Webull

In 2017, Webull launched its operations, and in 2018, its mobile brokerage platform went live. The company's mobile-first approach mirrors the characteristics of its target audience, which includes young people who are tech-savvy and who value access to real-time market data while on the road. S&P options (SPX), CBOE Volatility Index (VIX) options, and Mini-S&P 500 Index options are just some of the CBOE products that are now available on the Webull platform. In 2021, Webull expanded its offerings to include trading in fractional shares.

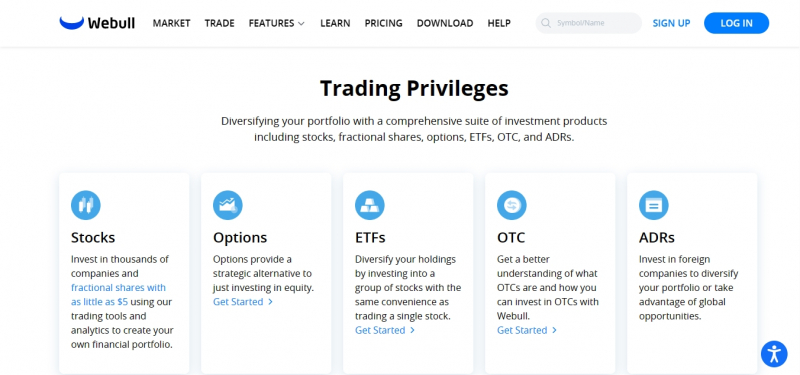

Webull is specialized in providing access to a small number of asset classes, including equities, ETFs, options, and cryptocurrencies. Webull provides its users with valuable resources, including streaming quotations, news, and technical and fundamental analysis, without charging any commissions or fees on these assets. In addition to publishing market calendars, Webull also gives a visual summary of ratings from numerous analysts. Mutual fund and fixed-income trading are not available on the platform.

Pros:

- No-cost stock, ETF, and options trading

- Strong desktop and mobile platforms

- Access to pre and extended hours trading

- Free real-time streaming quotes, news, and fundamentals

- Above average research capabilities

Cons:

- Limited to stock, ETF, options, and cryptocurrency trading

- Less robust options analysis tools than larger competitors

- Weak portfolio analysis tools

- Payment for order flow (PFOF) may result in poor price execution

- No interest earned on uninvested cash

Account Minimum: $0

Fees: $0 commissions for stock, ETF, options, and cryptocurrency trading (small markup is priced in)

Website: https://www.webull.com/