Top 10 Best Books On Financial Crisis

The word "financial crisis" can refer to a variety of events. However, the most typical application is to indicate when the value of financial assets falls by ... read more...a substantial percentage. Economists and historians occasionally propose theories on how a financial crisis occurred. Others examine incidents in order to prevent them from happening again. And it has repercussions in both the country where it occurs and the global economy. Financial crises include stock market collapses, currency crises, and the bursting of financial bubbles. You've come to the perfect site if you're interested in such issues. Toplist has prepared a list of the best books on the financial crisis.

-

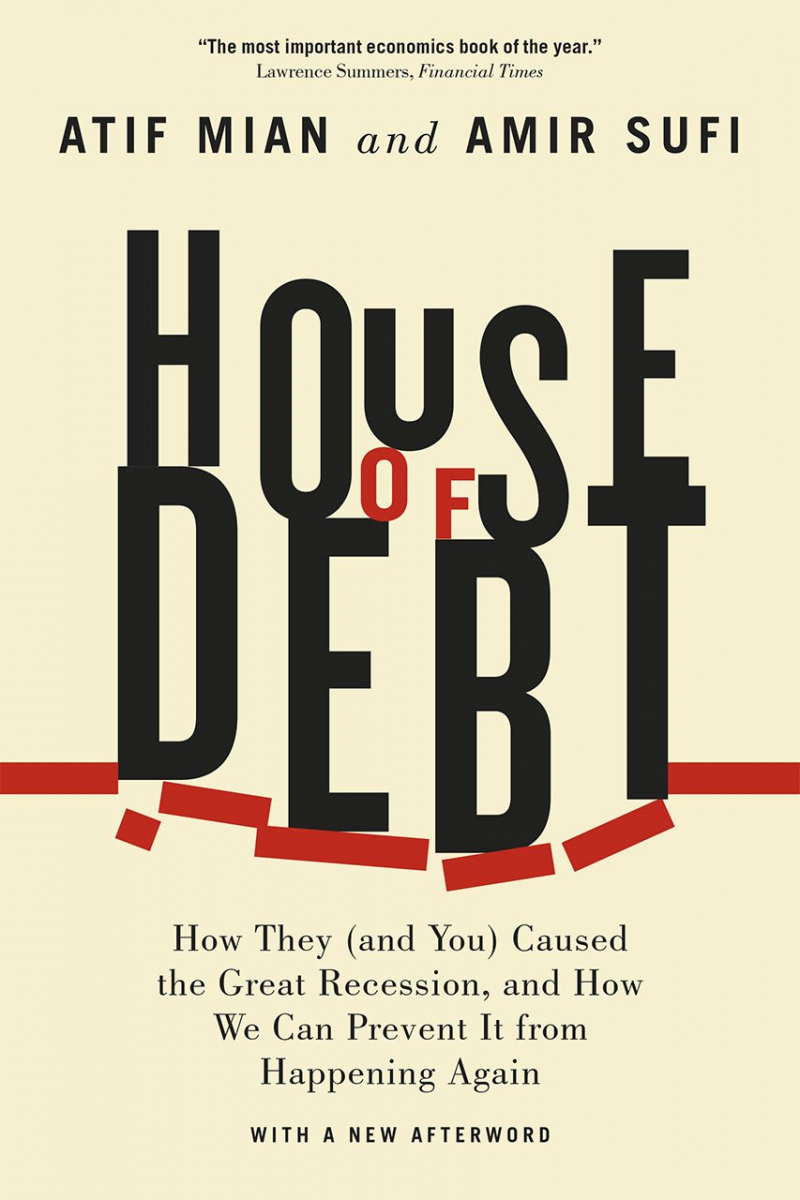

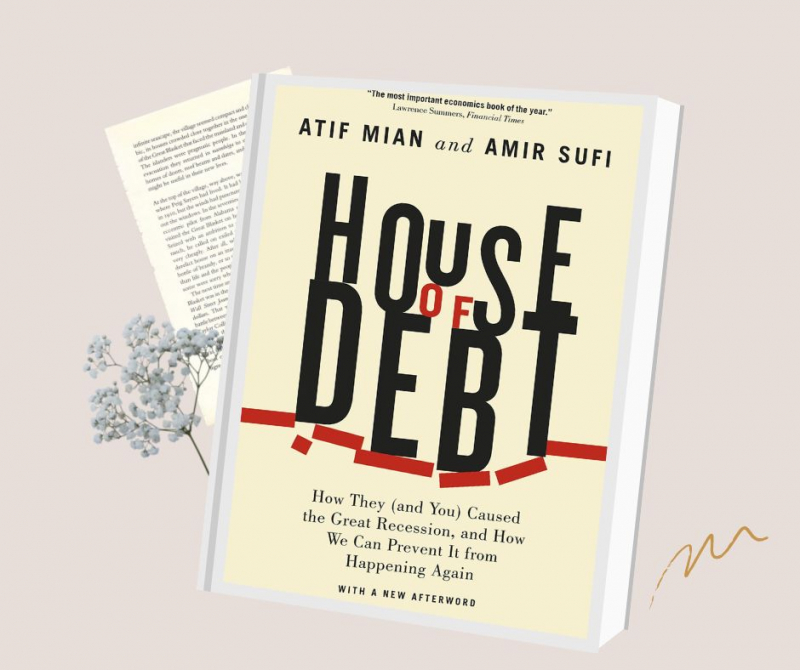

Between 2007 and 2009, the Great American Recession cost eight million jobs. Foreclosures resulted in the loss of over four million houses. Is it a coincidence that the United States saw a tremendous surge in household debt in the years preceding the recession, with the overall amount of debt for American households doubling to $14 trillion between 2000 and 2007? Certainly not. Atif Mian and Amir Sufi demonstrate in House of Debt, armed with clear and convincing data, how the Great Recession and Great Depression, as well as the current economic malaise in Europe, were caused by a substantial increase in family debt followed by a significant decrease in household spending.

Though the banking crisis attracted the public's attention, Mian and Sufi contend that present policy is overly focused on safeguarding banks and creditors. They demonstrate that increasing the flow of credit is disastrously unhelpful when the primary problem is too much debt. According to their findings, excessive household debt leads to foreclosures, prompting people to spend less and conserve more. Less spending equals less demand for goods, which leads to production decreases and massive job losses. How do we break this cycle? Mian and Sufi propose a frontal attack on debt. More aggressive debt forgiveness after the crisis helps, but as they show, we can only get rid of costly bubble-and-bust occurrences if the financial system shifts away from its reliance on rigid debt contracts. As an example, they propose new mortgage arrangements based on the risk-sharing principle, a proposal that might have prevented the housing bubble from forming in the first place.

