Top 10 Things You Should Know about the Stock Market

In January 2021, 6.6 million shares of stock were traded on Wall Street on average per day, according to CNBC. The value of the US stock market as a whole is ... read more...projected to be around $36 trillion as of September 2020. Consequently, it's worthwhile getting to know it a little bit better whether you think of it as an essential part of the free market or a casino run by sleazy addicts in suits. Who knows, you might even make some cash from it. Or, contrary to conventional opinion, you're more likely to lose money when you do it. Is that conventional wisdom accurate, though? Let's look at those and other intriguing Big Board elements.

-

One of the most upsetting events of its day was the passing of President Kennedy on November 22, 1963. People remembered their locations and activities at the time for decades afterward. Wall Street shut down the market as the rest of the country fell into grief and uncertainty, joining Wall Street in disbelief.

It did, at least, for two days. That is how long it took the market to make up all of the losses incurred as a result of the assassination. It barely took a month for the market to recover after the 9/11 attacks, which stunned the country more than Kennedy's passing. In short, supply chain disruptions and other types of disasters that have a more tangible impact on the economy have less of an influence on the market than tragedies that primarily have a psychological effect.

The conclusion that can be drawn from all of these entries is that you should have some liquid assets on ready in case a huge tragedy occurs that you can ghoulishly take advantage of. You don't need a hedge fund manager, and algorithms are probably too simple to adequately take advantage of it. But don't count on being able to deduct it from your taxes if the scheme backfires and you sell quickly. Cheers to trading!

https://www.myarg.com/

http://america.aljazeera.com -

We can now move on to the topic of which trader got lucky the most because we know that neither typical traders nor hedge fund managers are really that trustworthy. Who would you assume that is without checking? Warren Buffet, who was mentioned earlier? Gates, Bill Bezos Jeff? No, it's not a well-known person. David Tepper, who earned $7 billion in 2009, is the one.

It is Tepper's methodology that elevates the narrative from being interesting trivia to being practical. In 2008, when the real estate bubble burst and overdrawn banks appeared to be on the point of failing, he made a profitable investment in banking stocks. Because the banks were infamously bailed out, Tepper's investment had the fastest and one of the highest returns of any investment ever. It just goes to show that when it comes to the market, sometimes the hardest-against-the-flow play pays off the best.

