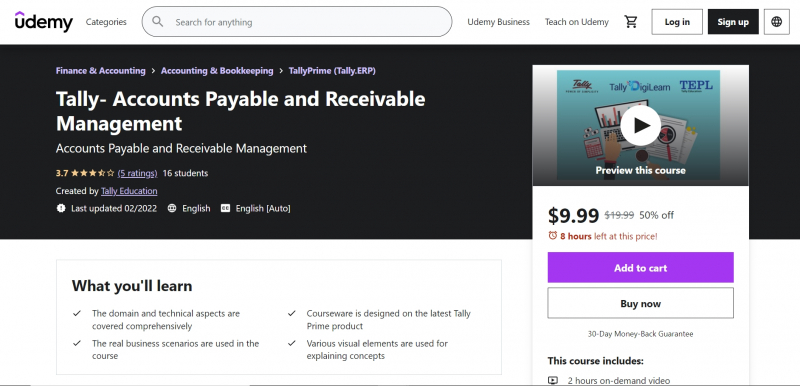

Top 8 Online Courses to Learn Accounts Payable and Receivable

Are you wondering which remote classroom to attend? You have spare time and want to broaden your horizon about a specific field of study whilst just staying at ... read more...home. Thus, to satisfy the burgeoning demand for online yet qualifying courses, Toplist has complied a rundown of the Online Courses to Learn Accounts Payable and Receivable offered by the prestigious universities, famous companies, top organizations across the globe for who in need!!!

-

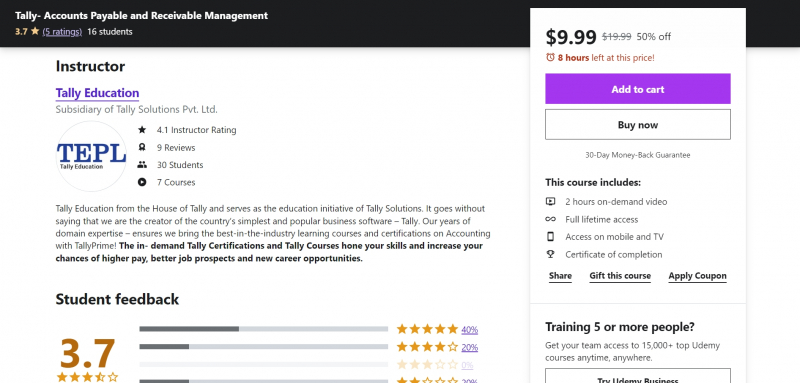

The specialization course on Accounts Payable and Receivable management covers step-by-step instructions from the fundamentals of credit management to managing outstanding management using real-world business scenarios – it includes defining credit limits, using bill-wise entry in Purchase and Payment Voucher, Sales and Receipts, Sales Returns, Purchase Returns, defining credit limits, generating reminder letters, generating confirmation of accounts, payment performance of debttors, and ageing analysis of outstanding accounts.

Numerous real-life business scenarios, charts, images, observations, solved illustrations, and practice scenarios on TallyPrime are included in the course. It is designed in a hybrid format that allows you to learn at your own pace while receiving assistance from experts. You gain an advantage in the job market by becoming certified in Accounts Payable and Receivable Management.Who this course is for:

- Working Professionals

- Freshers

This course requirement:

- No specific requirements to take this course

Udemy Rating: 3.7/5

Enroll here: https://www.udemy.com/course/tally-accounts-payable-and-receivable-management/