Among the best books on the financial crisis, House of Debt, based on strong economic facts, provides clear answers to some of the most pressing concerns confronting the modern economy today: What causes severe recessions? Could the Great Recession and its repercussions have been avoided? And what steps should be taken to avoid future crises?

Author: Atif Mian and Amir Sufi

Link to buy: https://www.amazon.com/-/es/Atif-Mian/dp/022627165X

Ratings: 4.4 out of 5 stars (from 223 reviews)

Best Sellers Rank: #208,140 in Books

#61 in Credit Ratings & Repair (Books)

#79 in Microeconomics (Books)

#196 in International Economics (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Andrew Ross Sorkin is The New York Times' award-winning top mergers and acquisitions writer, columnist, and assistant editor of business and finance reporting. He is also the editor and founder of DealBook, a daily financial report published online. He has received the top accolade in business journalism, the Gerald Loeb Award, as well as the Society of American Business Editors and Writers Award. He was recognized a Young Global Leader by the World Economic Forum in 2007.

Too Big to Fail is a nonfiction book by Andrew Ross Sorkin that chronicles the events of the 2008 financial crisis and the collapse of Lehman Brothers from the perspective of Wall Street CEOs and US government regulators. Viking Press published the book on October 20, 2009.

The book provides an overview of the 2008 financial crisis, from the start of 2008 to the decision to establish the Troubled Asset Relief Program (TARP). The book tells the story from the perspectives of the major financial institutions' and regulatory authorities' leaders, describing in great detail their daily discussions and decisions during that difficult period.

Too Big to Fail received the Gerald Loeb Award for Best Business Book in 2010, and was nominated for the Samuel Johnson Prize and the Financial Times and Goldman Sachs Business Book of the Year Award in 2010. The novel was adapted for the HBO television film Too Big to Fail in 2011.

