Top 4 Largest in Banks in Italy

Italy is one of the largest economies in Europe, and its banking sector plays a crucial role in supporting the country's economic growth and development. The ... read more...Italian banking sector is dominated by a handful of large banks, which collectively control a significant portion of the market. Toplist'll explore the top 4 largest in Banks in Italy in this article.

-

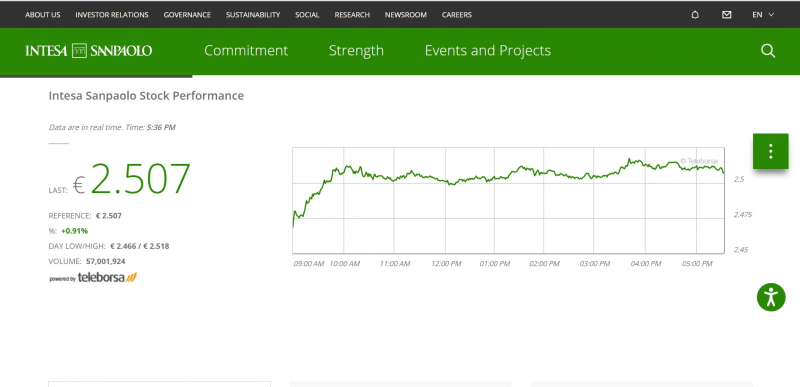

Intesa Sanpaolo is a result of the merger of two major Italian banks: Banca Intesa and Sanpaolo IMI. Intesa Sanpaolo, the head of Intesa Sanpaolo banking group, operates in Italy as a universal bank in all business areas: retail banking, corporate and investment banking and wealth management.

Intesa Sanpaolo is a highly reputable and full-service financial institution that provides a wide range of comprehensive banking and financial services to both individuals and businesses. Among its services are personal banking services such as accounts, loans, credit cards, and wealth management, as well as financing and capital markets services, investment funds management, and insurance products. Intesa Sanpaolo boasts a strong presence in Italy and has also expanded its operations to other regions around the world, including Europe, the Middle East, and Africa. This makes it a truly global financial institution that offers its customers a vast array of services across borders.

Intesa Sanpaolo has earned an enviable reputation in the financial sector, thanks to its unparalleled expertise, innovative products, and outstanding customer service. The bank's listing on the Milan Stock Exchange and its membership in the FTSE MIB index is a testament to its status as a highly respected financial institution. The bank's commitment to transparency, ethical behavior, and sound governance practices has earned it the trust and loyalty of its customers and stakeholders alike.

Founded: 2007Headquarters: Torino, Italy

Website: https://group.intesasanpaolo.com/en/

Screenshot of https://group.intesasanpaolo.com/en/ Video by Intesa Sanpaolo -

UniCredit is the head bank of UniCredit Group, one of the largest European banking group with a strong presence in Central and Eastern Europe. UniCredit SpA operates as a universal bank: it offers a broad range of products and services in retail, corporate, and investment banking and asset management. The bank adopts a fully integrated multi-channel banking model, combining traditional channels with digital ones.

UniCredit provides a range of services to individuals and households, including current and savings accounts, loans, mortgages, credit cards, insurance products, and wealth management services. The bank offers a range of financing, advisory, and capital markets services to businesses, institutions, and public sector clients. These include debt and equity financing, mergers and acquisitions, project finance, and trade finance. UniCredit manages a range of investment funds and provides asset management services to individuals, institutions, and corporations. The bank offers a range of insurance products, including life insurance, non-life insurance, and supplementary pension plans.

UniCredit has a strong presence in Italy and also operates in several other countries around the world, including in Europe, the Americas, and Asia.

Founded: 2006

Headquarters: Milano, Italy

Website: https://www.unicredit.it/

Screenshot of https://www.unicredit.it/it/privati.html

Screenshot of https://www.unicredit.it/it/privati/carte/tutte-le-carte.html -

Banco BPM emerged on January 1, 2017 as the result of the merger of two major cooperative Italian banks, Banco Popolare and Banca Popolare di Milano. Banco BPM provides a broad range of retail banking products and services to private individuals and SMEs. Banco BPM serves its customers through an extensive and complementary distribution network and a comprehensive multi-channel model.

Banco BPM provides a range of services to individuals and households, including current and savings accounts, loans, mortgages, credit cards, insurance products, and wealth management services. The bank offers a range of financing, advisory, and capital markets services to businesses, institutions, and public sector clients. These include debt and equity financing, mergers and acquisitions, project finance, and trade finance. Banco BPM manages a range of investment funds and provides asset management services to individuals, institutions, and corporations. The bank offers a range of insurance products, including life insurance, non-life insurance, and supplementary pension plans.

Banco BPM has a strong presence in Italy and also operates in several other countries around the world, including in Europe and Asia. Banco BPM has a strong credit rating and is considered one of the most financially stable and reliable banks in Italy and Europe. The bank has also received several awards for its digital banking services and its commitment to sustainability and social responsibility.

Founded: 2017

Headquarters: Verona, Italy

Website: https://www.bancobpm.it/

Screenshot of https://www.bancobpm.it/ Video by Banco BPM -

Banca Mediolanum offers a wide range of financial products and services to its clients, including investment and savings accounts, credit and debit cards, mortgages, loans, insurance policies, and pension plans.

One of the key features of Banca Mediolanum is its distribution model, which is based on a network of financial advisors who work closely with clients to provide personalized financial advice and solutions. These advisors are trained and supported by the bank to ensure that they have the necessary expertise and resources to help clients meet their financial goals.

Banca Mediolanum has a strong focus on innovation and technology, and it has invested heavily in digital platforms and tools to support its clients and advisors. For example, the bank has developed a mobile app that allows clients to access their accounts, track their investments, and communicate with their advisor from anywhere at any time.

In addition to its operations in Italy, Banca Mediolanum has a presence in several other European countries, including Spain, Germany, and Luxembourg. The bank has a solid financial position, with strong capital ratios and a long-term credit rating of A- from Standard & Poor's.

Banca Mediolanum is a reputable and reliable bank that offers a wide range of financial products and services to its clients. Its focus on personalized advice and technology-driven solutions makes it an attractive choice for those looking for a modern and innovative banking experience.

MarketCap: $6.70 B

Founded: 1997

Headquarters: Basiglio, Italy

Website: https://www.bancamediolanum.it/

Screenshot of https://www.bancamediolanum.it/

Screenshot of https://www.bancamediolanum.it/selfy