Top 6 Largest Oil And Gas Companies in the Australia

The value of Australia's oil and gas industry has grown steadily over the past decade, reaching A$31.4 billion in 2018. Numerous investors see this land as a ... read more...new chance to improve their assets, thus resulting in a significant rise in the number of petroleum companies. Yet, just some are among the largest and here are they.

-

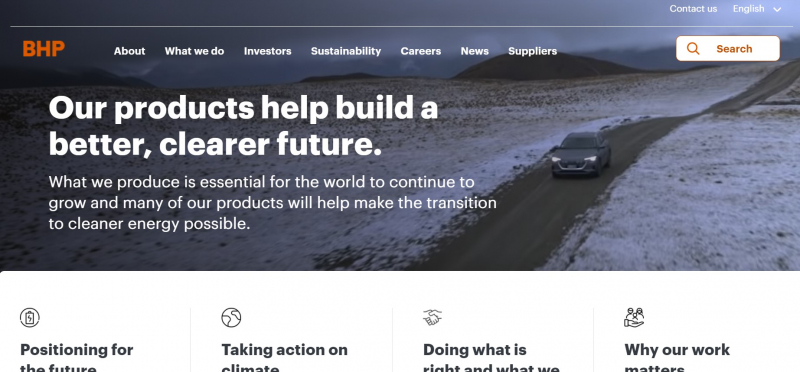

BHP Billiton is an Anglo-Australian multinational mining and oil company headquartered in Melbourne and Australia. It is the largest mining company in the world by revenue in 2011. As of February 2011, BHP Billiton was also the third-largest company in the world by market capitalization.

BHP Billiton was formed in 2001 via the merger of Australian Broken Hill Proprietary Company Limited (BHP) and Anglo-Dutch Billiton plc. Australia-registered Limited is listed on the Australian Stock Exchange and is one of the largest Australian companies by market capitalization. The English registered Plc sector is listed on the London Stock Exchange and is listed on the FTSE 100.

Founded: 2001

Headquarters: Melbourne, Australia

Market cap: $145.87 Billion as of 2021

Revenue in 2020: $42.93 B

Website: www.bhp.com

BHP Billiton,https://www.bhp.com/

BHP Billiton,https://archinect.imgix.net/ -

Woodside was founded on July 26, 1954. It was originally called Woodside (Lakes Entrance) Oil Co NL and was named after the small town of Woodside, Victoria. Woodside Petroleum Ltd is an Australian oil exploration and production company.

Woodside is an Australian oil and gas exploration operator and Australia's largest independent oil and gas company. A publicly traded company listed on the Australian Stock Exchange, headquartered in Perth, Western Australia. In the 2020 Forbes Global 2000 evaluation, Woodside Petroleum was ranked 1328 among the world's largest public companies. As of August 2021, Woodside entered into an agreement with BHP to merge the latter's oil and gas assets with Woodside.

Founded: 26 July 1954

Headquarters: Perth, Western Australia

Market cap:$15.34 Billion as of 2021

Revenue in 2019: $5.21 B

Website: http://www.woodside.com.au/

Woodside Petroleum,http://www.woodside.com.au/

Woodside Petroleum,https://en.wikipedia.org/ -

Santos Ltd (South Australia Northern Territory Oil Search) is an Australian energy company and among Australia's largest independent oil and gas producer. In the 2020 Forbes Global 2000 ranking, Santos is ranked 1,583 among the world's largest public companies.

Santos is one of Australia's regional gas producers, supplying commercial gas to all states and territories on mainland Australia, ethane to Sydney and petroleum and liquid hydrocarbons to domestic and international customers. The company's main business was based primarily on oil and gas fields in the Cooper Basin, serving northeast South Australia and southwest Queensland. This gas reserve is one of the natural gas sources in eastern Australia. Santos is a major venture partner and operator of natural gas processing facilities in Moomba (South Australia) and Baller (Queensland), and pipelines connecting these facilities to Adelaide, Sydney,..

