Top 10 Largest Banks In Singapore

Singapore is a global financial hub and a key player in the Asian banking sector. The city-state is home to many of the largest and most successful banks in ... read more...the region, offering a wide range of financial products and services to clients both locally and internationally. In this article, we will look at the top 10 largest banks in Singapore.

-

DBS Bank is the largest bank in Singapore by total assets, with around US$553.980B on December 31, 2022. It was founded in 1968 and today has more than 280 branches. DBS Bank has since grown to become one of the leading banks in Asia, with a presence in 18 markets globally.

DBS Bank offers a wide range of financial products and services, including consumer banking, wealth management, and corporate banking. Its consumer banking services include deposit accounts, credit cards, personal loans, and mortgages. The bank also offers wealth management services, such as investment products, insurance, and private banking. Its corporate banking services include cash management, trade finance, and corporate lending.

One of the key strengths of DBS Bank is its focus on digital banking. One of the typical strategies is "Make Banking Joyful" with 3 big pieces of Mr. Piyush Gupta, CEO of DBS: Be Digital to the core; Embed Ourselves in Customer Journey; Transform into a 22,000-person start-up. This strategy has brought DBS many awards, including "The best digital bank in the World 2018" voted by Euromoney.

One of DBS's dramatic shifts in the customer segment is the shift from product focus to customer focus. In 2009, they ranked last in the Singapore Customer Experience rankings. DBS has come up with many innovations and improvements that have helped them achieve great success in recent years. Furthermore, DBS Bank is also known for its commitment to sustainability. The bank has set a target to achieve net-zero carbon emissions by 2050 and has committed to providing SGD 50 billion in sustainable financing by 2024.

Founded: 1986

Headquarters: Marina Bay Financial Centre Tower 3, Singapore

Website: https://www.dbs.com.sg/DBS Bank

Screenshot of https://www.dbs.com.sg/ -

Oversea-Chinese Banking Corp (known as OCBC Bank) was founded in 1932. It is Singapore's second-largest banking group by assets, with US$417.296B on December 31, 2022. It has more than 540 branches and representative offices in 19 countries.

Recognized for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and named Best Managed Bank in Singapore by The Asian Banker.

OCBC Singapore is a market leader in bancassurance sales, home loans, unit trust distribution, personal lending, the market for small and medium-sized businesses, and the Singapore dollar capital market. OCBC Bank and its subsidiaries offer a broad array of banking services such as Consumer Banking, Business Banking, and Investment Banking. In addition, It also provides wealth management services and Insurance.

OCBC is also known for its focus on innovation and has launched several initiatives to support startups and entrepreneurs. It has established several innovation labs and accelerators, such as The Open Vault at OCBC, which provides funding and mentorship to startups. The bank has also launched several initiatives to support social entrepreneurship, such as the OCBC Social Enterprise Accelerator Program, which provides funding and mentorship to social enterprises.

OCBC is listed on the SGX-ST as one of the largest listed companies in Singapore by market capitalization. It is also one of the largest listed banks in Southeast Asia by market capitalization and has more than 29,000 employees worldwide.

Founded: 1932

Headquarters: OCBC Centre, 65 Chulia Street, Singapore

Website: https://www.ocbc.com/

Screenshot of https://www.ocbc.com/ OCBC Bank -

United Overseas Bank (UOB) is one of the largest banks in Singapore, with a history that dates back to 1935. The bank has grown to become one of the leading banks in Asia, with a presence in 19 countries and territories.

As the end of 2022, UOB has total assets of approximately US$375.790 billion. The bank has a network of over 500 branches and offices, with a strong presence in Singapore, Malaysia, Thailand, and Indonesia. UOB shares are traded on the Singapore Exchange (SGX), with a market capitalization of US$37 billion as of March 1, 2023. The company's headquarters is located at 80 Raffles Place.