Author: Andrew Ross Sorkin

Link to buy: https://www.amazon.com/gp/product/0143118242

Ratings: 4.5 out of 5 stars (from 1417 reviews)

Best Sellers Rank: #42,227 in Books

#39 in Banks & Banking (Books)

#88 in Economic Conditions (Books)

#125 in Economic History (Books)

https://www.amazon.com/

https://www.amazon.com/ -

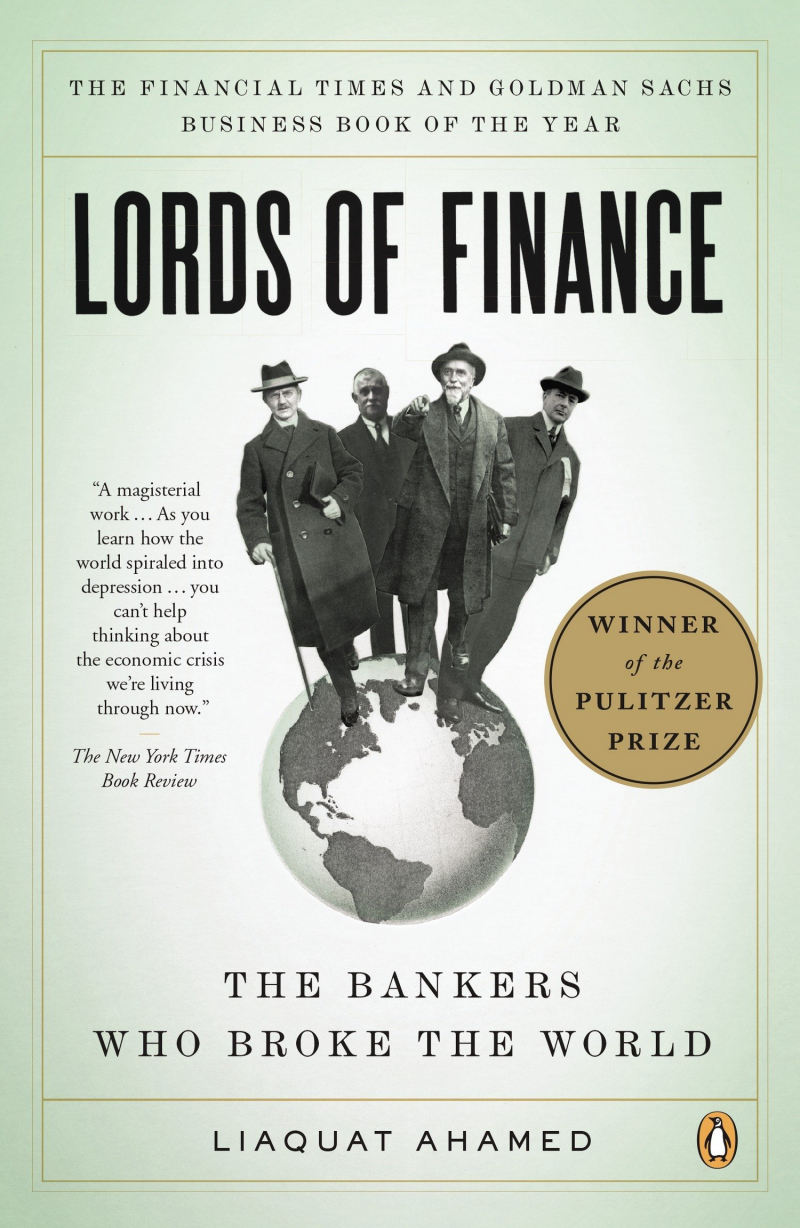

For the past 25 years, Liaquat Ahamed has worked as a professional investment manager. He formerly worked at the World Bank in Washington, D.C., and at the New York-based firm Fischer Francis Trees and Watts, where he was Chief Executive. He is currently an adviser to many hedge fund organizations, including the Rock Creek Group and the Rohatyn Group, as well as a director of Aspen Insurance Co. and a member of the Brookings Institution's Board of Trustees. He holds economics degrees from Harvard and Cambridge Universities.

