Top 10 Asia's Gas And Oil Firms

The oil industry has been hit hard in 2020 and continues to face instability amid the coronavirus crisis. Nevertheless, it has seen positive signs and begun to ... read more...rebound to pre-pandemic levels. Oil investors are hopeful as countries begin to vaccinate their populations and industries resume operations. Toplist has carried out research and here are some of Asia's gas and oil companies.

-

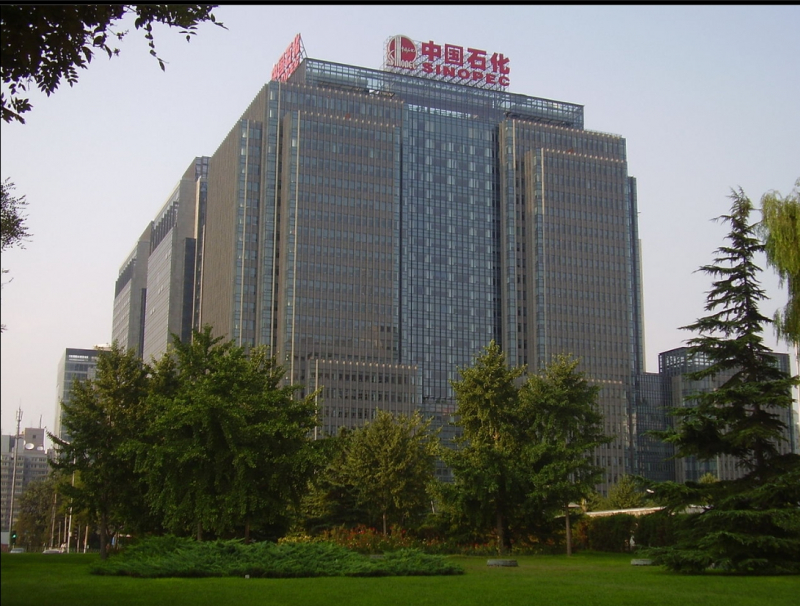

China's state-owned Sinopec was one of the first to feel the effects of the pandemic when China imposed lockdowns in early 2020. Since then, the company has recovered quickly. Although Chinese companies disclose far less information than companies in many other countries, Sinopec earned $323 billion in 2020, according to the white paper. According to GlobalData, the company's 2020 sales fell 28.8%. At the same time, net income fell 43%, raising Sinopec's value to around $70 billion. The company's total loss in 2020 for the company's oil refining and exploration/production was approximately $22 billion. However, gains of $21 billion in marketing and sales offset these losses.

In May, the first vessel docked at the Sinopec Zhongke Refinery Port, China's largest oil terminal. The pier includes a wharf with a capacity of 300,000 tonnes and eight terminals, providing an annual throughput of 5.61 million tonnes. The pier was built by more than 18,000 architects and the first construction cost more than $6 billion. In accordance with China's five-year plan, Sinopec proceeded to develop hydrogen production. The company has installed hydrogen refueling stations in at least four locations and has begun developing the infrastructure and technology for all hydrogen colors.

Founded: 25 February 2000

Headquarters: Chaoyang District, Beijing, China

Market cap: $74.85 Billion As of December 2021

Revenue: $323bn in 2020

Website: sinopec.com/listco/en

Sinopec, http://www.sinopec.com/listco/en/

Sinopec, headquarters - 22 Chaoyangmen North Street, Chaoyang District,Beijing, China, https://en.wikipedia.org/wiki/Sinopec#/media/File:SinopecHQChaoyang.JPG -

PetroChina is the public sector of the state-owned China National Petroleum Corp. The company has surpassed expectations after the pandemic, according to its 2020 annual report. Chairman Zhou Jiping explained that during the spread of Covid19, the focus was on profitable development. In one year, the company increased oil production by 4.8% and gas by 9.9% compared to 2019. At the same time, it reduced the cost of gas production by 8.3% to $11.1 per barrel.

PetroChina`s revenue fell by 23.2% in 2020, with PetroChina`s annual report stating that its financial position “remained stable”. Still, the company increased its full-year dividend by more than 20%. In 2021, PetroChina has achieved new record levels of gross profit, lifted by economic recovery and rising oil prices. The company discovered hydrocarbon reserves in the Sichuan, Ordos, and Tarim basins, which it will now develop. Abroad, the company made discoveries in Chad and Kazakhstan. PetroChina aims to start reducing emissions in 2025, reaching “near-zero” emissions by 2050.

