Top 11 Best Companies for Travel Insurance in The US

These are the top travel insurance companies to get you protected, whether you're looking for an international travel insurance plan, emergency medical care, ... read more...COVID coverage, or a policy that covers extreme sports. Take a look at top 10 list of businesses below, whether you already have a particular insurer in mind or simply want to learn more about some of the best travel insurance providers.

-

Ten different travel insurance options are offered by Allianz Travel Insurance to accommodate various traveler demands. If you frequently travel and would like to avoid purchasing a new travel insurance policy each time, you can get an annual travel insurance plan in addition to coverage for a specific trip.

OneTrip Premier offers benefits like up to $100,000 in trip cancellation insurance, $150,000 in trip interruption insurance, $50,000 in emergency medical coverage, up to $1,000 in baggage loss, theft, or damage insurance, and up to $800 in travel delay insurance. While traveling with a parent or grandparent, children under the age of 17 are also covered at no cost under the OneTrip Premier plan. You may also purchase extra coverage for preexisting conditions or rental cars.

Allianz offers various levels of coverage when it comes to acquiring travel insurance for a specific trip. The OneTrip Premier plan is its most popular single-trip option, while each plan has its own inclusions and coverage limits.You may also submit an application for a quote on travel insurance, make a claim, update your policy, or check on a claim online with Allianz. Also, the business provides a smartphone app so you may control your subscription from your favorite mobile device. Consumers can also call a 24-hour hotline for support if they run into any problems.

- Pro: Annual and multitrip policies are available

- Con: Distinguishing between the company's 10 travel insurance plans can be confusing

Website: https://www.allianztravelinsurance.com/

Screenshot via https://www.allianztravelinsurance.com/

Screenshot via https://www.allianztravelinsurance.com/ -

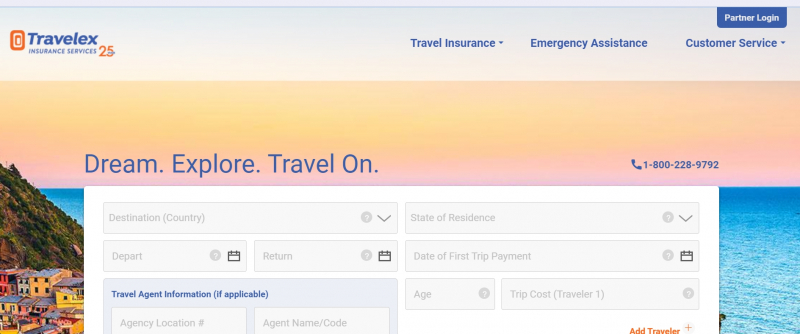

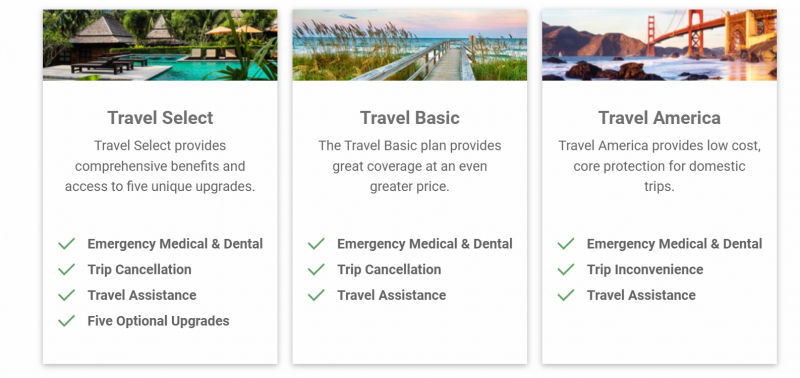

Travel Basic and Travel Select are the two primary travel insurance options provided by Travelex. The business also has a Travel America plan that is dedicated to the United States. Additionally, Travelex offers various add-ons that let you to customize your coverage to match your specific needs.

The business's Travel Basic plan should be taken into consideration if you're looking for a cheap option. For trip disruptions and cancellations, this plan will pay out 100% of the covered trip cost, as well as up to $500 for delays. Additionally, it provides up to $500 in coverage for lost, damaged, or stolen luggage and personal items in addition to up to $100,000 in emergency medical evacuation and repatriation coverage, $15,000 in emergency medical and dental coverage, and $100,000 in total. You also have access to primary insurance that is deductible-free. This itinerary is suggested by the company for quick domestic holidays.

