Top 10 Best Books On Financial Freedom

Financial freedom is the concept of becoming financially independent and being able to spend money on things that one enjoys. The concept stems from retiring ... read more...early and reaching a point in life where an individual has no financial obligations and is living a free and prosperous life doing work that they enjoy rather than work that is required to support a lifestyle. Now financial freedom becomes the ideal life of people of all ages and helps them to strengthen their happiness, stability and self-worth. The key to understanding it is to read the best books on financial freedom written by the world's brightest minds listed below.

-

The Almanack Of Naval Ravikant by Eric Jorgenson is a guide to wealth and happiness. With perspective and knowledge, the author and the book are known for changing many people's lives. However, it is not just any ordinary financial advice book; it discusses much more. This is a classic and one of the best books on financial freedom to read in your life.

According to the author, in order to be happy with money, health, meditation, and life goals, people must take care of themselves. The book is divided into two parts: wealth and happiness, and thus it discusses earning money, working the right way, becoming wealthy, and remaining wealthy. The book discusses how to enjoy the journey of wealth creation.

Important Takeaways:

- According to the book, money is a tool for becoming wealthy. However, it also implies an understanding of the importance of time and consistency in life.

- People must work hard in the right way to become wealthy; otherwise, contentment will always be lacking.

- The author advises readers to use compound interest with money, personality, and character.

Author: Eric Jorgenson

Link to buy: https://www.amazon.com/dp/1544514212?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

https://www.amazon.com/

https://www.amazon.com/ -

Morgan Housel's The Psychology of Money contains timeless lessons on wealth, greed, and happiness. The book was published in the year 2020. It offers a unique perspective on the use of money and how people's weaknesses with money stem from their relationship with it.

The author demonstrates that wealthy people make the most irrational financial decisions, and the goalpost moves as people earn more money. As a result, knowing when to spend enough and be satisfied is critical. The book also explains the car paradox, in which people do not think others in expensive cars are cool, but instead imagine themselves in that car. The book is one of the best books on financial freedom to read.

Important Takeaways:

- The author uses people's money relationships and perspectives to explain why they are afraid of investing and reinvesting.

- The book cites businessman Warren Buffet as an example of the power of compounding.

- According to the author, a tight budget, flexible thinking, and a flexible timeline can help people make good investments.

- The author advises readers not to be misled by people's apparent wealth.

Author: Morgan Housel

Link to buy: https://www.amazon.com/dp/0857197681?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

