Top 10 Biggest Corporate Scandals

A corporate scandal can occur whenever there is evidence of unethical behavior, negligence, or third-party interference that affects the reputation of a ... read more...company. This can include evidence of 'creative' accounting, questionable business practices, data breaches, or anything else that harms the environment. Here are 10 of the biggest corporate scandals of recent times – ranked according to notoriety.

-

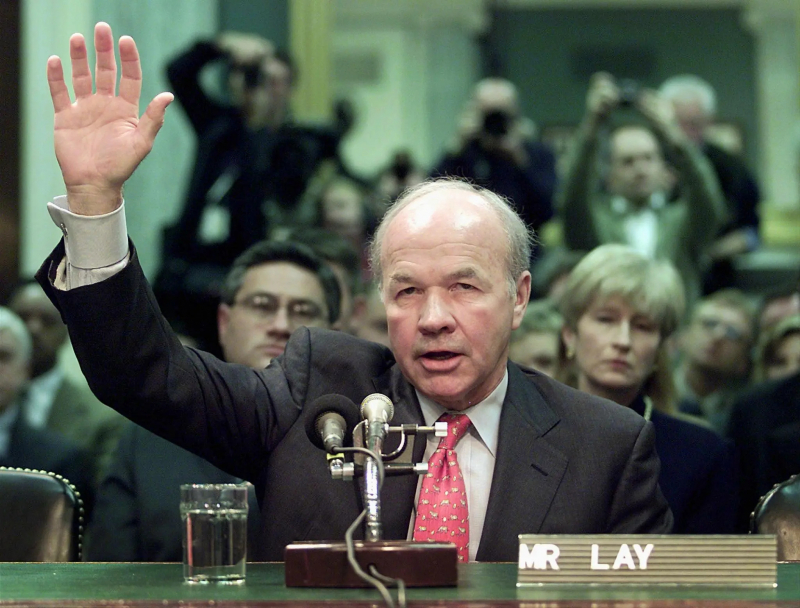

The Enron scandal was an accounting controversy involving Enron Corporation, a Houston-based American energy firm. Following its public disclosure in October 2001, the corporation filed bankruptcy, and its accounting firm, Arthur Andersen - then one of the world's five largest audit and accounting partnerships - was effectively dissolved. Enron was considered as the largest audit failure, in addition to being the largest bankruptcy reorganization in US history at the time.

Kenneth Lay founded Enron in 1985 by combining Houston Natural Gas and InterNorth. When Jeffrey Skilling was hired some years later, Lay established a team of executives who were able to hide billions of dollars in debt from failed transactions and projects by using accounting loopholes, special purpose corporations, and bad financial reporting. Enron's board of directors and audit committee were misled by Chief Financial Officer Andrew Fastow and other executives about high-risk accounting practices, and Arthur Andersen was pressured to ignore the issues.

Enron stockholders launched a $40 billion lawsuit after the company's stock price collapsed to less than $1 by the end of November 2001, from a high of US$90.75 per share in mid-2000. The Securities and Exchange Commission (SEC) launched an investigation, and major Houston competitor Dynegy offered to buy the company for a pittance. The deal fell through, and Enron declared bankruptcy on December 2, 2001, under Chapter 11 of the United States Bankruptcy Code. Enron's assets totaled $63.4 billion, making it the largest corporate bankruptcy in US history until the WorldCom scandal the following year.

Many Enron executives were charged with various crimes, and some were condemned to prison, including Lay and Skilling. Arthur Andersen was found guilty of illegally destroying records related to the SEC probe, which resulted in the firm's license to audit public firms being revoked and it effectively closing down. Arthur Andersen had lost the majority of its customers and had ceased operations by the time the ruling was overturned by the United States Supreme Court. Despite losing billions in pensions and stock prices, Enron employees and shareholders received limited compensation in lawsuits.

As a result of the scandal, new regulations and legislation were established to improve the accuracy of public corporations' financial reporting. The Sarbanes-Oxley Act, for example, increased penalties for destroying, altering, or fabricating records in federal investigations or attempting to defraud shareholders. The act also increased auditing firms' accountability to remain objective and independent of their clients.