The Travel Select plan should be taken into consideration if you are traveling abroad. With this plan, you have access to high coverage limits, including emergency medical evacuation and repatriation coverage up to $500,000, emergency medical and dental coverage up to $50,000, and personal effects and baggage coverage up to $1,000. In addition, minors under the age of 17 who travel with an insured adult are protected at no extra expense.Additionally, Travelex provides tailored upgrades that you can include in your plans, such as coverage for car rentals and accidental death and dismemberment insurance. When adding a preexisting condition waiver to your Travel Select plan, you must do it within 15 days after making your initial trip deposit. Additional coverage for adventure sports like mountain climbing, skiing, or scuba diving can be added to the Travel Select plan. Moreover, Travelex offers online policy purchases, document requests, and claim submissions.

- Pro: Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

- Con: Adventure sport and additional medical coverage plan upgrades are not available with the Travel Basic plan

Website:https://www.travelexinsurance.com/

Screenshot via https://www.travelexinsurance.com/

Screenshot via https://www.travelexinsurance.com/ -

Depending on your preferences, World Nomads offers a variety of adaptable travel insurance plans with varying levels of coverage and cost. Its policy provisions are extensive, and unlike other providers of travel insurance, it offers standard coverage for adventure activities including scuba diving, mountain biking, bungee jumping, and skiing.

When you get a free quotation from World Nomads, you will often have the option between two travel insurance plans: a Basic Plan or an Explorer Plan. The Explorer Plan gives more comprehensive coverage for a higher premium, while the Basic Plan offers a lower level of coverage for a cheaper upfront cost.For instance, the Explorer Plan guarantees $10,000 in trip insurance coverage whereas the Basic Plan only provides $2,500. The Basic Plan guarantees $300,000 in emergency evacuation coverage, whilst the Explorer Plan offers $500,000 in coverage. Both policies include $100,000 in emergency medical care.

You also receive coverage for trip cancellation, trip interruption, loss or damage to luggage and personal possessions, rental car insurance, accidental death and dismemberment, and more with both policies (with differing levels). You may easily request a quotation from Global Nomads online, and you can even submit a travel insurance claim online.- Pro: Adventure sports are covered at no additional cost

- Con: Standard plan only promises up to $2,500 in trip protection

Website: https://www.worldnomads.com/

Screenshot via https://www.worldnomads.com/

Screenshot via https://www.worldnomads.com/ -

Three different travel insurance options are provided by AIG Travel: the Yearly plan, which covers all trips taken during a year, the Pack N' Go plan for quick getaways, and the Single-Trip plan (of which there are three levels). Depending on the cost of your trip and the quantity of compensation you wish to be guaranteed, you can insure single excursions with Essential, Preferred, or Deluxe level coverage.

Depending on the specifics of your travel, your plan's limits and level of coverage may change. Due to this variation, it's imperative to request a quotation using the AIG Travel search engine in order to confirm the coverage levels you can be approved for.Kids under the age of 17 are typically covered by AIG travel insurance plans. You may be eligible for trip cancellation coverage up to 100% of your trip's cost (up to $150,000), as well as trip interruption coverage up to 150% of your trip's cost (up to $225,000), with a mid-tier Preferred plan. Depending on the specifics of your trip, medical expenditure coverage worth up to $50,000 and travel delay coverage for up to $800 may also be included.

AIG Travel makes it simple for customers to submit a claim or monitor the status of a travel insurance claim online, despite the fact that it provides few facts about its plans before seeking a quote.- Pro: Travel insurance policy coverage is tailored to your specific trip

- Con: Information about policy coverage inclusions is not readily available without first obtaining a quote

Website: https://www.aig.com/

Screenshot via https://www.aig.com/

Screenshot via https://www.aig.com/ -

In addition to providing travel insurance for Americans, Seven Corners also provides visitors to the US with travel insurance that includes medical coverage. You can purchase travel medical insurance plans with up to $5 million in coverage, as well as student travel insurance, group travel insurance, and annual travel insurance for regular travelers.

