Top 10 Best Robo Advisors

Are you a beginner-level investor looking for the best Robo advisors? Check out some of these programs below. They provide excellent services and ensure you ... read more...have the best investment portfolios available!

-

Betterment was one of the early adopters of the robo-advisor investment model. After about 10 years in operation, we feel that no other application provides clients with the same level of value as Betterment. Betterment received great marks in every category. Betterment Digital's entry-level service tier costs a reasonable yearly fee of 0.25 percent of your amount, with no minimum balance restriction. Individuals with larger balances - who want more sophisticated services - may sign up for Betterment Premium, which includes access to live financial counselors.

One caveat for those who choose the emergency fund route: You may wind up with a 15% equities and 85% bonds portfolio, which is a little too hazardous. If you need funds after a layoff due to an economic slump, chances are you will be selling cheap.

Besides, Betterment provides alternative portfolios, including one that is focused on environmental, social, and governance (ESG) considerations. The software automatically harvests tax losses and also offers a tax-coordinated plan option that arranges your stock and bond holdings to maximize your tax treatment.

Ratings: 4.8 stars (from 300 reviews)

Price: 0.25% - 0.4% annual fee

Website: https://www.betterment.com/

Source: CNBC

Source: Barron's -

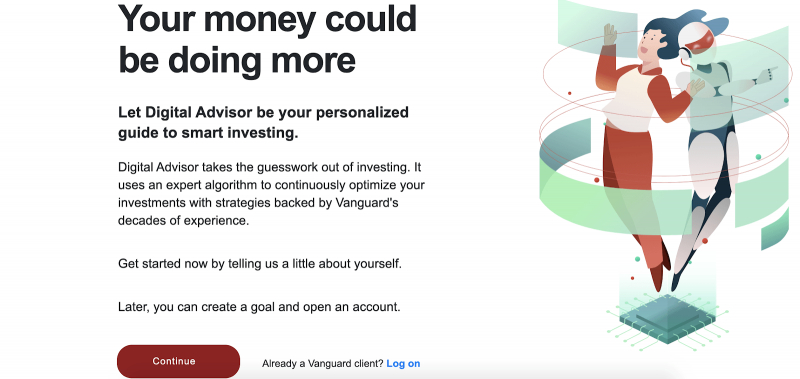

If you are just beginning your career or looking for a straightforward tool without a lot of bells and whistles, try Vanguard Digital Advisor, one of the best Robo advisors currently available. When Jack Bogle founded this Pennsylvania-based mutual fund business about 50 years ago, he kicked in the index fund revolution. By rejecting high-flying stock selections in pursuit of low-cost balanced funds (which followed broad market indexes such as the S&P 500), Bogle developed an empire by being the marketplace itself - rather than trying to beat it.

Vanguard Digital Advisor's core services, such as pension savings and automated rebalancing, are now available for a modest yearly net advising charge ( no more than 0.20 percent of your managed checking account). That is far better than the majority of Robo-advisors.

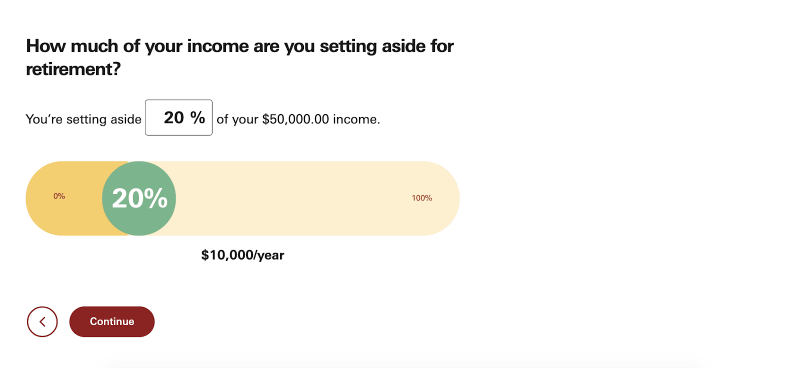

During the enrolling procedure, Vanguard Digital Advisor will ask you a number of routine questions about your marital status, income, and spending habits, as well as your comfort level with investment risk. This risk assessment, which incorporates gain/loss possibilities and a slider bar, is far more straightforward than those we tested.

