Great Recession of 2007 - 2008

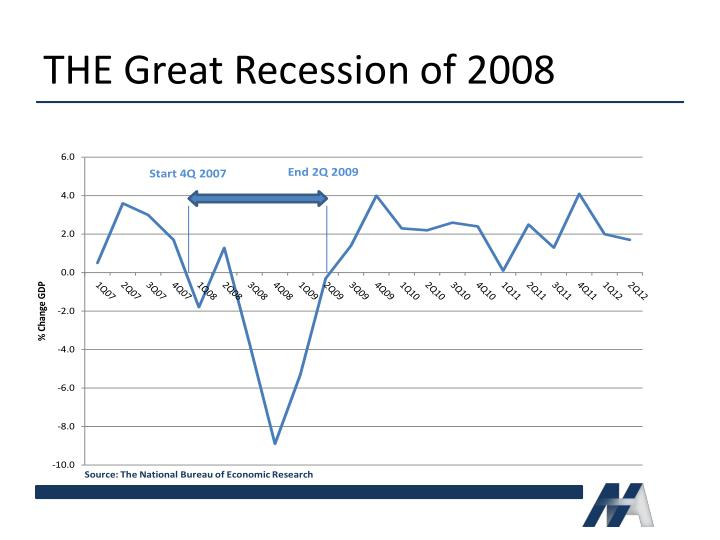

The abrupt decrease in economic activity in the late 2000s is known as the Great Recession. Since the Great Depression, it is regarded as the worst recession ever. The United States' official recession, which lasted from December 2007 to June 2009, as well as the subsequent worldwide recession in 2009, are both referred to as the "Great Recession."

When the U.S. housing market turned from a bubble to a collapse, a sizable quantity of mortgage-backed securities (MBS) and derivatives had considerable value losses. This is when the economic depression started. A spin on the phrase "Great Depression" is the phrase "Great Recession." The 1930s saw an official depression marked by a decrease in the gross domestic product (GDP) of more than 10% and an unemployment rate that peaked at 25%.

Although there are no clear criteria to distinguish between a depression and a severe recession, economists generally agree that the downturn of the late 2000s was not a depression. The United States' GDP shrank by 0.3% in 2008 and 2.8% in 2009 during the Great Recession, and the unemployment rate briefly rose to 10%. But there is little doubt that this catastrophe has caused the biggest economic collapse in the intervening years.