Start Date: October 2001

Location: United States

marketplace.org -

Volkswagen (VW) emissions crisis, also referred to as 'emissionsgate' and 'dieselgate.' The EPA issued a Notice of Violation to Volkswagen on September 18, 2015, after establishing that the business had created and installed software (known as "defeat devices") that significantly impaired the effectiveness of the diesel vehicles' emissions control system while on the road. The infractions occurred over the period of six model years (2009–15). The letter was signed by Phillip Brooks, director of the EPA's Air Enforcement Division, and was written to numerous Volkswagen and Audi corporate entities, as well as VW's outside counsel.

Volkswagen should have predicted it days, months, or even years ago. The day before the Notice of Violation, EPA and Volkswagen officials exchanged emails to schedule a high-level conference call for 9:00 a.m. the next morning. Brooks, a veteran of the Justice Department's Environmental Enforcement Section, had written Volkswagen an alarming follow-up the night before, requesting that its general counsel be present: "Please note that this is a call that Mr. [David] Geanacopolus would certainly want to make a priority."

The general counsel learned of the Notice of Violation during the call. This was only the beginning of an extraordinary series of events that would eventually result in costly litigation and criminal charges against Volkswagen and its CEO. To date, no auditors or lawyers associated with Volkswagen have been publicly identified as the subject of any investigation related to the scandal. Did any of them pass up chances to help prevent it?

Start Date: September 18, 2015

Locations: Around the World

environmentaldefence.ca

independent.ie -

Lehman Brothers Holdings Inc. was a global financial services corporation formed in 1847 in the United States. Prior to declaring bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (after Goldman Sachs, Morgan Stanley, and Merrill Lynch), employing around 25,000 people globally. It was active in investment banking, stock, fixed-income, and derivatives sales and trading (particularly in US Treasury securities), research, investment management, private equity, and private banking. From its inception in 1850 until 2008, Lehman was in operation for 158 years.

Following the evacuation of most of its clients, precipitous drops in its stock price, and asset devaluation by credit rating agencies, Lehman Brothers filed for Chapter 11 bankruptcy protection on September 15, 2008. Lehman's role in the subprime mortgage crisis, as well as its exposure to less liquid assets, contributed significantly to the bank's demise. Lehman's bankruptcy filing was the largest in US history, and it is regarded to have played a significant part in the 2007-2008 financial crisis. The market crash further bolstered the "too big to fail" notion.

Global markets crashed soon after Lehman Brothers declared bankruptcy. The following day, large British bank Barclays announced an agreement to purchase a significant and controlling interest in Lehman's North American investment-banking and trading departments, as well as its New York headquarters building, subject to regulatory approval. Judge James M. Peck of the United States Bankruptcy Court authorized a revised version of that deal on September 20, 2008. The following week, Nomura Holdings announced the acquisition of Lehman Brothers' Asia-Pacific franchise, which includes Japan, Hong Kong, and Australia, as well as Lehman Brothers' investment banking and equities businesses in Europe and the Middle East. The agreement went into effect on October 13, 2008.

Date: September 15, 2008

Location: United States

ig.com -

"BP scandal" is one of the best biggest corporate scandals of recent times. The Deepwater Horizon rig, owned and operated by Transocean and leased by BP, was located in the Macondo oil potential in the Mississippi Canyon, a valley on the continental shelf. The oil well was placed 4,993 feet (1,522 metres) below the surface on the seabed and extended nearly 18,000 feet (5,486 metres) into the rock. A surge of natural gas blasted through a concrete core recently installed by contractor Halliburton in order to seal the well for later use on the night of April 20. Wikileaks documents later revealed that a similar incident occurred on a BP-owned rig in the Caspian Sea in September 2008. Because they were made of a concrete combination that employed nitrogen gas to expedite curing, both cores were likely too weak to handle the pressure.