Ratings: 4.5 stars (from 300 reviews)

Price: 0.2% annual fee

Website: https://investor.vanguard.com/advice/digital-advisor/get-started

Source: Money Under 30

Source: Money Under 30 -

If you are looking for a Robo-advisor that can handle a substantial sum of money while still providing access to leading human economists, go no further; Vanguard Personal Advisory Services is right here. The $50,000 minimum balance requirement for this platform is half that of Personal Finance or Betterment Premium. Also, it charges cheaper fees (0.30 percent versus 0.89 percent and 0.40 percent, respectively).

Vanguard Personal Advisory Services connects you with real-world Vanguard experts - many of whom are qualified finance professionals (CFPs) and some are stewards - anytime you need assistance or have concerns about your financial situation. This means you will have access to a variety of services, including estate planning and charity giving, which become more crucial as your assets get larger.

As is the case with Vanguard Digital Advisor, your plan will be constructed using low-cost Vanguard funds that monitor broad market indexes and correspond to your risk tolerance.

Ratings: 4.5 stars (from 280 reviews)

Price: 0.3% annual fee

Website: https://investor.vanguard.com/advice/financial-advisor/advice-you-can-trust

Source: Vanguard

Source: Vanguard -

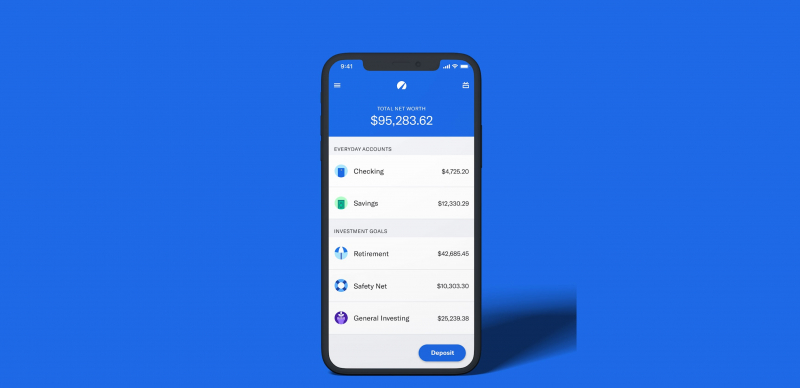

If you are looking to minimize expenses while still receiving some basic Robo-advisor services, then SoFi Automated Investing is an excellent solution. SoFi Automated Investing has the lowest fees of any Robo-advisor service in our evaluation. There is no yearly consulting fee; your account is invested in ETFs with relatively low-cost ratios; and you have access to real-world specialists if you have questions about your financial status. With a minimum account balance of only $1, nothing is stopping you.

The remainder of SoFi Automated Investing operates in a manner consistent with that of a Robo-advisor. You input your private information and financial objectives, and the platform will create a balanced portfolio of about ten exchange-traded funds (ETFs) that correspond with your financial objectives and risk tolerance.

There is one major disadvantage to SoFi Automated Investing that you should be mindful of: the sort of ETFs it includes in your portfolio. The platform features a large number of SoFi's own ETFs, similar to how Vanguard solely employs its own funds. However, in comparison to Vanguard, SoFi's funds are modest in terms of assets - relatively new and experimental - and, in some instances, even expensive in terms of cost ratios. As a result, they may be riskier investments for long-term investors.