Liaquat Ahamed's nonfiction book Lords of Finance tells the story of the events leading up to and culminating in the Great Depression through the personal histories of the heads of the world's four major central banks at the time: Benjamin Strong Jr. of the New York Federal Reserve, Montagu Norman of the Bank of England, Émile Moreau of the Banque de France, and Hjalmar Schacht of the Reichsbank. Penguin Press released the text on January 22, 2009. The book received generally positive reviews from critics and was awarded the 2010 Pulitzer Prize in History. Because the book was published in the midst of the 2007-2010 financial crisis, the subject matter was deemed extremely relevant to current financial events.

It is often assumed that the Great Depression, which began in 1929, was caused by a series of events beyond the control of any single individual or government. Indeed, as Liaquat Ahamed explains, the decisions of a tiny handful of central bankers were the principal cause of that economic disaster, the consequences of which laid the ground for World War II and reverberated for decades. Among the best books on the financial crisis, Lords of Finance is a powerful reminder, as we continue to battle with economic turbulence, of the huge impact that central bankers' decisions may have, their fallibility, and the awful human repercussions that can occur when they are wrong.

Author: Liaquat Ahamed

Link to buy: https://www.amazon.com/gp/product/0143116800

Ratings: 4.6 out of 5 stars (from 976 reviews)

Best Sellers Rank: #49,893 in Books

#42 in Banks & Banking (Books)

#50 in Business Ethics (Books)

#148 in Company Business Profiles (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Fortune senior writers Bethany McLean and Peter Elkind McLean, a former Goldman Sachs investment banking analyst, reside in New York City. Bethany McLean is a famous journalist. "Is Enron Overpriced?," her March 2001 article in Fortune, was the first in a national publication to openly question the company's dealings.

The finger-pointing began as soon as the financial crisis erupted. Should the finger be pointed at Wall Street, Main Street, or Pennsylvania Avenue? On greedy traders, erroneous regulators, shady subprime lenders, cowardly legislators, or oblivious home buyers?

The real answer, according to Bethany McLean and Joe Nocera, two of America's most acclaimed business journalists, is all of the above and more. Many devils contributed to the economy's downfall. And the entire story, in all its complexities and details, is reminiscent of the legend of the blind men and the elephant. Almost no one has seen the big picture. Almost no one has assembled all of the puzzle pieces.

All the Devils Are Here delves into the hidden history of the financial crisis in a way that no other book has. It delves into the motivations of famous CEOs, cabinet secretaries, and politicians, as well as anonymous lenders, borrowers, analysts, and Wall Street traders. It delves into the potent American myth of homeownership. And it demonstrates that the crisis was ultimately about human nature rather than finance.

Author: Bethany McLean and Joe Nocera

Link to buy: https://www.amazon.com/gp/product/159184438X

Ratings: 4.6 out of 5 stars (from 579 reviews)

Best Sellers Rank: #64,242 in Books

#70 in Banks & Banking (Books)

#144 in Real Estate Investments (Books)

#187 in Company Business Profiles (Books)

https://www.amazon.com/

carousell.com.my -

Nouriel Roubini is the founder and chairman of Roubini Global Economics, as well as an economics professor at New York University's Stern School of Business. He has worked at the White House and the United States Treasury. He currently resides in New York City.

Stephen Mihm is an associate professor of history at the University of Georgia and writes about economics and history for The New York Times Magazine, The Boston Globe, and other media. He currently resides in Decatur, Georgia.

Renowned economist Nouriel Roubini electrified the financial sector by foreseeing the 2008 financial catastrophe before others in his area. This myth-busting book Crisis Economics uncovers the strategies he used to predict the current crisis and demonstrates how those methods might help us make sense of the present and plan for the future. Nouriel Roubini and Stephen Mihm, a journalist and professor of economic history, deliver a crucial and timeless work that demonstrates that disasters are not only predicted but also preventable and, with the appropriate treatment, curable. Crisis Economics is among the best books on the financial crisis you should read.