The highlighted travel insurance option from Seven Corners is its RoundTrip Trip Cancellation Travel Insurance; this is the kind of plan you might be tempted to purchase to cover a single trip you have scheduled for the year. There are two levels of coverage accessible for Americans: elite or economic.

Some of the primary advantages of the fundamental RoundTrip Economy package include the following:- Trip cancellation coverage up to $20,000

- Trip interruption coverage good for up to 100% of the cost of the trip

- Trip delay coverage worth $250

- Missed connection coverage worth $250

- Emergency medical coverage worth up to $10,000

- Emergency dental coverage up to $750

- Emergency evacuation and repatriation coverage up to $100,000

- Lost, stolen or damaged baggage coverage up to $500

If you purchase your plan within 20 days of your first trip deposit and satisfy other requirements, this level of coverage can cover any preexisting problems. Also keep in mind that you may add extras like rental car coverage, flight accident coverage, and cancel for any reason coverage to any plan you purchase from Seven Corners.

- Pro: Coverage for preexisting conditions

- Con: Cancel for any reason coverage costs extra

Website:https://www.sevencorners.com/

Screenshot via https://www.sevencorners.com/

Screenshot via https://www.sevencorners.com/ - Trip cancellation coverage up to $20,000

-

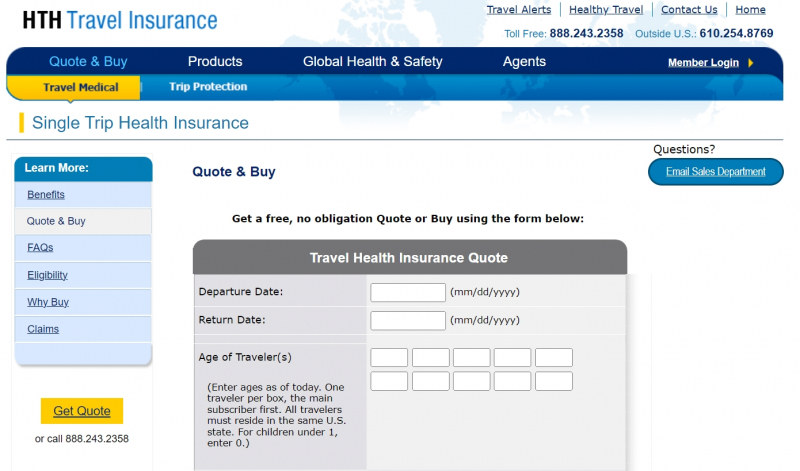

Customers have many alternatives with HTH Travel Insurance to suit a variety of objectives. You can purchase solo trip cancellation insurance, medical-only coverage for one or more trips, and more. HTH Travel Insurance offers full travel insurance coverage along with coverage for particular parts of your journey. There are three levels of plans: Preferred, Classic, and Economical.

The average Classic plan offers up to $25,000 in cancellation coverage, 150% of the trip cost in trip interruption coverage, up to $1,000 in baggage and personal effects coverage, $200 in baggage delay coverage, up to $1,000 in trip delay coverage, up to $250,000 in sickness and accident coverage per person, and up to $1 million in medical transportation coverage, among other benefits.For individuals who need additional coverage, the Preferred plan offers even higher limits, including up to $50,000 in trip cancellation coverage, 200% of your trip's cost in trip interruption coverage, $500,000 in medical coverage for illness and accident, and more.You can add prior condition coverage to the Classic and Preferred plans as long as you do so within 14 (Classic) or 21 (Preferred) days of making your first trip deposit.

- Pro: Generous coverage at the mid-tier level

- Con: Preexisting conditions coverage is only available at mid- and high-tier plans

Website:https://www.hthtravelinsurance.com/

Screenshot via https://www.hthtravelinsurance.com/

Screenshot via https://www.hthtravelinsurance.com/ -

Three travel insurance plans are available from Generali Global Help that you may tailor to meet your needs: the Basic plan, the Preferred plan, and the Premium plan. The Basic plan offers the least amount of coverage, while the Premium plan, for a greater up-front premium, offers more coverage and higher limits.

