Top 10 Largest Banks in Germany

Germany's banking sector is renowned for its robustness and stability, playing a vital role in the country's economy. Here is a list of the largest banks in ... read more...Germany.

-

Deutsche Bank was founded in 1870 by a group of financiers and businessmen. It aimed to facilitate trade between Germany and international markets. In its early years, the bank focused on financing infrastructure projects, industrial development and foreign trade. Throughout its history, Deutsche Bank has undergone numerous transformations and adaptations to changes in the global financial landscape.

It is one of the largest banking institutions in Europe and operates globally with nearly 1,500 branches worldwide. Deutsche Bank offers a wide range of services, including corporate banking, investment banking, asset management, retail banking, and wealth management. The bank serves both individual clients and institutional clients, providing services such as financing, advisory services, foreign exchange, trading, and risk management.

In 2022, the bank achieved robust and sustainable profitability, demonstrating the success of its transformation plan announced in July 2019. Over the past three and a half years, the bank aligned its business divisions based on their strengths and exited non-strategic areas. It also significantly improved efficiency, reducing running costs by over €3 billion since 2018.

The Common Equity Tier 1 capital ratio exceeded the target of at least 12.5 percent set in 2019, reaching 13.4% by the end of 2022. Additionally, its total assets were of €1,337,000 billion, making it the largest bank in Germany.

Founded: 1870

Headquarters: Taunusanlage 12, 60325 Frankfurt am Main, Gẻ

Website: https://www.db.com

Photo by dierk schaefer on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Deutsche_Bank_Mannheim.jpg)

Photo by mermyhh on Pixabay -

DZ Bank AG, originally known as Deutsche Zentral-Genossenschaftsbank, traces its roots back to the late 19th century. Over time, these cooperatives merged to form regional central cooperative banks, known as Landesbanken. In 2000, SGZ-Bank and GZB-Bank merged to form GZ-Bank, which resulted from the previous merger of central institutions in Southwestern Germany. The following year, GZ-Bank and DG BANK merged, giving rise to DZ BANK AG.

DZ BANK AG, headquartered in Frankfurt am Main, became Germany's sixth-largest bank at that time and operates under its current name, DZ BANK AG Deutsche Zentral-Genossenschaftsbank.

In 2022, the DZ BANK Group demonstrated a strong performance, achieving a noteworthy profit before taxes of €1.8 billion. The group's net interest income also displayed positive growth, reaching €3.32 billion compared to the figure of €2.79 billion in 2021. As of December 31, 2022, the DZ BANK Group's total assets stood at €627.0 billion. These results highlight the group's ability to generate robust financial outcomes and maintain a substantial asset base.

Today, DZ Bank AG serves as a central institution and service provider for the cooperative banks in Germany. It plays a crucial role in supporting the cooperative banking sector and promoting the cooperative principles of self-help, self-responsibility, and solidarity.

Founded: 2001

Headquarters: Frankfurt am Main, Germany

Website: https://www.dzbank.de/

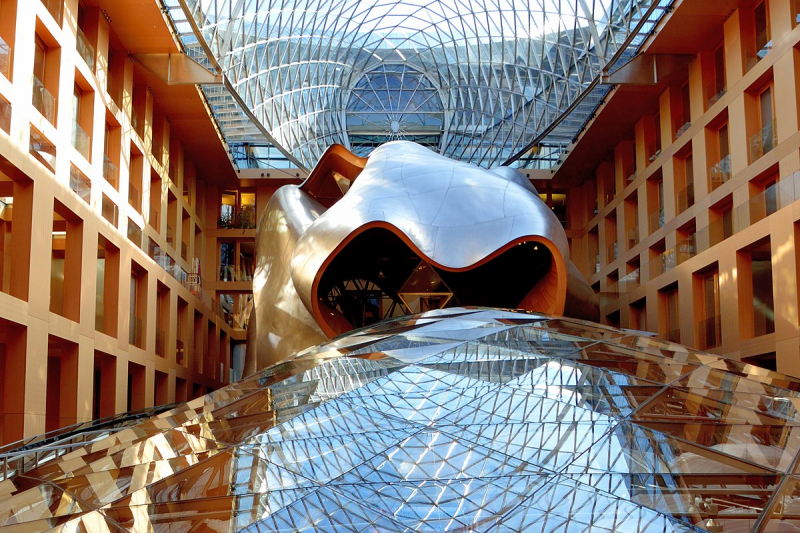

Photo by Spielvogel on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:DZ_Bank_building_in_Berlin_%2B_interior.jpg)

Photo by Katzenfee50 on Pixabay -

KfW, which stands for Kreditanstalt für Wiederaufbau (Reconstruction Credit Institute), is a German government-owned development bank. It was founded in 1948 as part of the Marshall Plan to support the reconstruction of Germany after World War II.