https://www.amazon.com/

https://www.amazon.com/ -

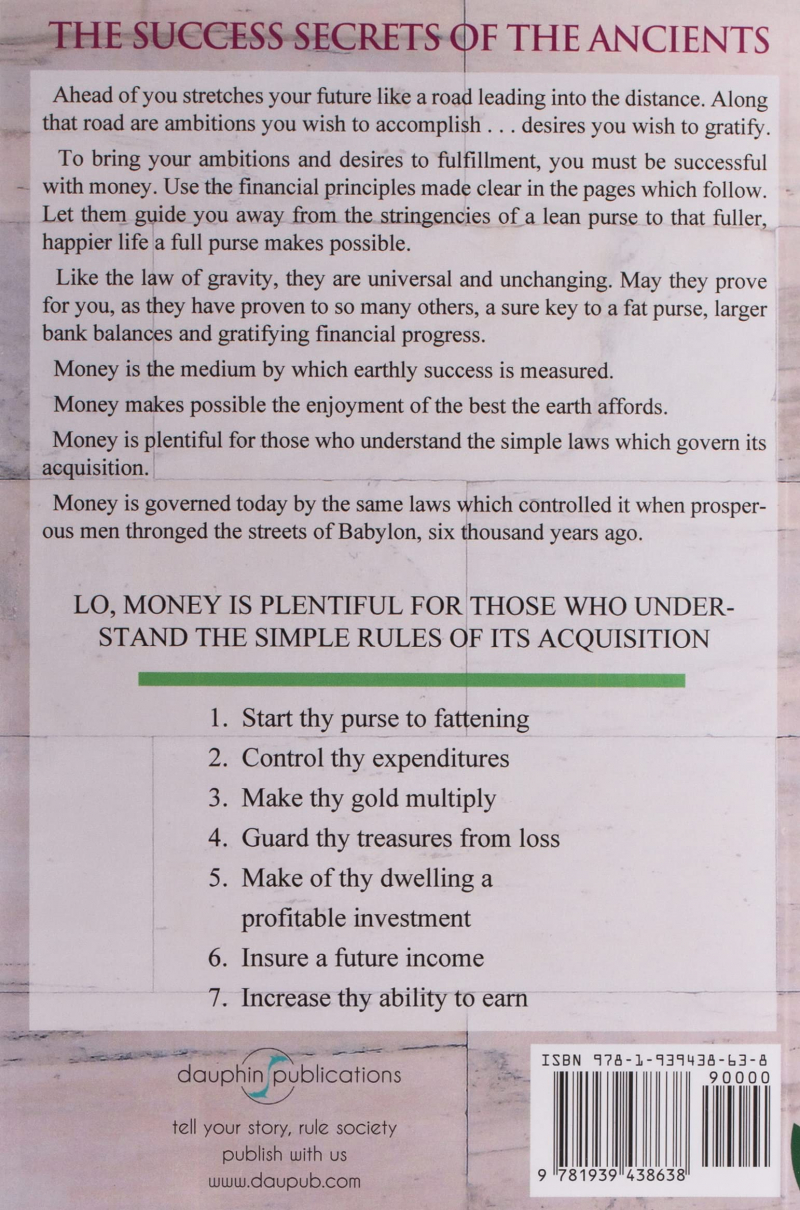

The book was first published in 1926, but many people still talk about it and use it to understand the value of money. Based on "Babylonian parables," The Richest Man in Babylon has been hailed as the greatest of all inspirational works on the subject of thrift, financial planning, and personal wealth. These fascinating and informative stories, written in simple language, set you on a sure path to prosperity and the joys that come with it. It is a well-known best-seller that provides insight and a solution to your personal financial problems. The secrets to making money, keeping money, and making money earn more money are revealed inside.

Along with seven money rules, the book teaches three lessons for beginning to build wealth: living below your means, learning to be lucky by working hard, and never going into debt. According to the author, anyone who follows these three lessons is already ahead of many others. He goes on to say that people should use less self-talk to justify their unnecessary purchases.

Important Takeaways:

- The book contains seven money rules.

- It provides a solid idea for money and is a must-read for beginners.

- According to the book, you should invest 10% of your income in the right assets.

Author: George Samuel Clason

Link to buy: https://www.amazon.com/dp/1939438632?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

https://www.amazon.com/

https://www.amazon.com/ -

Rich Dad's Cashflow Quadrant is a rich Dad's financial freedom guide. Rich Dad Co., the author's company, focuses on private financial education. He also wrote the classic "Rich Dad, Poor Dad."

The book discusses how some people work less and earn more, and it encourages others to do the same. The book is significant because it explains why some people make so much money while others struggle financially. Robert Kiyosaki divided the world into four quadrants: employee, business owner, self-employed, and investor. The book also discusses how people have long suffered from financial insecurity and how they can overcome it.

Important Takeaways:

- The author designed a quadrant in the book to explain where and how people fall and what they should do.

- It explains the problem of poor mindset and people's struggles to overcome it.

- The author condemns poor mentality and claims that people's mindsets must change in order for them to become wealthy.

Author: Robert T. Kiyosaki

Link to buy: https://www.amazon.com/dp/1612680054?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

https://www.amazon.com/

https://www.amazon.com/ -

The Millionaire Fastlane was published in 2011, and the author discusses the proper way to create wealth by following simple formulas and retiring early. It is considered one of the best books on financial freedom.

The author is very interested in the old and proper way of studying, getting a degree, working, and starting saving and creating wealth in the most basic way that most people do it. The book suggests that there is nothing wrong with working hard, but there are steps people can take in between to ensure a positive outcome.

Important Takeaways:

- The book explains what is wrong with the traditional method of gradually earning and creating wealth.

- According to the author, wealth is built on three things, none of which are money.

- It uses many famous people as examples to explain the income model in terms of time.

- The author explains that becoming a producer is more important than remaining a consumer.

Author: M. J. DeMarco

Link to buy: https://www.amazon.com/dp/0984358102?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

https://www.amazon.com/

https://www.amazon.com/ -

Among the best books on financial freedom, The 9 Steps To Financial Freedom by Suze Orman are both practical and spiritual steps that will allow you to stop worrying. Although the book was published in 1997, it remains relevant to financial planning, money management, and work-life balance.

The 9 Steps To Financial Freedom is about taking control of one's personal finances in order to achieve financial independence. The author encourages those with a sense of responsibility to assist the less fortunate. Suze discusses her personal experience as a Certified Financial Planner professional, as well as other jobs she has held. She also encourages people to face their fears and learn what true wealth entails. The book also explains why people should value their work and money.

Important Takeaways:

- The author of this book proposes nine steps to financial independence.

- All nine steps involve aspects of life other than money and finances.