The natural gas was released by the core fracture and went up the Deepwater rig's riser to the platform, where it ignited, killing 11 employees and injured 17. On the morning of April 22, the rig capsized and sank, rupturing the riser through which drilling mud had been poured to offset the upward pressure of oil and natural gas. Without any opposition, oil began to spill into the Gulf. The volume of oil exiting the damaged well—originally estimated by BP to be around 1,000 barrels per day—was considered to have peaked at more than 60,000 barrels per day by US government authorities.

BP attempted to activate the rig's blowout preventer (BOP), a fail-safe mechanism designed to stop the oil-drawing duct, but the equipment failed. The following year, forensic study of the BOP revealed that a set of huge blades known as blind shear rams—designed to slice through the pipe carrying oil—had malfunctioned due to the pipe bending under the pressure of the rising gas and oil. (According to a 2014 report by the United States Chemical Safety Board, the blind shear rams activated sooner than previously assumed and may have ruptured the pipe.)

Date: April 20, 2010 – September 19, 2010

Location: Gulf of Mexico

nrdc.org

nationalgeographic.com -

Uber is not without criticism. In recent years, there have been numerous allegations of sexual harassment within the corporation, as well as concerns about its'stop-at-nothing' strategy to expansion. According to the latter, it used illicit technology to elude law enforcement, steal drivers from competitors, and snoop on users.

However, it was allegations about Uber's "bro" culture that proved to be the most damaging, leading to the resignation of CEO Travis Kalanick in June 2017. Allegations included senior members of staff making sexist comments and visiting a brothel in Seoul. Even though some of the claims were not substantiated, the price of the company's shares, which were traded privately at the time, was influenced. With Uber preparing for an IPO, the company hired a new CEO, Dara Khosrowshahi, to clean up its image and establish a new culture. It went public in May 2019 at $45 per share, for a market capitalization of $69.7 billion.

Date: 2017

Locations: Around the World

e.vnexpress.net

e.vnexpress.net -

"Apple scandal" is one of the best biggest corporate scandals of recent times. Geekbench, a performance testing tool, produced statistics at the end of 2017 indicating that replacing the battery increases the performance of the iPhone, making it run quicker. Many consumers previously assumed that Apple lowered the clock on the iPhone to reduce the sudden power failure when the battery inside was drained. Many users advocate changing the battery with a new one since they saw on Reddit that their iPhone has a considerable gain in processing speed and performance after replacing the new battery. This battery replacement is reasonably priced.

Apple later acknowledged this and instituted a free battery replacement program for some affected iPhone models. They also released an update that allows users to toggle this "feature" on and off. They explain this by saying: "Our goal is to provide the best experience for their customers, including overall performance and extending the life of their devices. Lithium-ion batteries are not capable of delivering peak performance at capacity. low battery or degraded battery due to prolonged use.This may cause the device to turn off suddenly to protect the electronic components. Last year they developed a feature to prevent iPhone 6, iPhone 6, and iPhone SE from suddenly powering down (or restarting) under the above conditions (by lowering the device's performance). They're now extending that feature to iPhone 7 with iOS 11.2 and plan to add support for other products in the future."

Date: the end of 2016

Locations: Around the World

dailysabah.com

dailysabah.com -

The Guardian and New York Times reported in March 2018 that a corporation named Global Science Research had acquired data from millions of Facebook users in 2013 - without their explicit agreement. This was feasible because an earlier version of Facebook's privacy policy permitted apps to access data about users' friends' names, birthdays, and whereabouts. This allowed Global Science Research to collect data on 87 million Facebook users despite the fact that only roughly 30,000 people had utilized their app. These information was eventually sold to Cambridge Analytica, who used it to generate highly targeted advertising urging users to vote for Trump and Brexit. The furore surrounding this scandal was so serious that Mark Zuckerberg was called to answer questions in front of Congress in the US.