https://www.udemy.com

https://www.udemy.com -

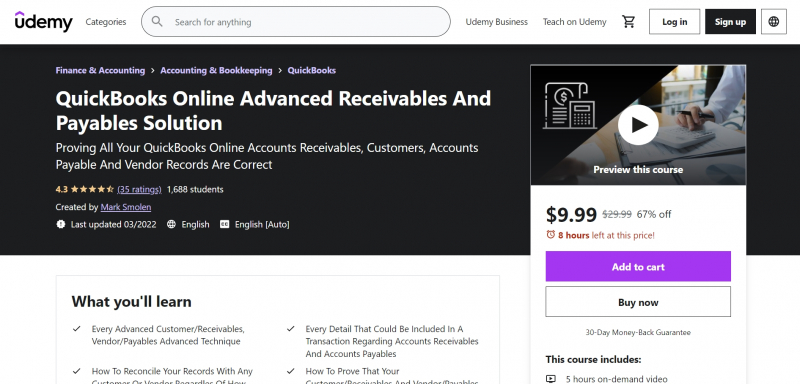

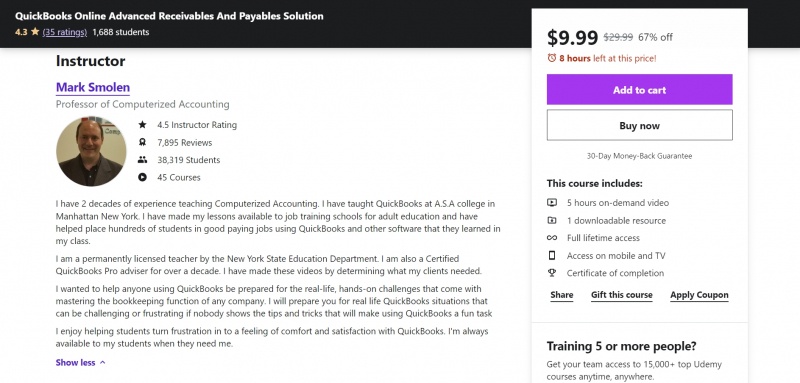

Advanced Receivable And Payable Transactions in QuickBooks Online is one of the Online Courses to Learn Accounts Payable and Receivable. Ensure that all of your customer and vendor records are complete and accurate.

You will be schooled and prepared for any of the following positions in this Advanced Bookkeeping, content-rich course: Accounts Receivable/Customers, Accounts Payable/Vendors, Clerk, Bookkeeper. You'll be able to handle any problem that arises when it comes to keeping financial records for those areas for any organization that need your assistance.There are clear, step-by-step instructions for reconciling with customers and vendors, so you can verify to anybody, anywhere, that your receivables and payables records are complete and accurate. The films show how to solve the most difficult "on the job," real-life problems that can arise while using these reconciliation approaches.

This is the Accounts Receivables/Payables component of the whole advanced quickbooks online video training course, which is also available on this website. Its main goal is to equip you with everything you'll need to manage a major company's customer and vendor financial records.Who this course is for:

- Anyone who would like to be an "Account's Receivable" Manager Or Accounts Payable Bookkeeper or Clerk

- Anyone who needs to prove Accounts Receivable Or Accounts Payable Records match the monthly Statements Of Customers And Vendors

- Anyone Who Would Like To Know How To Reconcile With Customers And Vendors To Prove Bookkeeping Accuracy

- Anyone Who Would Like To Improve Their QuickBooks Online Skills To An Expert Level

This course requirement:

- You must have some basic experience entering customer and vendor transactions in to QuickBooks Online

Udemy Rating: 4.3/5

Enroll here: https://www.udemy.com/course/quickbooks-online-advanced-receivables-and-payables-solution/