Ratings: 4.4 stars (from 260 reviews)

Price: No annual fee

Website: https://partners.sofi.com/gen-invest-robo/

Source: SoFi

Source: SoFi -

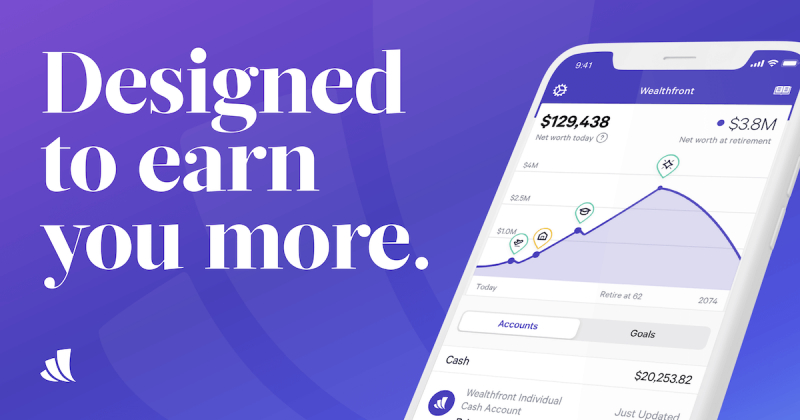

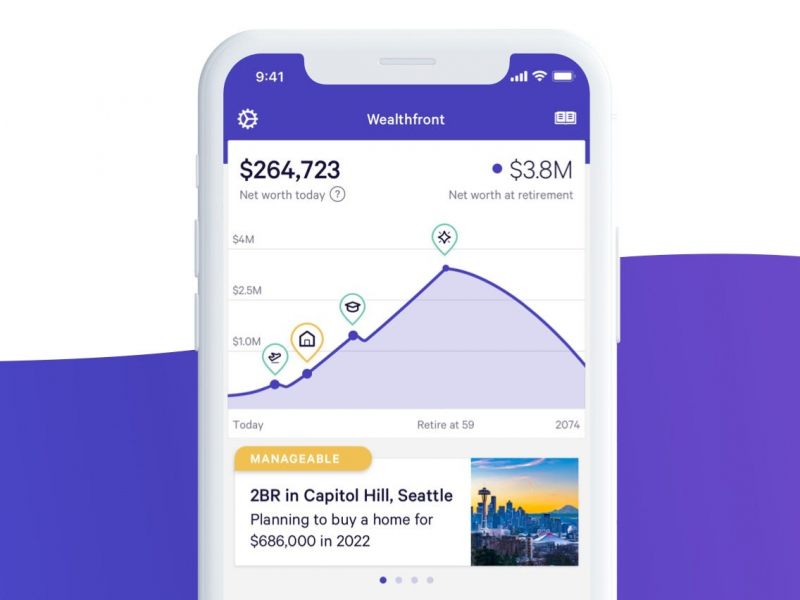

Wealthfront is a smart saving and investment platform with minimal costs and advanced financial planning features. With just a $500 account requirement, Wealthfront is pretty straightforward to get started. After that, you'll be automatically enrolled in a diverse portfolio of ETFs that span many asset classes, from large-cap businesses to municipal bonds.

Wealthfront's financial planning tools are very exceptional. After inputting your risk tolerance and financial objectives - and connecting your external financial accounts - Wealthfront provides two tools to assist you in managing your financial life more easily: Path and Autopilot. Path generates a bird's-eye perspective of your present financial status - using your income and spending - and then assists you in meeting your savings objectives. Notably, you can use Path to determine the influence of certain decisions (like taking some time off to vacation) on your capacity to achieve long-term objectives such as retirement.

While Path assists you in planning for the future, Autopilot assists you in managing your money for the present. This technology distributes your income automatically to several financial accounts, ranging from your bank account to emergency funds and investment accounts, in order to fulfill your various requirements and aspirations.

Ratings: 4.2 stars (from 260 reviews)