https://stg.sustainablejapan.jp

https://www.wikifolio.com -

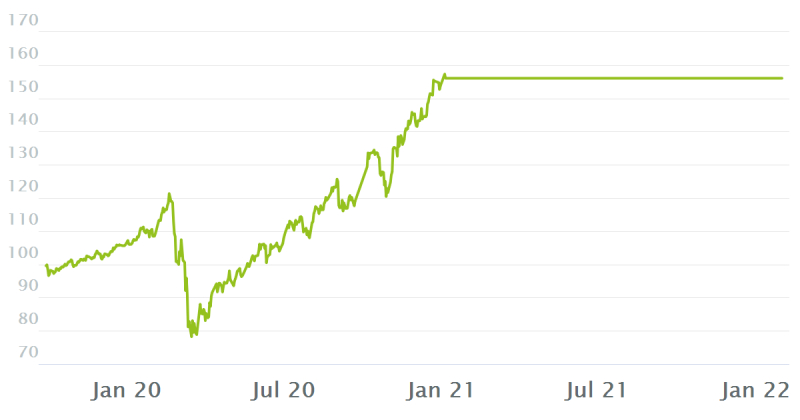

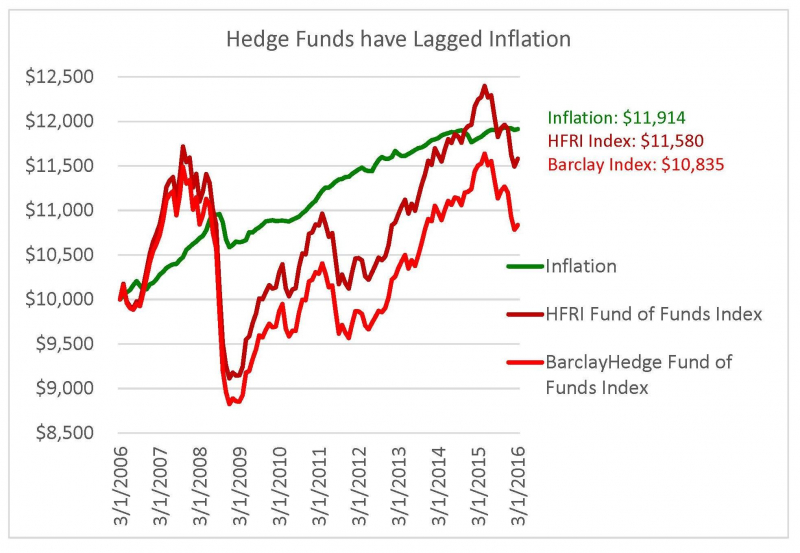

But as it turns out, neither are even the so-called "experts," despite what they'd like us to believe. Hedge funds were down 3% for 2020 even before the virus hit America and destroyed the market. The most well-known index, the S&P 500, was down a staggering 8.27%. According to the Wall Street Journal, that was only a small portion of a decade-long pattern in which hedge funds underperformed the wider market.

Famous investment mogul Warren Buffet earned bragging rights when he asserted that money left in the market passively will do better overall than money handed to hedge fund managers, which was cruelly adding salt to the wound given the fees that fund managers demand. Not that all of this has stopped the $3 trillion hedge fund sector from expanding.

https://www.pionline.com/

https://seekingalpha.com/ -

It's a well-known misconception that most people who invest directly in the stock market lose money. It's not just true, which is unfortunate for most people, but it's possibly disastrously true. According to CNBC's research from November 2020, between 85 and 90 percent of individual investors lose money in the market after 300 days. Given that the typical investment for middle-class and lower-class households is $15,000, this can result in considerable losses for those families.

We have something for those who could blame the current economic climate or the jittery, if not flightiness, of this young generation. According to financial experts, amateur direct stock traders have underperformed the market for 25 years in a row as of 2020. Therefore, even though it wasn't helpful enough for the average trader, it's unquestionably not the internet's fault.

https://www.siasat.com

https://pinekun.com/ -

As was indicated in item #10, the duration of stock ownership has decreased as a result of the internet and artificial intelligence. Therefore, it is usual for shareholders to receive a news report that sharply increases or decreases the value of relatively recently purchased shares and then decide to sell in order to profit or avoid losing money. When a sale is started without allowing enough time for the initial purchase to be fully processed, it is referred to as a "wash sale."

Shareholders who pay taxes ought to be particularly aware of one aspect of wash sales. In most cases, a shareholder's sale of shares at a loss reduces net income, which lowers the amount of taxes owed. With wash sales at a loss, that is not the case. Brokerages won't remove the sum from your yearly earnings. However, wash sale gains will still be subject to tax.

https://www.cp-advisors.com

https://www.youtube.com/ -

The idea that the market is a haven for the wealthy is not supported by what we've just learned about the obstacles that novice investors may encounter when they try to invest. 53% of all American families had investments in the stock market as of 2019. It was just a modest 32% thirty years ago, with a large portion of the difference undoubtedly attributable to the ease of stock trading on the internet.

Even if it's also true that the wealthiest 10% of families own 70% of the stock, many people in the middle classes still have sizable holdings. For instance, the median household savings in stocks is roughly $40,000 (i.e., the most typical amount, not the potentially very deceptive average). About a fifth of Americans, even those in the bottom 25%, have stock market investments.

The 53% of households that own shares have a strong but not overwhelmingly Caucasian bias. About 61% of homes have them, compared to 34% of African American households and 24% of Hispanic households. In a similar vein, 43% of the shares are owned by shareholders 65 and older. But across demographics, just a small portion of people directly purchase shares at a brokerage. 15% is about right. Retirement accounts are used for the remaining amounts.

https://www.forbes.com/

https://olymptradeforum.com/ -

We've seen evidence in the previous two posts that the market is biased against middle- and lower-class investors (sometimes known as "retail investors"). Whether it's preferable to a sizable portion of the stock trading market that the majority of people don't even have access to is up for debate. According to DR Barton Jr.'s research from May 2020, 53 private equity firms trade stock without allowing the general public access, frequently in unmarked structures situated in suburban districts.