https://www.udemy.com/

https://www.udemy.com/ -

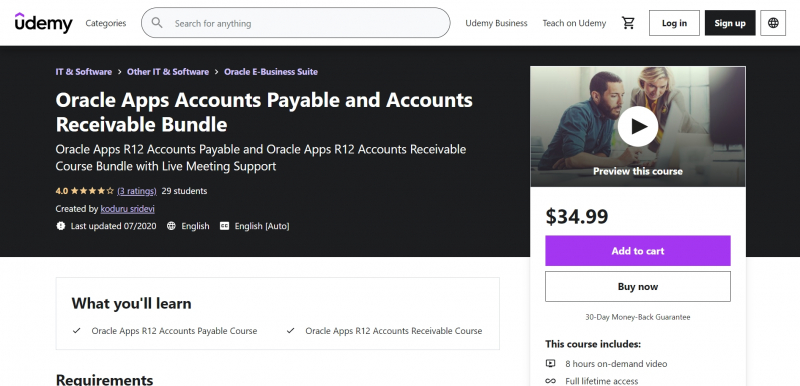

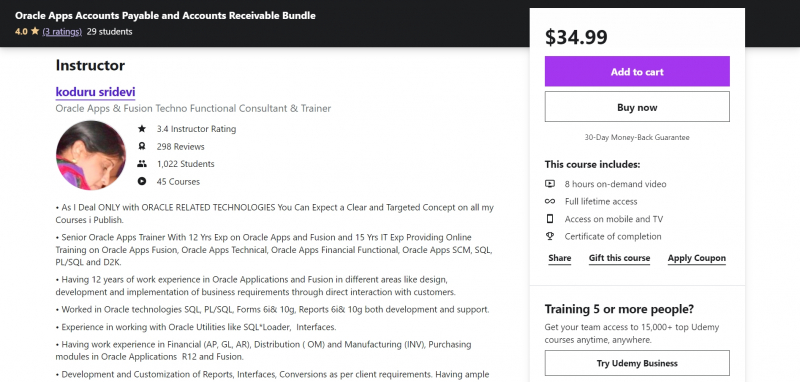

Oracle Apps R12 Accounts Payable & Accounts Receivable Course Bundle comprises Oracle Apps R12 Accounts Payable Course and Oracle Apps R12 Accounts Receivable Bundle with Live Meeting Support on every Sunday to answer your questions. Every Friday, you will receive the meeting link for the support session via Udemy educational announcement mails to your Udemy registered email id.

You'll learn how to set up and use Oracle Payables to handle your accounts payable process in this course. They learn how to create and maintain suppliers and supplier bank accounts, how to process individual and recurring invoices, how to match invoices to purchase orders or receipts, how to use numerous distribution methods, and how to process various sorts of payments.

Who this course is for:

- Any Professional with Basic Knowledge on Accounts

This course requirement:

- Basic Knowledge of Accounts

Udemy Rating: 4.0/5

Enroll here: https://www.udemy.com/course/oracle-apps-r12-accounts-payable-accounts-receivable/

https://www.udemy.com/

https://www.udemy.com/ -

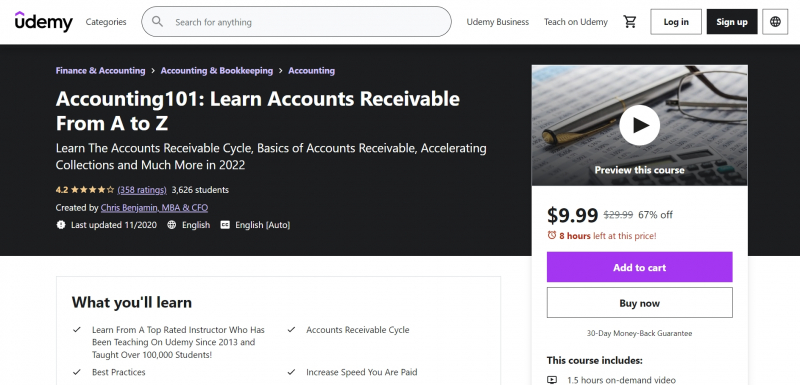

Accounts Receivable is where all of your sales are converted into real money and cash in your firm. As a result, it is a critical component of any business, and a thorough understanding of the accounts receivable function is essential. Increase your accounts receivable turnover, recover payments faster, and use industry best practices.

Learners will cover the fundamentals of accounts receivable, the accounts receivable cycle, best practices, fraud protection, collection tactics, and much more in this course! What We Do In The Course:- Learn the accounts receivable cycle

- Learn best practices for accounts receivable

- Learn how to prevent fraud in your accounts receivable department

- Learn multiple methods to increase your turnover and speed up collections

- And much more!

Who this course is for:

- Anyone interested in implementing accounts receivable best practices

- Accounting managers

- Accounts receivable specialists

- CFO's

- Small business owners

- Entrepreneurs

This course requirement:

- No special tools or knowledge is required!