Price: 0.25% annual fee

Website: https://invest.wealthfront.com/forbes

Source: Wealthfront

Source: Business Insider -

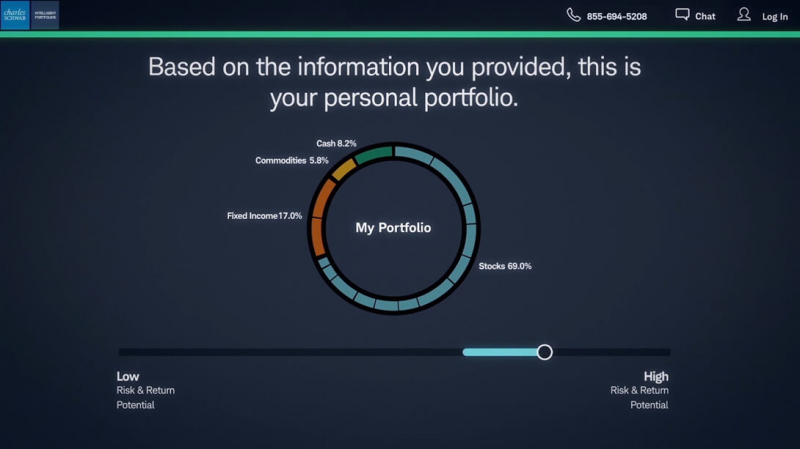

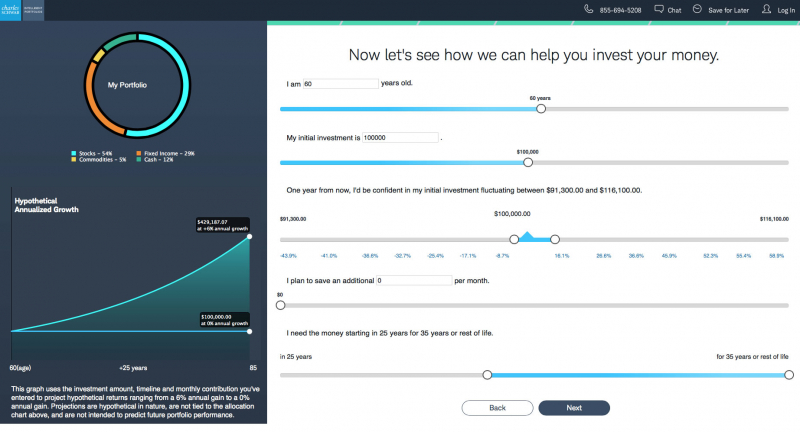

Another forerunner on our list of the best Robo advisors is the Schwab Intelligent Portfolios. With this service, we can say that Charles Schwab is aggressively pursuing the Robo-advisor business by offering only the most updated services on the market. It is not surprising that this program quickly became a household name for many investors around the globe.

Charles Schwab, who is rather famous for his extremely investor-friendly policies, extends this ethos to his Robo advisor as well. This policy clearly manifests in the Schwab Intelligent Portfolios via features like rebalancing, automated tax-loss harvesting, and 24/7 accessibility to U.S.-based customer care. And since Schwab does not impose a management fee, it is worthwhile to save enough to satisfy the larger account minimum.

If you want limitless access to human advisers, you can have it with a deposit of $25,000 and a monthly charge of $30 - a tremendous bargain for what you receive.

Ratings: 4.6 stars (from 254 reviews)

Price: $30/month

Website: https://www.schwab.com/intelligent-portfolios

Source: Charles Schwab

Source: My Money Blog -

Ellevest is an amazing and robust Robo-advisor that charges a low cost. Ellevest, founded by Wall Street expert Sallie Krawcheck, follows its own rhythm - whether it is charging a flat price for its robo-advisory solutions, or addressing the unmet planning requirements of female investors.

However, do not assume that only females should invest in this space. Ellevest provides investors with goal-based planning, robust cash management accounts, low-cost ETFs, and more than guidance, along with one-on-one accessibility to qualified advisers for an extra charge. Hence, it is suitable for all types of investors alike.

We could say that these characteristics distinguish Ellevest as a top Robo-advisor, and investors searching for a powerful all-in-one package should certainly check it out. (Those seeking access to human advisers might also choose Betterment and Schwab Intelligent Portfolios, which also provide this service). If you do not mind spending some little extra fees, you may appreciate its Personal Capital's high-touch service as well.

Ratings: 4.7 stars (from 251 reviews)

Price: $1 - $9/month

Website: https://www.ellevest.com/

Source: TechCrunch

Source: The Brand Guild -

Fidelity Go is a Robo-advisor solution from Fidelity Investments. This service provides consumers with various essential capabilities. Some examples of these functionalities include asset management, frequent rebalancing, and more. To be more specific, Fidelity Go develops your detailed portfolios by using fee-free Fidelity funds. With these approaches, you will not have to worry about your outcomes being dragged down by exorbitant charges.

