Value Investing Strategies for Stock Market Investing by Udemy

Indian Insights has put together an amazing value investing course to help you succeed in the stock market. It's best for current investors who want to learn how to master value investing and apply these approaches to achieve even better consistent returns. This course will also be valuable if you wish to examine businesses using the value investing paradigm.

You don't need to be concerned if you are unfamiliar with accounting, financial accounts, or investment. Because they will begin with teaching you financial statement analysis in this course, so you will have a fundamental comprehension of financial statements. This is critical to your success as a value investor.

The 7 segments of this advanced class are as follows:

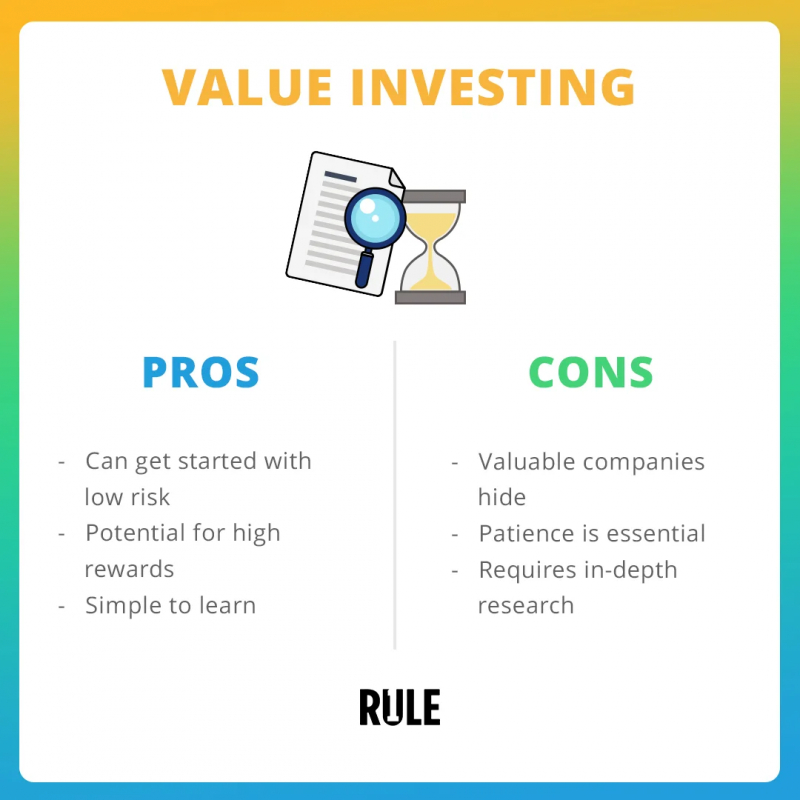

- General Thoughts on Value Investing

- Understanding Financial Statements

- Common Size Analysis of Financial Statements

- Financial Ratio Analysis

- Value Investing Strategies – Introduction

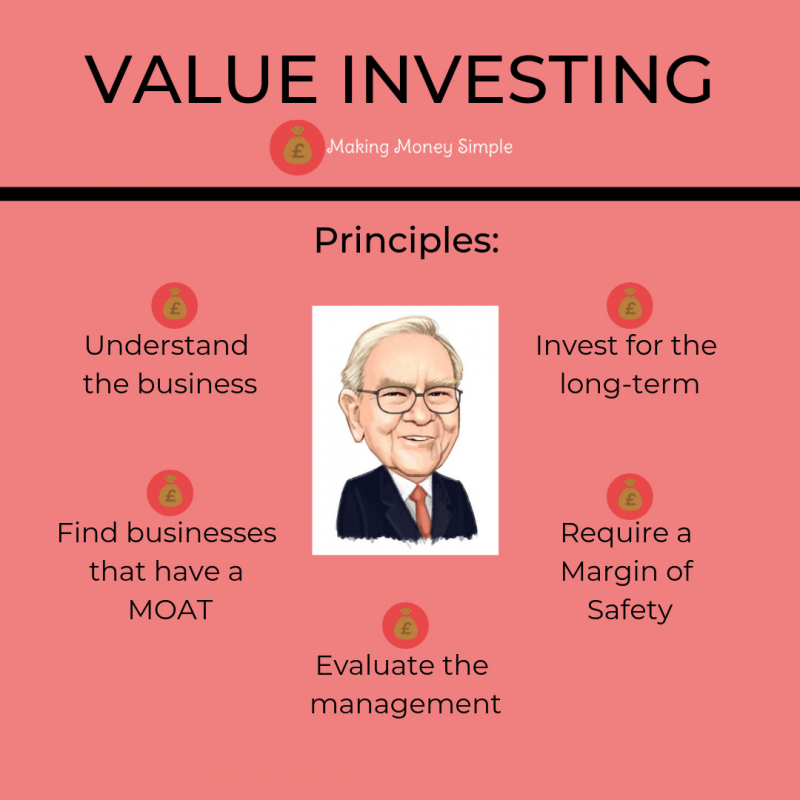

- Moat Based Value Investing

- Investment Framework

In this course, you will learn:

- Learn the Benjamin Graham Strategy. Also known as the cigarette butt strategy

- Learn the basics of moat based value investing employed by great investors like Warren Buffett, Charlie Munger & Seth Klarman

- Get an investment framework to evaluate any stock idea

- Learn how to identify if a business will be able to sustain its growth are not

- Learn potential accounting red flags to watch-out for in any stock investment idea

- Learn how to evaluate the management of the business you are looking to invest in.

- Understand basics of financial statements including balance sheet, profit & loss statement & cash flow statemen

- Learn Common Size Analysis and Ratio Analysis to understand performance of any business

Who it’s for: Advanced students

Price: 13,99 $US

Website: udemy.com/course/value-investing-strategies-for-the-stock-market