Top 10 Best Debt Consolidation Companies

If you're struggling under the weight of several financial obligations, the top debt consolidation businesses may be able to help. They'll consolidate your ... read more...different agreements into a single loan, making everything much easier to handle - and, hopefully, securing you a reduced interest rate in the process, lowering your repayments as well. Toplist will give you information about debt consolidation companies

-

National Debt Relief has been providing debt relief since 2008, and throughout that time has established itself as our preferred debt consolidation and debt settlement provider. The debt consolidation service is basic and straightforward, and it's best for people who have little bills that they'd like to pay off once and for all. The avalanche of tremendously positive customer ratings that National Debt Relief constantly receives from people who have utilized the service and seen their debt issues reduced as a consequence makes it truly stand out.

Loan amounts range from $2,000 to $35,000, with repayment terms ranging from 24 to 60 months. The debt consolidation loan pre-qualification process has no impact on your credit score. On the negative, you won't be able to find your loan conditions on the website; you'll have to call someone to get started and learn how National Debt Relief can assist you. You're unlikely to regret taking up the phone because National Debt Relief's debt consolidation loans and service are both excellent.

Application : Online initially, then a callback

Minimum credit score: 680

Loan amount: $2,000 - $35,000

Loan term : 24 - 60 months

Source: Philippines Lifestyle News

Source: BadCredit.org -

Discover offers a simple and well-thought-out debt consolidation solution, but it is its extraordinary devotion to customer service that has earned them the title of top debt consolidation company for overall service.

The application procedure is simple, your account can be handled online and over the phone, fees are reduced to a bare minimum, and you may check Discover's rate without impacting your credit score. As previously said, the accompanying resources are good, and you have the option to cancel your loan within the 30-day money-back guarantee if you find a lower rate elsewhere. There's also the option of having Discover handle your creditors' payments, which should alleviate some of your tension.

If you have greater bills, the maximum loan amount of $35,000 may not be enough, and you'll need a good credit score to get a cheap rate. Discover, on the other hand, should be one of your first choices if you want a straightforward debt consolidation service from a lender who appears to have your best interests at heart.

Application: Online, phone or mail

Minimum credit score: 680

Loan amount: $2,500 - $35,000

Loan term: 36 - 84 months

Source: Crediful

Source: Fonnnt.com -

Marcus by Goldman Sachs should be one of the first debt consolidation organizations that anyone with a good credit score should consider. Marcus, on the other hand, has a lot more to offer, such as an eligibility checker, a simple application process, and no costs.

There are also some handy stress-relieving and time-saving options available, such as the free Direct Payment option, which allows you to send payments straight to up to 10 credit card issuers without having to do so yourself. While everything may be done online, you do have the option to contact for assistance if you need it, and with the FAQs tucked away, you might need it.

If your debts exceed $40,000, you'll need to seek elsewhere, but if you meet Marcus' conditions - in particular, if you have a better-than-average credit score - you should have a positive overall debt consolidation experience.

Application: Online and over the phone

Minimum credit score: 660 for best rates

Loan amount: $3,500 - $40,000

Loan term: 36 - 72 months

Soure: BrainStation

Source: CNBC -

InCharge is so much more than your standard debt consolidation company, and what truly stands out is the effort it puts in to ensure that individuals who get out of debt don't end up back in it again. InCharge offers a credit counseling service as well as a variety of training programs aimed at helping consumers handle their debt more responsibly.

The debt consolidation proposal is also a little out of the ordinary. By signing up for the debt consolidation program, you agree to make a single monthly payment to InCharge, which will be distributed to your creditors, but you will not be taking out a new loan. Instead, the counselors try to negotiate reduced interest rates with credit card firms. The goal is to get individuals out of debt in three to five years, and because there are no credit score limitations (because you aren't taking out a loan), it is a viable choice for anyone.

Despite the fact that InCharge is a non-profit organization, there is a one-time setup fee and a monthly fee, which should be balanced against the possible interest savings. InCharge is the choice to choose if the numbers add up and you want a supportive and instructive road to better managing your debt.

Application: Online or over the phone

Minimum credit score: No minimum requirements

Loan amount: Not specified

Loan term: 3 - 5 years

Source: Top Ten Reviews

Source: incharge.org -

Prosper was a forerunner in the peer-to-peer lending industry and is now a top debt consolidation provider. Prosper's strategy is based on an easily navigable web platform and a desire to be honest with borrowers about how they can qualify for a debt consolidation loan and how much it will cost.

In this case, you'll almost certainly need a solid credit score to get a good rate, but there's a helpful eligibility checker to see if you're likely to succeed - and on what terms - without affecting your credit score. It's commendable that Prosper is transparent about their fees, as there are likely to be cheaper loan options available elsewhere, especially if you have a history of missing payments.

Because of the peer-to-peer feature, there may be a longer than usual wait for the loan funds to get in your account, but it is also a technique that can result in reduced rates. The fact that collaborative applications are permitted will be appealing to some, but it is Prosper's transparency that distinguishes them as a debt consolidation organization worth considering.