Compared to the Standard plan, the Preferred plan guarantees broader coverage as well as unique coverages for sporting equipment and delays in sporting equipment. This makes this plan a worthwhile choice if you're going on a golf or ski trip.The most comprehensive coverage is provided by the Premium plan for more expensive excursions like tours and cruises. In addition to other features, this upgraded plan guarantees a 100% refund for trip cancellation, a 175% refund for trip interruption, $2,000 in coverage for lost baggage per person, and $250,000 in medical and dental coverage per person. You may easily request a free quotation from Generali Global Help, and you can lodge a claim for your travel insurance over the phone or online.

- Pro: Sporting equipment coverage is included in the company's mid-tier plan

- Con: Coverage for those with preexisting conditions is only available on the Premium plan

Website: https://us.generaliglobalassistance.com/

Screenshot via https://us.generaliglobalassistance.com/

Screenshot via https://us.generaliglobalassistance.com/ -

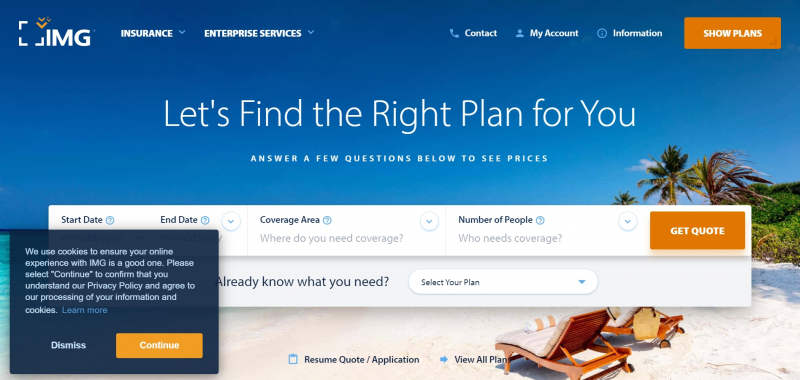

Travel medical insurance, international health insurance, and conventional travel insurance are the three main coverage kinds that IMG Travel Insurance concentrates on. Additionally, this organization has plans tailored especially for government employees, students, and expats as well as a GlobeHopper Senior plan for retired travelers 65 years of age and older.

The iTravelInsured Travel Lite, iTravelInsured Travel SE, and iTravelInsured Travel LX are the three primary travel insurance packages offered by IMG for families or business travelers. Family-friendly travel insurance is available through its mid-tier iTravelInsured Travel SE plan, which can be used for both domestic and international travel. Among the advantages of purchasing this package are:- Trip cancellation coverage worth up to 100% of the trip cost

- Trip interruption coverage worth up to 150% of the cost of the trip

- Travel delay coverage up to $2,000 (maximum of $125 per day)

- Emergency medical evacuation coverage up to $500,000

- Up to $150 in change fee reimbursement

This plan is still available for purchase up until the day before your departure. It's interesting to note that the travel delay coverage can cover a variety of expenses, including extra kennel fees for a pet or family internet usage costs. Additional rental car damage protection for up to $40,000 is also an option.

- Pro: A plan specifically designed for retired travelers ages 65 and older is available

- Con: The company's iTravelInsured Travel Lite plan does not include primary coverage

Website: https://www.imglobal.com/

Screenshot via https://www.imglobal.com/

Screenshot via https://www.imglobal.com/ - Trip cancellation coverage worth up to 100% of the trip cost

-

There are three levels of travel insurance offered by AXA Help USA (Silver, Gold, and Platinum) for clients who desire to pay more (or less) to have the correct level of coverage. The Gold Plan is AXA's mid-tier option, providing 100% coverage for trip cancellation, 150% coverage for trip interruption, $200 per day of delay coverage (up to $1,000), $1,000 of coverage for missed connections, $500,000 of coverage for emergency medical evacuation, and $100,000 of coverage for accidents and illnesses. The Gold Plan also offers $1,500 in coverage for baggage and personal possessions, as well as $300 in coverage for baggage delays.

