Top 10 Money Transfer Apps

Gone are the days of using credit cards to save social reputation. The digital currency has become a reality just like physical coins. In today's world powered ... read more...by advanced smartphone technology, mobile apps can be a lifesaver. Fortunately, numerous app providers offer a variety of options to send money to anyone who only uses your little pocket device. Here is a list of the most popular international online money transfer apps around the world.

-

Venmo is basically a miraculous app that has become so popular; Venmo is also casually treated as verb. You can easily send and receive money to and from your friends and family without any hassle.

Cost

No charge for sending money from a linked bank account, debit card or your Venmo account; a 3% fee for sending money using a linked credit card.Transfer speed

Instant transfer to Venmo balance; 1 to 3 busines days for direct deposit (free) or instant transfer to your bank account for 1% fee ($10 max).Standout features

Links to popular apps; social features to interact with your friends’ payments (including stickers and emojis); Venmo debit and credit cards.Links to accounts

Yes, bank and credit cards.Availability

Only available in the U.S. and only compatible with U.S.-based bank accounts and phone numbers; compatible with iOS & Android.Security features

Multi-factor authentication when signing in; QR code readers to make sure you link to the correct user account before you send money.Pros

Widely used and therefore easy when splitting bills with friends

Can link as payment method to popular apps including Uber, Uber Eats and Seamless

Can use to pay at participating online merchants

Users who opt-in can use a free Venmo debit card

Can link to the Venmo Credit Card to earn rewards on most popular spending categories at authorized merchants (subject to 3% credit card fee for person-to-person payments)

Cons

Charges a 3% processing fee when using linked credit card as a payment method

Charges a 1% fee for instant cash-outs (to disperse funds immediately to your bank account with no waiting period)

Not all users can currently link two separate Venmo user accounts to a joint bank account (Venmo is slowly rolling out this feature)Website: https://venmo.com/

https://venmo.com/

https://venmo.com/ -

Cost

Free (but check with your bank to ensure it doesn’t charge an additional fee)

Transfer speed

Instant: transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle

Standout features

No need to download an extra app; Zelle is already included with most mobile banking apps

Links to accounts

Yes, to U.S. bank accounts

Availability

iOS and Android; must have U.S. bank account linked to an email address or compatible U.S. phone number

Security features

The Zelle app uses authentication and monitoring features to make your payments more secure

Pros

Fastest money-sending method (when both sender and recipient are signed up)

Compatible with hundreds of U.S. banks and credit unions

Cons

You can’t link your account to credit card to use as payment method

You can’t send money to international bank accounts

Recipients must sign up for Zelle to receive money (if the recipient doesn’t enroll within 14 days, the payment will expire, and the funds will be returned to your account)Website: https://www.zellepay.com/

https://www.zellepay.com/

https://www.zellepay.com/ -

PayPal is a company of growing popularity for sending money and purchasing items online – but it also offers international transfers as a service. With the Paypal app, you can send money online, request money or even collect money from people around the world. With a wide geographic presence across the world and a huge user-base, it is among the most popular and best-known money transfer providers across the globe.

Alongside this, PayPal has integrated its payment method with many shops and service providers, enabling you to keep all your financial activity in one place. The Paypal money transfer app has prominent ratings of 4.8 on Apple app store and 4.4 on Google Play Store.Pros

Widely used by individuals and businesses alike

Flexible payment options with the ability to finance large purchases over six months interest-free with PayPal Credit (APRs vary)

High transfer limits: send up to $60,000 in a single transaction (depending on eligibility)

Cons

International transfers can get pricey ($2.99 to $4.99, plus 2.9% of the transaction amount and an additional fee based on location)

Fee structure is more complex than other money transfer appsWebsite: https://www.paypal.com/

https://www.paypal.com/

https://www.paypal.com/ -

Cash App is even a simpler money transfer app, evolving around the idea of sharing fund by adding an easy link to your debit card. The facility enables users to send, receive or request money from your folks in no time.

