Top 10 Best Online Derivatives Courses

Derivatives are one of the best things to happen to finance and even large main street companies. They allow for cheaply and quickly hedging risks or ... read more...underlying exposures in a highly liquid market. For all their beauty and complexity, derivatives are still not perfectly understood or utilized to their full potential. Nobel prizes have been awarded to economists for their efforts to price and understand derivatives. These are the best online Derivatives Courses that professionals dealing with them should take to get ahead.

-

Calculus through Data and Modeling: Differentiation Rules extends the study of differentiable calculus by developing new rules for finding derivatives without directly using the limit definition. These differentiation rules will allow the derivatives of polynomials, rational functions, algebraic functions, exponential and logarithmic functions, trigonometric and inverse trigonometric functions to be calculated with relative ease. Once developed, these rules are used to solve problems involving rates of change and function approximation.

They will look at the derivatives of some important functions in this module, such as polynomials, exponentials, logarithms, and trigonometric functions. You will also learn differentiation rules that will assist you in more efficiently computing derivatives. Finally, they will apply the derivative concept to multivariable functions and learn how to find derivatives and rates of change on a space graph.

Trigonometric Function Derivatives: Before beginning this module, please review trigonometric functions, particularly their graphs. They will create formulas to find derivatives for the common trigonometric functions sine and cosine in this module. The derivatives for the remaining trigonometric functions are formulated in conjunction with the product and quotient rules. These new derivative formulas are then added to their catalog for use in solving rate-of-change problems.

Duration: Around 10 hours

Format: Fully online, on-demand

Google rating: 4.8/5.0

Enroll here: coursera.org/learn/calculus-through-data-and-modelling-imits-derivatives

coursera.org -

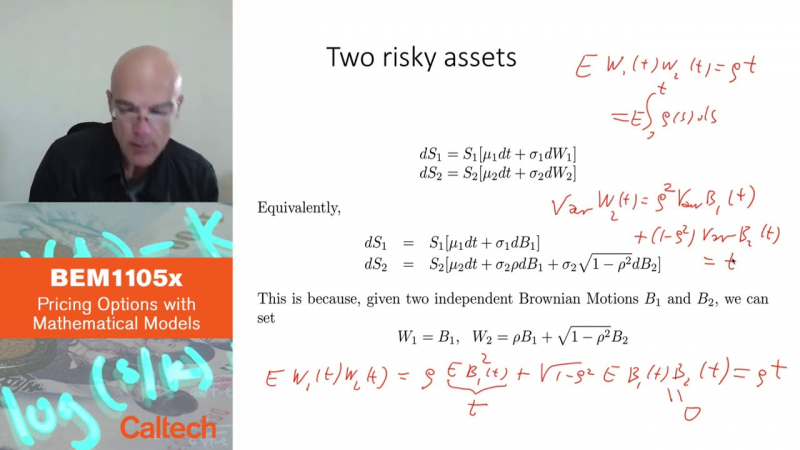

This is an introduction course on options and other financial derivatives, as well as their risk management applications. They will begin by defining derivatives and options, then move on to discrete-time binomial tree models, followed by continuous-time Brownian Motion models. A fundamental introduction to Stochastic, Ito Calculus will be provided. The Black-Scholes-Merton pricing model will be the baseline, but they will also examine more broader models, such as stochastic volatility models. They will go through the Partial Differential Equations approach as well as the probabilistic, martingale approach. They will also cover an introduction to interest rate modeling and fixed income derivatives.

They both teach the same advanced undergraduate class at Caltech. This suggests that the class may be difficult and need significant effort. On the other hand, successful completion of the class will provide you with a thorough understanding of the conventional option pricing models, allowing you to pursue additional study of the subject on your own or through other means. A fundamental understanding of calculus-based probability/statistics. Some knowledge of stochastic processes and partial differential equations is beneficial, but not required. It is strongly advised that you complete the requirements test offered in Unit 0 to determine whether your mathematical background is sufficient for effectively completing the course. If you get less than 70% on the test, it may be more useful to work further on your math skills before taking this course. Or you can just do a part of the course.

Duration: 69 hours

Format: Fully online, on-demand

Google rating: 4.8/5.0

Enroll here: coursera.org/learn/pricing-options-with-mathematical-models

coursera.org

coursera.org -

This course is taught by a seasoned capital markets practitioner and executive with many years of hands-on, in-the-field financial markets sales, trading, and analysis experience. Starweaver designed, produced, and delivered it. Starweaver is one of the world's most highly regarded and well-established training providers, providing courses to many of the world's leading financial institutions and technology companies.

