank -

Capitec Bank Holdings is a retail bank which operates exclusively in South Africa with total assets of over R100 billion. Capitec Bank has proliferated since its launch in 2001 and currently serves over 15 million clients. With its headquarters in Stellenbosch, Cape Town, Capitec Bank offers clients innovative and affordable banking solutions that are accessible through online banking and its network of over 830 branches throughout the country.

It offers financial and retail banking services, including savings accounts, loans, transactions, credit facilities and insurance services to individuals and businesses. Its core product is the Global One account, a transactional account that offers savings, credit, and funeral cover. Capitec Bank has been rated South Africa's best bank in the annual South African Customer Satisfaction Index (SACSI) for six consecutive years.

The bank has also been recognized internationally for its innovative banking solutions. Global Finance named Capitec Bank the world's best bank in 2020 and has been listed on the Johannesburg Stock Exchange (JSE) since 2002. The bank’s share price has been one of the top performers on the JSE in recent years, reflecting investor confidence in its business model, growth potential, and strong corporate governance.

Founded: 1974

Headquarters: Stellenbosch, Cape Town…

Website: https://www.capitecbank.co.za

Capitec Bank - photo by Flickr (https://www.flickr.com/photos/11155422@N00/6238840203/) Capitec Bank -

African Bank Holdings is a retail bank that operates exclusively in South Africa, with total assets of approximately R68 billion. African Bank was founded in 2014. Its headquarters are in Johannesburg, and it has a national footprint with over 500 branches nationwide. The bank has since been restructured and recapitalized, and in 2019.

African Bank Holdings Limited is a South African retail bank that provides various credit products: loans, savings accounts, investments, and insurance products to individuals and businesses and low-income customers. The bank has expanded its digital offerings recently, introducing a mobile banking app and online loan applications to improve its customer experience.

Despite the challenges it has faced, African Bank has shown resilience and a commitment to growing its client base and improving its financial performance. Its well-established presence in the South African retail banking sector makes it a key player in its financial system.

Founded: 2014

Headquarter: Johannesburg

Website: https://www.africanbank.co.za/en/home/

Screenshot of https://www.africanbank.co.za/en/home/ African Bank -

Rand Merchant Bank (RMB) is a corporate and investment bank with assets valued at R308 billion. Founded in 1977, RMB has since then evolved to become a leading investment bank which is known for its expertise in corporate finance, investment banking, and private equity. RMB operates in South Africa, Africa, and selects international markets.

Rand Merchant Bank (RMB) is a South African-based financial institution that has grown over the years to become a major player in the African financial industry that offers a full range of investment banking products and services including corporate and investment banking, wealth management, and asset management to corporate, institutional and government clients

The bank has a strong focus on innovation and has been at the forefront in the introduction of innovative financial products such as electronic trading platforms, online banking and transactional banking solutions for its clients.

In summary, RMB remains a leading financial institution in South Africa with a strong focus on innovation and sustainable practice. RMB has also established itself as a leader in sustainability and has been at the forefront of many initiatives in this area. The bank has initiatives to support climate change, infrastructure development, and poverty eradication which are aligned with the United Nations Sustainable Development Goals. RMB’s commitment to meeting the unique needs of its clients has earned it a reputation as one of the most reputable financial institutions in the region.