KfW operates as a promotional bank, providing financing and support for various sectors, including infrastructure, environmental protection, energy, housing, and small and medium-sized enterprises (SMEs). It offers a wide range of financial products and programs, including loans, grants, guarantees, and equity investments. KfW has established a global presence with approximately 80 local and representative offices spread across the world.

In 2022, KfW achieved another year of impressive financial results, building upon its positive trajectory from previous years. The volume of new business reached an all-time high of nearly EUR 167 billion, indicating the bank's continued growth and strong performance. With its total assets amounting to €554.6 billion, KfW solidified its position as the third-largest bank in Germany in terms of total assets.

Furthermore, KfW is a leading global financier of climate and environmental protection projects. It has supported the transformation of the economy through financing fiber-optic projects, wind farms, and photovoltaic systems. Currently, KfW is actively progressing towards its goal of becoming a digital transformation and promotional bank.

Founded: 1948

Headquarters: Frankfurt am Main, Germany

Website: https://www.kfw.de/

Photo by DXR on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Westarkade_highrise,_Frankfurt,_Northwest_view_20170226_1.jpg)

Photo by Vysotsky on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:KFW_Frankfurt_2019.jpg) -

Commerzbank AG is a prominent financial institution in Germany. It was founded in 1870 in Hamburg, Germany, under the name "Commerz- und Disconto-Bank." Since then, it has grown to become one of the country's leading banks, providing a wide range of financial services to individuals, businesses, and institutional clients.

With its headquarters in Frankfurt, Commerzbank operates a vast network of branches and offices throughout Germany, as well as maintaining a global presence through its international offices. The bank is known for its commitment to innovation and digital transformation, aiming to provide efficient and modern banking solutions to meet the evolving needs of its customers.

The bank operates through two business segments: Private and Small-Business Customers, and Corporate Clients, offering a comprehensive range of financial services. With its strong presence in nearly 40 countries, Commerzbank facilitates around 30% of Germany's foreign trade, primarily focusing on the Mittelstand, large corporates, and institutional clients.

Commerzbank is the fourth-largest in Germany by total assets, with assets totaling approximately €477.4 billion at the end of 2022. According to the financial report of the year 2022, the Group's operating profit surged by 77.5% to approximately €2.1 billion. Net profit more than tripled, reaching €1.435 billion, which marked the best result in over a decade. The achieved profit exceeded the initial forecast of one billion euros by a significant margin.

Founded: 1870

Headquarters: Kaiserplatz, 60261 Frankfurt am Main, Germany

Website: https://www.commerzbank.com/

Photo by Commerzbank AG on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Commerzbank-Hochhaus_2010-09-06_02.jpg)

Photo by Commerzbank AG on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Commerzbank_flagship_branch_Stuttgart_2014.jpg) -

J.P. Morgan has a longstanding presence in Germany that began in 1928 with establishment of a representative office. Following World War II, J.P. Morgan was the pioneering foreign bank to resume operations by reopening branches in Germany in 1947. In 2022, it conducted a restructuring that consolidated its EU credit institutions into a single legal entity called J.P. Morgan SE. Through this consolidation, J.P. Morgan Bank Luxembourg S.A. and J.P. Morgan Bank (Ireland) plc. have merged into the German entity J.P. Morgan AG and converted J.P. Morgan SE.

The consolidation has positioned J.P. Morgan SE as one of the largest banking legal entities in Germany and among the top 20 under the direct supervision of the European Central Bank in the EU based on the size of its balance sheet. Today, J.P. Morgan SE offers a comprehensive range of products and services across J.P. Morgan's business lines, including corporate & investment banking, commercial banking, and private banking.

At present, it has headquarters in Frankfurt, Germany and operates a network of 14 branches across the European Economic Area that includes Dublin, Luxembourg, Paris and a London branch for specific private banking services.