This course focuses on basic derivative products such as futures and options. To begin, they explain what these products are and how they work in general. They demonstrate the common characteristics of all derivatives as well as the essential characteristics that distinguish them from other types of financial instruments. If you work in finance at a small, medium, or large business, or if you work in a financial institution of any kind (retail bank, business bank, commercial bank, investment bank, hedge fund, family office, investment management firm, insurer, and/or reinsurer), this course is for you.

Starweaver has delivered, and continues to deliver, thousands of live in-person and online educational programs for organizational training programs for new hires and induction, as well as mid-career and senior level immersion and leadership courses. If you are looking for live streaming education or want to know what courses in technology or business might be best for you.

Duration: Around 4 hours

Format: Fully online, on-demand

Google rating: 4.7/5.0

Enroll here: udemy.com/course/introduction-to-futures-options/

capitalmind.in -

This course covers derivative pricing topics. The first module is intended to help students understand the Black-Scholes model and how to use it to calculate Greeks, which measure the sensitivity of option value to variables such as underlying asset price, volatility, and time to maturity. Greeks are important in risk management and hedging, and they are frequently used to calculate portfolio value change. The risk management of derivatives portfolios will then be examined from two perspectives: the Greek approach and scenario analysis. The second module explains how implied volatility links the theoretical price of an option to the real market price.

They will go over volatility surface pricing as well as explanations of volatility smile and skew, which are common in real-world markets. The third module covers credit derivatives and structured products, with a focus on Credit Debit Obligation (CDO), which played a significant role in the previous financial crisis beginning in 2007. They will discuss the definition of a CDO, simple and synthetic CDOs, and CDO portfolios. The final module introduces valuation methods such as dynamic programming in real options by using natural gas and electricity related options as examples.

Duration: Around 4 hours

Format: Fully online, on-demand

Google rating: 4.7/5.0

Enroll here: coursera.org/learn/financial-engineering-advancedtopics

coursera.org

e-courses4you.com -

Derivatives – Options & Futures from IB ranks 5th in the list of the best online Derivatives Courses. While investing and trading in the options market may appear to be more difficult than investing and trading in other asset classes such as stocks, bonds, exchange-traded funds, currencies, and commodities, you'll eventually discover that their complexity can be boiled down to simple concepts you'll be able to understand and use the more you're exposed to and have hands-on experience with the material. This is a quick and easy introduction to derivatives and trading them in real-world scenarios. You will learn about options, market mechanics, fundamental strategies, and everything else you need to know to begin trading on Day 1.

Before you enter the market, you will have a solid understanding of the fundamental principles of how derivatives work. The second half of the course, which focuses on option strategies, is designed to provide you with hands-on experience with using derivatives as part of your trading strategy. You also get a free demo Trader Workstation Paper Trading account, which you can use to trade in a simulated environment while you learn the ropes. This is a good way to gain confidence before dealing with real traders.

Duration: Around 17 hours.

Format: Fully online, on-demand

Google rating: 4.5/5.0

Enroll here: coursera.org/learn/derivatives-options-futures

coursera.org

youtube.com -

This course will concentrate on capturing the evolution of interest rates and providing in-depth knowledge of credit derivatives. The first module covers term structure lattice models and cash accounts, followed by an examination of fixed income derivatives such as options, futures, caplets and floorlets, swaps, and swaptions. The second module will look at model calibration in the context of fixed income securities before expanding it to other asset classes and instruments. Learners will use Excel to calibrate a model and then use it to price a payer swaption in a Black-Derman-Toy (BDT) model. The third module introduces credit derivatives before concentrating on modeling and pricing Credit Default Swaps.

Learners would be introduced to the concept of securitization, specifically asset-backed securities, in the fourth module (ABS). The discussion then shifts to Mortgage Backed Securities (MBS) and the mortgage mathematics that goes with them. The final module looks at how to introduce and price Collateralized Mortgage Obligations (CMOs).

Duration: 6 weeks long, 14 hours worth of material

Format: Fully online, on-demand

Google rating: 4.5/5.0

Enroll here: coursera.org/learn/financial-engineering-termstructure

coursera.org -

Financial derivatives are ubiquitous in global capital markets, and both the products and the institutions that support them are rapidly evolving. This course is part of the MicroMasters Program in Finance and is intended for students who want to gain a sophisticated and long-term understanding of valuation and hedging methods, as well as a basic understanding of major markets and instruments. The importance of tools for quantifying, hedging, and speculating on risk is emphasized. Forwards, futures, and options in stock, fixed income, and commodity markets, exotic options, real options, interest rate and currency swaps, mortgages, credit risk, securitization, the yield curve, duration, and convexity are among the topics covered.

