Top 5 Best Options Trading Platforms

To assist investors in finding the optimal platform, Toplist presents the leading options trading platforms in terms of education, speed, cost, tools, ... read more...research, and more.

-

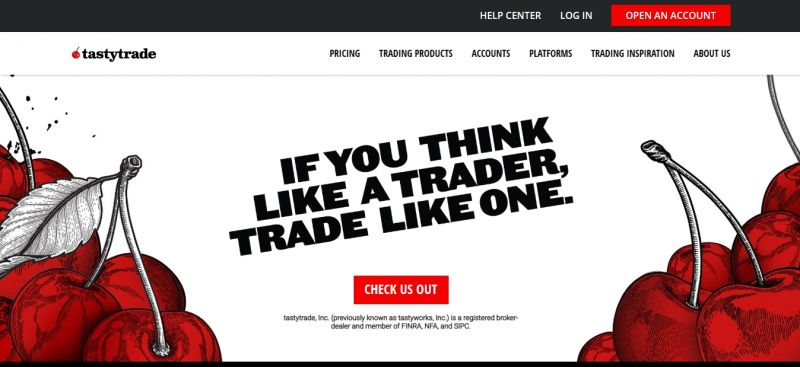

Tastytrade was designed by the same team responsible for TD Ameritrade's stellar Thinkorswim® platform. Motivated by a desire to provide self-directed retail traders with access to markets and sophisticated research tools, the company's founders set out to build such a platform. Tastytrade caters exclusively to active traders and investors and only allows for the purchase and sale of stocks, ETFs, options, and cryptocurrencies.

Options trading on Tastytrade is offered at low, competitive rates. Options trade opening fees are $1 per contract, with a maximum of $10 per leg, regardless of deal size. Each contract has a $0.10 clearing fee added on top. Tastytrade's relatively low fees for options trading are made possible by the fact that, unlike most brokers, it does not charge a commission for closing positions.Pros:

- Competitive commission rates for options

- Multiple tools for analyzing and monitoring options trades

- Library of options-specific content and educational material

- Focus is more on trading than investing

Cons:

- Limited investment choices Focus on trading and options results in weak portfolio analytics No news or fundamental analysis

Account Minimum: $0

Fees: $0 stock trades, $1 to open options trades (capped at $10 per leg), $0 to closeWebsite: https://tastytrade.com/

Screenshot via https://tastytrade.com/

Screenshot via https://tastytrade.com/ -

TD Ameritrade has dethroned last year's victor, tastytrade, as the best for mobile options traders. In recent years, TD Ameritrade and tastytrade have been neck-and-neck, but tastytrade's neglect of news and fundamental research has given thinkorswim® the upper hand. TD Ameritrade is a popular online broker because of the wealth of tools it offers its clients, from beginners to advanced investors. Founded in 1975, Charles Schwab acquired the firm in 2019.

Whether you're an active trader or a passive investor, you'll find a platform at TD Ameritrade that suits your needs. The convenience of being able to trade stocks, options, and other investments on a single platform may outweigh the somewhat higher options commissions offered by this broker.Pros:

- Broad range of product offerings

- Excellent educational materials

- Solid options analytics on thinkorswim®

- Near equality between the powerful desktop and mobile platforms

Cons:

- No fractional shares trading

- No automatic sweep of uninvested cash

- Cryptocurrency trading limited to futures on Bitcoin

Account Minimum: $0.00

Fees: $0.00 for equities and ETFs. $0.65 per contract for options. Futures $2.25 per contractWebsite: https://www.tdameritrade.com/

Screenshot via https://www.tdameritrade.com/

Screenshot via https://www.tdameritrade.com/ -

This year's Advanced Options Traders award goes to Interactive Brokers, which unseats last year's victor, Tasty Trade. This is due to the fact that tastytrade still doesn't provide streaming news or fundamental research, whereas IBKR is making strides towards its goal of being the industry standard.