These private exchanges are hosting transactions that are neither infrequent nor trivial. According to reports, 42% of all stock trading take place through these companies. The sums represent exchange accounts worth hundreds of billions from 110 firms. Since 2005, it has operated in a completely legal manner, while receiving a dubious amount of public attention or responsibility.

https://www.youtube.com

https://open.spotify.com -

Here is a summary for those who may have heard of the GameStop price manipulation but never gave it any thought: Due to the replacement of analog video game sales by internet sales, hedge funds (i.e., significant money from affluent contributors) purchased shares in inexpensive stocks from firms in industries that were usually considered to be on the decline, such as the shop chain GameStop.

On January 22, 2021, the online group /r/wallstreetbets started strategically buying large amounts of shares, frequently incurring significant debt to do so (a practice known as buying "on margin"). As a result, the value of GameStop increased rapidly. GameStop and similar businesses experienced price increases of up to dozens of times their original worth, forcing funds that had made significant investments in them to lose an estimated $40 billion in just the first week. In June 2021, GameStop's valuation was still over $200 per share, which is over sixty times larger than it was prior to the inflation caused by /r/wallstreetbets.

As a result, several lessons were discovered. For starters, organized middle class and lower class individuals showed that they could have an impact on the market in spite of the enormous wealth divide in America. For another, the fact that several significant online brokers, including RobinHood and E-Trade, halted all purchases of shares of GameStop and other companies and that /r/wallstreetbets did the same, demonstrated the blatant lengths to which the market was prepared to go in an effort to lower prices for the benefit of its participants. Finally, it's important to note that the mass-buy by /r/wallstreetbets also surprised hedge funds that depended on algorithmic trading, which supports a claim stated in a previous entry on this list.

https://strefainwestorow.pl/

https://www.youtube.com -

People have occasionally come upon forgotten pieces of paper that were bought by departed relatives granting them ownership in businesses that developed into behemoths, potentially making the shares worth fortunes. Anyone who discovers such a document should get in touch with a stockbroker and a transfer agent to check whether there are any records of the firm being renamed, bought out, amalgamated, or anything else that would indicate it is highly valuable. Micheline Masse, the founder of Stock Search International, discovered $3 million in value in outdated certificates in 1989. In 1979, one of the most expensive certificates ever discovered was discovered to be worth $4 million.

Unfortunately, there is no assurance that anything will be valid for an ancient certificate for a surviving gigantic corporation that has been thoroughly notarized and officialized. Consider the incident from 2008, when Tony Mahron bought an old portion in Palmer Union Oil Company, which led to the Coca-Cola Company acquiring it. Although the stake would initially be valued at $130 million, judges ultimately sided with Coca-Cola and determined that the claim was without merit. This proves that if a firm would prefer to battle your claim in court than pay it off, be prepared for them to do so.

https://www.etsy.com/

https://www.pinterest.com -

It goes without saying that those days are long gone when trading was largely controlled by people screaming into phones, but it turns out that human involvement in trading has been declining for at least ten years in favor of automated computer deals. Mother Jones noted in 2013 that more than 50% of all stock trades had already been automated, with some trades being completed just seconds after the initial purchase. It reduced the typical duration of holding shares from eight years in the 1960s to less than five days.

While it is obvious that human mistake has had terrible effects on the stock market, as evidenced by the Crash of 1929 and Black Monday in 1987, algorithmic trading has plenty of reasons to worry. For instance, in May 2010 computerized transactions caused the market to lose $860 billion. And it just took 30 minutes. Additionally, it has permeated deeper facets of the global economy, as evidenced by the British pound's sudden 6% decline in value in October 2016. In other words, it has the capacity to drastically alter the economic landscape in the space of a work break. However, there are some websites online that may instruct you on how to acquire artificial intelligence systems to manage your portfolio for you if you believe you could make it work for you.

https://randerson112358.medium.com

http://binaryoptionsprofitcalculator.logdown.com/