Founded: 18 March 1954

Headquarters: 60 Flinders Street

Adelaide, South Australia

Market cap: $9.83 Billion as of 2021

Revenue in 2018: US$3.660 billion

Website: http://santos.com/

Santos Ltd.,http://santos.com/

Santos Ltd.,https://th.bing.com/ -

Origin Energy is an Australian - registered public energy company headquartered in Sydney. It is a company listed on the Australian Stock Exchange. Origin Energy was established on February 18, 2000, as a spin-off of Australian conglomerate Boral Limited, establishing the energy business as a new company separate from the building materials business.

SAGASCO became part of Origin Energy as part of the spin-off. Between 2001 and 2002 Origin acquired Victorian electricity seller licenses from Powercor and CitiPower distributors. In 2004, the SEAGas pipeline linking Victoria and South Australia's gas markets was completed. During this period, Origin acquired a 50% stake in New Zealand Contact Energy's Kupe gas field and a 51.4% stake in Edison Mission Energy.

Founded: February 2000

Headquarters: Barangaroo

Sydney, New South Wales, Australia

Market cap: 6.164B as of 2021

Revenue in 2019: A$14,727 million

Website: https://www.originenergy.com.au/

Origin Energy, https://www.originenergy.com.au/

Origin Energy,https://upload.wikimedia.org/ -

A key moment for Chevron in 2020 was the October acquisition of US shale oil and gas producer Noble Energy. Due to high production costs, the US shale sector felt the impact of lower oil prices more severely than other sectors. As Noble's margins shrink and debt rises, Chevron seizes the opportunity to purchase its reserves in a $4.2 billion deal.

Meanwhile, Chevron needed to think about finances. The loss peaked in the second quarter of 2020 when the company reported a net loss of $8.3 billion. During the year, the company suffered no significant changes in net production but suffered a net loss of $5.5 billion.

Chevron increased its dividend by 8% when several large companies stopped or cut payments to shareholders in 2020. Although the company's profits have recovered in 2021, they have not yet returned to pre-pandemic levels. The company also converted existing refineries to increase biofuel production. The company also joined the Hydrogen Council, which later acquired a joint venture for hydrogen production and announced plans to expand its own hydrogen production. A collaboration with Algonquin Renewable Energy has also begun the construction of 500 MW renewable generation by Chevron.

Caltex is the Chevron Corporation petroleum brand used in 29 countries in the Asia Pacific, Middle East and South Africa. In 1936 Chevron and Texaco formed the Caltex Group, operating in Africa, the Middle East, Asia, Australia and New Zealand.

Founded: September 10, 1879

Headquarters: San Ramon, California, U.S.

Market cap: $222.26 Billion As of December 2021

Revenue: $94bn in 2020Website: chevron.com, Caltex: https://www.caltex.com/

Chevron, https://www.chevron.com/

Caltex, https://caltex.co.nz/ -

APA Corporation is the holding company of Apache Corporation, an American hydrocarbon exploration company which also operates in Australia. It is organized in Delaware and is headquartered in Houston. The company is ranked #595 on the Fortune 500.

APA Corporation's total production in 2020 is 439,000 barrels (2,690,000 GJ), of which 58% is the United States, 28% is Egypt and 14%. - in the North Sea. As of December 31, 2020, the company's estimated reserves are 873 million barrels of oil equivalent (5.34 × 109 GJ), of which 68% are located in the United States, 20% in Egypt and 12% in the North. Sea. Almost all the company's US reserves are located in the Permian Basin. The company also has reserves in western Oklahoma, the Texas Panhandle and South Texas.

Founded: 1954

Headquarters: Post Oak Central

Houston, Texas, U.S.

Market cap: $9.67 Billion as of 2021

Revenue in 2021: $6.90 B

Website: https://apacorp.com/

APA Corporation,https://th.bing.com/