Author: Nouriel Roubini and Stephen Mihm

Link to buy: https://www.amazon.com/gp/product/014311963X

Ratings: 4.3 out of 5 stars (from 201 reviews)

Best Sellers Rank: #880,126 in Books

#432 in Business Planning & Forecasting (Books)

#1,040 in International Economics (Books)

#2,010 in Economic Conditions (Books)

https://www.amazon.com/

carousell.sg -

Rana Foroohar just joined the Financial Times as a global business journalist and Associate Editor. She also serves as CNN's global economic commentator. Prior to joining the Financial Times and CNN, Foroohar was the assistant managing editor in charge of business and economics at TIME for six years, as well as the magazine's economic columnist. She also worked for Newsweek for 13 years as an economic and foreign affairs editor as well as a foreign reporter covering Europe and the Middle East. During that time, she received the Peter Weitz Prize for transatlantic reporting from the German Marshall Fund.

When it comes to the dynamics that formed the 2016 presidential election, one thing is clear: a large portion of the population believes that our economic system is rigged to reward the privileged elites at the expense of hardworking Americans. This is a belief shared by people on both sides of the political spectrum, and it appears to be gaining traction.

According to Financial Times columnist Rana Foroohar, one of the main reasons is that Wall Street is no longer supporting Main Street enterprises that create jobs for the middle and working classes. She uses in-depth reporting and conversations with leaders in business and government to demonstrate how the "financialization of America", the phenomena in which finance and its way of thinking have come to dominate every aspect of business, is endangering the American Dream.

Makers and Takers, now updated with new material explaining how our corrupted financial system propelled Donald Trump to power, delves into the forces that have led American businesses to favor balance-sheet engineering over the actual kind, greed overgrowth, and short-term profits over putting people to work. From Wall Street's cozy relationship with Washington to a tax scheme designed to reward wealthy individuals and businesses, to forty years of disastrous policy decisions, she explains why so many Americans have lost trust in the system, and why it matters so much to us all.

Foroohar demonstrates how we can reverse these patterns for a better road forward via colorful anecdotes of both "Takers," individuals restricting job creation while padding their own pockets, and "Makers," entrepreneurs helping the real economy.

Author: Rana Foroohar

Link to buy: https://www.amazon.com/gp/product/0553447254

Ratings: 4.4 out of 5 stars (from 377reviews)

Best Sellers Rank: #73,117 in Books

#54 in Income Inequality

#95 in Economic Policy & Development (Books)

#97 in Economic Policy

https://www.amazon.com/

https://www.amazon.com/ -

For more than a decade, Roger Lowenstein, author of the best-selling books Buffett: The Making of an American Capitalist and When Genius Failed: The Rise and Fall of Long-Term Capital Management, reported for the Wall Street Journal and wrote the stock market column "Heard on the Street" as well as the "Intrinsic Value" column. He now writes for the Journal and the New York Times Magazine and is a columnist for SmartMoney Magazine.

Bestselling author Roger Lowenstein delivers the complete story of the end of Wall Street as we knew it, with razor-sharp insight.

Among the best books on the financial crisis, The End of Wall Street by Roger Lowenstein is a riveting account of the 2008 financial meltdown based on 180 interviews with top government officials and Wall Street executives. Lowenstein delves into the crisis's origins to show how America succumbed to the siren call of easy loans and speculative mortgages. The Conclusion of Wall Street charts the end of an age of unparalleled and unjustifiable optimism while looking ahead to the legacy of the bailout, combining profound analysis with blazing narrative.

Author: Roger Lowenstein

Link to buy: https://www.amazon.com/End-Wall-Street-Roger-Lowenstein/dp/0143118722

Ratings: 4.4 out of 5 stars (from 114 reviews)

Best Sellers Rank: #622,203 in Books

#776 in Political Economy

#1,411 in Economic Conditions (Books)

#1,581 in Economic History (Books)

https://www.amazon.com/

https://www.amazon.com/ -

Greg Farrell is a Financial Times correspondent. In January 2009, he said that Merrill Lynch had paid out its 2008 bonuses a month ahead of schedule, in December, despite Merrill losing $28 billion for the year and Bank of America requiring an additional $20 billion in taxpayer cash to complete its takeover of the firm. The story prompted New York Attorney General Andrew Cuomo to launch an investigation. Greg has previously received the American Business Press's Jesse Neal Award for investigative reporting and the Knight-Bagehot Fellowship for business journalism. He received a BA from Harvard University and an MBA from Columbia University's Graduate School of Business.

