Top 10 Best Investment Management Courses

Whether you're new to investing or have some expertise, an investment management course can provide you with the skills you need to better manage your ... read more...portfolio and generate higher returns over time. You can also put your newfound knowledge to use in the workplace to help you enhance your career. Toplist is here to assist you in finding the finest solutions for your needs, budget, and hectic lifestyle.

-

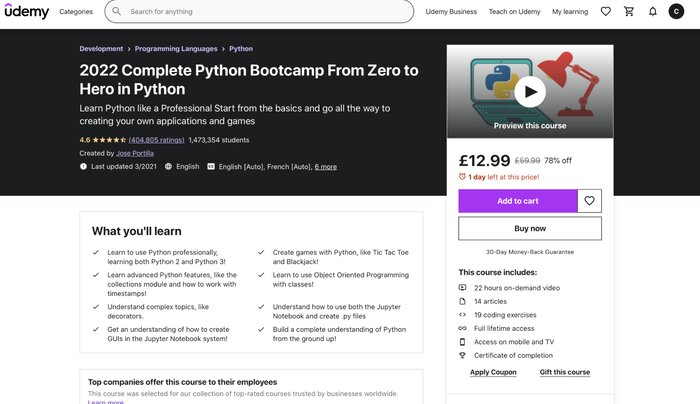

The Complete Investor Bootcamp 2020 by Udemy tops the list of best investment management courses. This beginner course from 365 Careers explains the fundamentals of stock market investing from the ground up. It's aimed at first-time investors who wish to build a passive income and achieve financial independence. This training is designed to improve your financial knowledge and abilities. The most important thing to understand is that there is no quick fix for achieving six- and seven-figure profits.

This is unrealistic, and you should be wary of anyone who promises you such results. It's all about smart money management! What they'll do together is go over some very key concepts that will help you develop a strong foundation for investing in the stock market. Two of the most important abilities you will learn along the road are using your own analysis and creating your own thoughts.

This course will also teach you how to:

- Download financial data and interpret the data available in different financial sources

- Calculate rates of return and volatility measures

- Understand the concepts of correlation and diversification

- Interpret the Modern Portfolio Theory and use the Capital asset pricing model to determine expected return on equity in stock valuation models

- Build the efficient frontier in Excel

- Calculate the Sharpe and Treynor ratios, as well as indicators like M2 and Jensen’s alpha

- Distinguish between public and private equity securities

- Compute the intrinsic value of a stock using the Dividend discount model

- Use the industry life cycle model

- Define primary and secondary markets

- Calculate and interpret the value, price, and total return of an index

- Contrast the different weighting methods used in index construction

- Characterize behavioral finance and its relevance to understanding market anomalies

- Review the principles of technical analysis, and examine common chart patterns

- Describe the different types of investors, and consider the various aspects of the asset management industry

Who it’s for: Beginners

Price: 12,99 $USWebsite: udemy.com/course/the-complete-investor-bootcamp/

learnopoly.com

learnopoly.com -

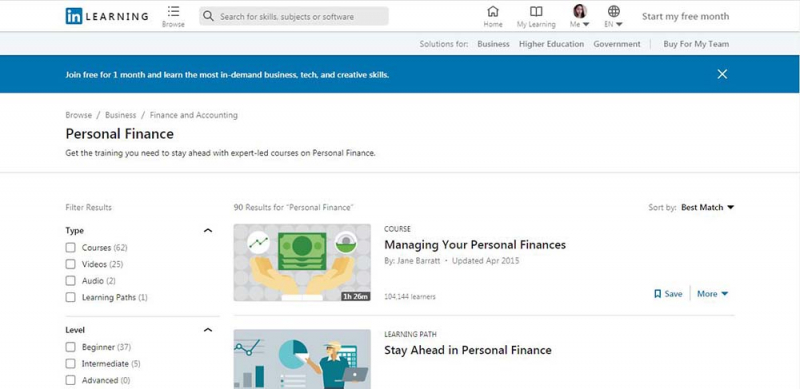

Learn how to put your money to work for you by investing it. Jane Barratt, a financial advisor, debunks the idea that investing is only for retirement in this course. In fact, wise investing is essential for long-term financial success—and it pays much more than merely saving money.