What is delightful to experience is how money gets deposited into your bank account quickly as soon as the transaction is finished.Cost

Free to download and use basic services

Transfer speed

1 to 3 business days or instant cash-out deposits for a 1.5% fee (25 cent minimum)

Standout features

App allows users to invest money in individual stocks as well as buy and sell bitcoin

Links to accounts

Yes, bank accounts and credit cards

Availability

iOS or Androis

Security features

Data encryption and fraud detection technology; unique, one-time login codes, two-factor authentication

Pros

Free debit card for users who opt in

Free ATM withdrawals if you set up direct deposit (otherwise $2 per withdrawal)

“Cash boosts” offer discounts with certain retailers that are automatically applied to a purchase to help users save money (only one boost may be active at a time)

App includes features to let users invest in stocks and buy and sell bitcoin

Cons

Charges a 3% processing fee when using linked credit card as a payment method

Charges a 1.5% fee for instant cash-outs (to disperse funds immediately to your bank account with no waiting period)

Cash App is not FDIC-insured, despite its more sophisticated investing features

Website: https://cash.app/

https://cash.app/

https://cash.app/ -

Cost

Free to download; transfer costs vary by country and amount (economy are often $0, express transfers start at $3.99)

Transfer speed

3 to 5 business days

Standout features

Convenient delivery options, including sending money directly to trusted banks, cash pick-up locations, mobile wallets or via home delivery

Links to accounts

Yes, links to debit cards, credit cards and bank accounts

Availability

iOS and Android; for U.S. users sending to other countries only

Security features

Secure server with data encryption; two-factor authentication

Pros

Straightforward fee structure based on country and amount

Affordable economy transfers (3 to 5 business days)

High user approval rating in Google Play and Apple Store

Large network of financial partners to send money for cash pick-up

Cons

Extra charges for linking credit card as payment methods

Express transfer fees as high as $93.99 (for transfers of $9,000 or more)Website: https://www.remitly.com/

https://www.remitly.com/

https://www.remitly.com/ -

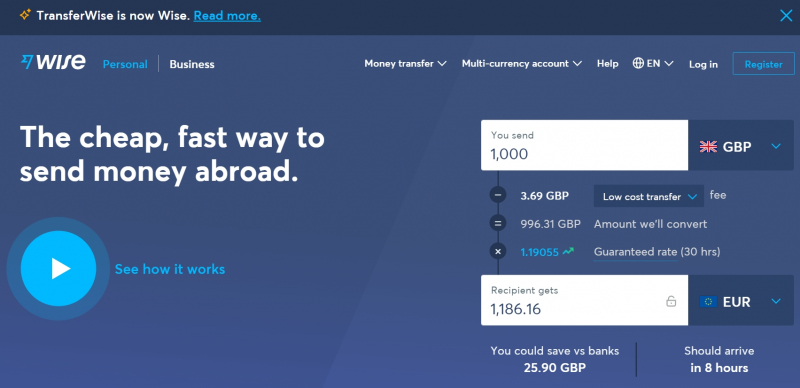

Wise,formerly TransferWise is one of the largest and best-known names in the international transfers space, and for good reason. Its platform lets you send money abroad quickly and easily, and attaches great importance to transparent rates with no hidden fees.

The service lets you hold and send money in 50 currencies, and all transfers occur at interbank rates-there is no mark-up on the exchange rate. With thousands of reviews and a reported 8 million customers, the Transferwise app enjoys a rating of 4.4 on the Google play store and 4.7 on the Apple app store.

Pros

Very transparent fee structure with no hidden costs

Lets you set up local business accounts in over 40 countries even if you don’t have a local address

Instant transfers available

Provides the option of a rate lock-in for a period of 24-48 hours

Supports a variety of payment methods

Very user-friendly and registration process is very straightforward

Offers transfers at the mid-market rate

Cons

The app not facilitate cash pickup – bank transfers are possible

Large transfers are more limited

Big online focus can make quick troubleshooting difficult

Some users complain that the verification process leads to longer transfer timesWebsite:https://wise.com/

https://wise.com/

https://wise.com/ -

WorldRemit is an extremely popular money transfer service and renowned for being a reliable brand with prudent security measures. World Remit enables senders in 56 countries to send money in 90 currencies to over 150 countries across the world.

WorldRemit supports a wide variety of payment and delivery methods, and these can all be accessed through its mobile app. You can send money to other bank accounts, arrange cash pickups/home delivery, deliver to mobile wallets, or even carry out mobile top-ups. To fund your transfer, you can utilize bank transfer, credit/debit card, Google Pay, Apple Pay, and many other e-wallets. The WorldRemit app has received a rating of 4.2 on Google Play Store and 4.8 on Apple App Store.