In a matter of days, Facebook's market capitalization was reduced by more than $100 billion, and legislators in the United States and the United Kingdom demanded answers from Facebook CEO Mark Zuckerberg. Because of the harsh public reaction to the media portrayal, he agreed to testify before the United States Congress. Meghan McCain drew an analogy between Cambridge Analytica's use of data and Barack Obama's 2012 presidential campaign; PolitiFact, on the other hand, claimed that this data was not used unethically because Obama's campaign used it to "have their supporters contact their most persuadable friends" rather than for highly targeted digital ads on websites like Facebook.

Start Date: 2014

Location: United States

thegioididong.com

thegioididong.com -

Few collapses in business history have been as abrupt and precipitous as Michael Pearson's, the CEO of drugmaker Valeant. He was recently the CEO of a company whose stock price had increased by almost 4,000% during his tenure. He was a former McKinsey consultant who devised a strategy focused on acquisitions, cost-cutting, and price increases. One of Valeant's major owners, influential hedge-fund manager Bill Ackman, compared Pearson to Warren Buffett, highlighting his skill at capital allocation. Pearson is no longer regarded as a genius. The Valeant Pharmaceuticals scandal began in August 2015, when Bernie Sanders and other congressmen demanded an explanation from the company for raising the prices of two drugs.

According to investigations, the company's aim was to purchase small pharmaceutical companies and raise the prices of their products, rather than investing in its own R&D. This sparked public outrage and a drop in the company's stock price. In October, it was revealed that Valeant owned a pharmacy chain called Philidor and had exploited its position to inflate the size of its order book and generate larger revenues. The company's name has since been changed to Bausch Health Companies Inc.

Date: August 2015

Location: New York

cbc.ca

fortune.com -

The Kobe Steel scandal began in October 2017 when the business admitted to falsifying statistics regarding the quality of its aluminum, steel, and copper products. Japan's third-largest steelmaker announced that its CEO will step down to accept responsibility for the widespread data fraud scandal that surfaced last year, though questions about its corporate culture and the possibility of future fines remain. Kobe Steel, which supplies steel parts to car, plane, and train manufacturers around the world, admitted last year to supplying products with falsified specifications to approximately 500 customers, disrupting global supply chains. The company, in announcing the results from a four-month-long investigation by an external committee, said it had also found new cases of impropriety, widening the total of affected clients to 605, including 222 customers overseas.

Hundreds of large corporations, including Toyota, Honda, Subaru, and Mitsubishi Heavy Industries, had employed these, raising worries about product safety. For example, the Central Japan Railway Company discovered that 310 parts in its bullet trains did not match agreed-upon requirements. The controversy caused a significant drop in Kobe Steel's stock price and the resignation of CEO Hiroya Kawasaki. According to the company's March 2018 report on the scandal, it had "a management style that overemphasized profitability, as well as weak corporate governance."

Date: October 2017

Location: Japan

bbc.com

cnbc.com -

Equifax, one of the three main consumer credit reporting agencies in the United States, announced in September 2017 that its systems had been accessed, exposing sensitive personal information of 148 million Americans. Names, home addresses, phone numbers, dates of birth, social security numbers, and driver's license numbers were among the information compromised. Credit card information for about 209,000 customers was also compromised. In terms of scale and severity, the Equifax breach is unprecedented. Other firms have had larger security breaches in the past, but the sensitivity of the personal information possessed by Equifax, as well as the extent of the problem, make this breach unusual.

Chinese Military Charged in Equifax Breach: The US government has charged four members of China's military with hacking Equifax and stealing the personal information of 150 million Americans. They allegedly planned to breach Equifax's computer networks, gain unauthorized access to those computers, and steal sensitive, personally identifiable information from nearly half of all American citizens. EPIC President Marc Rotenberg testified about the Equifax breach before the House in 2018 and the Senate in 2017. Rotenberg warned lawmakers and regulators that the US government's failure to protect Americans' personal data has put them at risk from foreign adversaries. And in the Harvard Business Review, Rotenberg explained that "consumer privacy is not a goal achieved by markets. It must be mandated by Congress."

Date: between May and July 2017

Location: the American credit bureau Equifax

ethicsunwrapped.utexas.edu

nbcnews.com