Founded: 5 November 1999

Headquarters: Dongcheng District, Beijing, China

Market cap: $134.23 Billion As of December 2021

Revenue: $296bn in 2020

Website: petrochina.com.cn/ptr/

PetroChina,http://www.petrochina.com.cn/ptr/

PetroChina headquarters ,https://en.wikipedia.org/wiki/PetroChina#/ -

In April 2020, Saudi Aramco reached a record high of 12.1 million barrels per day in one day. In August, the company pumped 10.7 billion cubic feet of gas per day. At the same time, global regulations have forced Saudi Aramco to pump 6% fewer hydrocarbons than in 2019. In the same year, Saudi Aramco was listed on the Saudi Arabian Stock Exchange, but the company is still primarily owned by the Saudi Arabian government. This link has played a key role in helping Saudi Arabia curb oil production in 2020 when demand declines in partnership with other OPEC members and the Russian government. This has forced Saudi Aramco to limit its own production in mid-2020 with the goal of raising oil prices.

In 2020, Saudi Aramco's capital expenditures decreased by $6 billion. However, Aramco spent some money in June to acquire a controlling stake in chemical company Sabic. The company also invested in a joint materials company with oilfield services company Baker Hughes and agreed to build a chemical plant in eastern Saudi Arabia with TotalEnergies. Saudi Aramco achieved a pre-tax profit of $101 billion and a net income of $49 billion in 2020, which is about 60% of the previous year. The company made significant progress in 2021 and profits nearly tripled as oil prices recovered. Saudi Aramco also joined the Hydrogen Council, which aims to accelerate hydrogen development. In August, the company shipped a blue ammonia trial batch to Japan to test its hydrogen export infrastructure. However, in 2020, the company’s flaring intensity slightly rose.

Founded: 29 May 1933

Headquarters: Dhahran, Saudi Arabia

Market cap: $1.864 Trillion As of December 2021

Revenue: $230bn in 2020

Website: aramco.com

Saudi Aramco,https://www.aramco.com/#

Saudi Aramco,https://en.wikipedia.org/wiki/Saudi_Aramco#/ -

China National Offshore Oil Corporation (CNOOC Group) is one of the largest state-owned oil companies in China. It is the third-largest state oil company in the People's Republic of China after CNPC (PetroChina's parent company) and China Petrochemical Corporation (Sinopec's parent company).

By the end of fiscal year 201920, revenues were $109 billion, making it Asia's fourth-largest oil and gas company. CNOOC Group, headquartered in Beijing and established in 1982, specializes in offshore oil and natural gas development, exploration, and development in China. The company's earnings fell 5.1% in 2019-20 to $7 billion.

Founded: 1982

Headquarters: Beijing, China

Market cap: $43.65 Billion As of December 2021

Revenue: $7 billion in 2020

Website: http://www.cnooc.com.cn/

China National Offshore Oil Corporation,http://www.cnooc.com.cn/

China National Offshore Oil Corporation, http://www.cnooc.com.cn/ -

Eneos Holdings is a Japanese oil and metals conglomerate headquartered in Tokyo, Japan. In 2012, the multinational had 24,691 employees worldwide, and as of March 2013, JX Holdings was ranked 43rd in the world by revenue. Mitsubishi Oil is one of the main companies of the Mitsubishi Group through the merger of Original Nippon Oil and Mitsubishi Oil.

The Tokyo-based company generated $75.9 billion at the end of the fiscal year 2019-20 and posted a loss of $1.7 billion over the same period. Eneos Holdings, which changed its name from JXTG Holdings in 2020, was established in 2010. Its business includes the exploration, import and refining of crude oil, and the production and sale of refined products.

Founded: April 1, 2010

Headquarters: Tokyo, Japan

Market cap: $12.39 Billion As of December 2021

Revenue: $68.15 billion in 2020

Website: https://www.hd.eneos.co.jp/english/

Eneos Holdings,https://www.hd.eneos.co.jp/english/

Eneos Holdings,https://content.fortune.com/ -

SK Inc. is a holding and IT services company headquartered in Seoul, South Korea. The company is divided into an investment department and a business department. The investment segment operates as a holding company operating in petroleum, telecommunications, wholesale and retail, chemical, semiconductor, biotechnology and other industries.

SK Innovation Co., Ltd. is an intermediate holding company of SK Group engaged in petroleum, alternative energy, and oil exploration. It runs its business through six major subsidiaries, including SK Energy, SK Geo Centric, SK Lubricants, SK Incheon Petrochem, SK Trading International, and SK IE Technology.