Pros

Global presence allowing your to send money to over 150 countries

A variety of payment and delivery options, including cash pick up

Quick transfer times available

Competitive exchange rates and fees on commonly used routes

Large number of currencies supported

Cons

Complex fee structure which can be more expensive than other providers at times

Limits on large transfers on some routesWebsite: https://www.worldremit.com/

https://www.worldremit.com/

https://www.worldremit.com/ -

Azimo is a fantastic money transfer app infamous for its sleek interface and excellent user reviews. Azimo currently has the capacity to offer transfers from 24 European countries to over 195 countries around the world.

Using its excellently-regarded mobile app, you can send money to any bank account, to more than 300,000 cash pick-up locations, and to mobile wallets. With a rating of 4.5 on Google Play Store and 4.7 on Apple app store, Azimo is among the greatest choices with migrants and expats looking to send money to family back home.

Pros

Supports a variety of payment and delivery methods

Provides real-time updates on your money transfer

No credit/debit card fees

Touch ID and Face ID security to keep your personal data secure

In-app customer support in 10 languages

No minimum send amount

Cons

Available only in 25 European countries

No telephone support – email onlyWebsite: https://azimo.com/

https://azimo.com/

https://azimo.com/ -

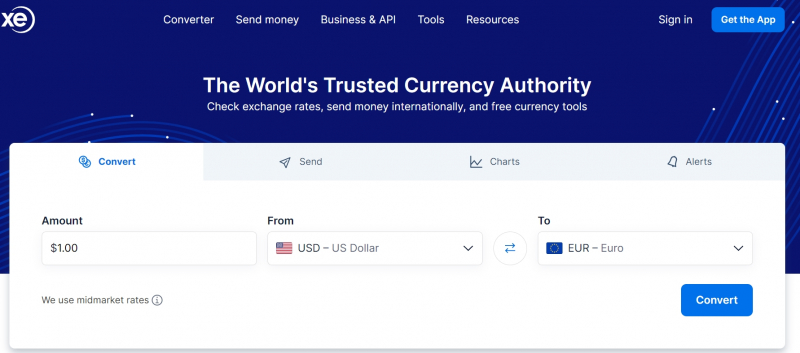

XE allows money transfers from Europe to over 120 countries in 60 currencies. Because the service does not charge any transfer fee, only a margin on the exchange rate, XE is one of the most reasonable money transfer services around.

Even with no fees, the exchange rate margins you can access through the XE app are much lower than the rates offered by banks and some other financial institutions, making it a great option for users who want to save money on their transfers and more. The XE app has positive ratings of 4.5 on the Google Play Store and 4.6 on Apple app store.

Pros

No transfer fees on international transfers

Wide coverage. Lets you send money in 60 currencies to over 160 countries

Competitive exchange rates, making it one of the most cost effective money transfer providers out there

User friendly, feature-rich app

Very well-regarded company in the money transfers industry

Fast transfer times (typically same day)

Cons

Available only in Europe

No option of cash pickupWebsite: https://www.xe.com/

https://www.xe.com/

https://www.xe.com/ -

Western Union is among the best-known names in the world of international money transfers and has a history for over 145 years, so it’s fair to assume they know what they’re doing.

The Western Union app enables you to transfer money on the go via a variety of payment methods: using a debit/credit card, directly from your bank account, or via Apple Pay. In case you wish to pay cash, you can visit one of the thousands of agent locations spread worldwide. Western Union possesses one of the widest disbursing networks of any provider, permitting users to send money to more than 500,000 agent locations in over 200 countries. The company’s app has an impressive rating of 4.8 on the Apple app store and 4.5 on Google Play Store.Pros

One of the most established names in the industry

Have a huge network of over 500,000 agent locations across the world

Quick transfers, with many being instant

Supports a variety of payment and delivery methods

Covers over 200 countries

Large range of currencies to choose from

Cons

High fees compared with other providers

High exchange rate margins (around 5%) make Western Union's rates more inline with traditional banks than more affordable transfer providers

Maximum limit of $2,999 on transfers made with the app and onlineWebsite: https://www.westernunion.com/

https://www.westernunion.com/

https://www.westernunion.com/