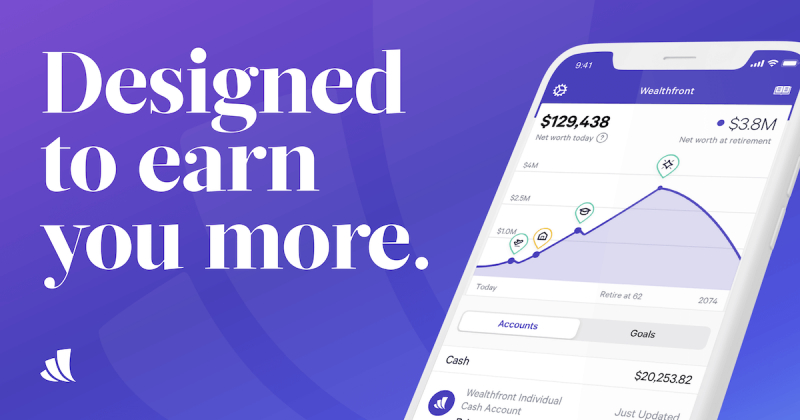

Wealthfront

Wealthfront is a smart saving and investment platform with minimal costs and advanced financial planning features. With just a $500 account requirement, Wealthfront is pretty straightforward to get started. After that, you'll be automatically enrolled in a diverse portfolio of ETFs that span many asset classes, from large-cap businesses to municipal bonds.

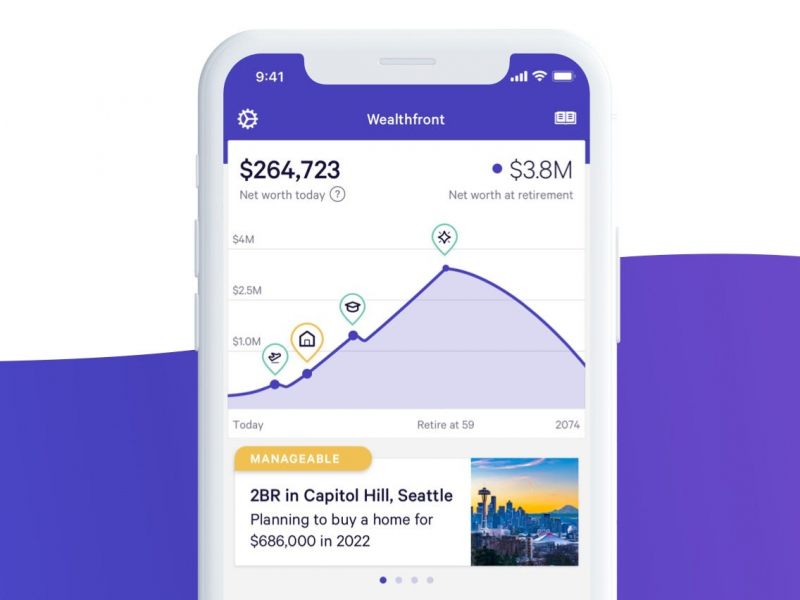

Wealthfront's financial planning tools are very exceptional. After inputting your risk tolerance and financial objectives - and connecting your external financial accounts - Wealthfront provides two tools to assist you in managing your financial life more easily: Path and Autopilot. Path generates a bird's-eye perspective of your present financial status - using your income and spending - and then assists you in meeting your savings objectives. Notably, you can use Path to determine the influence of certain decisions (like taking some time off to vacation) on your capacity to achieve long-term objectives such as retirement.

While Path assists you in planning for the future, Autopilot assists you in managing your money for the present. This technology distributes your income automatically to several financial accounts, ranging from your bank account to emergency funds and investment accounts, in order to fulfill your various requirements and aspirations.

Ratings: 4.2 stars (from 260 reviews)

Price: 0.25% annual fee

Website: https://invest.wealthfront.com/forbes