Top 7 Best Money-Saving Apps

Saving money might be tough to begin, but fortunately, money-saving apps can make it easier in this task. Some apps even go a step further by helping you in ... read more...making investments that might help you expand your money. Let's look at some of the greatest money-saving apps below that may help you build an emergency fund, save money, and enhance your wealth.

-

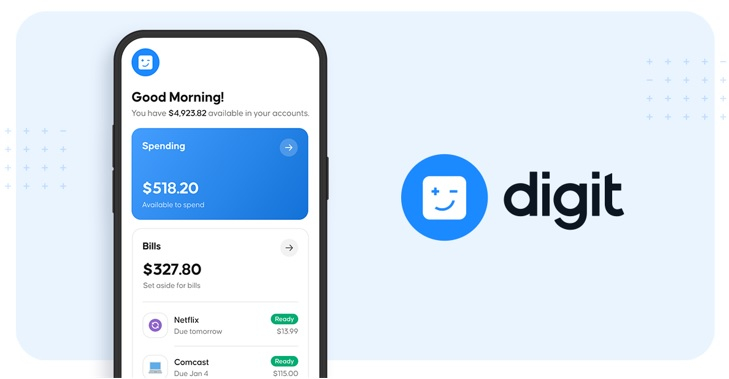

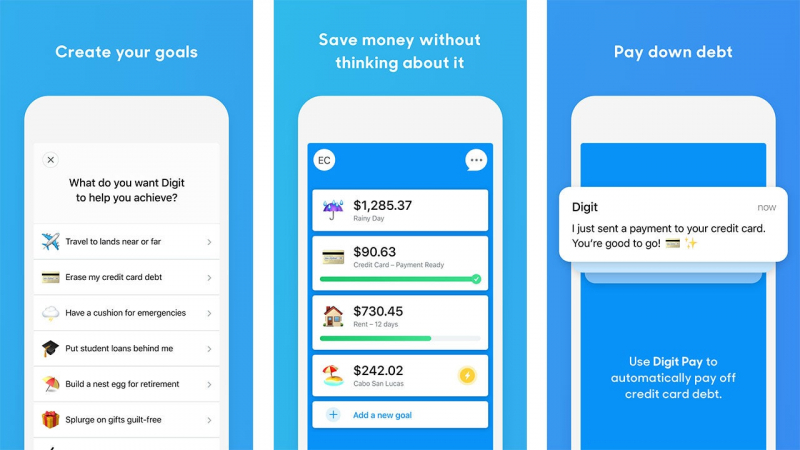

Budgeting might be a headache for some people, but Digit makes it easier by automating the process of saving and investing. Digit does the work for you by calculating the appropriate amount to input in order to meet your financial objectives. Digit is a great alternative for users who want to prioritize saving and investing.

Digit creates a personalized savings strategy for you based on your personal information, such as your income and expenses. This intelligent tool makes it simple to save for your objectives without impacting your daily expenditures. With Digit's no-overdraft guarantee, you won't have to worry about exceeding your credit limit. It's simple to access your funds with Digit when you need them. By sending Digit an SMS, you can get access to your money the next working day.

Price: 100 days free/$2.99 per month

App Type: Money-Saving

Download:

- For iOS: https://cutt.ly/0OmqEew

- For Android: https://cutt.ly/IOmqnuL

Digit

Digit -

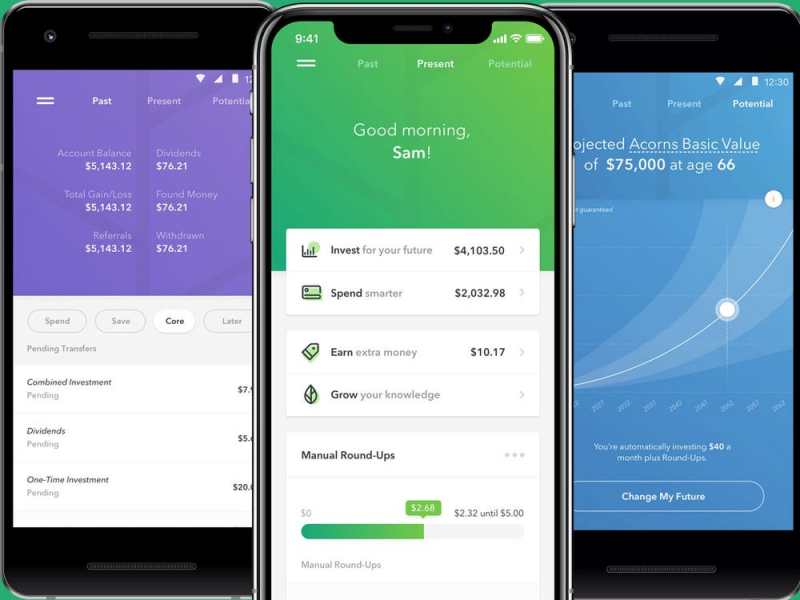

Acorns is a low-cost, easy passive investment solution that is ideal for beginning investors. Acorns' automated roundups make saving and investing simple, and most investors will be astonished at how fast their pennies add up.

You may withdraw your money from Acorns whenever you want and without any problems. You can also have instant access to your funds after you've met a goal. Once you've connected the app to your US bank account, Acorns automatically rounds up your purchases and saves your change, making investing money simple. This app also allows you to set up regular investments and make one-time investments. Your money is automatically diversified over a variety of equities using Acorns to maximize your returns while limiting your risks.

Price: $1 per month

App Type: Micro-investing

Download:

- For iOS: https://cutt.ly/cOmwOeW

- For Android: https://cutt.ly/jOmwDy2

Acorns

Acorns -

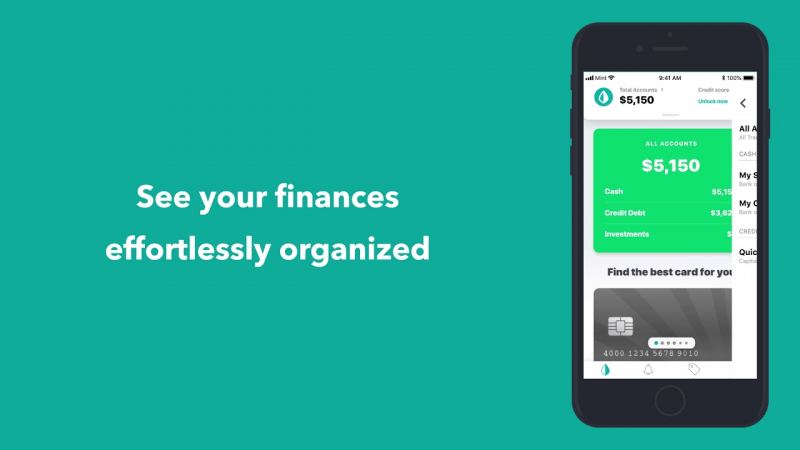

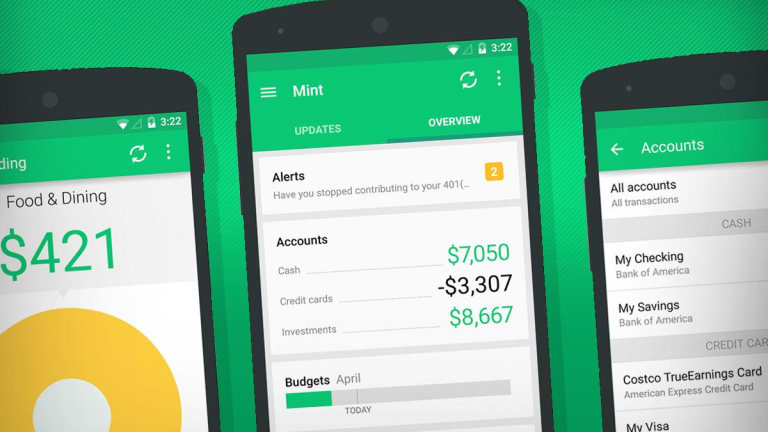

Mint is a free budgeting tool that connects all of your financial accounts in one digital space, giving you a high-level snapshot of your financial health. Users may also use the app to keep track of their spending and savings, as well as establish and monitor budget objectives.

Users may link their bank accounts, money management accounts, retirement and investment accounts, credit cards, and other financial accounts with Mint. Mint also allows you to keep track of all of your monthly expenses and receive reminders so that you can pay them on time. Mint records your transactions and categorizes them into budget categories when you connect your bank accounts, making it easier to keep track of them.

