Pricing Options with Mathematical Models

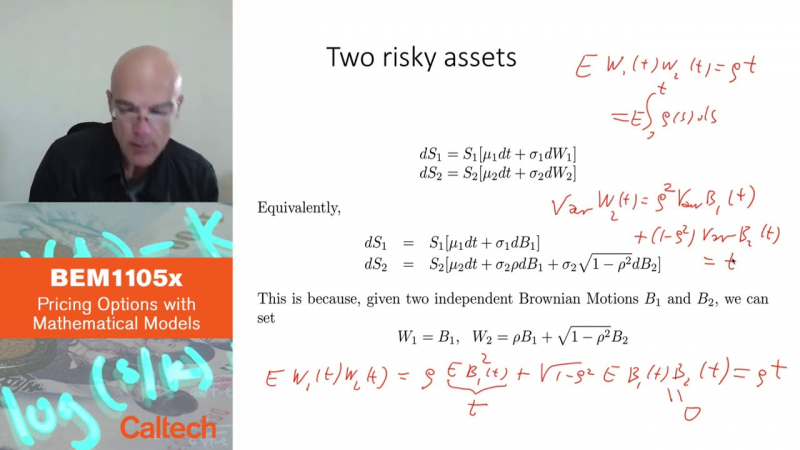

This is an introduction course on options and other financial derivatives, as well as their risk management applications. They will begin by defining derivatives and options, then move on to discrete-time binomial tree models, followed by continuous-time Brownian Motion models. A fundamental introduction to Stochastic, Ito Calculus will be provided. The Black-Scholes-Merton pricing model will be the baseline, but they will also examine more broader models, such as stochastic volatility models. They will go through the Partial Differential Equations approach as well as the probabilistic, martingale approach. They will also cover an introduction to interest rate modeling and fixed income derivatives.

They both teach the same advanced undergraduate class at Caltech. This suggests that the class may be difficult and need significant effort. On the other hand, successful completion of the class will provide you with a thorough understanding of the conventional option pricing models, allowing you to pursue additional study of the subject on your own or through other means. A fundamental understanding of calculus-based probability/statistics. Some knowledge of stochastic processes and partial differential equations is beneficial, but not required. It is strongly advised that you complete the requirements test offered in Unit 0 to determine whether your mathematical background is sufficient for effectively completing the course. If you get less than 70% on the test, it may be more useful to work further on your math skills before taking this course. Or you can just do a part of the course.

Duration: 69 hours

Format: Fully online, on-demand

Google rating: 4.8/5.0

Enroll here: coursera.org/learn/pricing-options-with-mathematical-models