Per year-end 2022, its total capital base was approximately € 36.5 billion, with capital ratios of 19.73% CET1 and 33.80% total capital ratio. Additionally, the bank demonstrated significant total revenues of €4,817 million, mainly driven by outperformance in markets - private bank and a profit before tax amounting to €1,743 million. Its total assets were of €435.8 billion.

Founded: 1928.

Headquarters: 1 Taunustor 1, Frankfurt Am Main, Germany

Website: https://www.jpmorgan.com/DE/

Photo by Robert Lamb on Geograph (https://www.geograph.org.uk/photo/5496459) Video by Bloomberg Television on Youtube -

Landesbank Baden-Württemberg (LBBW), a state-owned regional bank in Germany is considered a pioneer in the field of finance-banking with a rich history dating back to the 19th century.

It traces its roots to the establishment of several predecessor banks, including Badische Bank, Wurmisis Notenbank, and Städtische Sparkasse Stuttgart. In 1975, Städtische Sparkasse and Girokasse Stuttgart merged with Wurmisische Landessparkasse to form Landesgirokasse (LG).

Subsequently, in 1999, LG merged with Südwestdeutsche Landesbank and a portion of LBBW, leading to the formation of LBBW. The integration process continued in 2005 with the inclusion of Landesbank Rheinland Pfalz as a subsidiary of LBBW and the full incorporation of AG-Wurmisische AG into the bank.

LBBW is a financial institution offering a comprehensive range of services. With expertise in finance, asset management, cash management and international business, LBBW caters to the diverse financial needs of its clients. The bank serves a wide spectrum of customers, including corporate clients, institutional clients, international banks, and SSAs. LBBW's commercial real estate finance division provides specialized financing solutions for real estate projects.

In 2022, Landesbank Baden-Württemberg achieved impressive financial results. The bank reported operating earnings of €901 million, reflecting its strong performance in generating income from its core business activities. Additionally, LBBW recorded a profit before tax of €1.873 billion and total assets of €324.2 billion.

Founded: 1999

Headquarters: Am Hauptbahnhof 2, Stuttgart, Baden-Wurttemberg, Germany

Website: https://www.lbbw.de/

Photo by Pjt56 on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:LBBW-Hochhaus_Stuttgart-pjt.jpg)

Photo by JKCarl on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:JKCarl_LBBW_Stuttgart-Mitte_6_800.jpg) -

Hypovereinsbank, also known as UniCredit Bank AG, was founded in 1998 through the merger of Bayerische Hypotheken- und Wechsel-Bank Aktiengesellschaft (Hypobank) and Vereinsbank. In 2005, Hypovereinsbank became a subsidiary of UniCredit Group, one of Europe's leading banking groups, and adopted the name UniCredit Bank AG. Under UniCredit's ownership, Hypovereinsbank continued to grow and strengthen its position as a significant player in the German banking sector.

The bank provided various services to clients, including portfolio management, asset management, and trust management. It also engaged in brokering insurance, savings and loan contracts, and investment funds. Additionally, the bank conducted investment and securities commission activities, as well as payment processing services.

In the financial year, Hypovereinsbank achieved strong financial results. The bank reported a total income of €6,020 million, reflecting its ability to generate substantial revenue across its various business activities.

Hypovereinsbank also saw growth in its total assets, which increased to €311,735 million compared to €291,501 million in the previous year. Net interest income, a key component of the bank's earnings, amounted to EUR 3,470 million, highlighting its success in managing interest rate differentials and generating income from lending and investment activities.

With its extensive branch network and digital banking solutions, Hypovereinsbank aims to meet the diverse needs of its customers and provide them with innovative financial solutions. Today, it continued to grow and strengthen its position as a significant player in the German banking sector.

Founded: 1998

Headquarters: München, Germany

Website: https://www.hypovereinsbank.de/

Photo by Dacse on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:HypoVereinsbank_Niederlassung_D%C3%BCsseldorf.jpg)

Photo by Fred Romero on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:M%C3%BCnchen_-_HVB-Tower_%283%29.jpg) -

Bayerische Landesbank, commonly known as BayernLB, is a state-owned bank headquartered in Munich, Germany. It was established in 1972 and serves as the central bank for the Free State of Bavaria.