With one notable exception, the Wall Street firms have long been part of an inbred, insular culture that most people only vaguely grasp. Merrill Lynch was an exception, a firm that revolutionized the stock market by bringing Wall Street to Main Street, opening offices in far-flung cities and towns long ignored by finance's titans. Perhaps no other industry, whether in financial services or elsewhere, exemplified the American spirit more than the "thundering herd" of financial counselors. Merrill Lynch was not just "bullish on America," but it was also a major reason why so many ordinary Americans became wealthy by investing in the stock market.

Merrill Lynch was a household name. Its abrupt slide, failure, and sale to Bank of America came as a surprise. What caused that to happen? What caused that to happen? And what does this tale of greed, arrogance, and ineptitude teach us about the culture of Wall Street, which persists even after nearly ruining the American economy? A culture in which the CEO of a company that is losing $28 billion fights hard for a $25 million bonus. A culture in which two Merrill Lynch executives have assured incentives of $30 million and $40 million for four months of work, despite the firm's efforts to decrease losses by laying off thousands of people.

Greg Farrell's Crash of the Titans is a Shakespearean story of three imperfect masters of the world, based on unprecedented sources at both Merrill Lynch and Bank of America. E. Stanley O'Neal, whose inspirational rise from the segregated South to the corner office of Merrill Lynch, where he staged a spectacular turnaround, was derailed by his notion that a smooth-talking salesperson could perform one of Wall Street's most challenging positions. Because he had O'Neal's backing, this executive was able to amass a staggering $30 billion position in CDOs on the firm's balance sheet at a time when all other Wall Street firms were desperately attempting to exit the sector. Following O'Neal is John Thain, the MIT-educated technocrat whose rescue of the New York Stock Exchange won him the moniker "Super Thain." He was hired to save Merrill Lynch in late 2007, but his optimism in the markets caused him to misunderstand Merrill's troubles. Finally, we meet Bank of America CEO Ken Lewis, a street fighter raised barely above the poverty line in rural Georgia, whose "my way or the highway" management style suffers fools more easily than potential rivals, and who made a $50 billion commitment over a September weekend to buy a business he barely understood, putting his own institution in jeopardy.

The merger itself turns out to be a weird mix of cultures that blend like oil and water, with sophisticated Wall Street bankers, suddenly reporting to a cast of Beverly Hillbillies types. BofA's inbred culture, which saw New York banks as its adversaries, was centered on loyalty and a good-ol'-boy network in which competence took a back seat to unquestioning devotion.

Crash of the Titans is a financial thriller that immerses you in the historic events of the financial crisis as people in charge of billions of dollars of other people's money gamble foolishly to increase their power and income or save their own skins. Its richness of previously unknown information and focus on two corporate America titans make it the book that brings the Wall Street calamity together.

Author: Greg Farrell

Link to buy: https://www.amazon.com/gp/product/0307717879

Ratings: 4.6 out of 5 stars (from 195 reviews)

Best Sellers Rank: #187,796 in Books

#128 in Macroeconomics (Books)

#188 in Banks & Banking (Books)

#449 in Economic Conditions (Books)