Application: Online or over the phone

Minimum credit score: 640

Loan amount: $2,000 - $40,000

Loan term: Choice of 36 or 60 months

Source: Prosper.com

Source: TIME -

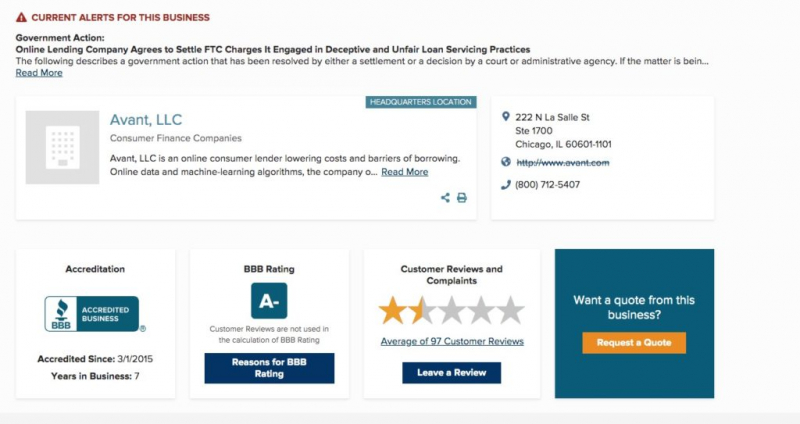

Avant is one of the top debt consolidation organizations because of its readiness to work with people who have bad credit and the fee-free possibility to pay off your loan early. Avant also provides a user-friendly web platform, the ability to check your loan eligibility without hurting your credit score, and the possibility of receiving funds the day after your loan is accepted.

Given that Avant will consider weaker credit ratings, the lowest APR on offer of 9.95 percent is more than the cheapest alternatives offered elsewhere, which is rather unsurprising. In addition, any computations must account for an administration charge that might be as high as 4.75 percent.

However, if you're looking for a dependable online debt consolidation loan, need funds quickly, and haven't had much luck applying elsewhere, Avant still has plenty to offer.

Application: Online and over the phone

Minimum credit score: 600

Loan amount: $2,000 - $35,000

Loan term: 24 - 60 months

Source: Avant

Source: Trusted Company Reviews -

If you like to shop online and want the most freedom with your debt consolidation loan alternatives, LightStream is a terrific option. All borrowers' requirements should be satisfied by inviting individuals with debts up to $100,000 and offering payment terms of up to seven years.

Because everything must be done online, it's helpful to know that the application process is swift and painless - and for people who aren't comfortable with screens, there's no phone to call. LightStream's relatively high credit score criteria may exclude certain applicants, and the lack of a soft pull credit search before applying is unusual for an online lender.

There are no fees, and there's a chance you'll get your money the same day you apply. There's also a rate guarantee, in which LightStream promises to beat a competitor's rate under the same terms by 0.1 percent. When you combine that with the most flexible loan terms available, LightStream becomes a fantastic debt consolidation solution.

Application : Online only

Minimum credit score: "Good" score

Loan amount: $5,000 - $100,000

Loan term: 24 - 84 months

Source: Top Ten Reviews

Source: Business Insider -

Wells Fargo is a well-known bank that should be able to help most people with debt reduction. Few lenders can match the $100,000 loans it provides, and repayment terms can be as lengthy as seven years. There is also the possibility of submitting joint applications, as well as rate discounts for existing bank customers and no costs.

While new clients will need to visit a Wells Fargo branch to get started, the opportunity for a face-to-face consultation and advice is sure to appeal to many people who prefer a more personal experience with their finances than is often accessible through online-only lenders. Wells Fargo is a well-known bank that should be able to help most people with debt reduction. Few lenders can match the $100,000 loans it provides, and repayment terms can be as lengthy as seven years. There is also the possibility of submitting joint applications, as well as rate discounts for existing bank customers and no costs.

While new clients will need to visit a Wells Fargo branch to get started, the opportunity for a face-to-face consultation and advice is sure to appeal to many people who prefer a more personal experience with their finances than is often accessible through online-only lenders.

Application: New customers in-branch; existing online or phone

Minimum credit score: 620

Loan amount: $3,000 - $100,000

Loan term: 12 - 84 months

Source: The Sun

Source: The New York Times -

LendingClub is a peer-to-peer lender that aims to provide innovative financial solutions, which it does via its debt consolidation strategy.

The company has made a commitment to make the debt consolidation loan application process as simple and stress-free as feasible. Everything can be completed quickly online, or you can call if you prefer a warm voice. From then, managing your account is simple, and there is a wealth of information available on the website, both about the loan and about debt and finance in general.

Some people may find it difficult to acquire a loan with LendingClub because to its strict lending standards, however this is mitigated by the possibility to make joint applications, which may boost your chances or lead to a better rate. LendingClub may disappoint you if you have larger debts or want a variety of loan conditions to pick from, as there is an origination cost to consider, as well as a longer than normal turnaround time for money.

However, if you have a good credit score and are looking for a simple online debt consolidation solution, LendingClub may be a good fit.

Application: Online and over the phone

Minimum credit score: Relatively strict

Loan amount: $1,000 - $40,000

Loan term: Choice of 36 or 60 months

Source: PR Newswire

Source: Finovate -

Payoff is a debt consolidation firm that appears to be looking out for your best interests. Payoff promises to help customers get their finances back on track by focusing just on credit card debt, and then making sure they don't get off track again. Payoff employs both psychologists and scientists as part of their endeavor to promote better financial habits among its consumers.

The application method for debt consolidation is simple, and there is a soft inquiry 'Check my rate' option to determine your eligibility before you apply properly. Support is readily available both online and over the phone, which comes as no surprise.

Some may be put off by the origination cost, which might be as high as 5%, and higher loan amounts and faster turnaround times are likely to be found elsewhere, but Payoff is completely transparent in all it does. Some consumers may be ready to pay a bit more or wait a little longer for their money just to take advantage of Payoff's extra assistance. A debt consolidation business that takes a proactive approach to aiding its consumers includes things like welcome calls and frequent check-ins.

Application: Online and over the phone

Minimum credit score: 640

Loan amount: $5,000 - $35,000

Loan term: 24 - 60 months

Source: Investopedia

Source: SlideTeam