The acquired knowledge and skills are critical for any well-trained financial practitioner. They will be especially beneficial to those considering a career in sales and trading, portfolio management, commercial banking, investment banking, insurance, as a hedge fund manager, or as an analyst or manager in a public sector financial institution, central bank, or financial regulatory agency. Corporate financial managers will benefit from this knowledge as consumers of complex financial products and hedging instruments. Anyone planning to take the CFA exams will benefit greatly from this course.

Duration: Around 12 weeks

Format: Fully online, on-demand

Google rating: 4.5/5.0

Enroll here: edx.org/micromasters/mitx-finance

prathamonline.com

prathamonline.com -

Financial Edge is yet another elite training provider used by some of the world's top investment banks to train their employees. As you might expect, the stakes are pretty high for these banks, so the training providers they hire must also be top notch. That is most likely the single most important indicator of the quality of this course. The best part about these certifications is that they are instantly recognizable in the industry, which means you will immediately stand out. To stand out in a competitive world, you need every advantage you can get.

The course focuses on equity and equity derivatives, fixed income derivatives, and even foreign exchange and commodities. It is a comprehensive course that covers all aspects of the market that a trader should be aware of. There's no point in re-pasting the entire table of contents here, so they recommend you click on the link below to see all of the topics covered.

There are hours of videos from industry experts, pdf files to download and read, over 60 practical exercises to practice with, and online quizzes to complete in order to earn the certificate. You can display this certificate proudly on your LinkedIn profile and use it to build your personal brand and showcase your skills to potential employers.

Duration: Around 15 hours

Format: Fully online, on-demand

Level: Intermediate

Google rating: 4.3/5.0

Enroll here: fe.training/product/online-finance-courses/sales-trading/the-trader/

fe.training -

LSE is an excellent brand to have on your resume. This course was developed by their Finance Department and is taught by their faculty. It's a fantastic opportunity to learn from some of finance's top academics. This course introduces the concepts and models that underpin modern financial derivative analysis and pricing. The course's underlying philosophy is to first lay the groundwork for understanding derivatives in general. The necessary technical tools will be thoroughly explained, allowing students to learn the language and converse with derivatives professionals. After the tools are in place, they can be applied to any derivative. The derivatives that shape the modern world will receive special attention.

The first half of the course consists of a review of the necessary tools, the setup of the pricing framework, the intuition of the methodology, and its application to plain vanilla derivatives. In the second half of the course, these techniques are applied to more advanced topics such as exotic derivatives, volatility modeling (including stochastic volatility, local volatility, and volatility derivatives such as variance swaps), and interest-rate derivatives.Duration: Around 3 weeks.

Format: Fully online, on-demand

Google rating: 4.0/5.0

Enroll here: lse.ac.uk/study-at-lse/summer-schools/Summer-School/Courses/Secure/Finance/FM360

personal.lse.ac.uk -

This is without a doubt one of the best online Derivatives Courses available. For more than 90 years, NYIF has been educating bankers, traders, and other finance professionals, and this expertise is evident as you progress through this course. The best thing about this course is that it has been specifically designed as a derivatives certification. That is, it covers only the most important topics without wasting your time and will get you where you want to go with derivatives.

From forwards, futures, options, fixed income, and equity derivatives to risk management with derivatives and asset-backed securities, all of your favorite derivatives are covered. Delta, Gamma, Theta, Vega, Black Scholes, Hedging, CDOs, and ABSs are all present and well. These are some fairly complex topics, and they do an excellent job of making the material understandable and practical. The emphasis is on practical application rather than academic theory.

This should be your starting point for any of the careers that require a knowledge or understanding of derivatives. Traders, structurers, hedgers, institutional sales, financial advisors, risk managers, asset and portfolio managers, wealth managers, and other professionals work in the financial services industry. Following completion, you will receive a certificate from NYIF that will add value to your CV. If you need a CV boost before the hiring season, or if you are a finance professional looking to change jobs, you need boosts like this.

Duration: Around 30 hours

Format: Fully online, on-demand. Classroom option also available.

Level: Professional

Google rating: N/A

Enroll here: nyif.com/online-derivatives-professional-certificate.html

coursalytics.com

info.nyif.com