Top 10 Best Home Warranty Companies for Keeping Repair Costs Down

Purchasing a home warranty plan protects you against unexpected charges and stress, particularly during the winter months when you will want to ensure that all ... read more...of your heating appliances are in working order. However, picking the proper plan is not easy because there are numerous aspects to consider, such as money, home type, and lifestyle. Here is a list of the top home warranty companies to see whether one is suitable for you.

-

Choice Home Warranty is considered one of the most comprehensive, versatile, and cost-effective companies on the market. Choice Home Warranty provides cost-effective options that cover most major appliances and systems. Furthermore, new users are eligible for a free month of coverage. You can file a claim online or over the phone, 24 hours a day, seven days a week, and a service provider will contact you within 48 hours. In Washington and California, however, services are not offered, and Choice limits coverage to $3,000 per item per contract term.

Pros:

- Low premiums are an advantage.

- The first month is free.

- Support is available online and via phone 24 hours a day, seven days a week.

Cons:

- Coverage ranges from $250 to $3,000 per item.

- California and Washington are the states where this product is not accessible.

Best for: Homeowners looking for affordable full-home coverage

Average annual premium: $476 – $660

Service: 24/7 by phone and online

Website: choicehomewarranty.com

Choice Home Warranty Logo. Photo: choicehomewarranty.com

Choice Home Warranty Website. Photo: cherokeerealtors.org -

Select Home Warranty covers the whole country, with the exception of Washington, Wisconsin, Nevada, and New York. Homeowners can select from three different plans, each of which covers the majority of important appliances and systems. Its coverage limits are lower than those of many competitors, despite the fact that it offers discounts that make premiums inexpensive. Select Home Warranty, on the other hand, includes free roof leak coverage with all of its plans, as well as phone support 24 hours a day, seven days a week to help customers whenever they need it.

Pros:

- Reasonably priced premiums and fees.

- Support is available 24 hours a day, 7 days a week.

- Roof leaks are covered for free.

Cons:

- Coverage limits are low.

- Nevada, New York, Washington, and Wisconsin are the states where this company is not accessible.

Best for: Customers seeking affordable premiums and fees

Average annual premium: $404.99 - $756

Service: 24/7 online and phone

Website: selecthomewarranty.com

Select Home Warranty Logo. Photo: investopedia.com

Select Home Warranty Website. Photo: retirementliving.com -

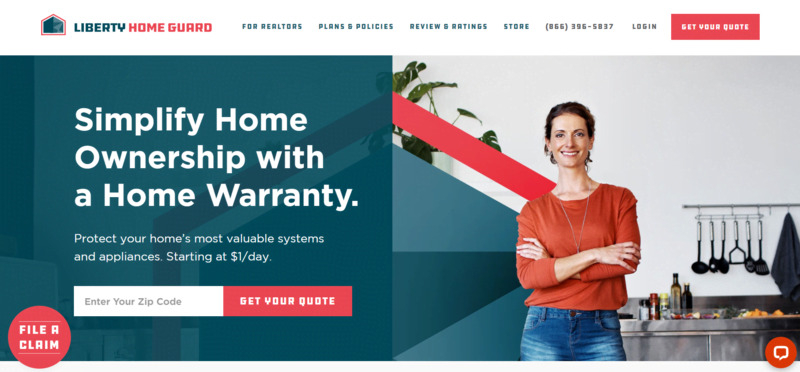

Liberty Home Guard believes that a problem in customers' houses is a problem in theirs. Therefore, they are not going to stop until it is fixed. Customers have more claim reimbursement choices with Liberty Home Guard than with any other home warranty provider. When you buy a plan from Liberty Home Guard, you will get an outstanding reputation, exceptional customer service, and many deals and discounts. In addition, when you get a year's worth of coverage, for example, you will get two months free. Although Liberty Home Guard's network of technicians is slightly less than that of some competitors, you can also hire your own.

Pros:

- Outstanding client service.

- 2 months free with annual billing.

- High customer satisfaction

Cons:

- Only 47 states are covered.

- A decrease in the number of technicians.