Thomas Peterffy, the current chairman, established T.P. & Co. in 1978. Founded in 1993 as a U.S. broker-dealer, Interactive Brokers Inc. is credited with developing the first mobile computers specifically designed for trading purposes.Since then, IBKR has risen to prominence as the go-to platform for seasoned investors thanks to its ability to provide access to virtually every type of security traded on the majority of marketplaces.Pros:

- Superb options screeners and probability calculators

- Superior order execution and order routing controls

- Widest range of trading vehicles and market locations

- Low margin rates Available paper trading

Cons:

- Advanced platform features can intimidate new users

- Order routing not available to all clients No backtesting of custom algorithms

Account Minimum: $0.00

Fees: $0.00 commissions for equities and ETFs available on IBKR’s TWS Lite, or low costs scaled by volume for active traders that want access to advanced functionality such as order routing. $0.65 per contract for options on TWS Lite; that is also the base rate for TWS Pro users, with scaled rates based on volume. $0.85 per contract for futures.Website: https://www.interactivebrokers.com/en/home.php

Screenshot via https://www.interactivebrokers.com/en/home.php

Screenshot via https://www.interactivebrokers.com/en/home.php -

Even though E*TRADE's costs are greater than those of competing online brokers in the options trading industry, the company still ranks as our top recommendation for novice traders and investors because of the company's intuitive and powerful desktop, web, and mobile platforms. In 2020, Morgan Stanley acquired E*TRADE, one of the earliest internet brokers founded in the 1980s.

To aid new options traders in learning the ropes, E*TRADE provides not only superb tools and statistics but also a wealth of training materials on options and other investing ideas. One of the best features of E*TRADE for novice options traders is the opportunity to "paper trade," or simulate an actual trade, without risking real money.Pros:

- Excellent educational content

- Robust and easy-to-use platforms for desktop and mobile

- Paper trading

Cons:

- Higher commissions for options trading

- Higher fees for less frequent traders

- Does not support international trading, forex, or cryptocurrency

Account Minimum: $0

Fees: No commission for stock or ETF trades. Options are $0.50–$0.65 per contract, depending on trading volume.Website: https://us.etrade.com/home

Screenshot via https://us.etrade.com/home

Screenshot via https://us.etrade.com/home -

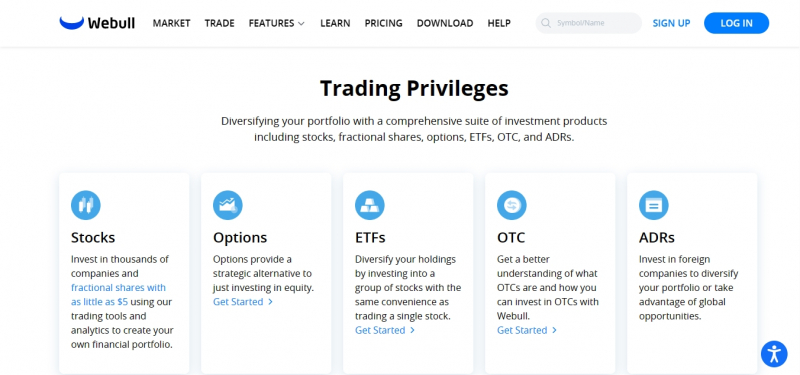

In 2017, Webull launched its operations, and in 2018, its mobile brokerage platform went live. The company's mobile-first approach mirrors the characteristics of its target audience, which includes young people who are tech-savvy and who value access to real-time market data while on the road. S&P options (SPX), CBOE Volatility Index (VIX) options, and Mini-S&P 500 Index options are just some of the CBOE products that are now available on the Webull platform. In 2021, Webull expanded its offerings to include trading in fractional shares.

Webull is specialized in providing access to a small number of asset classes, including equities, ETFs, options, and cryptocurrencies. Webull provides its users with valuable resources, including streaming quotations, news, and technical and fundamental analysis, without charging any commissions or fees on these assets. In addition to publishing market calendars, Webull also gives a visual summary of ratings from numerous analysts. Mutual fund and fixed-income trading are not available on the platform.Pros:

- No-cost stock, ETF, and options trading

- Strong desktop and mobile platforms

- Access to pre and extended hours trading

- Free real-time streaming quotes, news, and fundamentals

- Above average research capabilities

Cons:

- Limited to stock, ETF, options, and cryptocurrency trading

- Less robust options analysis tools than larger competitors

- Weak portfolio analysis tools

- Payment for order flow (PFOF) may result in poor price execution

- No interest earned on uninvested cash

Account Minimum: $0

Fees: $0 commissions for stock, ETF, options, and cryptocurrency trading (small markup is priced in)

Website: https://www.webull.com/

Screenshot via https://www.webull.com/

Screenshot via https://www.webull.com/