Enron scandal

The Enron scandal was an accounting controversy involving Enron Corporation, a Houston-based American energy firm. Following its public disclosure in October 2001, the corporation filed bankruptcy, and its accounting firm, Arthur Andersen - then one of the world's five largest audit and accounting partnerships - was effectively dissolved. Enron was considered as the largest audit failure, in addition to being the largest bankruptcy reorganization in US history at the time.

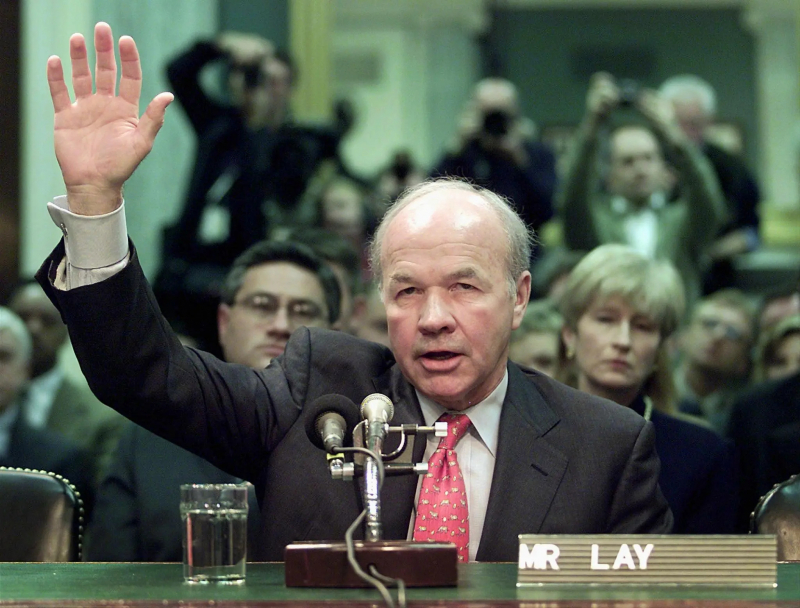

Kenneth Lay founded Enron in 1985 by combining Houston Natural Gas and InterNorth. When Jeffrey Skilling was hired some years later, Lay established a team of executives who were able to hide billions of dollars in debt from failed transactions and projects by using accounting loopholes, special purpose corporations, and bad financial reporting. Enron's board of directors and audit committee were misled by Chief Financial Officer Andrew Fastow and other executives about high-risk accounting practices, and Arthur Andersen was pressured to ignore the issues.

Enron stockholders launched a $40 billion lawsuit after the company's stock price collapsed to less than $1 by the end of November 2001, from a high of US$90.75 per share in mid-2000. The Securities and Exchange Commission (SEC) launched an investigation, and major Houston competitor Dynegy offered to buy the company for a pittance. The deal fell through, and Enron declared bankruptcy on December 2, 2001, under Chapter 11 of the United States Bankruptcy Code. Enron's assets totaled $63.4 billion, making it the largest corporate bankruptcy in US history until the WorldCom scandal the following year.

Many Enron executives were charged with various crimes, and some were condemned to prison, including Lay and Skilling. Arthur Andersen was found guilty of illegally destroying records related to the SEC probe, which resulted in the firm's license to audit public firms being revoked and it effectively closing down. Arthur Andersen had lost the majority of its customers and had ceased operations by the time the ruling was overturned by the United States Supreme Court. Despite losing billions in pensions and stock prices, Enron employees and shareholders received limited compensation in lawsuits.

As a result of the scandal, new regulations and legislation were established to improve the accuracy of public corporations' financial reporting. The Sarbanes-Oxley Act, for example, increased penalties for destroying, altering, or fabricating records in federal investigations or attempting to defraud shareholders. The act also increased auditing firms' accountability to remain objective and independent of their clients.

Start Date: October 2001

Location: United States