Price: Free

App Type: Money Management

Download:

- For iOS: https://cutt.ly/1OmePc9

- For Android: https://cutt.ly/7OmeTQd

Mint

Mint -

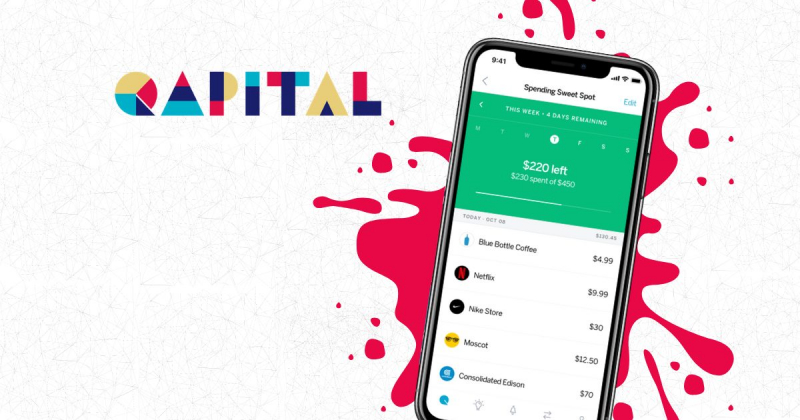

Qapital is a mobile banking app with an automatic savings feature that may be able to assist you in achieving your financial objectives. This app uses a number of tactics to keep you motivated to save, such as depositing your change, setting up recurring savings contributions, and lowering weekly costs.

Qapital links to a funding source, such as your bank account, and then uses particular guidelines to move funds to an FDIC-insured Qapital Goals account. Whether you're interested in establishing an emergency fund, saving for a vacation, or something else, Qapital offers several saving rules that you can set up to help you work toward your financial objectives. These guidelines make conserving money more enjoyable by adding a gamification element to it.

Price: Free

App Type: Money-Saving

Download:

- For iOS: https://cutt.ly/nOQtfZA

- For Android: https://cutt.ly/0OQtvwf

Qapital

Qapital -

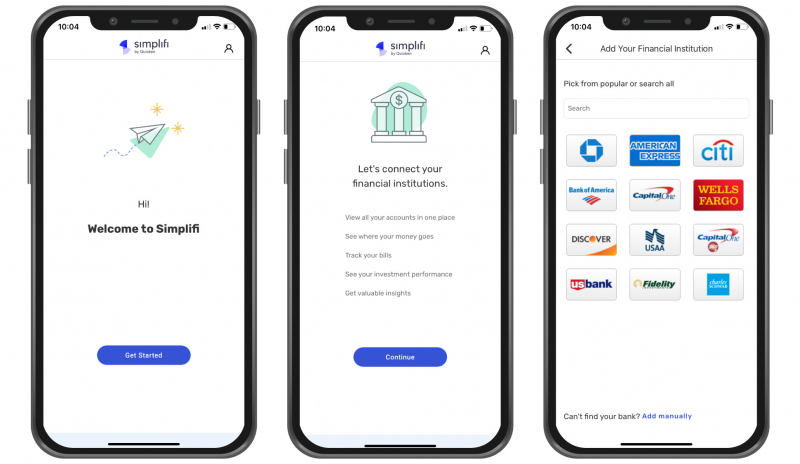

Simplifi is a personal financial app that helps users manage their cash flow and see their money in reality. The app is compatible with mobile devices and is also available as a desktop website.

Simplifi comes with two amazing features. The first is its budgeting strategy. Your monthly income and fixed costs are forecasted in the spending plan. Another useful feature is "watchlist", which allows users to keep track of specific spending goals. You can simply monitor how much money is left in your "budget" thanks to the watchlist. Simplifi reporting allows users to filter data by category, payee, tag, account, and more to provide new insight into spending habits.

Price: 30 days free, from $2.99 per month

App Type: Money Management

Download:

- For iOS: https://cutt.ly/HOQpxJ0

- For Android: https://cutt.ly/2OQpQW9

Simplifi

Simplifi -

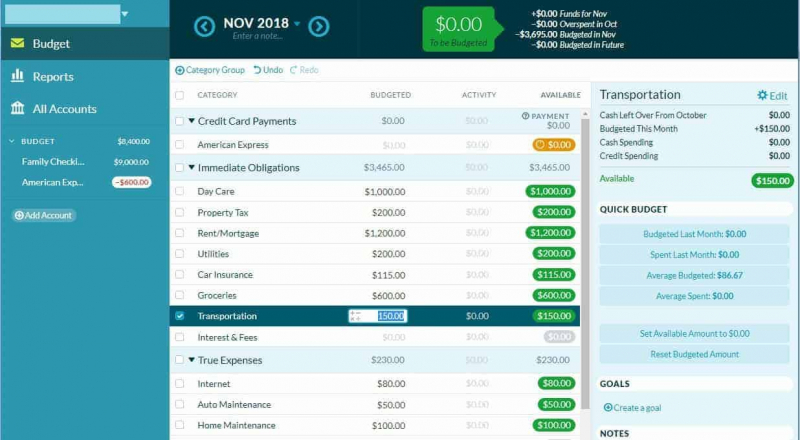

YNAB is an acronym that stands for "You Need a Budget," and it's accurate. This web program, based on a financial responsibility mindset, assists you in learning about personal finance while keeping your expenditures in check.

