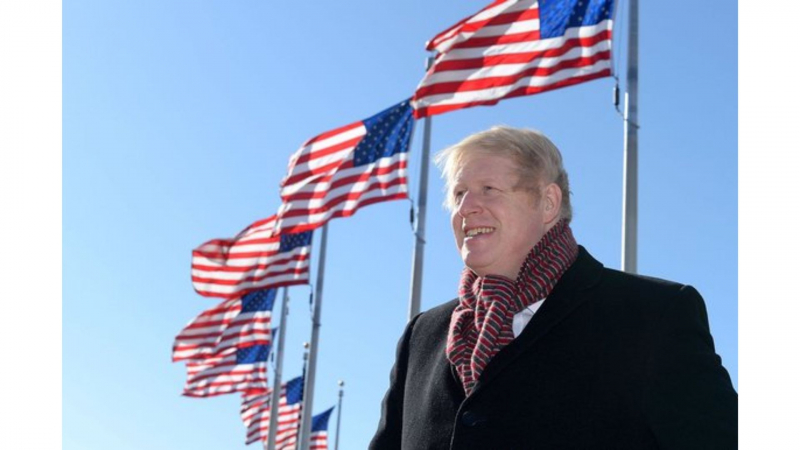

He Gave Up American Citizenship In 2017

One of the interesting facts about Boris Johnson is that, due to his dual citizenship, he was responsible for paying taxes in both England and the United States. The lawmaker was required to pay capital gains tax in 2015 on the significant profit he realized from the sale of his North London residence by the American IRS. After paying the tax, he renounced his American citizenship. A quick side note: after finishing his term as prime minister, Johnson could have run for president of the United States had he not renounced his citizenship.

Johnson admitted to NPR that giving up his citizenship would be challenging. I have to admit that you're correct; it is really difficult. However, I will admit that the great United States of America does have some very strict laws, you know. You might find it hard to believe, but if you're an American citizen, your country practices the amazing doctrine of global taxation. As mayor of London, I pay all of my taxes in the UK, despite the fact that the tax rates there are much higher. As a result, I pay a much higher percentage of my income in taxes than I would if I were an American citizen.