Top 6 Most Devastating Financial Crises

One of the most dreaded keywords that is heard or read all around the world is "financial crisis." Depending on a number of macroeconomic indices, an economy ... read more...is either experiencing a recession or perhaps a financial crisis, or there is concern that it may be headed in that direction. The per capita consumption, GDP, trade, money flow, energy consumption, and employment rate have all seen sharp reductions. Even the world's most powerful and prosperous countries have experienced some severe recessions in the past. Let's examine some of the most devastating financial crises the world has ever experienced.

-

The panic of 1772, often referred to as the credit crisis of 1772, was a financial catastrophe that started in London. The crisis weakened the nation's banking confidence, which led to the decline of faith in the neighboring European banks. More than 500 London-based banks went bankrupt as a result of the crisis, which also caused 30 European banks to fail. It was regarded as the worst in the area in the past 50 years.

Despite having a significant impact, the credit crisis of 1772 is not generally recognized, despite the fact that it occurred immediately after the financial crisis of 1763 and before the American Revolutionary War. The banking crisis of 1772, as its name implies, was akin to a conventional banking crisis and was driven by the cascading effects of bank runs. Despite having a significant impact, the crisis's root cause is still up for debate.

In conclusion, the confluence of three factors the overheated economy, financial fraud, and banks' lax oversight of debtors' previous activities led to the banking crisis of 1772. The banking crisis of 1772 had a sharp and infectious effect. As soon as possible, the Bank of England increased bill reductions, increased loans to struggling banks, and increased working capital injections into specific segments of the private sector.

Source: YouTube>StudyIQ IAS

Source: Reddit -

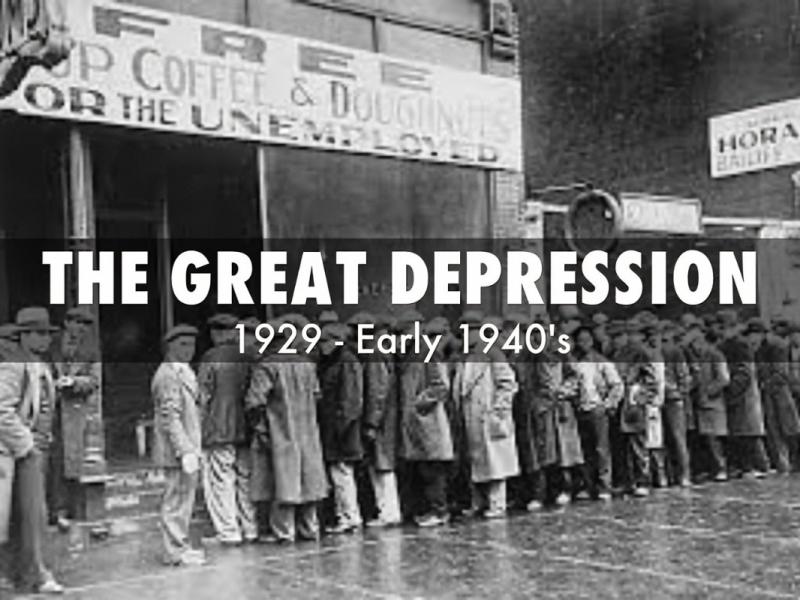

The Western industrialized world's most severe and protracted economic downturn was the Great Depression (1929–1939). Soon after the stock market disaster in October 1929, which paralyzed Wall Street and destroyed millions of investors, the Great Depression in the United States started. The following few years saw a reduction in consumer spending and investment, which resulted in sharp drops in industrial output and increased unemployment as faltering businesses laid off workers. When the Great Depression peaked in 1933, there were between 13 to 15 million unemployed Americans and nearly half of the nation's banks had failed. Although President Franklin D. Roosevelt's relief and reform initiatives helped mitigate the worst impacts of the Great Depression in the 1930s, the economy would not fully recover until after 1939, when World War II sped up American industry.

Most nations established relief initiatives, and the majority experienced some type of political upheaval that pushed them to the right. Many of the democracies that existed in Europe and Latin America had their governments overturned by a dictatorship or other type of authoritarian authority, most notably in Germany in 1933. The Dominion of Newfoundland willingly abandoned democracy.