Jane discusses with you her investment techniques. She deconstructs the market into its five basic components—cash and equivalents, stocks, bonds, funds, and insurance products—as well as the various vehicles through which you can invest these components. She also discusses the necessity of a well-balanced portfolio, risk management, finding value in the market, and gradually strengthening your "money muscles." Learn how to calculate a portfolio's rate of return vs overall market performance. Finally, Jane discusses DIY investing possibilities, when working with an advisor makes sense, and how to minimize pricey investment fees.

Barratt also discusses the importance of a well-balanced portfolio and investing for wealth accumulation (after retirement), as well as the need of a well-balanced portfolio and investing to accumulate money (not just for your nest egg). At the end of each segment, you'll take a quiz to demonstrate your understanding of the topic. Registration is free with a monthly LinkedIn subscription. Not a member yet? Sign up for a one-month trial to get a free seat in the class.

She divides the course into 4 core segments:

- Why Invest?

- What Is Investing?

- How Do I Invest?

- Where to Invest?

Who it’s for: Beginners

Price: Included with the monthly membership

Website: linkedin.com/learning/managing-your-personal-investments

dollarflow.com

dollarflow.com -

This investment management course will teach you about the major financial markets, their features, and how they are related to the economy. Their diverse team of specialists will begin by teaching you how stock and bond prices are calculated and why they change, while also enhancing your understanding of risk and why it is important when evaluating an investment's performance.

The focus will next shift to less well-known markets including gold, developing markets, real estate, hedge funds, and private equity. These will be examined with a focus on their unique risks and return prospects, as well as how they might assist in the development of effective portfolios. Finally, you will learn about central bank policies and how they affect financial markets, as well as the relationship between the economy and the price of financial assets. Throughout these steps, specialists from UBS, corporate partner, will demonstrate how the concepts you have learned are put into practice at a prominent worldwide bank. This focus on practicality means you will not only understand what is going on in global financial markets but also start to figure out how you can use them to achieve financial goals, be it a client's or your own.

About this course:

- Flexible deadlines: Reset deadlines based on your availability.

- Shareable Certificate: Get a Certificate when you complete

- 100% online: Start now and learn at times that suit you.

- 1 of 5 in the: Investment Management Specialization

- Beginner level

- Approx. 11 hours to complete

- English

- Subtitles: Arabic, French, Portuguese (European), Chinese (Simplified), Italian, Vietnamese, German, Russian, English, Spanish

Who it’s for: Beginners

Price: Free

Website: coursera.org/learn/understanding-financial-markets

coursera.org -

Finance Fundamentals for Building an Investment Portfolio by Udemyranks 4th in the list of best Investment Management Courses. All prospective portfolio managers should take this finance fundamentals course. It serves as the framework for the rest of the program. You'll discover why a well-diversified portfolio is the most effective way to generate consistent returns while minimizing risk. They'll look at how the process of putting together an investing portfolio has changed over time using a chronological perspective. From the beginning, when the concept was originally conceived, to the most recent advancement in portfolio management. This course should be suitable for all investors, from beginners to specialists, as it only uses conceptual diagrams.

They'll also utilize short videos to explain the concepts underlying certain well-known quantitative hedge fund techniques. This will serve as an excellent foundation for the quantitative strategy classes. They'll also look at how these quantitative techniques performed in the real world in 2020, which included a once-in-a-century disaster. This course does not address the specifics of the particular techniques. It is strongly advised that you take at least two, if not all, of the strategy courses, as they cover the fundamentals of major investment ideas, financial mathematics, and basic Excel abilities.