UOB offers a wide range of financial products and services, including consumer banking, wealth management, and corporate banking. Its consumer banking services include deposit accounts, credit cards, personal loans, and mortgages. The bank also offers wealth management services, such as investment products, insurance, and private banking. Its corporate banking services include cash management, trade finance, and corporate lending.

With sustainable growth over the years, providing the best services to customers as well as focusing on putting customers at the center, UOB has won many prestigious awards, most notably: Best Bank in Singapore Award in 2022.

UOB is also known for its strong support of small and medium-sized enterprises (SMEs). The bank has launched several initiatives to support SMEs, including the UOB BizSmart platform, which provides a suite of digital solutions for business owners. The bank has also launched several SME-focused initiatives, such as the UOB-SMU Asian Enterprise Institute, which provides training and support for SMEs in the region.

Founded: 1935

Headquarters: UOB Plaza, 80 Raffles Place, Singapore.

Website: https://www.uobgroup.com/

Screenshot of https://www.uobgroup.com/ UOB Bank -

Standard Chartered Bank is a multinational banking and financial services company that operates in over 60 countries worldwide. Standard Chartered Bank was founded in 1853 in London, England.

As of the end of 2022, Standard Chartered had total assets of US$114.246. It operates over 1,000 branches worldwide, with a strong presence in Asia, Africa, and the Middle East. The bank has a significant retail banking business, with over 600 branches in Asia alone.

Standard Chartered distributes its products and services through a variety of channels, including branches, online and mobile banking, ATMs, and telephone banking. The bank has also invested heavily in digital technologies and now offers a range of digital services, including mobile banking apps, online account opening, and virtual assistant chatbots.

Standard Chartered provides a wide range of banking and financial services for individuals and companies. It includes Priority Banking, Priority Private, Private Banking, wealth management, Personal Banking, and International Banking for individual customers. For Companies, It has Business Banking, Comercial Banking, and Corporate banking. Standard Chartered is also a major player in emerging markets, providing services such as project finance, structured trade finance, and debt capital markets to businesses in developing countries. In addition, the bank has a significant presence in wealth management, offering investment advice and financial planning services to high-net-worth individuals and families.

Founded: 1953

Headquarters: 6 Battery Road, Singapore

Website: https://www.sc.com/sg/

Screenshot of https://www.sc.com/sg/ Standard Chartered Bank -

Maybank Singapore is a subsidiary of Maybank, a leading financial institution in Malaysia. Singapore is one of Maybank Group's largest overseas operations. Maybank Singapore was established in 1960, making it one of the oldest banks in Singapore. Maybank was identified as one of the domestic systemically important banks (D-SIBs) in 2015.

As of December 2022, Maybank Singapore's total assets stood at US$53.248 billion. Maybank Singapore has a network of 18 branches, 4 wealth centers, nearly 2,000 employees, as well as more than 11 ATMs in Singapore. Customers can also access atm5 – Singapore's only shared ATM network among the six participating QFBs to provide a combined coverage of over 200 ATMs in Singapore.

Maybank Singapore operates as a full-service bank, offering a range of financial products and services to individuals, businesses, and corporations. It has a strong presence in both retail and commercial banking segments, with offerings such as deposits, loans, investments, and trade financing.

Maybank Singapore operates in several fields, including consumer banking, corporate banking, and global markets. Its consumer banking services include personal loans, credit cards, wealth management, and insurance. Meanwhile, its corporate banking services include trade finance, cash management, and corporate loans. Finally, its global markets division provides forex, fixed-income, and commodities trading services.

Founded: 1960

Headquarters: Maybank Tower, 2 Battery Road, Singapore.

Website: https://www.maybank2u.com.sg/en/

Screenshot of Maybank Singapore Maybank Singapore -

Citibank Singapore Ltd. is one of the leading banks in Singapore with a long history of operation since 1902. It is a branch of Citigroup, a global financial services corporation headquartered in New York, USA. Globally, Singapore is a significant hub for Citi. With a wide network, Citibank Singapore provides customers with a range of financial products and services including deposits, loans, investments, insurance, credit cards, as well as asset management and advisory services.