Source: YouTube>StudyIQ IAS

Source: SlideServe -

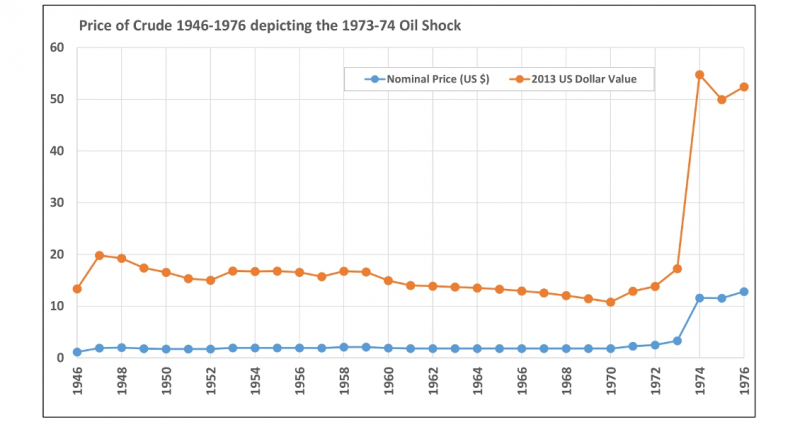

When the Organization of Arab Petroleum Exporting Countries (OAPEC) countries, led by Saudi Arabia, declared an oil embargo in October 1973, the 1973 oil crisis also known as the first oil crisis began. Targets of the embargo were countries that had backed Israel during the Yom Kippur War. Although the embargo was later expanded to Portugal, Rhodesia, and South Africa, the initial countries targeted were Canada, Japan, the Netherlands, the United Kingdom, and the United States. The price of oil had increased by about 300% by the time the embargo ended in March 1974, going from US$3 per barrel ($19/m3) to almost $12 per barrel ($75/m3) globally; US prices were much higher. The embargo caused an oil crisis, or "shock", with many short- and long-term effects on global politics and the global economy. It was later called the "first oil shock", followed by the 1979 oil crisis, termed the "second oil shock".

For the nations in northern Europe and the Persian Gulf that export oil, the price decline created a significant issue. Countries with high populations and low incomes, such as Mexico, Nigeria, Algeria, and Libya, whose economy depended heavily on oil, failed to plan for a market turn that left them in often hopeless positions.

Midway through the 1980s, when a global market was oversupplied due to decreased demand and rising supply, oil prices crashed, and the cartel disintegrated. The economies of Mexico (a non-member), Nigeria, and Venezuela, all of which had experienced economic growth in the 1970s, were on the verge of collapse, and even Saudi Arabia's economic might was severely diminished. Consolidated action was made more challenging by the disagreements within OPEC. OPEC's dominance has never come close to it as of 2015.

Source: YouTube>StudyIQ IAS

Source: Reddit -

The Asian financial crisis, often known as the "Asian Contagion," was a series of events that started in July 1997 and extended throughout Asia, including currency devaluations and other things. The crisis began in Thailand when the government withdrew the de facto peg of the local currency to the US dollar after using up a large portion of the nation's foreign exchange reserves in an effort to protect it from months of speculative pressure.

Just a few weeks after Thailand stopped protecting its currency, pressure from the speculative market forced Malaysia, the Philippines, and Indonesia to do the same. By October, the crisis had moved to South Korea, where the government was on the verge of default due to a balance-of-payments problem.

There was pressure on other economies as well, but those with strong economic fundamentals and sizable foreign exchange reserves fared far better. Hong Kong's currency, which is tied to the U.S. dollar via a currency board system and supported by sizable U.S. dollar reserves, has withstood a number of significant but unsuccessful speculative attacks.

Source: SlideServe

Source: Reddit -

There is no doubt that bubble popping is not only an American phenomenon. Prior to the 1990s, Japan saw notable 1980s growth that was far higher than the usual 2 percent. Some said that it was designed to keep pace with American growth. But in 1991, the growth essentially came to an end. Japan's gross domestic product increased by 0.5 percent between 1991 and 2000. This gradual development has been nicknamed the "Lost Decade" by analysts.

Analysts and historians have not yet identified a particular cause for this slow expansion. It might have something to do with the shorter workweek due to legislation, which saw workers put in 40 hours each week rather than 44. The number of national holidays has also raised. Financial institutions and government agencies were now sometimes closed on Saturdays. While the government's portion of output increased, private investment decreased. Some claim that this may have been brought about by restrictions on bank and financial institution borrowing, but that theory does have some flaws.