Founded: 1977

Headquarter: Johannesburg

Website: https://www.rmb.co.za

Screenshot of https://www.rmb.co.za Rand Merchant Bank -

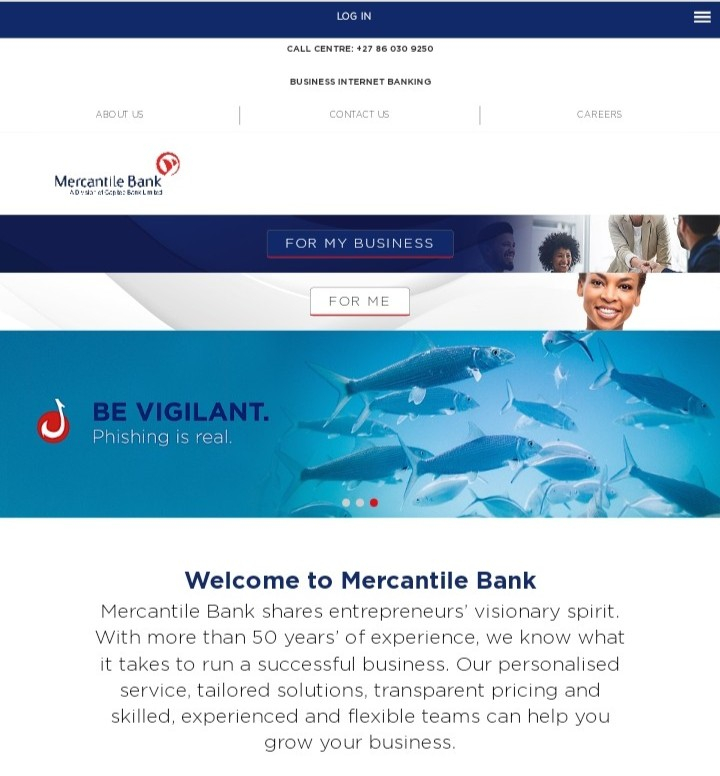

Mercantile Bank is a South African financial institution that has been providing banking and financial services for over 55 years. The bank was founded in 1965 and initially focused on providing banking services to the small business community. Over the years, the bank has expanded its range of products and services to cater to the needs of a broader client base. Mercantile Bank is owned by the Portuguese banking group Caixa Geral de Depósitos and operates across South Africa with its headquarters in Sandton.

Regarding its products and services, Mercantile Bank offers a range of banking products and services to individuals and businesses in South Africa. The bank provides traditional banking services such as current and savings accounts, card services, loans, and mortgage finance. It also offers more specialized products and services such as merchant services, treasury services, trade finance, and private banking. These products and services are tailored to meet the needs of different clients and help them achieve their financial goals.

Mercantile Bank has been recognized as a leading financial institution in South Africa, receiving numerous awards and accreditations over the years. The bank has been accredited as one of the top-rated banks for customer satisfaction by the South African Customer Satisfaction Index (SAcsi). It has also been recognized for its contribution to small businesses, receiving the Best Business Bank award from the Global Banking and Finance Review in 2020. Additionally, Mercantile Bank is committed to sustainable banking practices and has received certification from the South African Department of Environmental Affairs for its environmental management program.

Founded: 1965

Headquarters: Sandton

Website: https://www.mercantile.co.za

Screenshot of https://www.mercantile.co.za Mercantile bank -

Grindrod Bank is a specialist bank with assets valued at R12 billion. The bank is known for its marine finance and freight solutions, catering to the shipping and logistics industries. Grindrod Bank is one of the leading banks in South Africa. Established in 1997, the bank started off as a small financial services provider and has now grown into a well-respected banking institution. It is also a member of the Grindrod Limited Group with its headquarters located in Durban, South Africa.

Grindrod Bank's investment banking division offers services such as debt capital markets, equity capital markets, mergers and acquisitions, and project finance. The division is known for its innovative transactions and its ability to provide tailored solutions to clients. On the other hand, the corporate finance department offers advisory services to businesses operating in different sectors, ranging from infrastructure to natural resources.

The bank's primary focus is on the corporate and investment banking sectors. Although the banking industry in South Africa is highly competitive, with a number of large and small players, Grindrod Bank has established itself as one of the most trusted financial institutions in South Africa. It's product offerings and partnerships demonstrate the bank's commitment to innovation and continuous improvement. Grindrod Bank's growth trajectory is a testament to its dedication to providing quality banking services to its customers.

Founded: 1977

Headquarters: Durban, South Africa

Website: https://www.grindrodbank.co.za

Screenshot of https://www.grindrodbank.co.za (Link ảnh) Grindrod Bank -

Discovery Bank is a digital bank with assets valued at R3.6 billion. Founded in 2018 with its headquarter in Sandton, Discovery Bank is a subsidiary of Discovery Limited, a well-known South African life insurance and healthcare company. Discovery Bank offers personalized banking solutions, rewards for healthy living, and innovative financial products.

Discovery Bank is a South African financial institution that has quickly established itself as a disruptor in the competitive banking industry in the country. What sets Discovery Bank apart from other traditional banks is its strong focus on technology and innovative solutions to help customers manage their finances more effectively. The bank operates entirely online, and customers can access all of their accounts, products, and services through their mobile devices. Discovery Bank also offers customers a rewards program, which incentivizes responsible financial behaviour, such as saving money and maintaining healthy lifestyles. This unique approach to banking has attracted a large number of customers since its launch, with over 300,000 clients now registered with the bank.

Additionally, Discovery Bank has received numerous awards for its customer-centric approach and innovative solutions, including being named Best Digital Bank in South Africa for 2021 by the Global Finance Magazine. Overall, Discovery Bank has cemented itself as a leading player in the financial services industry in South Africa, thanks to its cutting-edge technology and customer-focused approach.

Founded: 1977

Headquarter: Durban, South Africa

Website: https://online.discovery.bank/login

Discovey Bank - Photo by Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Discovery_Limited_Head_Office.jpg) Discovery Bank