This course will also teach you about:

- Basic finance fundamentals for a stable and resilient investment portfolio

- Modern Portfolio Theory and its limitations

- Efficient Frontier and its usage

- Capital Market Line and the use of leverage

- Introduction to Risk Parity Concept

- Introduction to Multi-Strategy Approach

- Simple concepts behind proven quantitative strategies used by hedge funds

- See real world performance of proven quantitative strategies used by hedge funds

Who it’s for: Intermediate students

Price: 149,99 $US

Website: udemy.com/course/foundation-course-for-building-an-investment-portfolio

amazon.com -

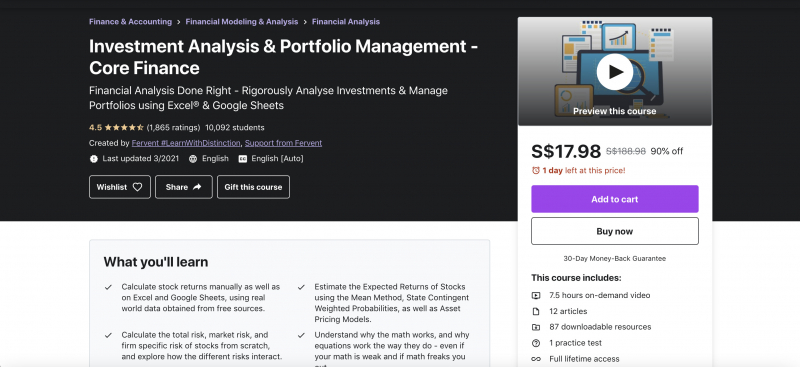

Investment Analysis and Portfolio Management – Core Finance by Udemy ranks 5th in the list of best Investment Management Courses. Interested in learning how to use Excel and Google Sheets to analyze assets and manage portfolios? This is the ideal program for you. It is provided by Fervent and includes 7.5 hours of on-demand video, 12 articles, 87 downloadable resources, and 1 practice test.

Learn whythey divide some variables by something, and multiply other variables by something else. Get past the painful approach of memorising countless equations. Not only will they rip apart each equation one variable at a time, they’ll also give you mathematical proofs that show the equation’s logic one step at a time. Save yourself time and effort by understanding why the equation works the way it does. Then go out and create your own equations, and redefine the way you conduct your own financial analysis.

This course will also teach you about:

- Calculate stock returns manually as well as on Excel and Google Sheets, using real world data obtained from free sources.

- Estimate the Expected Returns of Stocks using the Mean Method, State Contingent Weighted Probabilities, as well as Asset Pricing Models.

- Calculate the total risk, market risk, and firm specific risk of stocks from scratch, and explore how the different risks interact.

- Understand why the math works, and why equations work the way they do - even if your math is weak and if math freaks you out.

- Witness the power of diversification and how the risk of your portfolio can be lower than the individual assets that make up the portfolio!

- Measure your investment portfolio's performance by calculating portfolio returns and risks.

- Optimise your investment portfolios by maximising your returns while minimising your risk.

- Decompose Diversification so you understand why it actually works (hint: it's the mathematical "magic" of Rho)

Who it’s for: Intermediate students

Price: 12,99 $US

Website: udemy.com/course/investment-analysis-portfolio-management

vectorstock.com

vectorstock.com -

This course will teach you about the theory behind optimum portfolio design, the various methods portfolios are constructed in practice, and how to measure and manage the risk of such portfolios. You'll begin by looking at how imperfect asset correlation leads to diversified and optimal portfolios, as well as the implications for asset pricing.

Then you'll learn how to combine strategic and tactical asset allocations to create an appropriate investor profile and portfolio. Finally, you'll get a closer look at risk, including its various aspects and the tools and approaches that can be used to measure, manage, and hedge it. As you continue through the course, key speakers from UBS, the corporate partner, will regularly give a practical perspective on these many themes.