https://www.amazon.com/

ebay.com -

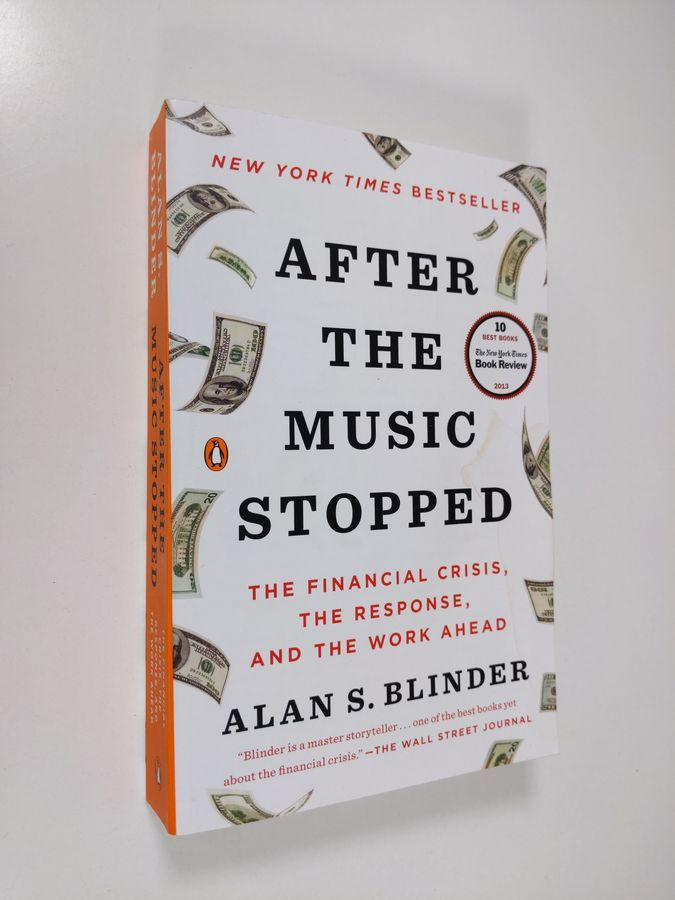

Alan S. Blinder is the Gordon S. Rentschler Memorial Professor of Economics and Public Affairs at Princeton University and the vice chairman of the Promontory Interfinancial Network.

Many excellent publications on the financial crisis were early drafts of history, written to meet the demand for rapid comprehension. Alan S. Blinder, esteemed Princeton professor, Wall Street Journal columnist, and former vice chairman of the Federal Reserve Board, waited, taking the time to understand the crisis and think his way through to a truly comprehensive and coherent narrative of how the worst economic crisis in postwar American history occurred, what the government did to combat it, and what we can do from here, wading through its wreckage as we still are.

Blinder describes how, beginning in 2007, the United States' financial sector, which had grown much too complicated for its own good, and far too unregulated for the public good, met a perfect storm. The much-discussed housing bubble popped, but the accompanying implosion of what Blinder refers to as the "bond bubble" was larger and more damaging. Some regard the financial business as a sideshow with no connection to the real economy where the jobs, factories, and stores are. But finance is more like the economic body's circulatory system: if the blood stops flowing, the body goes into cardiac arrest. When America's financial structure collapsed, the consequences were not just severe, but also widespread. It took the crisis for the world to realize how deeply interconnected and fragile the global financial system is. According to some commentators, enormous global factors were the primary causes of the crisis. Blinder disagrees, claiming that the problem began in the United States and spread internationally as sophisticated, opaque, and overpriced investment products were exported to a hungry world, nearly poisoning it.

The second section of the story describes how American and worldwide government involvement saved the world from utter collapse. Many of the operations of the United States government, particularly the Federal Reserve, were previously unthinkable. And they worked to an amazing and certainly misunderstood extent. The worst did not occur. Blinder provides clear-eyed solutions to the remaining problems, even if some of the options ahead are as controversial as they are inescapable. After the Music Stopped is an important piece of history that we cannot afford to overlook, since history reminds us that it will happen again.

Author: Alan S. Blinder

Link to buy: https://www.amazon.com/gp/product/014312448X

Ratings: 4.4 out of 5 stars (from 324 reviews)

Best Sellers Rank: #212,783 in Books

#270 in Economic Policy

#272 in Economic Policy & Development (Books)

#513 in Economic Conditions (Books)