Even better, most users will have the chance to enjoy Fidelity Go's excellent customer service, which will handle common issues within 24 hours. You are also exposed to the company's many educational resources, which is an excellent choice for new traders or those with an existing Fidelity account.

Of course, some other alternative Robo-counselors (like Betterment, Schwab, or Wealthfront) are wonderful too, especially if you are searching for extra features such as tax-loss harvesting or connections with financial advisors. If affordability is a primary consideration for you, have a look at SoFi Automated Investing. All these alternatives have made their appearance on our list.

Ratings: 4.1 stars (from 230 reviews)

Price: $3/month

Website: https://www.fidelity.com/

Source: Fidelity Investment

Source: Money.com -

Wells Fargo Intuitive Investor provides investors with a good Robo-advisor solution that features several great features (and for an above-average yearly charge). Investors will get the standard portfolio management advantages associated with high-quality Robo-advisors, as well as tax-loss harvesting and fair fees for funds used to construct portfolios. Even better, you will have access to a financial adviser 5 days per week, which is a service that is often reserved for premium levels for certain Robo-advisors and is highly appreciated by beginning investors.

However, as we said, the advantages come at a cost. Wells Fargo Intuitive Investor charges an above-average 0.35 percent annual service fee (much higher than a typical Robo-advisor); and some account activities (such as canceling an IRA), may incur extra account costs.

Also, you will need $5,000 to get started, which is far costlier than rival robots such as Betterment or Wealthfront demand. Investors seeking a lower-cost alternative for consulting with expert advisers may want to investigate SoFi Automated Investing instead.

Ratings: 4.2 stars (from 221 reviews)

Price: 0.35% annual fee

Website: https://www.wellsfargoadvisors.com/services/intuitive-investor.htm

Source: Kayleen Mayhew

Source: Financial Planning -

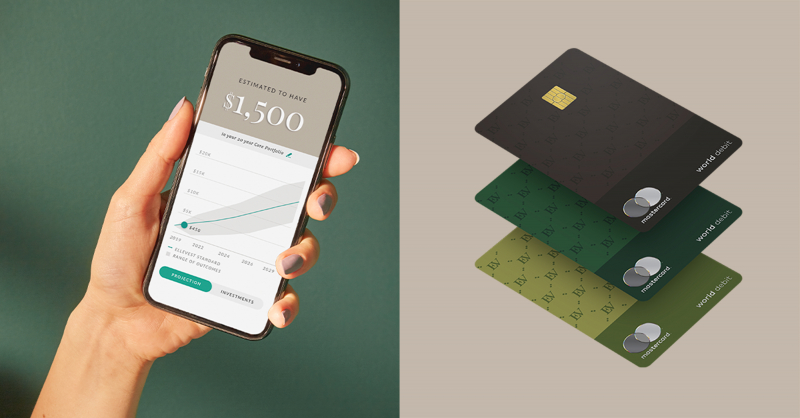

Acorns is a platform for micro-investing. You do not need a large sum of money to begin or to maintain growth in your assets. So if you just have a little amount of spare change, try Acorns. This automated investing Robo-advisor does not require a minimum checking account or trading fees - as some of our other selections do.

However, a simple account costs $1 per month and automatically invests your surplus funds via its Round-Ups program. When you make purchases with a connected card, the transaction is rounded to the closest dollars, and the remaining change is deposited in your Acorns investing account. This hands-off investing Robo-advisor technology eliminates the need to log in to make the minimum investment commitments to a trading account.

Additionally, there is a $3 monthly fee for a personal account that combines many other smaller accounts into one, including investment, retirement, checking, and a real debit card. Meanwhile, the $5 monthly family plan includes investment accounts for your children - aside from investment, retirement, and extra checking accounts.

Ratings: 3.8 stars (from 180 reviews)

Price: $1-$5/month

Website: https://www.acorns.com/

Source: MarketWatch

Source: MoneyMade