Top 5 Best Finance Apps

On this list, we have some of the best finance apps to help you manage your money, available on both iOS and Android. All these apps will let you view, ... read more...monitor, and manage their financial health and activity. Check them out and see which one suits you the most!

-

You Need A Budget or YNAB is one of the most popular and reputable finance apps available on both iOS and Android. It is a simple method and budgeting app that has taught millions of people to change their relationship with money.

Key features of YNAB are:

- Subscription Sharing: A close-knit group of up to six people can share budgets (and dreams!) at no extra cost.

- Loan Planner: Tackle debt by calculating the time and interest saved with every extra dollar paid.

- Expense Tracking: View changes to your budget in real-time to simplify sharing finances with a partner.

- Goal Setting: Turn your dreams into categories, set spending targets, and visualize your progress as you go.

- Import Income & Expenses: Add transactions manually or securely link accounts to view your big financial picture in one place.

- Spending & Net Worth Reports: See your spending averages (down to the cent) and your growing net worth in full technicolor glory by slicing and dicing your data.

- Privacy Protection: We don’t (and won’t) sell your data. We don’t host in-app ads or pitch recommended products. We make it easy to trust your budget.

- Resources Galore: We have an award-winning customer support team eager to answer your questions and a wealth of free resources, including live workshops, video courses, written guides, and more.

However, even though the app has lots of advanced budget planning features, it has no free plan even for the free trial.

Cost: $14.99 per month; Free trial available

iOS Rating: 4.8/5

Android Rating: 4.8/5

Download:

- For iOS: https://apps.apple.com/us/app/ynab-you-need-a-budget/id1010865877

- For Android: https://play.google.com/store/apps/details?id=com.youneedabudget.evergreen.app&hl=en&gl=US

Website: https://www.ynab.com/

Screenshot of http://youneedabudget.com/ Video by YNAB -

Credit Karma is where credit meets confidence! The app offers a wide range of unique and useful perks and features, making it one of the best finance apps for everyone, everywhere, at all times.

Credit Karma's more than 120 million members love the app for its features, including:

- Check your free credit scores: Learn what affects your credit scores and how you can take control.

- Credit Karma Money™ Spend: A checking experience with Early Payday.

- Credit Karma Money™ Save: No fees with this interest-bearing savings account.

- Approval Odds: See personalized recommendations and know your chances of approval for a personal loan or credit card before you apply.

- Credit card choices: Browse great credit card offers based on your credit profile.

- Auto savings and more: Tune up your auto loan, see about saving on insurance, see open recalls, and find vehicle records.

- Karma Drive™: Track your safe driving score to see if you can unlock lower car insurance rates.

- Home sweet home: Calculate how much home you can afford, see personalized home loan offers and get a mortgage pre-qualification letter.

- Personal loan shopping: Whether you want to refinance credit card debt or borrow for an emergency, you can compare personal loan offers on Credit Karma.

- Free ID monitoring: Check your free reports to spot potential identity theft and get tips for keeping your personal information safer.

- Free credit monitoring: Get credit alerts when we see important changes happen to your Equifax or TransUnion credit reports.

Credit Karma has some cons that could be overlooked, including no expense tracking and the lack of budget planning features.

Cost: FREE

iOS Rating: 4.8/5

Android Rating: 4.7/5

Download:

- For iOS: https://apps.apple.com/us/app/credit-karma/id519817714

- For Android: https://play.google.com/store/apps/details?id=com.creditkarma.mobile&hl=en&gl=US

Website: https://www.creditkarma.com/

Screenshot of https://www.creditkarma.com/ Video by Intuit Credit Karma -

Acorns is a unique finance app as it is one of the best investment apps for beginners, helping its users to save up by investing their spare change. Also being one of the best finance apps out there, this app helps users to invest, save, learn, and grow for their future, all in one place.

Acorns gives you the tools to manage your money, including:- Invest for multiple purposes: Invest for your future, for your changes, for your kids, and for your retirement with the app's wide range of plans.

- Bank smarter: Get an Acorns Checking account and a heavy metal debit card that invests your spare change when you spend and automatically invests a portion of every paycheck. Set an Emergency Fund goal and automatically start saving a piece of each paycheck for those surprise expenses.

- Earn rewards: The more you earn, the more you can save and invest! Try the Acorns Earn Safari Extension to earn rewards while you shop from your Safari browser on your iPhone.

- Grow your knowledge: Custom financial literacy content right in your app.