Best for: Special offers and discounts

Average annual premium: $499.99 - $639.99

Service: Phone or online, 24/7

Website: libertyhomeguard.com

Liberty Home Guard Logo. Photo: facebook.com

Liberty Home Guard Website. Photo: top10besthomewarranty.com -

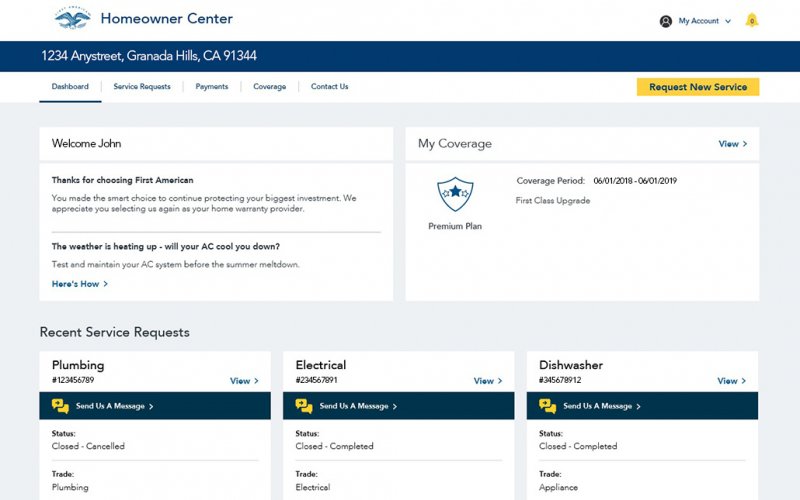

With over 35 years of experience, First American Home Warranty is a powerful company for individuals seeking solid all-around protection for their systems and appliances. Its promises to cover products regardless of age and to replace those that are beyond repair with brand new counterparts are among its most appealing aspects. Despite the fact that there are maximum payouts for multiple items, they are extremely reasonable and affordable. Customers should also be aware of which things come under their coverage plans and which do not, thanks to the company's simple and transparent application process.

Pros:

- Service is available 24 hours a day, seven days a week.

- Tradespeople have been thoroughly vetted.

Cons:

- There are just two standard plans available.

- The app is currently unavailable.

Best for: High payout caps

Average annual premium: $372 - $546

Service: 24/7 phone and online service. No limit on the number of service requests

Website: homewarranty.firstam.com

First American Home Warranty Logo. Photo: retirementliving.com

First American Home Warranty Website. Photo: homewarranty.firstam.com -

Cinch House Services has been providing home warranty services to clients around the country since 1978. It offers three options that cover most of the main appliances and systems in your home. While its service fees are more than those of its competitors, Cinch's premiums, depending on your state, might be relatively reasonable. It covers corrosion and rust damage as well as pre-existing issues, unlike many of its competitors. Cinch's 180-day service guarantee assures that you keep your service fees low for recurrent calls, and you can submit a claim at any time.

Pros:

- It protects against rust, corrosion, and pre-existing issues.

- A 180-day workmanship warranty is included.

- On all plans, the first two months are free.

Cons:

- Alaska and Hawaii are not available.

- Exorbitant service rates in comparison to other businesses.

Best for: Workmanship guarantee

Average annual premium: $335.88 - $1,163.88

Service: 24/7 online and phone

Website: cinchhomeservices.com

Cinch Home Services Logo. Photo: investopedia.com

Cinch Home Services. Photo: semonin.com -

Complete Care Home Warranty, which has only been in operation for two years, provides comprehensive coverage for both household systems and appliances. It includes a 24/7 service request hotline and will cover older items, in addition to potentially expediting emergency claims. The most significant problem we discovered was the low payout caps on some items. Complete Care Home Warranty, on the other hand, may be the perfect decision for you if you consider these should be sufficient to cover the objects in your home.

Pros:

- No maintenance records are required.

- All makes and models are covered.

- It provides coverage for older goods.

Cons:

- Payout caps are rather modest.

- The app is currently unavailable.

Best for: Protecting older items

Average annual premium: $450 - $570

Service:

- 24/7 over the phone.

- Emergency cases may be expedited.

Website: completecarehomewarranty.com

Complete Care Home Warranty Logo. Photo: homewarrantyreviews.com

Complete Care Home Warranty. Photo: top10.com -

AFC Home Club, which covers a wide range of systems and appliances, might give you peace of mind if one of your home's most important items fails. It offers four plan categories, including Systems, Silver, Gold, and Platinum, each with in-house claims support available 24 hours a day, seven days a week. Despite having prices that are roughly in line with industry standards, the provider has a number of advantages over its competitors, including the market's longest craftsmanship warranty and a variety of appealing features.

Pros:

- No need to keep track of home inspections or maintenance.

- There is no limit to the number of service requests you can make.

- The ability to select one's own contractor.

Cons:

- There is no live chat option.

- The app is currently unavailable.