Founded: 2007

Headquarters: Seoul, South Korea

Market cap: $15.00 Billion As of December 2021

Revenue: $30.54 B in 2020

Website: http://eng.skinnovation.com/

SK Innovation, http://eng.skinnovation.com/ -

Petroliam Nasional Berhad (National Petroleum Limited), commonly known as Petronas, the pride and joy of Malaysia, is a Malaysian oil and gas company. Founded in 1974 and 100% owned by the Malaysian government, the company owns all of Malaysia's oil and gas resources and is responsible for adding value to and developing these resources.

Petronas is one of the largest companies in the world according to the Fortune Global 500. In the 2017 Forbes Global 2000 evaluation, Petronas Gas was ranked 1881 on the list of the world's largest public companies. Petronas had assets of $153.78 billion and $100.618 billion in 2014. The company also operates outside of Asia, proving it truly is one of the largest powerhouses in the global oil and gas industry.

Founded: 17 August 1974

Headquarters: Tower 1, Petronas Towers, Kuala Lumpur City Centre, 50088 Kuala Lumpur, Malaysia

Market cap: 33.28B As of November 2021

Revenue: RM179bil in 2020

Website: https://www.petronas.com/

Petronas, https://www.petronas.com/

Petronas,https://d1zah1nkiby91r.cloudfront.net/ -

The next place is the state-owned PTT Public Company Ltd. Known as one of Thailand's largest oil companies, it can still survive despite the difficulties of meeting Thailand's energy demand and fierce competition from foreign companies. The company has $50 billion in assets and has diversified into other energy businesses. So the company proves it's not going anywhere.

Formerly known as the Thai Petroleum Authority, the company owns an extensive subsea gas pipeline in the Gulf of Thailand, a network of LPG terminals across Thailand, and is also involved in power generation, petrochemicals, oil and gas exploration and production, and gasoline. retail business.

Founded: 29 December 1978

Headquarters: 555 Vibhavadi Rangsit Rd, Chatuchak, Bangkok, Thailand.

Market cap: $32.00 Billion As of December 2021

Revenue: $54.72 B in 2021

Website: http://www.pttplc.com/

PTT Public Company,http://www.pttplc.com/

PTT Public Company,https://static.bangkokpost.com/ -

Indian Oil Corporation is a state-owned oil company headquartered in Delhi. Indian Oil, India's largest commercial company and known as India's leading oil company, accounts for nearly half of India's energy demand. The company is also truly profitable because its business interests are linked to every aspect of the oil and gas value chain. With $37.35 billion in assets and operations in India, Mauritius, UAE, and Sri Lanka, Indian Oil is having a great time and will certainly be able to weather the economic storm.

As of May 2018, IOCL became the most profitable public corporation in India for the second consecutive year with a record profit of Rs 21,346 in 2017-2018, followed by Oil and Natural Gas Corporation with a profit of Rs 19,945. ... As of March 31, 2021, Indian Oil had 31,648 employees, including 17,762 executives and 13,876 non-executives. It also employs 2,775 women or 8.77% of its total workforce.

Founded: 30 June 1959

Headquarters: New Delhi, India

Market cap: $15.09 Billion As of December 2021

Revenue: $62.73 B in 2021

Website: http://www.iocl.com/

Indian Oil Corporation,http://www.iocl.com/

Indian Oil Corporation, https://upload.wikimedia.org/ -

Known as the second-largest crude oil producer in Indonesia, Pertamina shows a lot to back up that title. With $50.37 Billion in assets, the company is able to carry out financially-risky oil exploration activities despite the slumping oil prices; proving that it still has a firm grip and confidence on Indonesia’s oil and gas industry. The state-owned company also has its eyes on $1.61 Billion profit this year.

It was founded in August 1968 by the merger of Pertamin (established 1961) and Permina (established 1957). In 2020, Pertamina was the third-largest crude oil producer in Indonesia behind US-based companies ExxonMobil's Mobil Cepu Ltd and Chevron Pacific Indonesia.

Founded: August 1968

Headquarters: Jl. Medan Merdeka Timur, Gambir, Central Jakarta, Indonesia

Market cap: updating

Revenue: $41,469.5 million in 2021

Website: http://www.pertamina.com/

Pertamina,http://www.pertamina.com/

Pertamina, https://ft.ugm.ac.id/