Currently, Citibank Singapore has 22 branches and over 300 ATMs throughout the country. The bank has also won many awards, including Best Digital Bank and Best Consumer Bank in Singapore. This demonstrates Citibank Singapore's commitment to providing the best financial products and services to its customers.

Citibank Singapore is organized around three major business lines: (1) wealth management products and services such as investments, insurance, deposits, and treasury products; (2) unsecured products such as credit cards and personal lines of credit; and (3) secured products such as housing loans and share financing.

In addition to a diverse range of financial products and services, Citibank Singapore also focuses on providing digital financial solutions. The bank has invested heavily in technology, providing customers with a great experience through advanced online services, mobile apps, and utility tools.

Founded: 1902

Headquarters: Asia Square Tower 1, 8 Marina View, Singapore

Website: https://www.citibank.com.sg/

Screenshot of Citibank Citibank -

HSBC Bank (Singapore) Limited is one of the leading multinational banks in Singapore. The bank is a member of the HSBC Group, one of the world's largest financial conglomerates with headquarters in London, UK. HSBC Singapore provides its customers with a range of financial services, including deposits, loans, insurance, investment, and online banking products.

HSBC Bank (Singapore) Limited has been operating in Singapore for over 140 years and currently has over 10 branches and 40 banking outlets throughout the country. In recent years, HSBC Singapore has maintained a stable operating performance and delivered consistent revenue for the HSBC Group.

As of December 2022, the total assets of HSBC Singapore reached 21.85 billion USD, a 5.5% increase from the previous year. The total customer deposits amounted to 19.53 billion USD, up 2.1% compared to the previous year. The bank's loan book stood at 10.86 billion USD, representing a decrease of 1.5% from the previous year.

The financial report from HSBC Group shows that the total operating income of HSBC Singapore for the fiscal year ending in December 2022 reached 466.24 million USD, a 49% increase compared to the previous year.

With stable financial performance and growth, HSBC Bank (Singapore) Limited has won numerous awards, including Best Foreign Trade Bank in Singapore and Best Business Customers Award in Singapore. The bank has been growing in recent years and has made important contributions to the development of Singapore's economy.

Founded: 1877

Headquarters: HSBC Building, 21 Collyer Quay, Singapore.Website: https://www.hsbc.com.sg/

Screenshot of https://www.hsbc.com.sg/ HSBC bank in Singapore -

Industrial and Commercial Bank of China (ICBC) is one of the largest banks in China and has been operating in Singapore since 1993. ICBC Singapore Branch is a subsidiary of ICBC Group, with headquarters located in Beijing, China.

The bank provides a wide range of financial services to customers, including personal banking, corporate banking, private banking, and Renminbi special business. Besides, the Bank also provides commercial business services such as Personal Financial Services, credit cards, Corporate Financial Services, Institutional Financial Services, Investment Banking Services, Private Banking Services, Internet Banking Services, and Renminbi special business.

ICBC Singapore has a strong presence in Singapore, with a network of four branches and two off-site automated teller machines (ATMs). The bank is committed to providing high-quality services to its customers, with a focus on meeting their financial needs and supporting their business growth.

ICBC Singapore has also made significant contributions to Singapore's financial industry. In 2020, the bank launched its first digital platform in Singapore, "ICBC Connect", to provide customers with a seamless and secure online banking experience. Additionally, the bank has actively participated in Singapore's corporate social responsibility (CSR) initiatives, such as supporting education and environmental protection programs.

ICBC Singapore has received numerous awards in recent years, including Best Domestic Bank in China, Best Foreign Bank in Singapore, and Best Digital Bank in Singapore.

Founded: 1993

Headquarters: Ocean Financial Centre, 10 Collyer Quay, Singapore.