Cost: $1 to $5 per month (2 options: Personal and Family)

iOS Rating: 4.7/5

Android Rating: 4.6/5

Download:- For iOS: https://apps.apple.com/us/app/acorns-invest-spare-change/id883324671

- For Android: https://play.google.com/store/apps/details?id=com.acorns.android&hl=en&gl=US

Website: https://www.acorns.com/

Screenshot of https://www.acorns.com/ Video by Acorns -

Mint gives users a fresh way to manage money - it helps users to reach their goals with personalized insights, custom budgets, spend tracking, and subscription monitoring. As one of the best finance apps in the market, Mint brings together all of your finances, from balances, budgets to credit health, etc.

With the help of Mint, you can:

- Take care of all your money in one place: Mint gives you a complete picture of your financial health by bringing everything together: account balances, monthly expenses, spending, your free credit score, net worth, and more.

- Monitor your cash flow: Mint helps track your transactions, budgets, expenses, and subscriptions.

- Start saving with Billshark Bill Negotiation: A new and exciting feature that could help you save on your monthly bills.

- Spend smarter and save more with Mintsights: Mintsights will take a deep dive into your accounts and uncover new ways to make every dollar count.

- Better budgeting and expense monitoring: Make every dollar count with our budgeting feature.

- See your bills like never before: Track bills right alongside your account balances. The app's bill tracker makes it easy to manage your expenses, helping you keep tabs on your debt.

- Stay focused on your financial goals: Set custom financial goals in our budgeting app and get actionable tips tailored to you.

- And many more!

However, users should keep in mind that Mint doesn't round up spare change after purchases.

Cost: Free version available; In-app purchases: $0.99 per item

iOS Rating: 4.8/5

Android Rating: 4.2/5

Download:

- For iOS: https://apps.apple.com/us/app/mint-budget-expense-tracker/id300238550

- For Android: https://play.google.com/store/apps/details?id=com.mint&hl=en&gl=US

Website: https://mint.intuit.com/

Screenshot of https://mint.intuit.com/ Video by Mint.com -

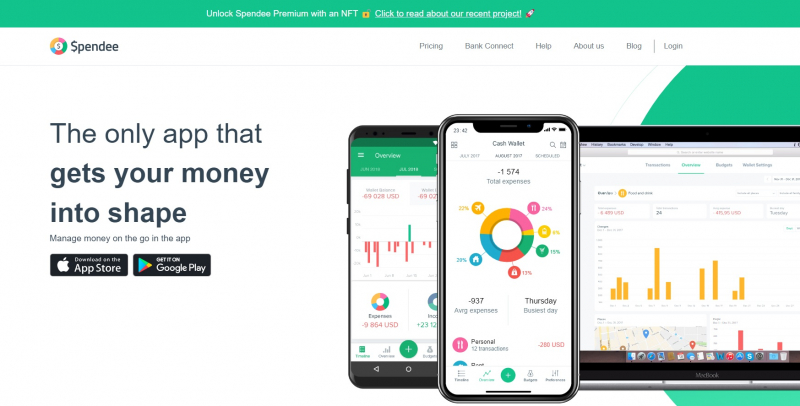

Spendee helps users to track their spending and optimize their budgets effortlessly. The app enables you to stick to your goals and be organized in what's important by letting you see all your financial habits. As the app now serves over 3 million people around the world, it is one of the best finance apps out there.

Spendee helps your money shines with great features like:

- Manage your money: See all your money in one place; Organize & analyze your expenses; Optimize your spending; Learn through personal insights.

- Budgets - to help you stick to your financial goals

- Wallets - organize your cash, bank accounts, or different financial occasions

- Shared Finances - to efficiently manage money with partners or flatmates

- Multiple Currencies - to handle vacation finances with ease

- Labels - to mark and analyze transactions in more depth

- Dark Mode - to enjoy an eye-friendly environment

- Web Version - to see your finances on a bigger screen

- Secure Data Sync - to keep your details private, confidential, and safe

However, users should know that Spendee lacks credit monitoring features, which the app is currently working on.

Cost: Free version available; Subscription plans: Premium: $2.99 per month; Plus: $1.99 per month

iOS Rating: 4.6/5

Android Rating: 4.4/5

Download:

- For iOS: https://apps.apple.com/us/app/spendee-budget-money-tracker/id635861140

- For Android: https://play.google.com/store/apps/details?id=com.cleevio.spendee&hl=en&gl=US

Website: https://www.spendee.com/

Screenshot of http://spendee.com/ Video by SPENDEE