As a universal bank, BayernLB provides a comprehensive range of financial services to corporate clients, institutional investors, and retail customers. The bank operates in various sectors including commercial real estate, infrastructure finance, energy, transportation and public sector financing. BayernLB also offers wealth management and private banking services to high-net-worth individuals and families.

BayernLB has a strong regional focus on Bavaria, but it also has a presence in other German states and international locations. The bank has branch offices and representative offices in major cities such as Frankfurt, Berlin, New York, Hong Kong, and London, among others. It maintains a global network to serve its clients and support their international business activities.

In 2022, BayernLB achieved positive financial results, demonstrating its strong performance and stability. The bank's net interest income reached €2,137 million and total assets were of €259,343 million. BayernLB maintained a robust capital position, with a CET1 capital ratio of 17.4% and a total capital ratio of 21.3%.

It also recorded an operating profit of €151 million in 2022, a notable increase of 10 million compared to the previous year's operating profit of €141 million. This growth in operating profit signifies the bank's effective management of expenses and optimized performance across its various business segments.

Founded: 1972

Headquarters: Frankfurt am Main, Germany

Website: https://www.bayernlb.de/

Photo by rufus46 on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Brienner_Str._16_Muenchen-1.jpg)

Photo by Rufus46 on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Briennerstr._18_Glasbrunnen_Muenchen-4.jpg) -

ING Holding Deutschland GmbH was founded as ING-DiBa AG in Germany in 1965. It started its operations as a direct bank, focusing on retail banking services. Over the years, the bank expanded its product offerings and customer base, gaining popularity for its customer-centric approach and innovative digital solutions. In 2019, ING-DiBa AG changed its legal structure and became ING Holding Deutschland GmbH, reflecting its broader scope of activities within the ING Group.

With a strong presence and established reputation, ING Holding Deutschland serves a wide range of customers, offering a variety of financial services and products. The company plays a significant role in the German banking sector, contributing to the country's financial landscape.

As of 31 December 2022, with 5,972 employees, it serves 9 million customers. The company operates across several major cities in Germany, including its headquarters in Frankfurt am Main, as well as branches in Berlin, Hanover, and Nuremberg.

The bank achieved a remarkable financial result in 2022, with significant growth increased in total assets by approximately 8.97%, reaching €198,189 million compared to €181,897 million in the previous year. This substantial increase reflects the bank's successful management and strategic initiatives. Additionally, it reported a pre-tax profit of €.04 billion, demonstrating its strong financial performance and ability to generate sustainable earnings.

Founded: 2006

Headquarters: Theodor-Heuss-Allee 2, Frankfurt am Main, Germany

Website: https://www.ing.de/

Photo by Epizentrum on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Frankfurt_Theodor-Heuss-Allee_100-104.ING_DiBa_Hochhaus.20130607.jpg) Video by ING Deutschland on Youtube -

Landesbank Hessen-Thüringen Girozentrale (Helaba) is a state-owned regional bank based in Germany. With its headquarters in Frankfurt, Helaba serves as a key financial institution in the Hessen-Thüringen region. Helaba operates in several sectors, including cash management, corporate banking, real estate financing, public authorities, and capital markets.

In particular, it offers a wide range of financial services, including secure transactions, liquidity management and support for growth and investment. it specializes in serving the real estate sector, providing services to municipalities and corporations. In addition, its capital markets division offers various financial products such as securities, money market instruments and foreign exchange.

In 2022, Helaba reported a positive financial performance, with an increase in operating income by €356 million compared to the previous year. The net income for the year reached €278 million, surpassing the prior-year figure of €221 million. Net interest income, a significant component of Helaba's earnings, slightly rose from €1,298 million to €1,303 million. With total assets amounting to €195,612 million, Helaba continues to maintain a strong financial position.

As a prominent player in the German banking sector, Helaba continues to contribute to the economic growth and stability of the Hessen-Thüringen region while expanding its reach both domestically and internationally.

Founded: 1953

Headquarters:- Neue Mainzer Strasse 52-58, Frankfurt am Main, Germany

- Bonifaciusstrasse 16, Erfurt, Germany

Website: https://www.helaba.com/de/

Photo by Helaba on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:HELABA_LOGO_2018.jpg)

Photo by Dacse on Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Helaba_-_Niederlassung_D%C3%BCsseldorf.jpg)