Other prevalent hypotheses focus on financial speculating and significant borrowing as a result of low interest rates. When the government intervened to restrain expenditure and keep inflation in check, credit became more difficult to come by, which in turn hampered growth. This ultimately halted development and economic growth. The "Lost Decade" was a result of the asset bubble burst, according to the majority of sources.

Source: SlideServe

Source: YouTube>StudyIQ IAS -

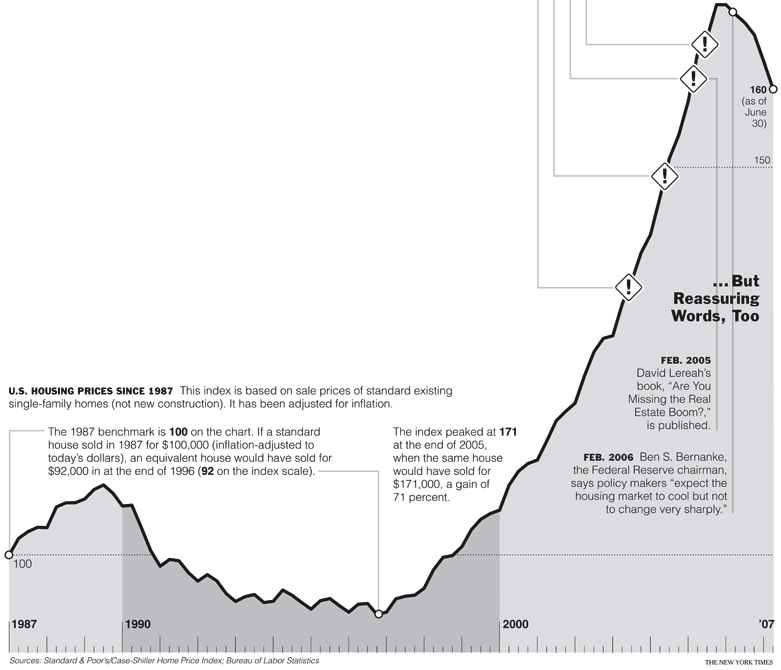

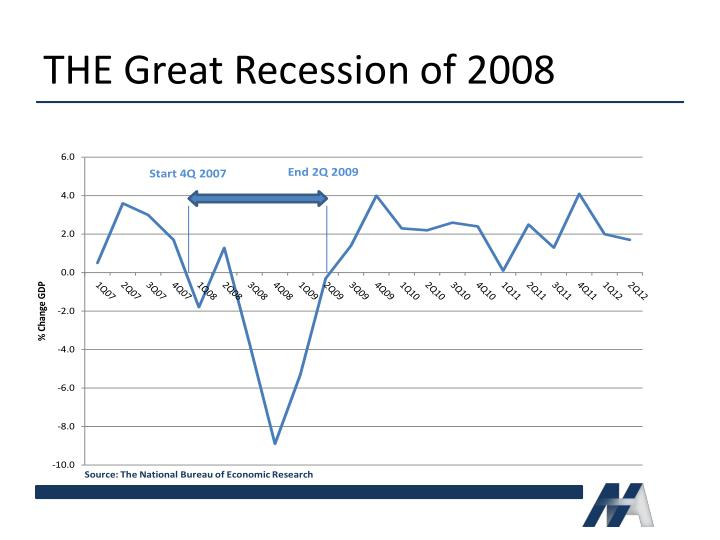

The abrupt decrease in economic activity in the late 2000s is known as the Great Recession. Since the Great Depression, it is regarded as the worst recession ever. The United States' official recession, which lasted from December 2007 to June 2009, as well as the subsequent worldwide recession in 2009, are both referred to as the "Great Recession."

When the U.S. housing market turned from a bubble to a collapse, a sizable quantity of mortgage-backed securities (MBS) and derivatives had considerable value losses. This is when the economic depression started. A spin on the phrase "Great Depression" is the phrase "Great Recession." The 1930s saw an official depression marked by a decrease in the gross domestic product (GDP) of more than 10% and an unemployment rate that peaked at 25%.

Although there are no clear criteria to distinguish between a depression and a severe recession, economists generally agree that the downturn of the late 2000s was not a depression. The United States' GDP shrank by 0.3% in 2008 and 2.8% in 2009 during the Great Recession, and the unemployment rate briefly rose to 10%. But there is little doubt that this catastrophe has caused the biggest economic collapse in the intervening years.

Source: Reddit

Source: SlideServe