Here’s what you can expect to learn while enrolled:

- General Introduction and Key Concepts

- Modern Portfolio Theory and Beyond

- Asset Allocation

- Risk Management

Who it’s for: Intermediate students

Price: Free

Website: coursera.org/learn/portfolio-risk-management

acuityppm.com

acuityppm.com -

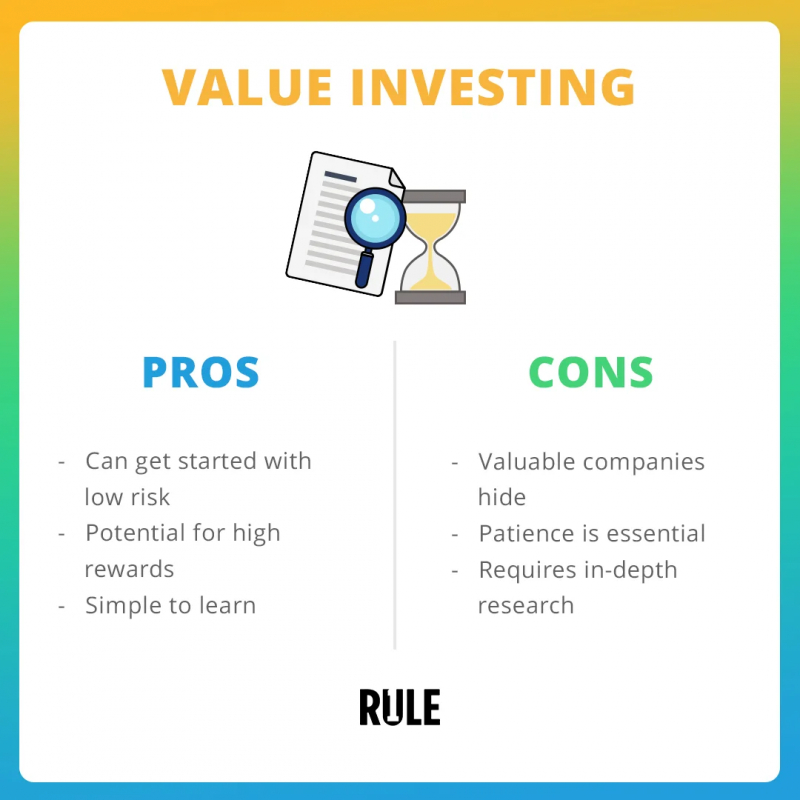

The Value Investing: How to Invest Wisely Like Warren Buffett Course is meant to give you a comprehensive and succinct investment guidance that will make it much easier for you to get started investing in the stock market and become a highly successful value investor.

This course will teach you how to swiftly assess a company's financial performance using essential stock selection criteria, as well as how to establish a winning investor's mindset so that you may avoid costly investment blunders and achieve long-term success. You'll also learn a lot about how the stock market works, how to purchase and sell stocks, how to diversify your portfolio to reduce risk, the dollar cost averaging strategy, your next actions, and much more.In this course, you will learn:

- How to Become a Wiser Unstoppable Investor & Start Kicking Off Your Investment Journey In Just 2 Hours With Real World Examples!

- Powerful Shortcut to Stock Market Investing - Everything You Need to Know Before Starting to Invest in the Stock Market!

- The Highly Successful Investor Warren Buffett's Approach to Investing

- How to Make Money Owning Stocks

- The Differences Between Common Share vs Preferred Share

- What Makes the Stock Price Fluctuate

- How the Stock Market Actually Works and How You Can Profit From It

- Why Should You Jump Into the US Stock Market?

