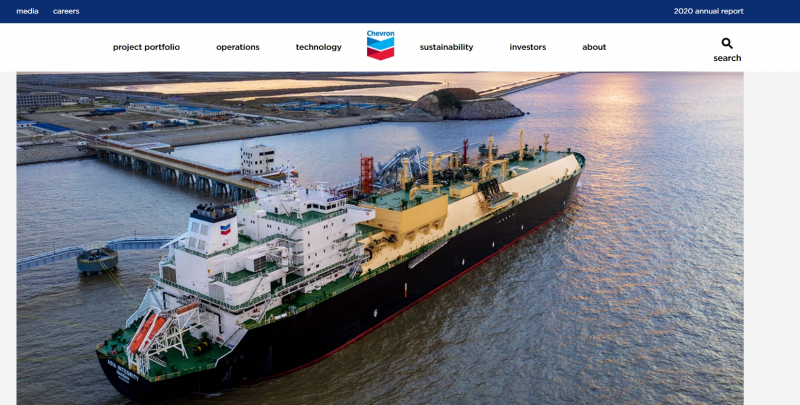

Chevron-Caltex

A key moment for Chevron in 2020 was the October acquisition of US shale oil and gas producer Noble Energy. Due to high production costs, the US shale sector felt the impact of lower oil prices more severely than other sectors. As Noble's margins shrink and debt rises, Chevron seizes the opportunity to purchase its reserves in a $4.2 billion deal.

Meanwhile, Chevron needed to think about finances. The loss peaked in the second quarter of 2020 when the company reported a net loss of $8.3 billion. During the year, the company suffered no significant changes in net production but suffered a net loss of $5.5 billion.

Chevron increased its dividend by 8% when several large companies stopped or cut payments to shareholders in 2020. Although the company's profits have recovered in 2021, they have not yet returned to pre-pandemic levels. The company also converted existing refineries to increase biofuel production. The company also joined the Hydrogen Council, which later acquired a joint venture for hydrogen production and announced plans to expand its own hydrogen production. A collaboration with Algonquin Renewable Energy has also begun the construction of 500 MW renewable generation by Chevron.

Caltex is the Chevron Corporation petroleum brand used in 29 countries in the Asia Pacific, Middle East and South Africa. In 1936 Chevron and Texaco formed the Caltex Group, operating in Africa, the Middle East, Asia, Australia and New Zealand.

Founded: September 10, 1879

Headquarters: San Ramon, California, U.S.

Market cap: $222.26 Billion As of December 2021

Revenue: $94bn in 2020

Website: chevron.com, Caltex: https://www.caltex.com/