Best for: Choose your own contractor

Average annual premium: $345 - $575

Service: Online or phone 24/7

Website: afchomeclub.com

AFC Home club Logo. Photo: inc.com

AFC Home club. Photo: afchomeclub.com -

The Home Service Club has provided home warranty coverage to homeowners across the country since 2008. Its two-service contracts cover the majority of the major appliances and systems in your home. Despite having higher premiums and service fees than many of its competitors, Home Service Club offers discounts to make its plans more reasonable. You may get pest damage coverage as well as unique optional features like utility line coverage with the Home Service Club. You can submit a claim online 24 hours a day, seven days a week, and the Home Service Club will schedule your service within 12 to 48 hours.

Pros:

- Coverage for insect damage.

- It is available all around the country.

- All repairs come with a 90-day craftsmanship warranty.

Cons:

- Service costs and base premiums are high.

- There is no phone assistance available 24 hours a day, 7 days a week.

Best for: Homeowners looking for extensive coverage options

Average annual premium: $552 - $799

Service: 24/7 online and by phone during normal business hours

Website: hscwarranty.com

Home Service Club Logo. Photo: hscwarranty.com

Home Service Club. Photo: comparisonshop.com -

First Premier Home Warranty offers fair costs that are slightly lower than some competitors, as well as two free months with your plan, making it a suitable alternative for those on a tight budget. First Premier, the company's most basic plan, covers a wide range of appliances and systems, with the ability to upgrade or add extras if you require more coverage. There is also a 30-day labor guarantee and a 90-day parts guarantee. While First Premier's contractor network is not the largest, it strives to resolve your concerns within 48 hours.

Pros:

- There is a $60 service fee.

- Two months of free service.

- Prompt response from customer service.

Cons:

- There are not enough details on the webpage.

- There are not a lot of planning possibilities.

Best for: Lower service fees

Average annual premium: $420 - $540

Service: Phone or email, 24/7

Website: firstpremierhomewarranty.com

First Premier Logo. Photo: firstpremierhomewarranty.com

First Premier. Photo: top10.com -

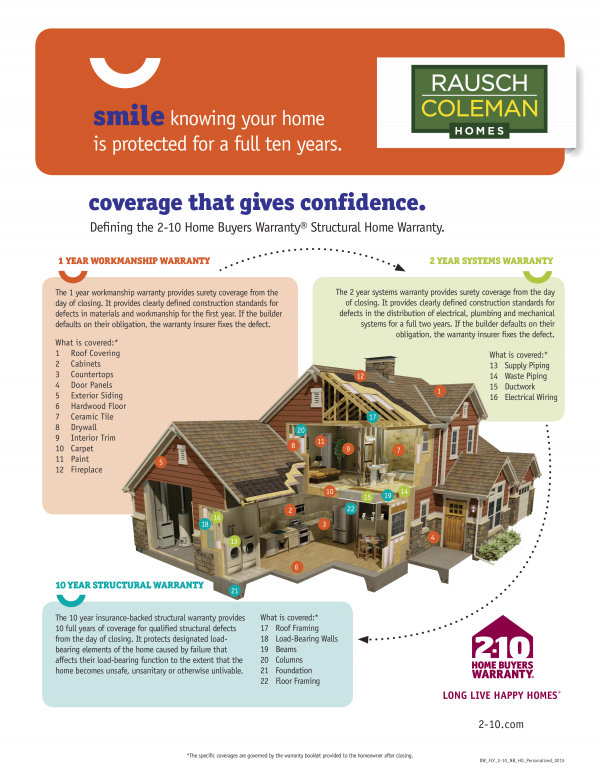

2-10 Home Buyers Warranty (2-10 HBW) has been providing home warranties for over 40 years. It claims to pay out 97.5 percent of claims, according to the website of this company. Whether you are buying a new house, selling your present one, or living in it, the 2-10 Home Buyers Warranty offers wear and tear coverage. While 2-10 HBW has a higher premium and service fee than most warranties, it also has a greater yearly coverage limit. Services are offered in the 48 contiguous states, and the corporation offers online and phone support 24 hours a day, seven days a week.

Pros:

- It is available in 48 states.

- You can purchase a plan at any moment.

- The coverage limit is $25,000 per year.

Cons:

- Expensive annual premium.

- High base service charge.

Average annual premium: $239.88 - $720

Service: Online and phone, 24/7

Website: 2-10.com

2-10 Home Buyers Warranty Logo. Photo: bhhsamb.com

2-10 Home Buyers Warranty. Photo: rauschcolemanhomes.com