https://www.amazon.com/

finlandiakirja.fi -

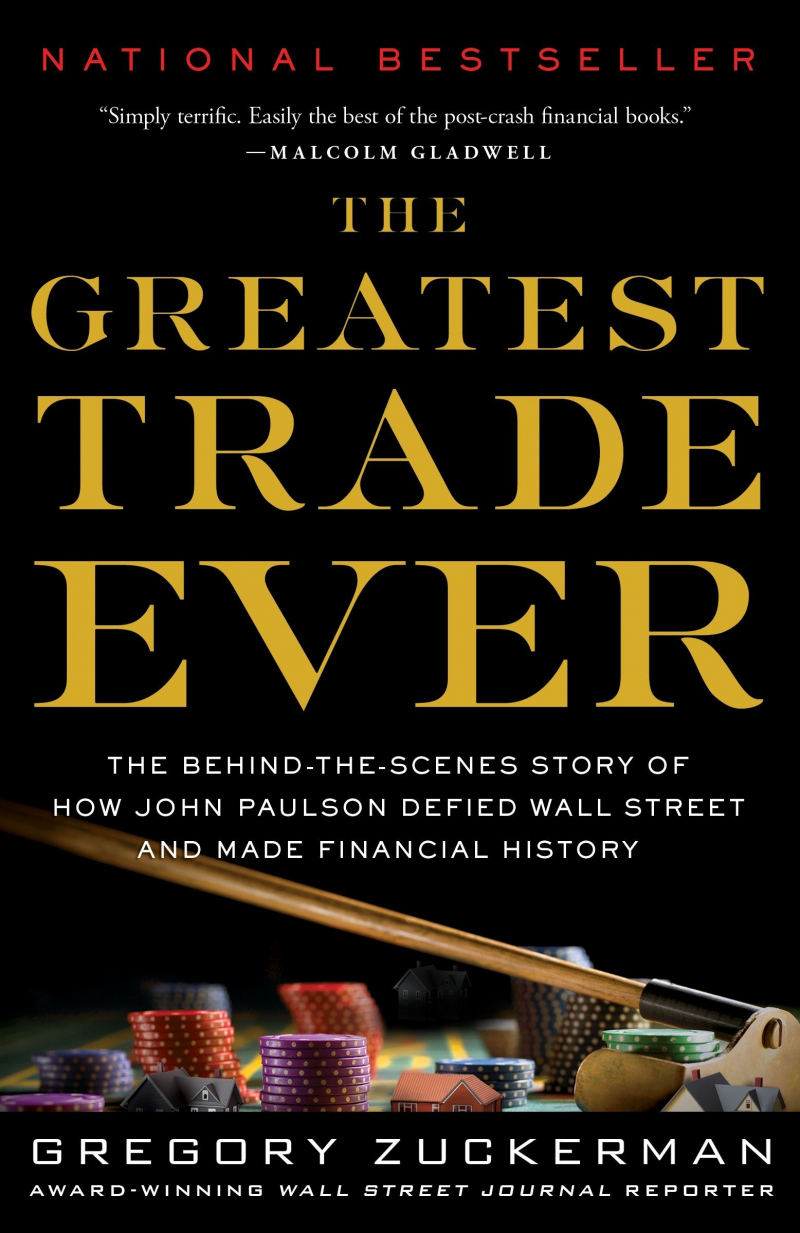

The Greatest Trade Ever, written by the Pulitzer Prize-winning reporter who broke the story in The Wall Street Journal, is a superbly written, fast-paced, behind-the-scenes account of how a contrarian foresaw an escalating financial crisis, outwitting Chuck Prince, Stanley O'Neal, Richard Fuld, and Wall Street's titans to make financial history.

In 2006, hedge fund manager John Paulson saw something few others did: the housing market and the value of subprime mortgages were excessively overvalued and on their way down. However, Paulson's background was in mergers and acquisitions, and he knew nothing about real estate or how to bet against housing. He'd spent his entire career on Wall Street as an afterthought. But Paulson was certain that this was his moment to shine. He simply didn't know how to go about it. Investment bank colleagues mocked him, and investors dismissed him. Even real estate professionals who were dubious about the housing market avoided the sophisticated derivative deals that Paulson was only learning about. However, Paulson and a few other rogue investors, including Jeffrey Greene and Michael Burry, began to wager aggressively against bad mortgages and unstable financial firms. However, timing is everything. Initially, Paulson and his colleagues lost tens of millions of dollars as real estate and stock prices skyrocketed. Rather than backing down, Paulson increased his wagers, putting both his hedge firm and his reputation at risk.

The markets began to crash in the summer of 2007, providing Paulson early profits but also igniting efforts to save real estate and derail him. By the end of the year, however, John Paulson had pulled off the largest trade in financial history, earning his firm more than $15 billion- a number that surpassed George Soros's billion-dollar currency trade in 1992. Paulson gained billions more in 2008 by repurposing his audacious maneuver. Some of the underdog investors who took the risky gamble also made a fortune. Others, on the other hand, who failed due to poor timing discovered that being early and correct wasn't nearly enough.

Author: Gregory Zuckerman

Link to buy: https://www.amazon.com/gp/product/0385529945

Ratings: 4.6 out of 5 stars (from 662 reviews)

Best Sellers Rank: #328,981 in Books

#109 in Private Equity (Books)

#876 in Economic History (Books)

#1,221 in Business Professional's Biographies

https://www.amazon.com/

https://www.amazon.com/