- She emphasizes the importance of being honest with yourself.

- According to the author, it is critical to ensure long-term life insurance plans and other applicable benefits.

Author: Suze Orman

Link to buy: https://www.amazon.com/dp/030734584X?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

ffcompendium.com

amazon.com -

The author released Financial Freedom in 2019 and offered advice to people looking to achieve financial independence and live life to the fullest. This is one of the best financial freedom books for beginners.

The author describes his personal journey from $2.26 to $1 million in just five years. He recommends that readers begin investing as soon as possible because time is more valuable than money. Grant Sabatier guarantees that by following these simple steps, people can rewrite their retirement. He also claims that financial freedom comes from sticking to your work and achieving your goal.

Important Takeaways:

- The author outlines seven steps to financial independence.

- He asks people to consider how much money they believe they will need by the time they want to retire.

- The book explains how money is synonymous with freedom.

- According to the author, impulse is an enemy of freedom.

Author: Grant Sabatier

Link to buy: https://www.amazon.com/dp/052553458X?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

https://www.amazon.com/

https://www.amazon.com/ -

The Wealthy Barber by David Chilton is a straightforward guide to successful financial planning. The book was first published in 1989 and has had a huge impact on people because of its subtle art of storytelling, in which a reader can relate to the fictional character established by the author.

The author introduces a fictional character, Ray Miller, a barber, and provides some slow and steady ways of making it big in the long run through his life story and experiences. There are many books that provide shortcuts to making more money in life, but this book is not like other books about financial independence. The book's popularity stems from its real-life references.

Important Takeaways:

- The book discusses various aspects of financial freedom.

- It is written in a novel format, which works in its favor and distinguishes it from other financial freedom books.

- Financial freedom is an important topic, but many people find it tedious to read; however, this book changes that.

Author: David Chilton

Link to buy: https://www.amazon.com/dp/0773762167?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

goodreads.com

fromalicewithlove.com -

Thinking, Fast And Slow by Daniel Kahneman was published in 2011 and has inspired people who are looking for spiritual upliftment, money management techniques, and financial literacy. In this megabestseller, world-renowned psychologist and Nobel Prize winner Daniel Kahneman takes you on a groundbreaking tour of the mind and explains the two systems that drive the way you think.

System 1 is quick, intuitive, and emotional, whereas System 2 is slower, more deliberate, and logical. The impact of overconfidence on corporate strategies, the difficulty of predicting what will make us happy in the future, and the profound effect of cognitive biases on everything from playing the stock market to planning our next vacation can all be understood only by understanding how the two systems shape our judgments and decisions.

Kahneman engages the reader in a lively discussion about how we think, revealing where we can and cannot trust our intuitions and how we can reap the benefits of slow thinking. He provides practical and illuminating insights into how we make decisions in both our professional and personal lives, as well as how we can use various techniques to avoid the mental blunders that frequently get us into trouble.

According to the author, the brain's general behavior is lazy, and it prevents people from using it to its full potential. In relation to financial freedom books, this book states that when people make financial decisions, they should put their emotions aside. According to the author, life is unpredictable, and people should have a clear vision of what they want. Thinking, Fast And Slow is exactly one of the best books on financial freedom and psychology to read.

Important Takeaways:

- The book discusses two systems that allow the brain to function and think (conscious and automatic).

- The author discusses how most people deceive themselves and cannot think clearly.

- It suggests that people examine their flaws. It is difficult, but it must be done.

Author: Daniel Kahneman

Link to buy: https://www.amazon.com/dp/0374533555?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

https://www.amazon.com/

https://www.amazon.com/ -

Money and the Law of Attraction by Esther Hicks and Jerry Hicks shows you how to attract wealth, health, and happiness. The book is regarded as one of the best books on financial freedom ever written. Many people's lives have been changed as a result of the book, which was published in 2008. It specifically highlights various issues that people face in their lives and can drive its stability.

Money, And The Law Of Attraction discusses two major topics: the application of the law of attraction in finance and the physical well-being of people in society. The authors want people to take charge of their finances and their lives. They emphasize that many people suffer as a result of a lack of money, health, and power in their lives. They hope to instill the law of attraction in the lives of their readers through this book.

Important Takeaways:

- The book discusses people's life struggles as well as money and living issues.

- Both authors want people to admire the law of attraction in all aspects of their lives, including finance.

Author: Esther Hicks and Jerry Hicks

Link to buy: https://www.amazon.com/dp/1401959563?tag=wallstreetmoj-20&linkCode=ogi&th=1&psc=1

https://www.amazon.com/

https://www.amazon.com/