Budgeting is approached in a proactive manner using YNAB. This app includes tools for creating budgets, paying bills, and reducing the danger of overspending. Users will take an active role in creating objectives, inputting spending, and revising their budgets as necessary. You can start with the default budget categories or create your own to suit your needs. It is easier to link a bank account to YNAB for automated transaction import if you want.

Price: 34 days free, $11.99 per month

App Type: Money Management

Download:

- For iOS: https://cutt.ly/AOQu3d2

- For Android: https://cutt.ly/bOQuUIH

YNAB

YNAB -

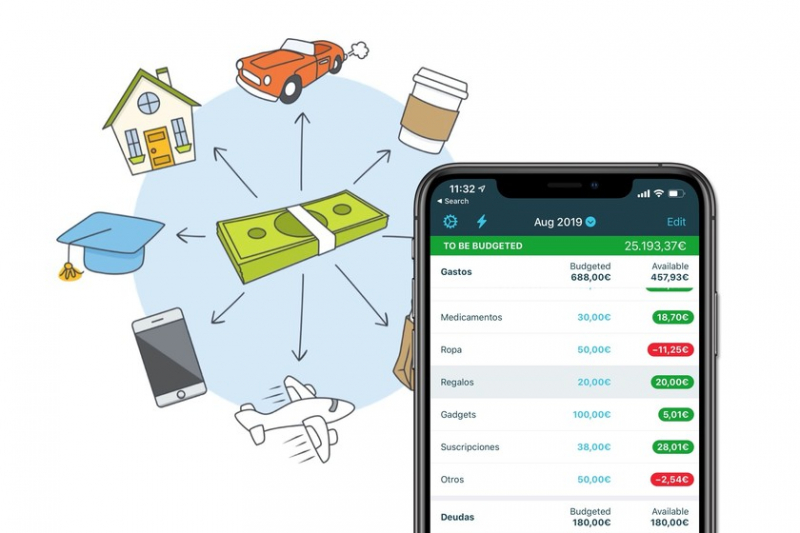

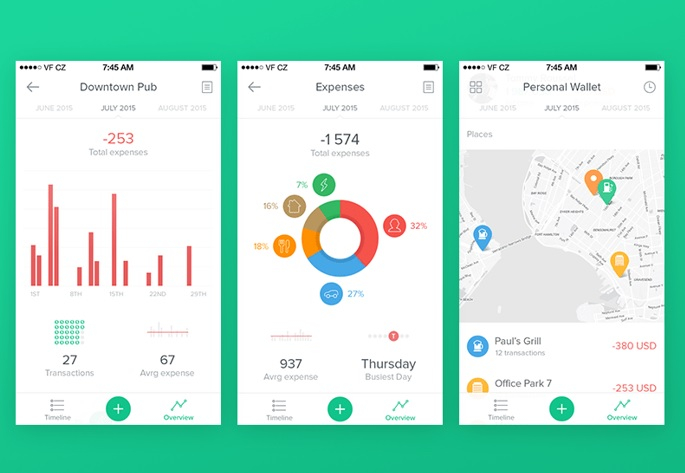

Spendee is a comprehensive financial dashboard that you can use on your phone to see where your money is going each month.

You can completely control your finances by using a variety of straightforward financial tools in this great app. By linking your bank accounts to your Spendee account, you can conveniently track your cash flow. When you link your bank accounts, Spendee automatically imports all of your incoming and outgoing transactions, giving you a month-by-month snapshot of your financial flow. You may link your bank accounts, crypto wallets, and manually input your costs to keep an accurate record of your money in addition to integrating your bank accounts.Price: $1.99-$2.99 per month

App Type: Money Management

Download:

- For iOS: https://cutt.ly/4OQfdeF

- For Android: https://cutt.ly/DOQfhJp

Spendee

Spendee