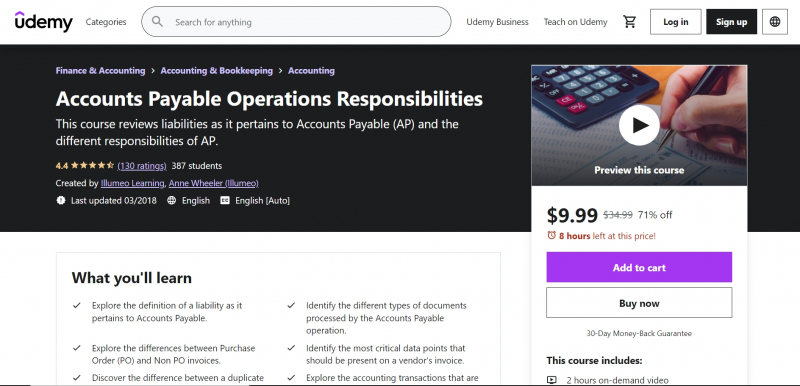

Accounts Payable Operations Responsibilities

Accounts Payable Operations Responsibilities examines the definition of liabilities in the context of Accounts Payable before delving into the various roles of various Accounts Payable operations. Learners learn about the various types of documents that an Accounts Payable operation might handle, such as invoices, credit memos, modifications to accrued Purchase Order (PO) Receipts, reviews of aged accounts payable and outstanding checks, identification of funds to be accrued, and so on.

Learners distinguish between processing a Purchase Order invoice and an invoice that does not include a PO reference. Learners look at some of the issues that Accounts Payable may encounter with each classification.

Accounts Payable Operations Responsibilities analyzes the most important components of the vendor's invoice and find solutions to the missing data problem. Learners look at the dangers of processing the same invoice many times and what can be done to reduce them. Learners distinguish between a duplicate invoice and a duplicate billing as well. The accounting transactions resulting from the posting of an invoice, by kind, and the posting of a credit memo are discussed. Batch processing will be addressed as well.

Finally, Learners outline the Accounts Payable department's responsibilities for monitoring typical business standards such as Payment Terms, Payment Methods, and Sales and Use Tax, to mention a few.

Who this course is for:

- Anyone interested in accounting, finance, or related fields.

This course requirement:

- No advanced preparation or prerequisites are needed for this course.

Udemy Rating: 4.5/5

Enroll here: https://www.udemy.com/course/accounts-payable-operations-responsibilities/