Intuit QuickBooks Self-Employed

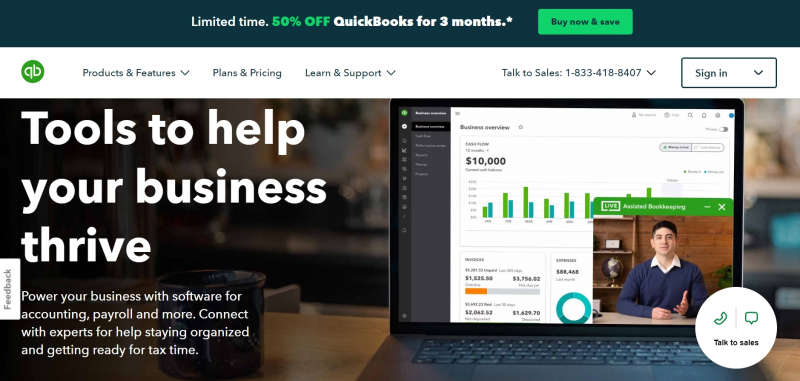

QuickBooks SelfEmployed will captivate freelancers and independent contractors looking for automated mileage tracking, quarterly tax estimates, and basic bookkeeping. Companies that want reliable time tracking, sales tax management, and custom invoice and item tracking should be considered in QuickBooks Online.

PROS

- Exceptional user interface and navigation

- Easily tracks expenses and income

- Automatic mileage tracking

- Can assign business transactions to Schedule C categories

- Estimates quarterly income taxes

- New time tracking tools

- Can assign tags to transactions

- Good support resources

CONS

- High price

- No contact or product records, advanced time tracking, project tracking, or recurring transactions

- Invoices not customizable or thorough

- No templates for estimates or quotes

- Manual sales tax management

- Mobile apps not updated with new features

Headquarters: Mountain View, CA

Website: https://quickbooks.intuit.com/self-employed/