- Commitment to learning

Udemy Rating: 4.2/5

Enroll here: https://www.udemy.com/course/learn-accounts-receivable-basics-and-best-practices/

https://www.udemy.com/

https://www.udemy.com/ -

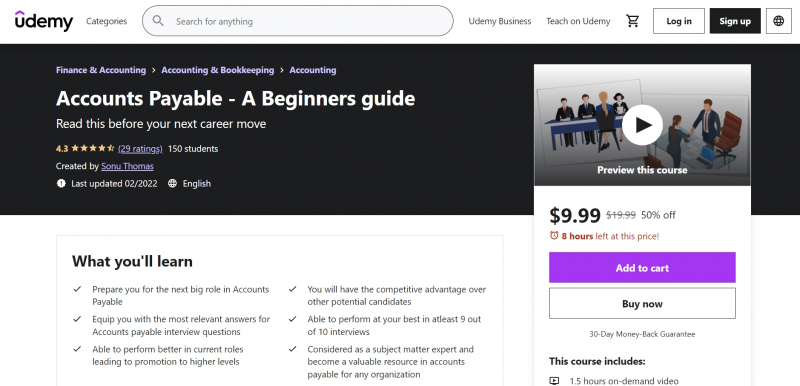

This course includes pertinent Interview questions and answers covering nearly every facet of the Accounts Payable process. Process overview, vendor management, procurement, invoice processing, documentation, payment accounting, controls, fraud controls, payment modes, month close, performance, and finance are all covered. Head reviews, for example.

Accounts Payable - A Beginners guide's main feature is scenario-based questions. I am convinced that you will be able to relate to these topics in your next interview, and that you will be able to manage them expertly in real-life situations.It contains questions that are appropriate for all phases of your profession - beginning, mid-level, and senior. This course is written in simple layman terms, so even those with little prior experience can grasp the fundamental principles and perform admirably in interviews.

Who this course is for:

- Anyone who wants to improve their knowledge in accounts payable process - Be it freshers, mid level or senior level professionals

- Anyone who is eager to move to the next level in the Accounts Payable process

- Anyone who is preparing for a Accounts Payable job interview

This course requirement:

- No prior finance knowledge is required to understand this course.

- It is in simple layman language and anyone can make use of this course

Udemy Rating: 4.3/5

Enroll here: https://www.udemy.com/course/accounts-payable-simplified-interview-questions-answers/