The Platinum Plan offers more coverage and higher coverage limits, but you can also choose the Silver Plan if you want to save money. Even more specifically designed for active travelers, the Platinum Plan offers coverage for missed ski days ($25 per day), lost golf rounds ($500), and lost sports equipment rentals ($1,000). Additionally, this level of coverage is the only one offered by AXA that enables you to add a cancel for any reason rider to your policy. If you choose to cancel your trip, you will be entitled to a reimbursement of 75% of your travel expenses. (Note: In order for the Cancel for Any Reason coverage to be applicable, it must be purchased within 14 days of your initial trip deposit.)

A 10-day money-back guarantee is also included with AXA Help USA plans. This implies that as long as you haven't begun your trip or submitted a claim, you can buy a plan, change your mind, and get your premiums reimbursed.- Pro: All plans include missed connection coverage

- Con: Only the highest-tier plan allows travelers to add cancel for any reason coverage

Website: https://www.axapartners.us/en

Screenshot via https://www.axapartners.us/en

Screenshot via https://www.axapartners.us/en -

You may select from a number of travel insurance packages and get a free online estimate from Berkshire Hathaway Travel Protection in just a few minutes. ExactCare Value, ExactCare, and ExactCare Extra are the three levels of coverage offered by the company, in addition to travel insurance expressly for flights or cruises. The business also provides unique travel arrangements for activities like road trips, cruises, and more.

Families should choose Berkshire Hathaway's mid-tier ExactCare plan, which includes:- Trip cancellation coverage worth up to 100% of the trip cost

- Trip interruption coverage worth up to 150% of the trip cost

- Trip delay coverage worth up to $1,000

- Medical coverage worth up to $25,000

- Emergency medical evacuation worth up to $500,000

- Missed connection coverage worth up to $500

It should be noted that all Berkshire Hathaway Travel Protection plans for individual visits offer 24/7 global travel assistance. If your wallet is stolen or misplaced, you require urgent translation services, you misplace your passport when traveling abroad, or if any other travel-related accidents occur, this can be of great assistance.

With its online portal, Berkshire Hathaway makes it simple to submit a claim. You can also examine your policy and update its details online. If you're concerned about delayed claims and reimbursement timelines, Berkshire Hathaway also boasts that it pays claims five times faster than the industry average.- Pro: All plans include 24/7 travel assistance that can aid in finding or replacing lost luggage and assist with lost or stolen wallets, tickets and passports

- Con: Missed connections and accidental death and dismemberment coverage are not part of the most basic plan

Website:https://www.bhtp.com/

Screenshot via https://www.bhtp.com/

Screenshot via https://www.bhtp.com/ - Trip cancellation coverage worth up to 100% of the trip cost

-

Nationwide Insurance, a well-known company in the insurance industry, offers three different forms of travel insurance to meet the demands of different sorts of travelers: cruise insurance, annual trip insurance, and single-trip insurance. Two plans are available for Nationwide's single-trip insurance: Essential and Prime.

The basic Plan includes coverage for delayed or lost baggage as well as trip cancellation up to $10,000, up to $250,000 in emergency medical evacuation, up to $150 per day reimbursement for delays of more than six hours, and up to $10,000 in trip cancellation.

The Prime Plan provides more comprehensive coverage with greater limits and the option to add a cancel for any reason policy. Among the benefits of Nationwide's Premier Plan are:- Trip cancellation coverage up to $30,000

- Trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- Missed connection and itinerary change coverage of $500 each

- $250 per day for trip delays (six hours or more)

- Up to $1 million in coverage for emergency medical evacuation

- Cancel for any reason coverage up to 75% of your trip cost. (Cancel for any reason coverage must be purchased for an additional fee within 21 days of your initial trip payment for it to apply.)

Plans from Nationwide Insurance can be ordered up to one day prior to the start of your journey. Consumers must contact the claims department to initiate a claim and arrange for the delivery of several forms to record all of the information that will be included with the claim. The data must then be delivered via fax, email, or mail. According to Nationwide, it takes roughly 15 business days for a review to be completed before a representative contacts you with more details or requests more supporting evidence.

- Pro: Variety of plans to choose from

- Con: Cancel for any reason addition is only available on the premium plan

Website:https://www.nationwide.com/

Screenshot via https://www.nationwide.com/

Screenshot via https://www.nationwide.com/ - Trip cancellation coverage up to $30,000