- How to Pick Stocks Using Fundamental Analysis & Technical Analysis

- How to Develop a Winning Investor Mindset to Become Successful As A Value Investor

- How to Apply Essential Stock Picking Criteria to Make Your First Investments

- How to Perform Price Volatility Assessment

- How to Evaluate a Company's Return on Equity Ratio

- How to Evaluate a Company's Earnings Per Share

- How to Evaluate a Company's Price-to-Earnings Ratio

- How to Evaluate a Company's Dividend Yield

- How to Evaluate a Company's Debt Repayment Capacity

- How to Taking Advantage of the Dollar-Cost Averaging (DCA) Approach

- How to Determine When to Sell Your Stocks

- How to Build Your Low-Risk Investment Portfolio

- How to Set Up a Trading Account to Practice Buying and Selling Stocks

- How to Accelerate Your Learning & Jump Start Your Investment Career

Who it’s for: Advanced students

Price: 13,99 $USWebsite: udemy.com/course/value-investing-bootcamp-how-to-invest-wisely

giftout.co

giftout.co -

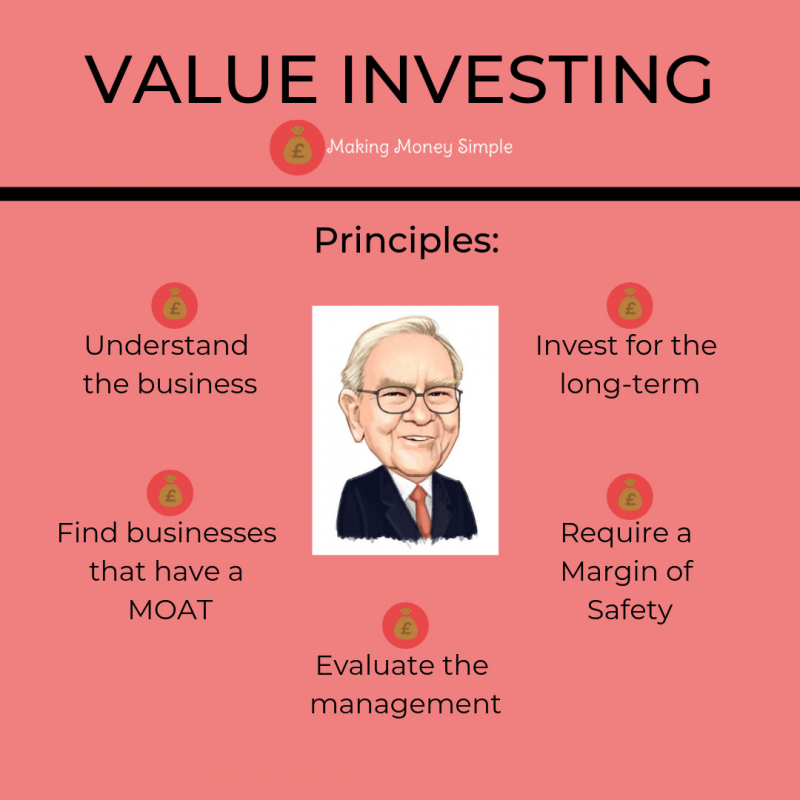

Indian Insights has put together an amazing value investing course to help you succeed in the stock market. It's best for current investors who want to learn how to master value investing and apply these approaches to achieve even better consistent returns. This course will also be valuable if you wish to examine businesses using the value investing paradigm.

You don't need to be concerned if you are unfamiliar with accounting, financial accounts, or investment. Because they will begin with teaching you financial statement analysis in this course, so you will have a fundamental comprehension of financial statements. This is critical to your success as a value investor.The 7 segments of this advanced class are as follows:

- General Thoughts on Value Investing

- Understanding Financial Statements

- Common Size Analysis of Financial Statements

- Financial Ratio Analysis

- Value Investing Strategies – Introduction

- Moat Based Value Investing

- Investment Framework

In this course, you will learn:

- Learn the Benjamin Graham Strategy. Also known as the cigarette butt strategy

- Learn the basics of moat based value investing employed by great investors like Warren Buffett, Charlie Munger & Seth Klarman

- Get an investment framework to evaluate any stock idea

- Learn how to identify if a business will be able to sustain its growth are not

- Learn potential accounting red flags to watch-out for in any stock investment idea

- Learn how to evaluate the management of the business you are looking to invest in.