https://www.udemy.com

https://www.udemy.com -

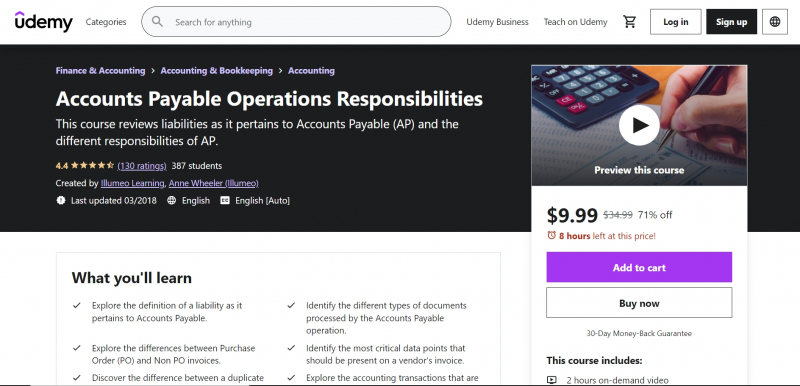

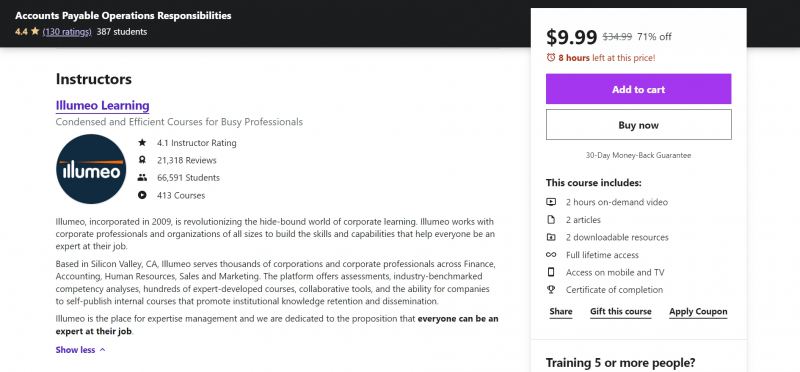

Accounts Payable Operations Responsibilities examines the definition of liabilities in the context of Accounts Payable before delving into the various roles of various Accounts Payable operations. Learners learn about the various types of documents that an Accounts Payable operation might handle, such as invoices, credit memos, modifications to accrued Purchase Order (PO) Receipts, reviews of aged accounts payable and outstanding checks, identification of funds to be accrued, and so on.

Learners distinguish between processing a Purchase Order invoice and an invoice that does not include a PO reference. Learners look at some of the issues that Accounts Payable may encounter with each classification.

Accounts Payable Operations Responsibilities analyzes the most important components of the vendor's invoice and find solutions to the missing data problem. Learners look at the dangers of processing the same invoice many times and what can be done to reduce them. Learners distinguish between a duplicate invoice and a duplicate billing as well. The accounting transactions resulting from the posting of an invoice, by kind, and the posting of a credit memo are discussed. Batch processing will be addressed as well.

Finally, Learners outline the Accounts Payable department's responsibilities for monitoring typical business standards such as Payment Terms, Payment Methods, and Sales and Use Tax, to mention a few.Who this course is for:

- Anyone interested in accounting, finance, or related fields.

This course requirement:

- No advanced preparation or prerequisites are needed for this course.

Udemy Rating: 4.5/5

Enroll here: https://www.udemy.com/course/accounts-payable-operations-responsibilities/

https://www.udemy.com

https://www.udemy.com -

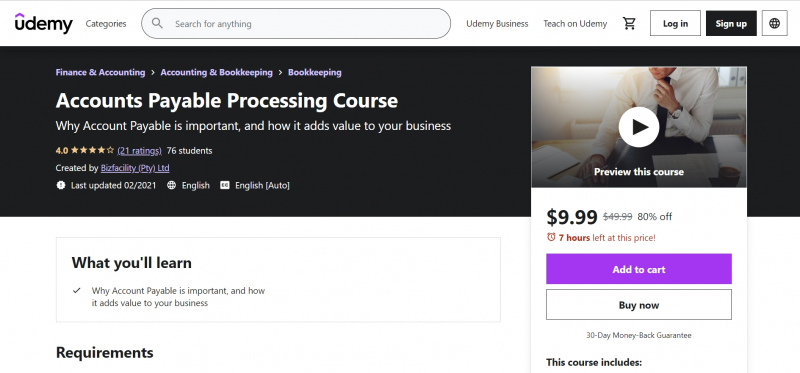

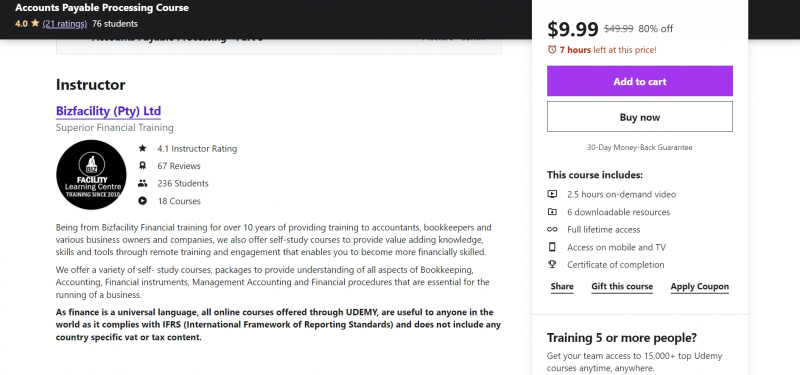

Do you need help allocating and managing business expenses? Why is it so important to add value for a smooth business workflow? How may Management Reports be streamlined ?Accounts payable and management is a vital business procedure for properly managing an entity's payable responsibilities.