Website: https://www.icbc.com.sg/

Screenshot of https://www.icbc.com.sg/ ICBC in Singapore -

Bank of China Limited (BOC) is one of the largest state-owned commercial banks in China and has been operating in Singapore since 1936. BOC Singapore Branch provides a comprehensive range of financial services to customers, including corporate banking, personal banking, trade finance, treasury, and investment banking.

BOC Singapore has a strong presence in Singapore, with a network of five branches and three sub-branches. The bank is committed to providing high-quality services to its customers, with a focus on meeting their financial needs and supporting their business growth.

BOC Singapore has also made significant contributions to Singapore's financial industry. In 2020, the bank launched its first digital platform in Singapore, "BOC Connect", to provide customers with a seamless and secure online banking experience. Additionally, the bank has actively participated in Singapore's corporate social responsibility (CSR) initiatives, such as supporting education and environmental protection programs.

BOC Singapore is committed to supporting Singapore's sustainable development and has implemented various initiatives to promote environmental sustainability, social responsibility, and community involvement. The bank has been recognized for its efforts in promoting sustainable finance, with the bank's first green bond issuance receiving a certification from the Climate Bonds Initiative.

Founded: 1936

Headquarters: Bank of China Building, 4 Battery Road, Singapore

Website: https://www.bankofchina.com/sg/

Screenshot of https://www.bankofchina.com/sg/ Bank of China ( Singapore) -

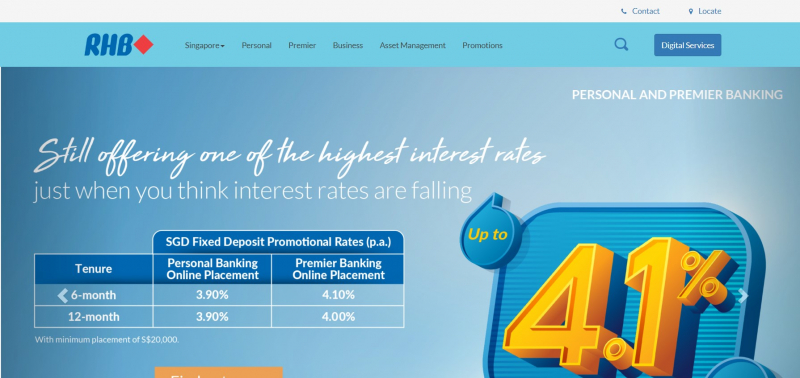

RHB Bank Berhad Singapore Branch is one of the banks operating in Singapore, owned by RHB Bank Berhad - one of the largest banks in Malaysia.

RHB Bank Berhad Singapore Branch provides banking services to individual and corporate customers, including deposit accounts, loans, money transfer services, credit cards, and insurance products. The Bank also offers online banking solutions and e-Banking services to assist in the financial management of customers.

RHB Bank Berhad Singapore Branch is continuing to grow in Singapore with the goal of becoming one of the first banks here. By the end of 2022, this bank has more than 10 branches and service stations nationwide and is focusing on improving its products and services to meet the increasingly diverse needs of customers.

In recent years, RHB Bank Berhad Singapore Branch has focused on digital transformation and innovation to serve its customers better. The bank has launched various digital services and initiatives, such as online banking, mobile banking, and e-payments, to enhance the customer experience.

RHB Bank Berhad Singapore Branch's vision is to become a leading multi-industry financial bank in Asia-Pacific and develop digital solutions to bring convenience and a good banking experience best for customers. The bank is committed to providing high-quality products and services that meet the needs of its customers and ensure respect and implementation of ethical and legal principles in the conduct of its business.

Founded: 1961

Headquarters: RHB Bank Building, 90 Cecil Street, Singapore.

Website: https://www.rhbgroup.com/sg/

Screenshot of https://www.rhbgroup.com/sg/ RHB Bank Berhad Singapore - APCSC 2012 CRE Awards Winner