- Understand basics of financial statements including balance sheet, profit & loss statement & cash flow statemen

- Learn Common Size Analysis and Ratio Analysis to understand performance of any business

Who it’s for: Advanced students

Price: 13,99 $USWebsite: udemy.com/course/value-investing-strategies-for-the-stock-market

pinterest.at

pinterest.at -

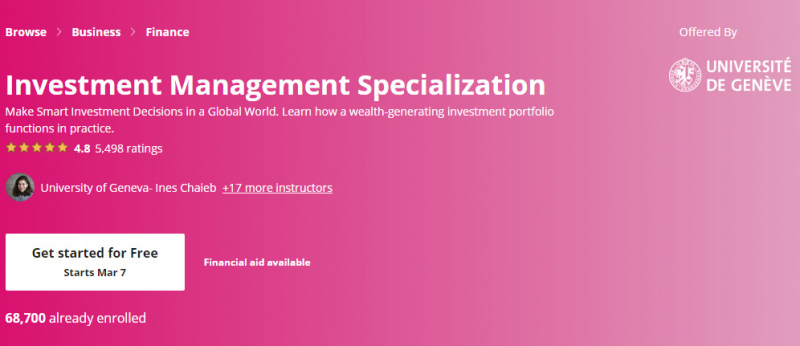

In this Specialization, you will understand how investment strategies are designed to reach financial goals in a global context. You will learn the theory that underlies strong investment decisions, as well as practical, real-world skills that you can apply when discussing investment proposals with your advisor, managing your personal assets or your client’s investment portfolio. You will start by developing a global understanding of financial markets and what impacts rational and irrational behaviors have in finance at the micro and macro levels.

You will then learn how to adequately build and manage a portfolio with a long-term view while gaining an appreciation for novel research advances in finance and related areas as well as future trends that are shaping the investment management industry. In the final Capstone Project, you will create a sensible 5-year investment plan that accounts for an investor's goals and constraints in a dynamic economic landscape. Key speakers from UBS, our corporate partner, will contribute to this specialization by providing you with practical insights they have gathered through years of experience working for the world’s largest wealth manager.

About this course:

- Shareable Certificate: Get a Certificate when you complete

- 100% Online Courses: Start now and learn at times that suit you.

- Flexible schedule: Set and meet flexible deadlines.

- Beginner level: No prior knowledge required.

- Approximately 5 months to complete: Recommended pace of 2 hours/week

- Subtitles: English, Arabic, French, Portuguese (European), Chinese (Simplified), Italian, Vietnamese, German, Russian, Spanish

Price: free

Website: coursera.org/specializations/investment-management

geekflare.com -

By the end of the project, you will understand how to calculate the value at risk for an investment portfolio and quantify risk-to-reward using the Treynor Ratio. To take this course, you must be familiar with basic financial risk management concepts. Take the guided project Compare Stock Returns with Google Sheets to get them.

This course is best suited for students based in North America. They're currently working on bringing the same experience to other parts of the world. The content of this course is not intended to be investment advice, nor does it constitute an offer to perform any operations in the regulated or unregulated financial markets.

Your teacher will guide you step by step, thanks to a split-screen video on your workspace:

- Introduction to Risk

- Monthly returns and Standard DeviationCalculating Beta

- Calculating Treynor Ratio

- Calculating Value at Risk

- Graphing and conclusion

In this free Guided Project, you:

- Quantify risk-to-reward using Treynor Ratio

- Calculate value at risk for investment portfolio

- Highlight this hands-on experience in an interview

Price: free

Website: coursera.org/projects/investment-risk-management

coursera.org

coursera.org