The accounts payable process or function is critical since it handles nearly all of a company's non-payroll payments, regardless of size. The goal of accounts payable is to pay only legitimate and accurate invoices and business expenses.

It also enables businesses to better manage their financial flows, such as making payments only when they are due, utilizing vendor credit, and so on. In order to reduce the risk of fraud, error, and loss, a bookkeeping and accounting system also need excellent accounts payable internal controls. Internal controls for accounts payable ensure that valid supplier and vendor invoices are accurately documented and paid by the company on time.Who this course is for:

- Creditors Clerks, Data Capturers, Finance students

This course requirement:

- No previous knowledge on the subject required. Available to anyone wanting to learn.

Udemy Rating: 4.0/5

Enroll here:https://www.udemy.com/course/accounts-payable-processing-course/

https://www.udemy.com

https://www.udemy.com -

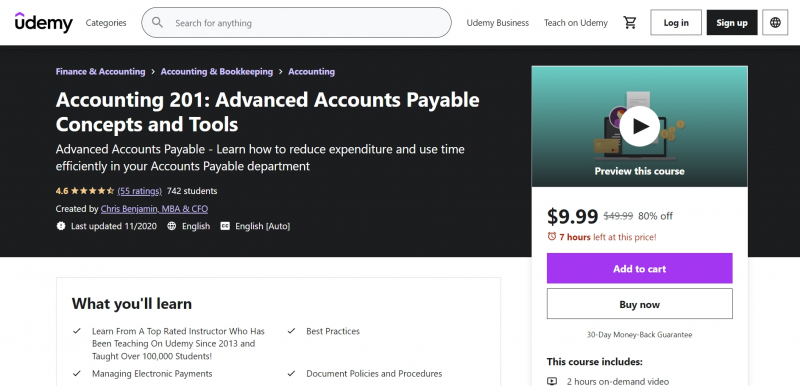

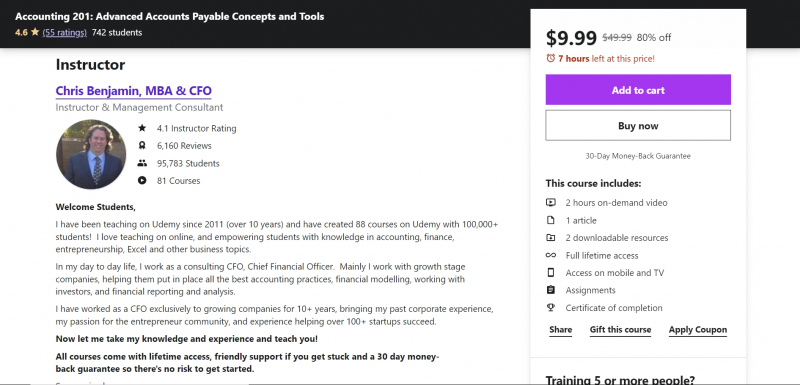

Accounts Payable is a hectic element of every organization, and it will only get busier as your company expands. There are a number of best practices that, when implemented, can help you save time and money. Run your accounts payable department intelligently, and you'll have the tools and knowledge to do so following this training.

Learners will master sophisticated accounts payable techniques step by step in this course. Learners will start with best practices and go on to electronic payments, policies and procedures, cash management, and much more. Then learners move on to more in-depth topics including fraud protection, payment strategy, internal controls, and more. Three case studies, accounts payable dos and don'ts, and a 10-point summary checklist are also included.

Who this course is for:

- Anyone wanting to learn how to save money and time in their business

- CFOs

- Accountants

- Accounts Payable Specialists

- Finance professionals

This course requirement:

- General knowledge of accounts payable

- No special tools or software are required

- Commitment to learning

Udemy Rating: 4.6/5

Enroll here: https://www.udemy.com/course/learn-advanced-accounts-payable-save-money-and-time/

https://www.udemy.com/

https://www.udemy.com/ - Anyone wanting to learn how to save money and time in their business